Today's Econ Data "Much Worse" Than 1970s Disaster

Peter St. Onge from Brownstone adds to data from Peter Schiff last week supporting my case that the economy's gears are grinding to a halt behind the scenes.

Just days ago, I released my latest take on macro and the markets, including two new long positions I like, heading into the second half of 2024.

As I wrote then, there are a number of negative catalysts still just waiting to play out for markets: numerous potential wars, a fiscal situation in the U.S. that is completely untenable (listen to this interview with James Lavish and read this report from Mark Spiegel to understand) and now even more uncertainties with the 2024 election, given the attempt on President Trump’s life over the weekend.

This comes on top of a good ole’ fashioned economic contraction.

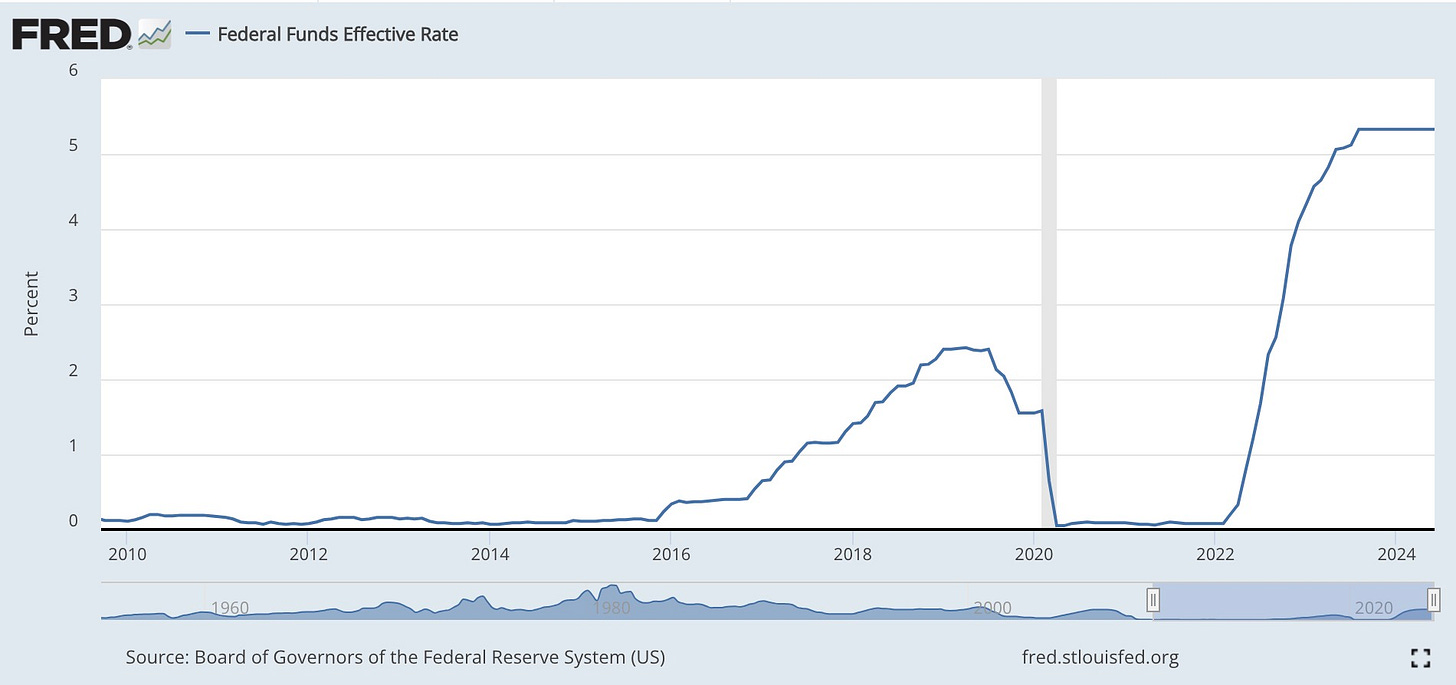

The cold hard fact is that two years of higher rates after 15 years of taking on debt at near-zero rates is eventually going to grind the gears of the economy to a halt. It’s as simple as math. Rates go up, cost of debt goes up, discretionary spending slows as a result of higher debt service, businesses generate less cash, layoffs happens and round and round we go, spiraling into a de-leveraging cycle.

