A Look Back On My "Fringe" Covid Analysis From 2020

A collection of my prognostications heading into what would become unprecedented times.

Often times I am misquoted or asked about analysis that I performed leading into the Covid panic for markets in 2020. I wanted to create a place where I could put down my historical analysis of the situation so I could reference it going forward, if necessary.

This is a list I started to compile on my old blog, when I thought a journalist was going to write a piece about those who were “ahead of the curve” in predicting the pandemic (I suggested he not focus on me, but rather on guys like Dr. Chris Martenson, Ben Hunt and George Gammon). Nonetheless, the piece never panned out anyway.

Now that I am truly once again clueless as to where the market is going to head from here (I have said either much higher as a result of inflation or much lower as a result of tapering and generally reality), it seems like a good time to reflect on 2020 - and remind my readers that I am generally clueless.

When looking back on these predictions from 2020, I think it’s important to realize the serious panic and major uncertainty the markets were subject to during the year when making these calls. Looking back, hindsight is 20/20, but when the market was either limit up or limit down for days (and sometimes weeks) at a time, it wasn’t incredibly easy to try and analyze the situation in real time, especially with CNBC on in the background.

Here’s the timeline of what I can remember from 2020. If you have anything to add to this, please shoot me an e-mail or a comment and I’d be happy to add it.

January 21, 2020: I ask “Where’s a Trump travel ban when you need one?”

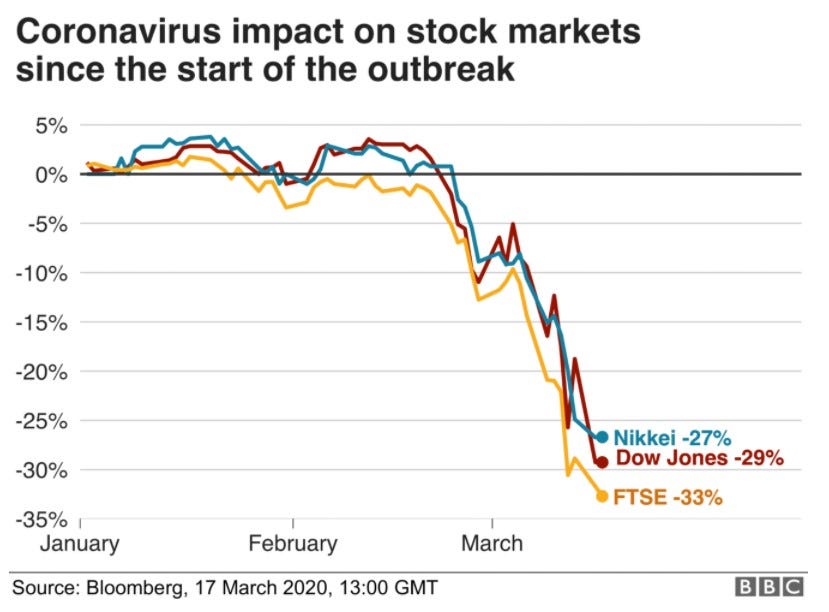

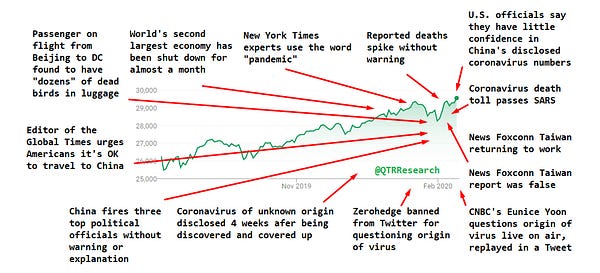

January 24, 2020: With the Dow at 29,230, I warned that the stock market was “not pricing in any type of event involving this coronavirus spreading across the U.S.” and that the market was “extraordinarily overpriced relative to near-term risk”.

I also urged people to consider how many U.S. states would eventually have cases, how many more countries would have cases and what else we will learn about the virus.

January 24, 2020: I Tweet out a pandemic prep list for those who would rather be safe, even if it means people calling you crazy.

January 30, 2020: I was critical of the World Health Organization’s first major press conference on the matter, where they thanked China repeatedly and did little to stress that the coronavirus was a public health emergency.

January 30, 2020: I say “we always have to learn the hard way” in the U.S. as people continue to ignore the coronavirus threat.

I call for a ban of flights in and out of China.

February 2, 2020: I tweet that people are starting to use the word “pandemic” to describe the coronavirus and say: “I take zero pleasure in this but I think a serious wake up call is coming for some asset managers. And is long overdue. Just my opinion.”. The World Health Organization doesn’t declare the coronavirus a pandemic for another 38 days.

