China Will Back Their Country's Digital Yuan With Gold

Some analysts predict gold would have to go as high as $64,000 per ounce if China backed their Yuan with gold.

Those that have listened to my podcast or that follow me on Twitter know that it has been my long-held belief that China is eventually going to back their digital Yuan with gold.

I wanted to organize, and take a little deeper of an examination of, the circumstantial evidence that I’ve been noticing that is leading me to believe that my predictions will be proven correct.

Though I’m hardly a Chinese national, nor am I an expert on the Chinese government, I did work for about 5 years alongside of some Chinese nationals and experts who were instrumental in helping my previous employer expose billions of dollars of U.S. listed China-based fraud. Those efforts were eventually made into a feature length documentary called The China Hustle.

I was also one of the first to sound the alarm that China was lying about Covid in early 2020.

As I’ve consistently said on my podcast, I feel that through my interactions with Chinese nationals and my analysis of companies in China, sometimes tied to the state and other times not, have given me a look into the ethos of the CCP that others may not have experienced.

Based on my years of experience, it’s easy for me to conclude that China is sharper, smarter, shrewder and more rugged than the U.S. when it comes to most things economics and politics.

Make no doubt about it: China has lofty goals for itself. Anyone who thinks that China isn’t eventually aiming to be the world’s biggest military and economic superpower hasn’t been paying attention. But, due to their penchant for working patiently and quietly over long periods of time, this may not be evident to many Americans, who often times need to be bludgeoned over the head with a conclusion before “arriving at it on their own”.

China thinks in terms of generations and centuries. They are officially playing the long game. And don’t let the lack of a hot war fool you, the gears and wheels of trying to advance their country’s interests are there, grinding away slowly behind the scenes, for those who care to peek behind the curtain.

Backing their currency with gold could be seen by Xi as the ultimate “Trump card” of sorts, especially as the U.S. has watched its currency fall into a precarious position over the last 18 months due to unprecedented quantitative easing. It’s the type of revelation that, if done correctly by China, can immediately hoist China’s economic status to the top of the global ladder and can immediately challenge other countries to follow suit. Except those “other countries” won’t be nearly as prepared to “flip the switch” to a gold-backed currency, because we will not have even considered the idea.

Let’s look at some of the pieces to this puzzle I have been noticing play out.

China looks to be clearing the way for its digital currency, regardless of whether or not it is going to be backed by anything. The digital Yuan is no longer a concept, it is being tested in reality and will soon be implemented.

A big part of clearing the way for the digital Yuan (and a potentially gold-backed version) is getting competitors out of the way. This means Bitcoin. China has been notoriously hawkish on Bitcoin as of late, with some speculating it is to make room for their digital Yuan.

“China’s government is doing everything they can to ensure that bitcoin and other cryptocurrencies disappear from the Chinese financial systems and economy,” said Fred Thiel, CEO of Marathon Digital Holdings and a member of the Bitcoin Mining Council.

“Part of this is to ensure the adoption of China’s central bank digital currency, and part of this is most probably to ensure financial surveillance activities are able to see all economic activity,” Thiel said. The digital yuan could, theoretically, enable the government greater power to track spending in real time.

One analyst predicts a 50% chance that China will ban bitcoin outright.

With bitcoin out of the way, the focus domestically would have to turn to gold: keeping it in reserve, transacting it, making it synonymous with value domestically.

In making the case that China may be planning to attack the dollar with a gold-backed Yuan, Gold Alliance wrote back in April about a oil futures contract that could be converted to gold:

In 2018, China launched a oil futures contract that was priced in yuan but could be converted to gold. It means that oil producers could sell oil to China and immediately convert the yuan they got into gold, providing them better value than the paper yuan and even the dollar.

The move raised concerns that this so-called “petroyuan” would be the first of a series of blows China is planning to impact the world’s reserve currency, our dollar.

And those concerns seem to be valid. In the fourth quarter of 2020, central banks worldwide are holding less dollars as the dollar’s share of global exchange reserves dropped to 59%, according to the IMF — its lowest number since 1995.

The same piece also noted that China’s central bank was allowing more imports of gold into the country:

This week came the news that the People’s Bank of China (China’s central bank) is now allowing domestic and international banks to import significant amounts of gold into the country. Until then, the central bank had tight restrictions in place, usually only allowing enough gold to enter the country to satisfy local demand.

Author Brandon Duplessie concludes:

The loosening restrictions on gold imports could be a sign that China may be moving towards a gold-backed yuan to escape a coming dollar collapse and to reinforce their own currency. Think about the security that a gold-backed currency would give to central bankers around the world. If I am a central banker, then not only can I hold the yuan as a reserve currency for trading purposes, but knowing it’s backed by gold gives me the peace of mind it will not be devalued… well, at least not at first.

Gold Alliance CEO Joe Sherman also wrote a great piece this summer suggesting that China’s current agenda is:

Hoard gold to build their reserves and back the yuan

Create massive trade deals that are contracted in yuan

Passively back yuan with gold (as with the oil contracts)

Create a digital currency ahead of other countries

Buy up infrastructure and foreign trade

That article is worth a read in its entirety.

MoneyWeek also wrote in April of this year that China “has more gold than it’s letting on”. Almost as if they are playing it close to the vest, for some reason.