In other words, this will have consequences. Try to act surprised when it happens, OK?

It’s only a question of how long it’s going to take to get there. My readers also know that I have been predicting this outcome for 18 months, while the stock market has done nothing but rocket higher. I underestimated how much liquidity there was in the economy and have been wrong on timing — though I don’t believe I’m wrong on outcome — for the past year or two.

Now, macro data — which operates on a pretty significant lag — is starting to turn into “ugly” territory, indicating that a true economic slowdown could already be taking place, just not showing up in the data yet.

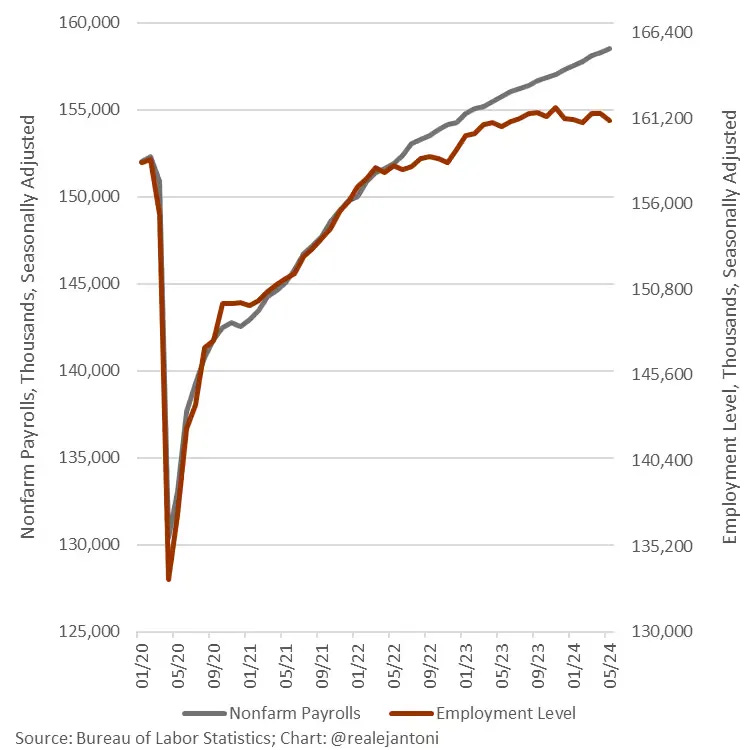

My readers know I published a great recap from Schiffgold days ago where economist Peter Schiff reviewed a recent batch of major economic data, including new jobs data and revisions to job numbers, and why a declining manufacturing sector bodes poorly for the economy.

Today, I offer up Peter St. Onge from Brownstone, who throws his own data into the mix to make my point. I also point out additional data on the U.S. housing market struggling.