February 2, 2020: I wrote an article called “The One Number That Could Reveal A Chinese Coronavirus Cover-Up”, stressing that we must look at data outside of China to determine whether the data we get from inside China is truthful or not.

“As a reminder, despite the government saying that the risks of outbreak are low outside of China, I’ll remind readers that it costs nothing to take extra precautions,” I said at the time. 6 weeks later, grocery stores in the United States would be cleaned out.

February 3, 2020: I called the market’s reaction the virus news a “hilarious, albeit potentially extremely sad, mispricing of risk.”

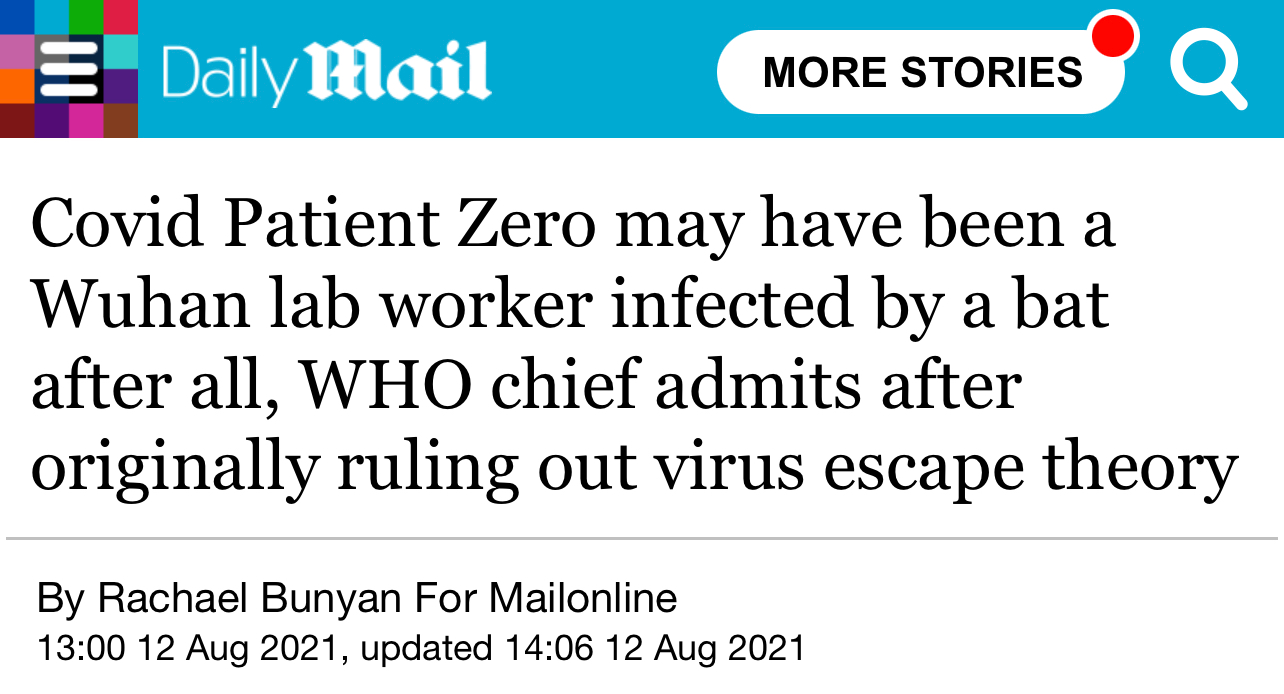

February 4, 2020: I appeared on George Gammon’s podcast and talked about the Zerohedge ban from Twitter. The site was banned from Twitter after questioning whether or not the coronavirus outbreak was a result of a man made virus or a lab leak from the Wuhan Institute of Virology - a theory that has now become mainstream.

“Zerohedge wrote an article basically asking the question ‘is there a link here, between the virus and this scientist [working on bats at the Wuhan Institute of Virology].”

“Is there a basis for Zerohedge to ask these questions? I think to ask the question of whether or not it is natural versus man-made is a reasonable thing to do.”

“As they say in their manifesto…often times their conspiracy theories become conspiracy fact,” I said about Zerohedge’s article. “A lot of things that over time are revealed as truth were at one point considered conspiratorial in nature.”

“I thought the article was very reasonable. I think it’s reasonable to ask questions about this stuff.”

I was also critical of the WHO’s first press conference on the issue:

“I watched the WHO’s press conference last week and all it seemed they were doing was kissing the ass of China.”

