Black Friday Bedlam: Markets Thrashed On New Covid Variant Fears

Index futures are getting smacked, oil is down 5%, gold is bid and bitcoin is selling off. What's to come today and next week?

It’s semi-hilarious that when Covid first occurred at the beginning of 2020, I couldn’t get a single soul to listen to me when I warned that the market would eventually react negatively.

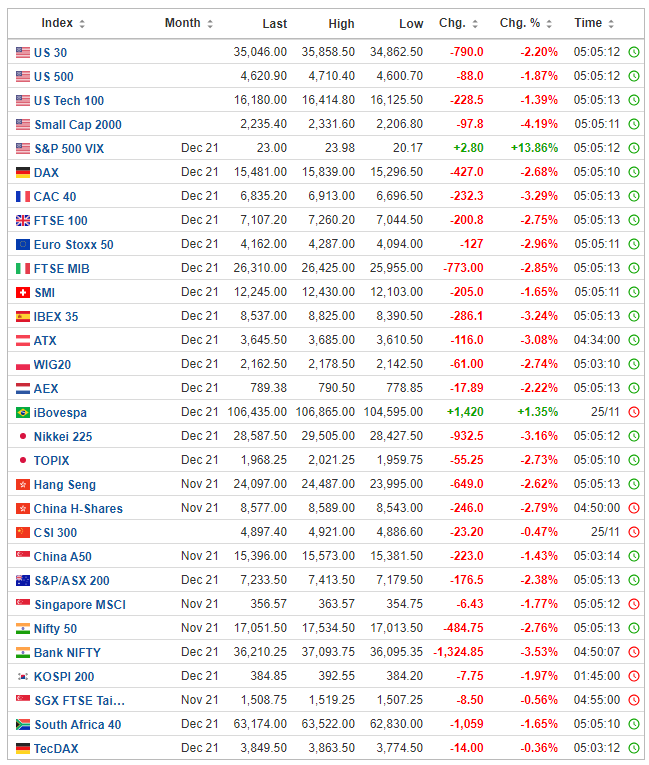

Now, entire continents stop all travel, immediately consider lockdowns and markets sell off 2% every time a new variant makes its way into the news cycle. Behold, this morning’s shit show and the overnight shellacking, as of about 5AM EST:

Just hours after Goldman Sachs made the dumbass move of predicting a quicker than expected taper, index futures are getting destroyed on news of a new Covid variant out of South Africa - days after I warned that the market could wind up getting its salad tossed heading into the new year. That prediction was for reasons other than another Covid variant, but I stand by my analysis. Just three days ago, I wrote:

I’m often one of the first people to joke about how nonsensical the idea of a Santa Claus rally is, but it puts the idea of a rising market over the holidays into everybody’s head, every year. Obviously, it’s just made up bullshit-lingo used to provide an excuse for people to buy overvalued money losing crap in the market, but it seems like a good year to remind market participants that a rally doesn’t always have to happen.

You can read that article here:

Additionally, I had already detailed several reasons why I believed the NASDAQ could be on the verge of a collapse without warning here:

As mentioned, the overnight panic has been due to a scary sounding report of a new Covid variant out of South Africa. The variant may evade immunity, reports say, but is still being evaluated by scientists. Newsweek summed up the hysteria:

Scientists have voiced concern about a new COVID variant that has a "really awful" combination of mutations that could possibly cause the virus to evade immunity.