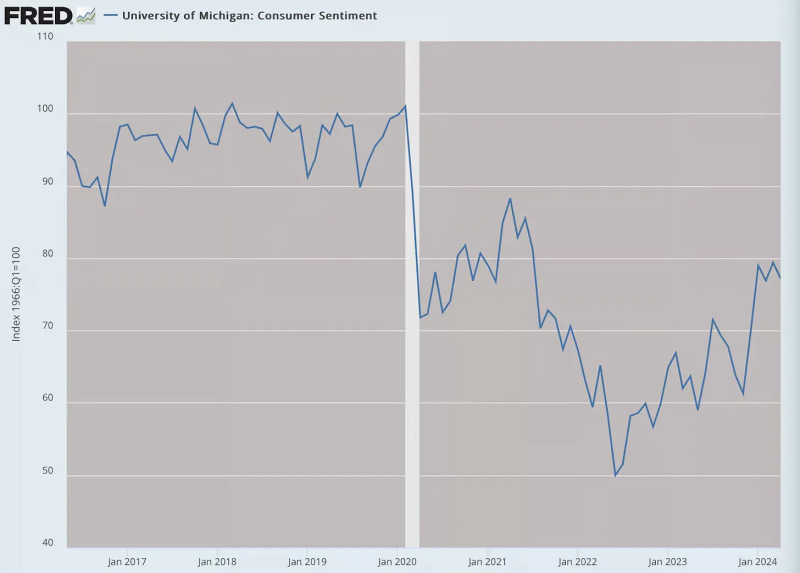

St. Onge asserts economic data is "broken" - something I asked my readers about over the weekend. He uncovers the "actual" inflation rate, stalling manufacturing orders, and indicators that quality of life is suffering even when the numbers don't make it look as though Americans are taking it on the chin.

Finally, he compares the data to the 1970s "disaster" to make the point we may damn well already be in recession.

Are We Already in Recession?

By Peter St. Onge, Brownstone Institute

Have we already entered a recession? Worse, have we been in a recession for years now?

Recently I joined Jeff Tucker of Brownstone Institute on an article about the Herculean task of trying to figure out what’s actually happening in the economy.

Which is a challenge given that every official economic number out there is broken.

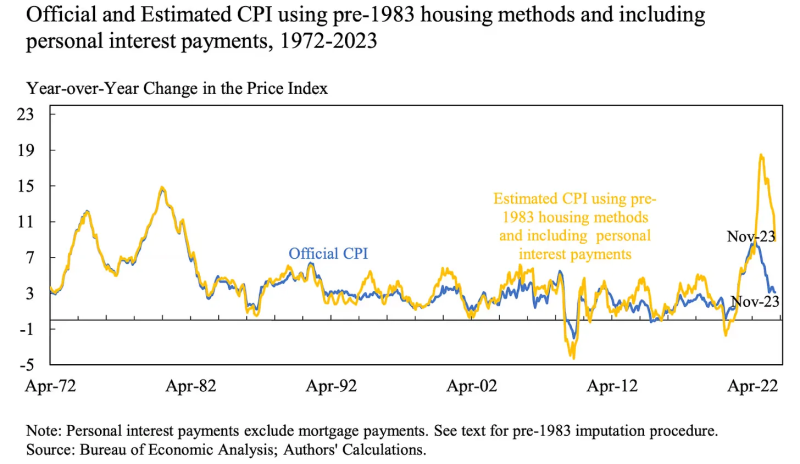

I’ve covered some of these in recent videos, including failing to count homeless people as unemployed, calling welfare spending economic growth, and undercounting inflation — perhaps by a lot.

Thing is, if the official numbers are wrong, it could mean we’re already in recession, masked by rising asset prices courtesy of the Fed.

Inflation: the Key to Recession

To give a flavor, the official inflation rate since Covid has been around 21%. But fast food menu prices — a go-to indicator for foreign exchange investors — are up between 35% and 50%. People posting grocery receipts online say it’s actually more than 50%.

The problem is if inflation was actually, say, 35% it means GDP hasn’t gone up at all since pre-Covid. It means it actually went down. Implying we’ve been in recession for nearly 5 years.

This is because official growth numbers are discounted by inflation. If growth was 3% but inflation was 2%, we grew. If inflation was actually 4%, we shrank.

That means that if inflation was actually worse than 35% — if, say, it was the 50% that grocery receipts — that would put us near Depression levels with a 13% drop in real GDP since pre-Covid.

A Hidden Depression?

The idea seems absurd — it shocked me. But, historically, inflationary depressions are hard to see for the simple reason that asset prices pump before consumer prices do. The affluent keep spending since their stocks soared and their house prices soared — sound familiar?

In Germany’s Weimar hyperinflation, for example, early on people weren’t complaining about prices, they were popping champagne over how much money they were making on their stocks. The hunger came later.