We spoke about the government and Fed’s response to the virus. At the time, the government was focused only on stimulating the markets due to an initial slide in equity markets. I commented about why stimulus shouldn’t be the focus, but rather combating the virus. I also predicted inflation:

“People on CNBC last Friday are talking about stimulus coming out of China. It’s like, that’s not the fucking problem. The problem is the virus. Fuck the money printing. We need to figure out whether or not this is going to becoming a pandemic. Then you’re going to have hyperinflation and and pandemic, instead of just a pandemic.”

“The CPI is covering up the rate of inflation, but even the CPI is going to be ugly if we have to print to get out of this. The rich will get richer, the wealth gap will expand, it’ll be an unfortunate wake up call for everyone.”

“Put aside where this came from, I think it could be a bigger problem than people think,” I said about the virus.

When asked about whether or not the virus would get to the U.S., I commented “the virus is already here and we’ve already shut down flights.”

Predicting the Fed’s bazooka, which hadn’t happened yet, I commented:

“The market certainly isn’t pricing in the risk of a global pandemic, I’ll tell you that.”

“Am I surprised the market is up today? No. I think it’s a sad joke.”

I also talked about the disconnect between the market and the economy, even before the Fed’s stimulus:

“If you live in China and want to know how one doesn’t equal the other, look out your fucking window! At 1:30pm on a Tuesday there’s nobody in the streets, there’s nobody buying anything, there’s nobody on the subway. One of the world’s largest economies in the world grinding to a halt isn’t affecting the U.S. stock market, which is up 75 bps today!”

George Gammon noted that imports would be affected substantially if China locks down (he was incredibly right, see: supply chain problems, semi shortage, etc.).

“The whole thing rests on the idea that being able to print is always going to work,” I warned.

As of August 2021, Zerohedge’s Twitter account has been restored and the lab leak theory/altered virus theory is getting the most attention it ever has from the mainstream media.

This headline appeared in August 2021:

Days later in a Wall Street Journal op-ed, former CDC director Robert Redfield wrote:

The story of SARS-Cov-2 started long before January 2020. We believe the virus was most likely uncontained in a laboratory where it was being worked on, and that it escaped unintentionally.

February 7, 2020: I suggest owning $LAKE to play the pandemic. The stock was at $13.14 on the day and hit a high of $47.95 in 2020.

February 8, 2020: In a podcast I did called “Pandemics and Other Things That Make Stocks Go Up”, I worry about the fact that no one is taking Covid seriously. I warn that one day we’re going to wake up and Covid is going to be a big deal.

“As I was saying last week talking about the coronavirus. It's one of those things where you go to bed one night, and you wake up the next morning and things have gone horribly wrong. And attitudes change. And sentiments change. And it happens like that," I said.

Shortly thereafter, things went horribly wrong.

February 9, 2020: I called out hypocrisy from the World Health Organization for, eight days after their press conference, coming out and saying that we may “only be seeing the tip of the iceberg” regarding the coronavirus.

February 10, 2020: I write, “we will reap what we sow” with markets up on the morning.

“Time for the world to wake up” to the virus, I write.

“The world’s second largest economy is shut down amidst an epidemic/pandemic that we have questionable details about - and the market can’t stop scorching to new highs,” I write.

February 12, 2020: Editor of China’s Global Times says “it is now time for the US and other countries to actively consider resuming flights to China”.

February 13, 2020: I continue to note the absurdity of the market going up in the face of the virus in China.

The Fed said it would cut the size of its overnight Repo operations, to which I replied “This’ll last about 45 minutes”. By August 2021, the Fed’s repo facility was routinely taking in about $1 trillion per night.

February 20, 2020: With the Dow at 29,296, I again warned there was a “wake up call for those ignoring virus impact coming”, that the market was underpricing risk due to the virus and that “pain is coming”. The Dow would drop more than 30% in coming weeks to a 52-week low of 18,213.

February 22, 2020: Weeks before our country acknowledged that we needed social distancing or active countermeasures to combat the virus, I wrote an article called “The Time Is Right Now: Why The U.S. Must Act Decisively To Confront The Coronavirus”.

“I am today suggesting that the government act swiftly and extraordinarily decisively to respond to this virus right now, by preparing the healthcare system and citizens of this country, before it gets out of control,” I said. “The first cases in major U.S. cities will grind the U.S. economy to a halt,” I predicted.

“Weeks ago, I was labeled a fear monger and a conspiracy theorist for merely suggesting that people may want to take some type of precaution and be skeptical of China's numbers. Now, those suggestions are looking closer to what the government may be ready to acknowledge as reality. It is with the same prescience that I am today suggesting that the government act swiftly and extraordinarily decisively to respond to this virus right now, by preparing the healthcare system and citizens of this country, before it gets out of control.

