Peter Schiff: The Doom Is In The Data

"You know what I detest most is hypocrisy, right? … Biden tells a lot of outright lies. I mean, complete lies."

Just days ago, I released my latest take on macro and the markets, including two new long positions I like, heading into the second half of 2024. As I wrote then, there are a number of negative catalysts still just waiting to play out for markets: numerous potential wars, a fiscal situation in the U.S. that is completely untenable (listen to this interview with James Lavish and read this report from Mark Spiegel to understand) and uncertainties with the 2024 election.

But then there are the fundamental cracks starting to show up in the data: regional banking and commercial real estate defaults are rising, consumers are completely tapped out as reflected in retail companies' recent earnings, and unemployment now ticking higher to 4.1%, the highest it's been since November 2021, this past week.

In Peter Schiff’s latest podcast episode, and a recap from Schiffgold, Schiff reviews the latest batch of economic data, including new jobs data and revisions to job numbers, and why a declining manufacturing sector bodes poorly for the economy. He also analyzes gold and silver’s big week last week and offers some thoughts on President Biden’s recent post-debate interview on ABC.

Friday saw an apparently optimistic jobs report overshadowed by large downward revisions for May’s and April’s figures:

“They were expecting 189,000 jobs created, and we ended up exceeding that with 206,000 jobs. … In fact, Biden once again bragged that the jobs that were created were over 200,000 for the month. Of course, he took credit for those jobs. But as is normally the case, once you look beneath the surface— and you don’t have to look deep beneath the surface—you get another very weak jobs report. Let’s start with their downward revisions because there were quite a few downward revisions. Both of the prior months were revised down. So April was revised down by 57,000 jobs, and May was revised down by 54,000 jobs. That’s not insignificant.”

Weak manufacturing job growth is indicative of America’s economic woes:

“The government now says that it was zero, that no manufacturing jobs at all were created in May, and 8,000 were lost in June. Again, these are the productive jobs that we need people making stuff. We’re not making stuff. We’re consuming more bigger trade deficits. This is a weak report that is also inflationary. So it’s stagflation, a weak economy, and more inflationary pressures. The labor force participation rate stayed at 62.6, which is a very weak number. And significantly, the unemployment rate rose to 4.1%. It was 4% in the prior month unrevised, and it went up to 4.1%. That is significant.”

If anything, these statistics are still too optimistic. Changes in government statistical methods paper over underlying economic fault lines:

“That’s why when you look at these rigged unemployment numbers and you come to the conclusion that we have a strong economy with low unemployment and you don’t understand why Biden is so unpopular, it’s because the way we’re keeping track of these economic statistics is wrong. The real statistics— if we measured the economy the way we did prior to 1994— you can see why so many people are so miserable.”

With gold hovering closer to $2400/oz, Peter thinks gold mining stocks will improve shortly:

“Gold is holding at a very high price. I expect a lot of these gold mining companies to report much better earnings than the street expects because the price of gold is staying at much higher prices for a much longer period of time than these analysts penciled into their earnings forecast. So I still think that this is the best way right now to play the gold sector is through these mining stocks. I think they’re still dirt cheap. There’s incredible value there. People should be buying these stocks.”

Peter slams President Biden’s most recent ABC interview in which he tries to excuse his ghastly debate performance. In addition to the president’s still-apparent cognitive problems, Peter takes issue with Biden calling Donald Trump a liar:

“You know what I detest most is hypocrisy, right? … Biden tells a lot of outright lies. I mean, complete lies. He has no right to call anybody a liar. When you do something yourself, you can’t accuse somebody else. It’s not just, you know, living in glass houses and not throwing stones. Biden has been in politics all of his life. And you don’t stay in politics without being a liar. You’re not going to have a long political career unless you’re a good liar. You’ve got to lie a lot to get reelected that often. And so he has no right to keep focusing on Trump lying, Trump lying. In fact, the reason he wants to talk about Trump’s lies so much is because that’s what he does. His whole presidency is a lie. Everything out of his mouth is a lie.”

For more technical analysis of last week’s metals price action, check out the SchiffGold Gold Wrap podcast.