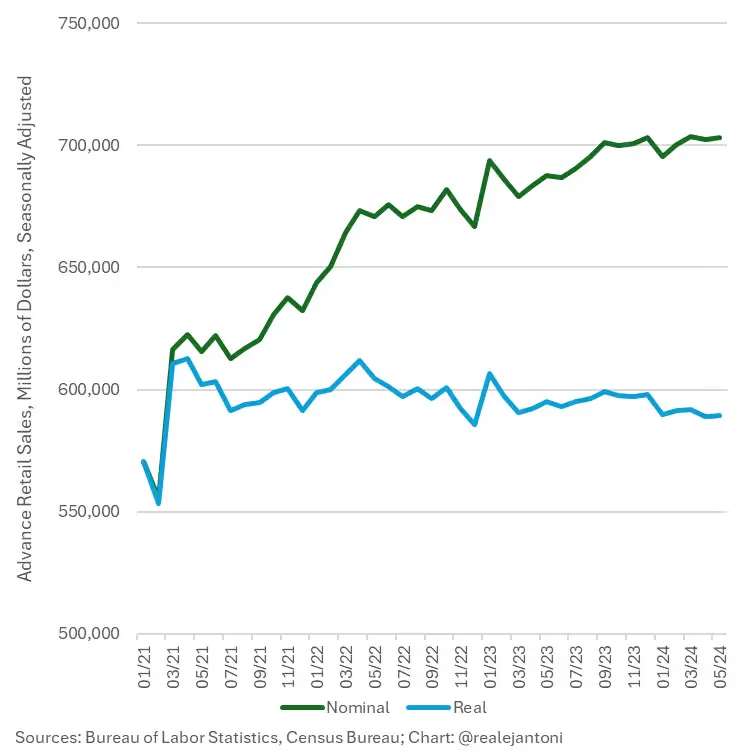

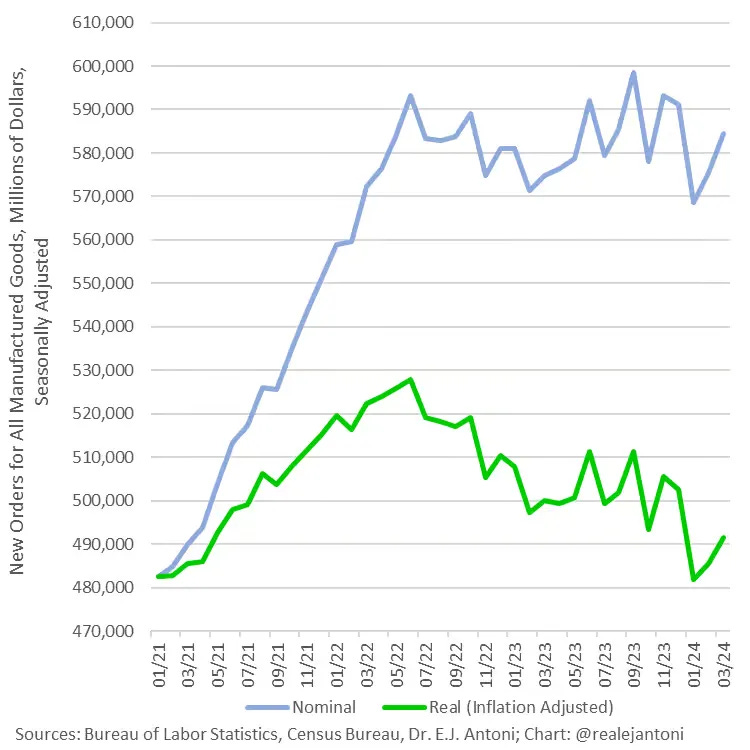

The 4-year depression theory explains a lot of otherwise mysterious data. My colleague EJ Antoni found that manufacturing orders have been flat for at least 3 years, while consumer spending has actually been negative for those 3 years. We get data points like Americans seeing McDonald’s as a luxury item, buying groceries on credit cards, selling off second cars, and downsizing to smaller homes — all hallmarks of a recession.