I urge our leaders to act in a bipartisan way – and I would urge my readers to forward them this article and suggest they do the same – for benefit of our families and our country, both of which we love.”

“It is becoming apparent that the World Health Organization, the CDC and many other international governments may have underestimated how big of an issue this virus is going to be…”

February 25, 2020: I make the prediction that the Olympics “isn’t happening”. It didn’t happen.

February 28, 2020: With noone paying attention yet, I tweet "wait til schools close and baseball games are called off” for people to get the message how serious this is.

February 29, 2020: In a Periscope live video stream, I was critical of President Trump’s first press conference on the novel coronavirus, where he said the U.S. had 15 cases and that the number was “going to zero”.

I said the comment would cost Trump re-election and that Democrats would win, specifically based on criticism of his handling of Covid. Trump would go on to lose the November 2020 general election.

March 1, 2020: I warn about the potential coming mental health effects of lockdowns, masks and our country’s coming response to the virus.

March 9, 2020: I appear on SNN Network to talk the market crash and the country’s response.

“By the middle of Jan. I was very convinced that this presented an existential threat to the market, that it was a unique threat because it was one we were not going to be able to subvert by printing money. It’s a biological problem, it’s not a systemic financial problem like 2008. I’ve been verbose in making that point since the beginning of January.”

I noted that valuations were still elevated based on historical means and said not to let a market pullback fool people into thinking that all of a sudden, things were cheap.

With gold at $1,673 per oz., I said:

“I think gold’s move here is still just the beginning. Gold I see as a win/win. The market may rally, but gold is probably going to rally with it.”

When asked about what I was optimistic about at the time, I said:

“On the virus front, if you wanted to try and play out the positives, now that the media has created urgency, I think every medical expert is trying to work on a vaccine and while its a lengthy process, the clock is running. Hopefully as more data comes out we find out the fatality rate is lower than we estimated.”

I talked about the price of oil and oil as an opportunity. At the time, the XLE was trading at about $29. As of August 2021, it’s at about $49:

“I think that it’ll be difficult for Russia and the Saudi’s to keep oil this low. Crude is printing $31 1/8 right now. I think crude starts getting into the $20’s its going to be difficult for them to maintain that. They’re doing this to make a geopolitical statement. I think if you’re interested in the space you look at oil and gas names that have been around for a long time, have a secure balance sheet, have paid a dividend consistently. I think there will be some generational opportunities in oil and gas here.”

I predicted lots of bankruptcies in the Permian Basin, but said the pressure isn’t going to “last forever”.

I talked about why I like financials and airlines:

“I think there’s opportunities in other equities too. I just Tweeted I was buying U.S. Bank. Lots of banks are falling here. I think there will be a generational opportunities in airlines, but not in cruise lines. Air travel will become a thing again, just like it was after 9/11.”

U.S. Bank was at about $31 at the time and as of August 2021 trades around $57.

I also commented on what Covid data would be forthcoming and again tried to prepare people mentally for a coming shock.

“I think now is a point where we should expect the death numbers/infection numbers to go up. I think if you hang on to and cling to every single death that happens going forward, it’s going to be gut wrenching exercise.”

March 11, 2020: I appeared on Jon Najarian’s podcast where he asks whether or not the market has finally capitulated in reacting to the emerging pandemic. We talk about the difference between being a permabear and being a skeptic based on common sense.

“I don’t think we have systemic financial risk now,” I say when asked about the state of the macroeconomic as a result of the developing pandemic.

I talk about why I am overweight gold and silver and plan on continuing to be overweight precious metals. Gold was about $1,689 at the time.

“I don’t think we’ve seen capitulation yet. We don’t really know what the long-term impact of this recession, and more importantly the Fed’s response to it, is going to be. We could turn into Japan as a result of this,” I say.

The VIX was at 53 on the day this podcast was recorded.

March 13, 2020: On a day the Dow falls 10% and just 48 hours after my last podcast, I start coming around to the idea that the virus isn’t going to be devastating enough to stand in the way of what the Fed is doing with QE infinity.

I tweet that “there's a chance the tailwind coming out of the coronavirus WAY down the line, with 0% rates, discount window open, short sell ban, etc. could be ungodly.” One year later, the S&P would hit 4,000. 17 months later, the S&P is around 4,400. 12 days later Bill Ackman says “hell is coming” live on CNBC and the market bottoms, the S&P closes at 2,447 and the Dow at 20,740.