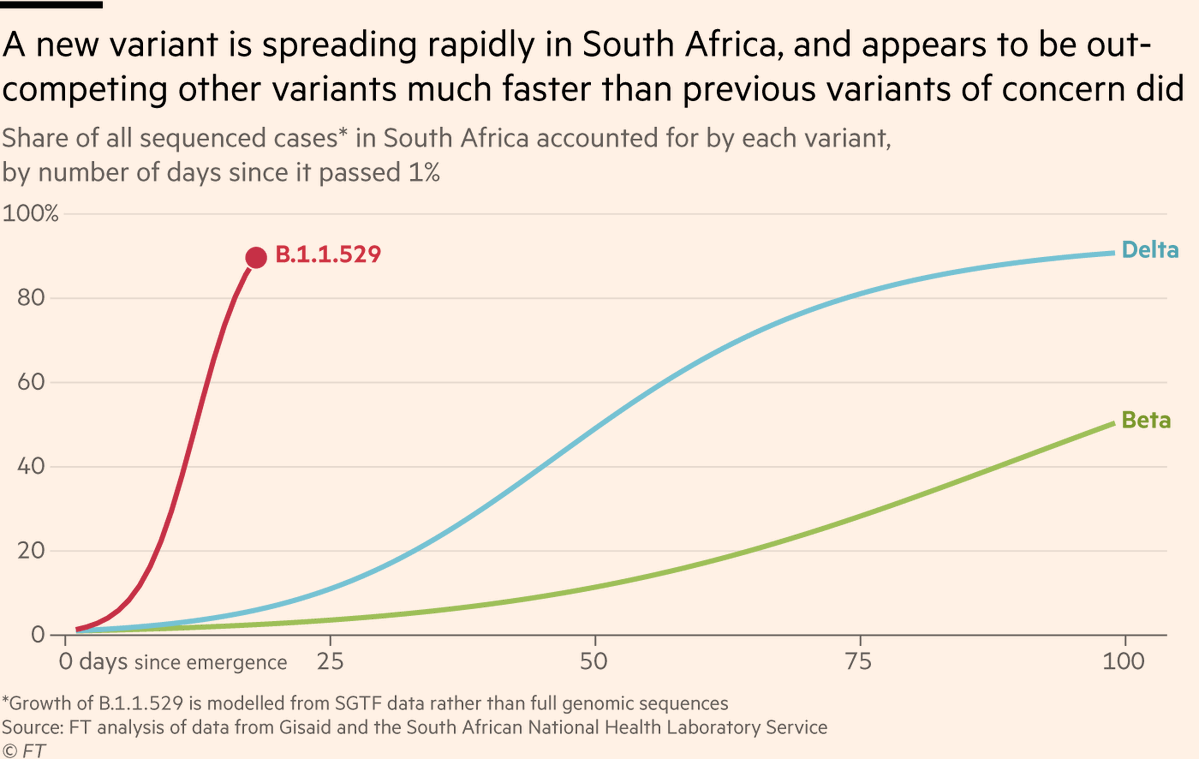

The variant, now called B.1.1.529, was reported on just days ago after a small cluster of cases were spotted by Tom Peacock, a virologist at Imperial College London in the U.K.

As of Wednesday this week, the variant had been detected in Botswana, South Africa, and Hong Kong, and there were only 10 cases reported, The Guardian newspaper reported.

Despite the low number of cases, B.1.1.529 has some experts worried due to the mutations it has.

In a Twitter thread on Tuesday, Peacock said the variant had a number of notable mutations such as K417N, S477N and E484A among several others associated with the virus' spike protein. The virus uses this protein to enter human cells.

Peacock wrote: "Worth emphasising this is at super low numbers right now in a region of Africa that is fairly well sampled, however it very very much should be monitored due to that horrific spike profile (would take a guess that this would be worse antigenically than nearly anything else about)."

As of this morning, the new variant has already been detected in Israel and is likely going to wind up spreading globally, so it’s probably a good idea to just accept that fact now.

While the significance of this variant as it relates to people’s actual health remains to be seen, its significance in terms of macroeconomic policy and certainly today’s trading session shouldn’t be overlooked. If you want to know more about the science, Zero Hedge did an excellent job of summing up the key points of what we know about the new variant in their overnight coverage.

Here’s my wild-ass guess at the path this new variant is going to take us: more than likely back to all time highs, but not before we hit some (potentially large) bumps in the road first. While I happen to think this will be the Delta variant part 2 (in that it drums up a lot of hysteria and then everyone eventually ignores it), that doesn’t mean the government and markets won’t overreact to the news.