Here is some of the exceptional analysis from this article:

Official records show the US owns some 8,133 tonnes, most of it in Fort Knox. It is the world's largest owner (or so you thought) and gold comprises 77% of its official foreign exchange reserves.

China’s officially declared holdings of 1,948 tonnes make up just 3% of its $3.2trn in foreign exchange holdings, but the real number is much larger than that. China has been the world’s largest gold producer since 2007 –this past decade it has produced about 15% of all the gold mined in the world; last year it produced 380 tonnes – that’s 20% more than the world’s second-largest producer, Australia.

Since 2000, China has mined roughly 6,500 tonnes. More than half of Chinese gold production is state-owned; the China National Gold Group Corporation alone accounts for 20%. Already that official 1,948 figure looks doubtful. Crucially, China keeps the gold it mines –exporting of domestic mine production is not allowed.

With reserves in decline at home, Chinese mining companies have also been buying assets abroad, across Africa, South America and Asia. International production exceeded domestic production by about 15 tonnes last year. As well as being the world’s biggest producer, China is the world’s biggest importer. It is hard to get precise import figures, but we do know that, for example, via Hong Kong alone, over 6,000 tonnes has entered the country since 2000. Add that to cumulative gold production since 2000 and you get a figure of 13,200 tonnes.

Whether imported, mined or recycled, most of the gold that enters China goes through the Shanghai Gold Exchange (SGE), including the gold imported from Hong Kong. So SGE withdrawals – for which we do have numbers – can act as something of an approximation for demand. And it is possible to get numbers for SGE withdrawals: since 2008, roughly 20,000 tonnes have been withdrawn from the SGE.

Then we have to add in gold held in China, whether as bullion or jewellery, prior to 2000. The World Gold Council estimates a figure of 2,500 tonnes in privately-held jewellery. If you add domestic mining and official reserves, you get a figure of around 4,000 tonnes.

Nick Laird of goldchartsrus.com, perhaps the world’s leading gold data expert, has cobbled it all together to produce this chart, showing cumulative gold held in China to be around 28,911 tonnes. I’ve spoken to numerous analysts – Ross Norman, Bron Suchecki and Koos Jansen – and they all arrive at similar estimates.

(MoneyWeek’s estimate of Cumulative gold potentially held in China is the black line)

Other reputable news outlets are also starting to allude to whether or not the digital Yuan could challenge the dollar. Nikkei's "Big Story" this month was whether or not China's digital yuan would "vanquish" the dollar.

Headlines making these types of suggestions have been floating around for months now, like this one from the South China Morning Post:

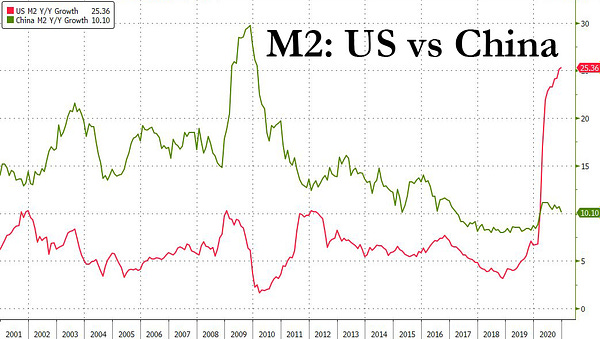

Certainly China hasn’t indulged in the same Central Banking excess that the U.S. has over the last 18 months. Instead, China has taken extraordinary care with its money supply during the pandemic

Statements like this over the summer also shed light on the attitude coming out of Beijing.

What would it mean for the price of gold, should China go down this road? Predictions range to as high as $64,000 per ounce, depending on how much gold China truly holds in reserve, according to GoldCore:

It seems like an outlandish forecast. However, as tensions between the U.S. and China continue to escalate such a scenario is not actually as implausible as it may first appear.

If China were to back its yuan with gold it would require a price of $64,000 per ounce according to a recent report from Bloomberg.

While Bloomberg give no details as to how they arrive at this figure, our “back of envelope” calculations would confirm that at its current value relative to the dollar the yuan would indeed require gold – priced in dollars – to be priced in the tens of thousands of dollars.

Chinese M1 money supply is roughly 33.64 trillion yuan which at todays exchange rate equates to around $5.4 trillion.

Bloomberg conservatively estimate China’s gold reserves at around 3150 tonnes although many analysts believe the figure to be much higher.

In order to back $5.4 trillion yuan with 3150 tonnes of gold, the gold price would need to be in the region of $48,600 per ounce.

Duplessie over at Gold Alliance makes a good point that it isn’t in China’s immediate interest to torpedo the dollar due to the amount of treasuries the country holds.

Future alarm bells would be anything involving China starting to dump their U.S. treasury holdings. Such a move might signify that “zero hour” for the gold backed digital Yuan could be close.

But, as I described above, this is where that long-term patience comes in. China doesn’t make rash, impulsive decisions; it makes calculated long-term strategic . Both Brandon and I agree: China is lining up its ducks in a row for when the right time comes to apply the pressure - whether its weeks, months, years or decades from now.

Regardless, my mind rests easy because much of my money still rides with gold and silver.

Right Chris, my IRA is holding gold plays

my hypothesis; XRP ledger running CBDC (digital yuan). CBDC(s) backed by gold &/or other native country commodities. Instantaneous settlement and "liquid" real time trusted value (gold). old meets knew.