Trading The Shit Show: July 2024 Market Review

Two new longs I find interesting and a review of where I think we are in the world of macro.

Please read my disclaimer at the bottom of this post multiple times, slowly.

Heading into the third quarter of 2024, I can't say the market has done exactly what I predicted it would at the beginning of the year. However, I will say that the risks I pointed out and the themes I thought would dominate the year have held true to form.

Here’s my take on when I think the overall market will see volatility and a couple new names on the long side I’ve been watching over the last month.

I'm now more convinced than ever that a pullback in markets, which I still believe is inevitably coming as a result of the effects of 5.5% rates working their way through the plumbing of the economy, will arrive just as soon as, or slightly after, the first rate cut.

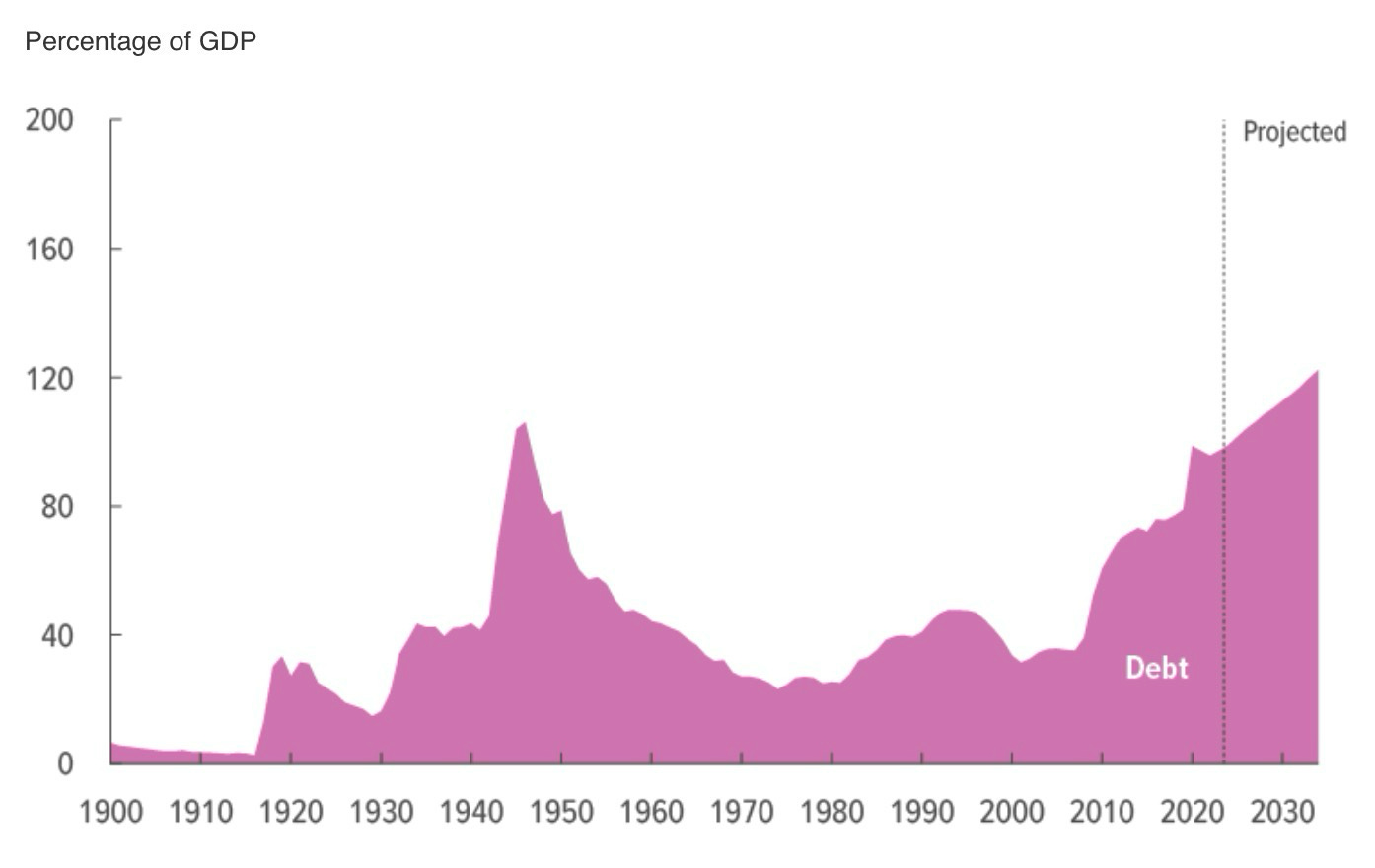

There are a number of negative catalysts still just waiting to play out: numerous potential wars, a fiscal situation in the U.S. that is completely untenable (listen to this interview with James Lavish and read this report from Mark Spiegel to understand), uncertainties with the 2024 election, regional banking and commercial real estate showing major cracks, consumers completely tapped out as reflected in retail companies' recent earnings, and unemployment now ticking higher to 4.1%, the highest it's been since November 2021, this past week.