Remember, scary sounding words like “mutation”, “spike protein” and “variant” are a prompt to act like hysterical hyenas and usurp power unilaterally for those on the left side of the aisle (read: our entire government right now).

We will have more information over the coming days as to what the government’s response is going to be globally, but if the U.S. follows the lead of the U.K. and the EU overnight, its looking like travel bans, mandates and lockdowns could all once again be on their way.

If the government uses this variant as a an excuse to assert even more control over the country and lock down again:

You can kiss any plans to taper goodbye for the time being. This’ll create political turmoil, as tapering seems to be the only “solution” politicians have explored to inflation running rampant in the country. Expect prices to continue to rip higher and the market to potentially react positively.

We can eventually expect more stimulus checks, as we head further down the path to stagflation and universal basic income. The additionally stimmies will throw a wet blanket onto job growth and make the nation’s labor shortage worse. This should be a massive tailwind for gold, which is up about $25/oz. as of the time of this writing. Bitcoin selling off like a risk asset this morning leads me to believe my long held thesis that BTC is a risk-asset and not a hedge may be correct. I’ll keep looking for rotation from BTC (risk on) to gold (risk off) in the event of deleveraging. Remember, gold also sold off in early 2020 prior to ripping to all-time highs. When margin calls come in, people sell whatever they can get their hands on.

Travel stocks could get pasted and stay-at-home stocks could rip. Of particular interest is oil, which has had a monstrous run over the last 6 months. Even though President Numb-Nuts is failing at actively trying to micromanage the oil market (as the Saudis look on and laugh), oil could still pull back further as perceived demand would crumble in the event of a lockdown. Also of note are names like Peloton (PTON) and Zoom (ZM) - both of which are more than 50% off their Covid-catalyzed highs.

Pfizer, Moderna and Johnson & Johnson could have a heyday again, especially if the new variant spreads (it will) and can evade current vaccines (undetermined). One has to think about whether or not the new variant will be able to evade the vaccines on the market. Should this turn out to be the case, it would not only be the impetus for another round of unilateral power grabs by the government, but could also send the stocks of Pfizer, Johnson & Johnson and Moderna into the stratosphere as it would almost ensure, at the very least, new booster shots, and at the very most, an entire new round of vaccines.

And if the government decides to do nothing about the new variant, we likely wind up going back to all time highs in 2022 anyways, as it’ll probably still be used as an excuse to delay the taper.

I think the only thing that could send the markets moving much lower in very fast fashion would be a lockdown style attitude from the government without clear messaging from the Fed that they’re going to back off the gas when it comes to the taper.

The odds of this are low, in my opinion, but it would be your classic lose/lose scenario.

I’d love to be able to tell my subscribers that I know exactly where the market is going to go today, and in the week ahead, but the fact of the matter is that I don’t, but for my prediction that we could see volatility heading into the end of the year.

With so many unknowns at play (the severity of the variant, how governments and the Fed will react), I’d rather be honest with you and tell you it’s too early to try and analyze than make up some shit to justify why I charge for analysis behind a pay wall to begin with.

The only one true honest inclination that I’ve had so far this morning has been that Gold rising just $20 on this news doesn’t seem like quite enough. It had already started to feel like sentiment was shifting back towards gold as an inflation hedge over the last couple months. A brand new round of stimulus from the government would only act as a tailwind for that thesis. Lockdowns that keep production and labor suppressed would also act as a tailwind, as they’d keep a bid under consumer prices.

If I had to make any bet, I’d say this headline too will pass. And even if it doesn’t, Covid is already over for me in my head - an attitude I suggested many should gift themselves heading into the holidays.

Enjoy your Thanksgiving leftovers, and your long weekend.

500 murders this year in the city of brotherly love, WTF, be careful Chris

I am dumping everything but gold and uranium, everything is about to get blasted