Even that grandaddy of statistics, GDP, may be an illusion. Because GDP counts government spending as production.

Which, of course, it is not: it’s spending, not building. So our current $2 trillion deficit is, on paper, automagically boosting GDP by nearly 7%. But the spending isn’t making us richer — it’s making us poorer as physical resources get squandered.

What’s Next

When the official numbers are lies, we’re left with data points and anecdotes like record credit card debt, financial distress among the middle class, and shrinking quality of life.

My base case has been that we’re repeating the 1970s disaster driven by out-of-control government spending and out-of-control Fed money printing. The official numbers are matching that almost to a tee.

But if, in fact, the real numbers are much worse — perhaps even as bad as voters and consumer surveys report — then we could be headed towards a proper Depression.

To add to this, Peter Schiff wrote over the weekend that: “We’re about to face the aftermath of a Fed-induced housing crisis.”

He noted that “U.S. pending home sales have dropped to historic lows not seen since the 2008 financial crisis, with a shocking 2.1% drop in May and a jaw-dropping 6.6% annual decline. With mortgage rates so high, banks and other investors are in massive trouble, facing severe cash shortages.”

He cites data from the Mises Institute and Zero Hedge, who both point out that “the current index is at 70.8, or 70.8 percent of the contract activity in the base year 2001.”

“This is lower than any point during the 2008 financial crisis; even lower than 2020, when lockdowns brought markets to a screeching halt. This is the lowest level of contract activity in my lifetime,” Jonathan Yen from Mises wrote last week.

“The position of new home buyers in 2024 is unprecedented,” he concluded. “Not only are prices at record highs, but the new generation of prospective home buyers can’t remember a time without cheap mortgages. During the steep decline in pending sales between 2005 and 2007, the average 30-year fixed rate mortgage only increased by about one percent. Since January of 2021, the average 30-year fixed rate has increased by 4.21 percent.”

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

30 year veteran of the commercial and residential development and home building industry here. Gee, who would have that artificially lowering interest rates to near zero and socially engineering the housing market would eventually be a bad thing? I certainly did back in 2008 when I worked in the home building industry and saw homeowners unable to pay HOA dues as low as $20 a month. This time around could be worse than 2008 and I’ve been saying that for a while now. Commercial real estate is the canary in the coal mine and the canary is dying.

“In Germany’s Weimar hyperinflation, for example, early on people weren’t complaining about prices, they were popping champagne over how much money they were making on their stocks. The hunger came later”

I am an expert in high inflation, fiscal deficit and macroeconomic volatility, not because I studied a PhD, but because I had to operate in the Argentinean economy for 40 years. I lived through the Hyperinflations of the 80/90s and the recent period (now collapsing fast)

The first thing that you learn in inflationary economies is that it turns imposible to make economic calculus with the traditional tools. They will lead you to a mistake, like you clearly state in your article. In Argentina you can’t measure the economy in local currency, neither in a foreign currency, because there is exchange volatility, so the best way to measure the economy is by units. Weight, Tons transported, houses and cars sold, units solds, number of tickets, you name it. And even with this, you will not know, because everything is relative, but is better than look at just money indicators.

What happens in high inflation economy is that it turns into an economy of arbitrage. Some things get very cheap and others very expensive, like now in the US.

The working class gets the effect almost immediately, while the upper class expands it’s benefits because they can rise prices and keep costs down. But sooner or later, the middle classes gets affected too and stop buying things, default in it’s debt and help us God.

To be honest, I never experienced this scenario in a leveraged economy like the US, it could be chaotic for the US and the rest of the world.

There is a book from 2009 called “This time is Different”, by Reinhart and Rogoff, the answer is there. The US will go through a period of high inflation to deflate the debt, there is no other way out. Only the rich will be able to mantain certain wealth, the middle classes are going to be wiped out. The most conservative aproach is own hard assets, no debt (risk of refinancing will be high) and stick to strong cash flows. Act as your grandfather will do and you will be fime. It will pass too. But things are not going to be the same.