When it comes to the market pricing in the risk of these scenarios, let alone the risk of getting another four years of a Democrat in the White House, all I can say is: I don't think the market has priced in a goddamn thing. The disconnect between this market, trading as though QE and negative rates are still here and that valuations don't matter, and reality, where the economy is on the verge of collapse and American families are completely tapped out, overseen by a President and party with what can only be described as a sick addiction to spending, couldn't be more apparent if someone was blowing it out of an airhorn a half inch from my face.

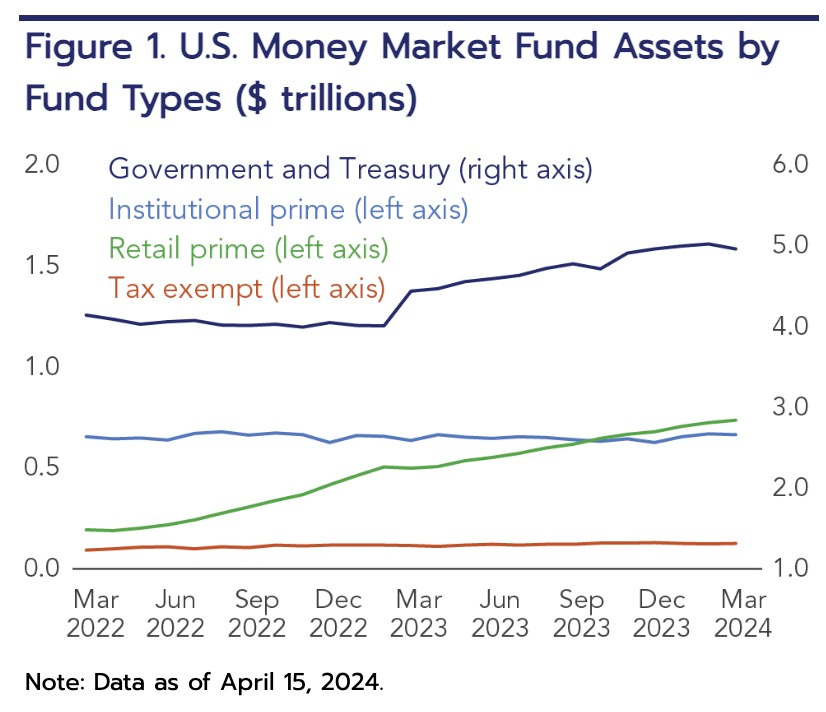

But hey, things work on God's timing and not QTR's, so I've adopted a stance of continued patience in waiting for the bottom to fall out. It was foolish of me over the last two years to believe the market would instantly fall apart due to the rate hikes and I definitely had my timing wrong. There was too much excess savings and liquidity to go around and, even now, there's still decent liquidity in retail money markets despite the fact that credit card debt is skyrocketing and personal savings really have tanked.