Treasury Finally Issues Some Long-Term Debt

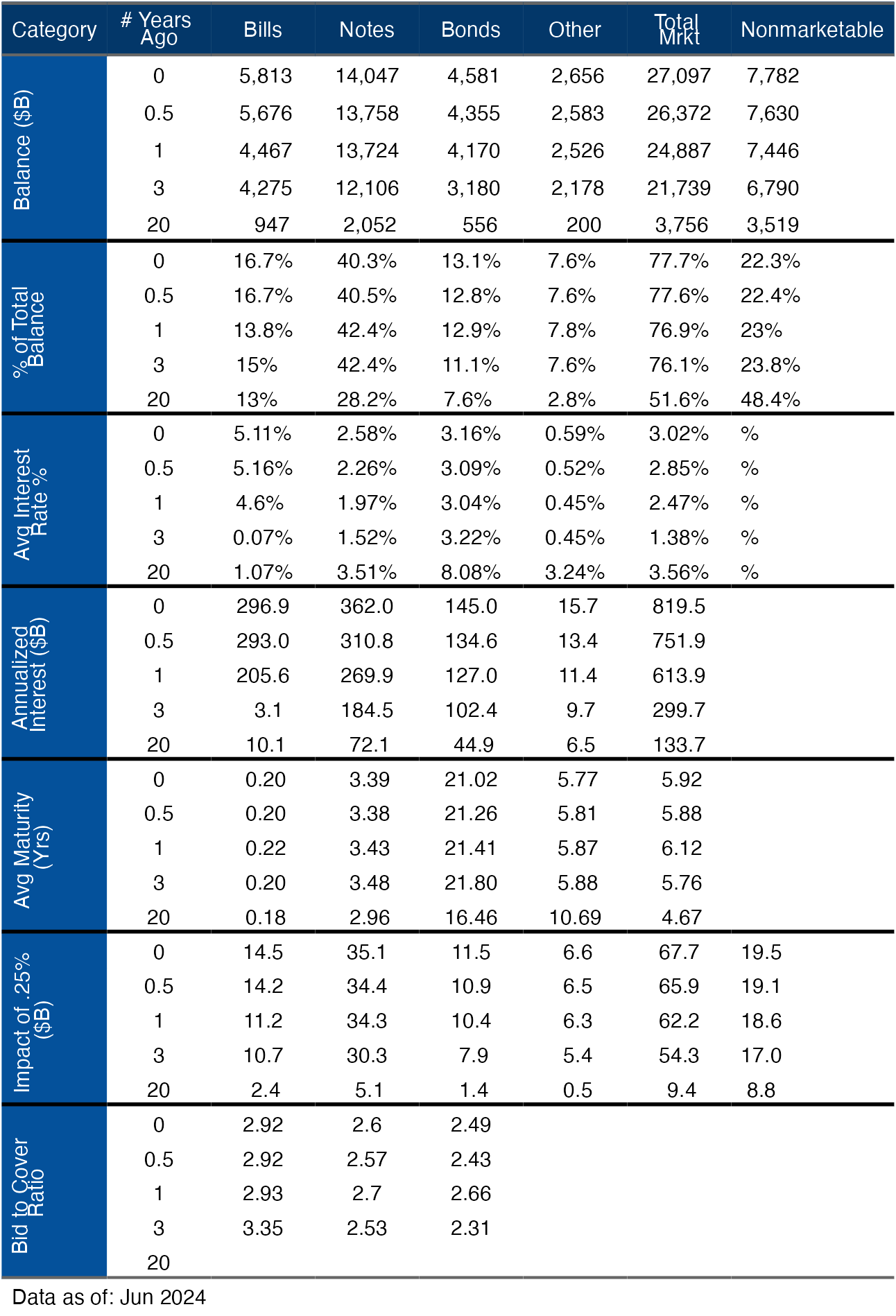

And after nearly 10 months of issuing mostly short-term debt, the Treasury finally issued Notes in 2 of the last 3 months.

Note: Non-Marketable consists almost entirely of debt the government owes to itself (e.g., debt owed to Social Security or public retirement)

Figure: 1 Month Over Month change in Debt

In the first six months of 2024, the Treasury has added over $870B in new debt.

Figure: 2 Year Over Year change in Debt

So far in 2024, the Treasury has kept a fairly stable cash balance of $800B.

Figure: 3 Treasury Cash Balance

The chart below shows the true danger of the recent drop in the overall maturity of the debt. After topping out at 6.24 years in 2023, the average weighted maturity of the debt is 5.91 years. At the same time, the weighted average interest rate has increased from 1.32% to 3.02%.

Figure: 4 Weighted Averages

The Treasury is in a really tough spot as rising interest payments have absolutely exploded debt service costs. The annual run rate is now over $800B. It was around $300B as little as 3 years ago.

Figure: 5 Net Interest Expense

Using the current Fed dot plot and the rolling maturity of the debt produces the forecast below. Again, the Treasury left “debt affordability” in the rearview mirror in 2021. The Treasury is now absolutely hemorrhaging cash on debt service costs.

Figure: 6 Projected Net Interest Expense

Speaking of debt issuance and rollover, the chart below shows the forecasted debt maturing this year for 2-10-year maturities. Debt rolling over will be more than $400B higher than it was in 2023 despite the fact they are adding almost no new debt to the note balance.

Note “Net Change in Debt” is the difference between Debt Issued and Debt Matured. This means when positive it is part of Debt Issued and when negative it represents Debt Matured

Figure: 7 Treasury Note Rollover

Yield Curve

The Treasury could be paying lower rates today by issuing longer-term debt. The two issues are market saturation and debt lock-in. The market cannot absorb massive volumes of long dated Treasury debt. Yellen also does not want to lock in these elevated rates.

Figure: 8 Tracking Yield Curve Inversion

Historical Perspective

The chart and table below show how the debt and interest have changed over time.

Figure: 9 Total Debt Outstanding

Figure: 10 Debt Details over 20 years

Wrapping Up

Many Fed officials and market pundits have called the current fiscal situation “unsustainable”. This is a gross understatement. The current fiscal situation is an absolute train wreck with no way out. It has been called a ticking time bomb for decades. That bomb has gone off and it is worse than anyone could have imagined. Anyone sticking to the soft landing narrative and justifying this as a future problem is not doing simple math. Buckle up!

Data Source: https://www.treasurydirect.gov/govt/reports/pd/mspd/mspd.htm

Data Updated: Monthly on fourth business day

Last Updated: Jun 2024

Schiff Gold: Interested in learning how to buy gold and buy silver? Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

If Pete Schiff accuses sleepy Joe of lying, he should give us 3/4/5 juicy examples to quote, perhaps hard to choose out of so many but it would be effective. ALSO how about a QTR quick run down year-by-year of Democrat disasters since they've been in power? Such as mass/unvetted immigration to wreck America, pulling out of Afghanistan, defunding the police, exploding violent crime, supporting Iran and leaving Israel to defend itself, Russia hoax, meddling in Ukraine etc etc

You're right and I am just sitting back ready to start loading up on the SQQQ.