Sensing a bottom and stimulus, I suggest Target (then $103, now $267) and Walmart (then $115, now $150) as names to own going forward.

March 14, 2020: I release 25 “for fun” predictions for a bunch of stocks in 2020, almost all of which did not come to fruition.

May 12, 2020: After talking about Warren Buffett essentially saying he was priced out of the market by the Fed’s intervention, I talked to George Gammon about what I thought the market would do going forward.

I noted that Cramer told people to sell their index funds days prior and that I didn’t agree. I criticized Cramer for taking his cues from Warren Buffett.

“I almost find this as a contrarian indicator. I wouldn’t be surprised if the market goes straight up now. Just because Buffett’s been priced out of the market and doesn’t see value doesn’t mean that this crazy psychotic tailwind of stimulus isn’t going to continue to drive the market higher.

First day after Cramer says that. Dow’s up 400 points. Something to have fun with. I just found it pathetic that people cling to Buffett’s narrative like it’s the end all be all. He gets things wrong. He was in the airlines, they just got clobbered. It’s possible for him to get things wrong.”

July 16, 2020: With gold nearing $2,000 per ounce, I appeared on Jon Najarian’s “Compound Interests” podcast and, with the Dow at 26,870, say that “by the end of 2021, I think the Dow could be over 40,000”. The Dow is at about 35,000 as of August 2021.

I reiterated my prediction that China was likely lying about the timing of the origins of the virus:

“If China says patient zero was in November [2019], I’d bet it was well before then,” I say.

When asked about what equities I like, I reiterate that financials are the sector I like the most. When Jon suggests I likely don’t own financials, I say:

“I actually own J.P. Morgan, I think it’s cheap on a price/book valuation. I think all the banks are going to come back. I think any losses that banks incurred to their share price as a result of coronavirus will eventually all be bought back. Because this is a financial problem to some degree, but it’s not a systemic financial problem. And you have the Fed providing unlimited liquidity and an unlimited backstop to the banks. So if you’re buying the banks now, you’re pretty much buying the Federal Reserve. Companies like JPM and GS are not, in my opinion, don’t pose any type of systemic risk. Those financial names are ones I like to buy on the dips. The sector is still off like 25% to 30% this year. I think they are being overlooked, it’s not like hospitality where there’s going to be real pain going forward.”

“I like the banks! I love the names like GS and JPM. As much as I hate the system, those entities are as close to a bet on the Death Star as you can get.”

At the time, Goldman was at $216, J.P. Morgan was at $98 and the XLF was at $23.

As of August 2021, Goldman trades at $384, J.P. Morgan trades around $156 and the XLF is at $37.

When asked about whether or not I would own a SPY index fund (SPY was about $310 at the time, and is about $405 as of August 2021), I said:

“I do think the market could go higher from here and I wouldn’t mind owning an equal weight S&P ETF here. And I hate hearing myself saying that, but that’s the truth”

August 4, 2020: With the S&P at 3294 and the Dow at 26,664 , I appear on Seeking Alpha’s Alpha Trader podcast.

“I feel like the S&P is going to go over 4,000 next year,” I tell the hosts. “The market is basically sipping on rocket fuel that the Fed is giving it.”

“Remember, every single person in March and April that went on CNBC said ‘we have to retest the lows’ and ‘we have to go back to Dow 17,000’. Gundlach said it, everyone said it. I’m the only person who didn’t say it and said we could just launch from here.”

“The Fed's sole mandate these days has devolved into keeping the stock market rising in order to give the impression that all is well,” I noted. “I think the economy is actually going to recover faster than people think from this,” I continue.

I note we are in the midst of “the most accommodative monetary policy in the history of humankind and every day we get more and more data, and every day we get closer and closer to a vaccine.”

“I’m long equities and I’m long gold and silver,” I said. With regard to the reaction to Covid, I say: “Over the next 6, 12, 18 months I think we’re gonna look back and say ‘OK, we may have overreacted a little bit. I think we have a lot of tailwinds. I think we are going to have one good vaccine and therapeutic headline after another from now until next summer.”

—

Disclaimer: These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot. If I am here listing things I got right or thinks I think will happen in the future, note that there are likely twice as many things I got wrong over the same period of time. I’m not a financial advisor, I hold no licenses or registrations and am not qualified to give advice on anything, let alone finance or medicine. Talk to your doctor, talk to your financial advisor or your therapist. Leave me a alone and do your research elsewhere. If you can find somewhere to rate this Substack one star, please do so as to save future readers from the misery of my often wholly incorrect prognostications.

Great seeing you over here Chris!