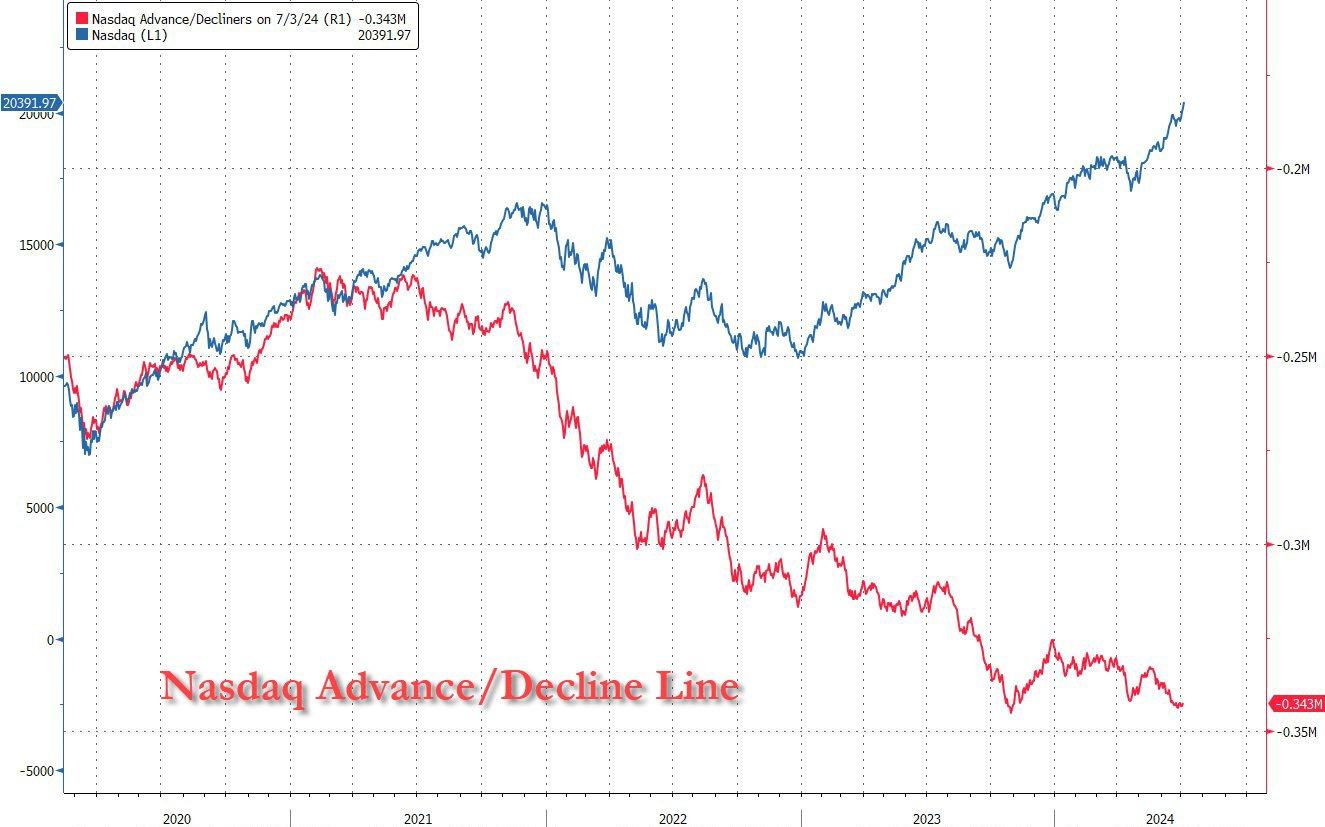

Right now, the situation continues to be that a handful of stocks, led by Nvidia, Apple, and Microsoft, are driving the entire market. Market breadth continues to be alarming, with indexes finishing green many days with upwards of 65% to 70% of their components trading red on the day.

“Just when you think it can’t get any wider…” Zero Hedge tweeted on Friday about the NASDAQ A/D line compared to how the index is performing.

This cannot last forever and, when the music stops, valuations that already look insane—like 65x earnings for Tesla and even 35x earnings for Apple—are going to be the obvious exits for those looking for liquidity. Even if you adopt the total nonsense new-school Cathie Wood snake-oil view of markets that they can somehow stay this aggressively valued on a P/E basis as a result of low rates or innovation or whatever bullshit excuse she's using this week to buy 200x PE dung, valuations are still too frothy. Let’s take a look and review some of the 24 stocks I picked for this year and two new names I’m adding now.