The Silver Market Just Nuked The Narrative

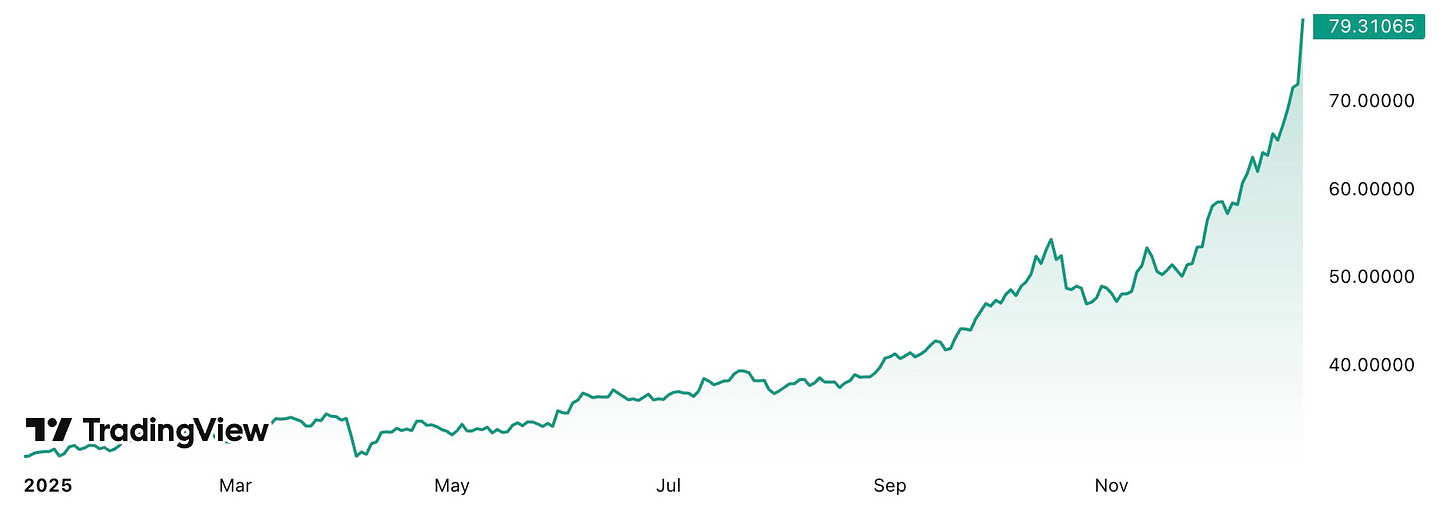

Silver rips faces clean off on Friday. It's a statement.

I want to take a walk down memory lane — but before I do, let’s start with Friday, because it was not just “a big day” for silver. It was a statement. It was the kind of violent, undeniable, face-ripping move that doesn’t just show up on a chart, it closes an argument.

Silver didn’t merely rally — it ripped higher in a way that perfectly wrapped up a year where the precious-metals markets have done nothing but confirm what some of us have been warning about for a very long time: the global financial system is fundamentally broken, monetary policy is a farce, and the theoretical scaffolding holding modern finance together is rotting at the seams. I’ve been yammering about this for the better part of 7 years now.

As Zero Hedge deduced on Friday, Silver’s explosive move was the result of a rare convergence of macro forces, market flows, and physical constraints all hitting at once: falling U.S. real yields and growing expectations for Fed cuts pulled investors back into precious metals just as central banks’ relentless gold buying encouraged rotation into silver. At the same time new demand from corporate treasuries and stablecoin firms broadened the buyer base further, silver’s already thin market was made even tighter by mining disruptions and deteriorating ore grades, and rising gold prices pushed retail jewelry buyers to trade down into silver, shrinking available supply.

There was bullish options positioning already in place, speculative derivatives activity accelerated the move and quickly forced a physical chase in a market with limited inventory, turning a strong rally into a squeeze and producing the kind of violent upside move that only occurs when macro tailwinds collide with structural scarcity.

Friday’s move happened after a year of gold making new highs, central banks hoarding metal, currencies quietly losing credibility, deficits exploding, and policymakers pretending they still control outcomes. Friday was the market’s way of saying what Austrian economists have been saying forever: the system can’t be fine if the money is broken — and the money is very clearly broken.

And that’s why this isn’t about being “right on a trade.”

This is about being right about the system.

Years ago, while the mainstream was hypnotized by zero rates, QE, and the fairy tale of MMT — the idea that governments can print forever, deficits don’t matter, and inflation is just a spreadsheet problem — I was writing the opposite. I was saying that if you dilute the currency, distort price signals, suppress rates, and pile on unpayable debt, you don’t get stability. You get delayed consequences. And those consequences eventually express themselves in what I would call a “blowoff valve”. It didn’t mean markets had to crash, it meant price distortions would have to show up somewhere.

And they did, in the only honest barometers left: gold and silver.

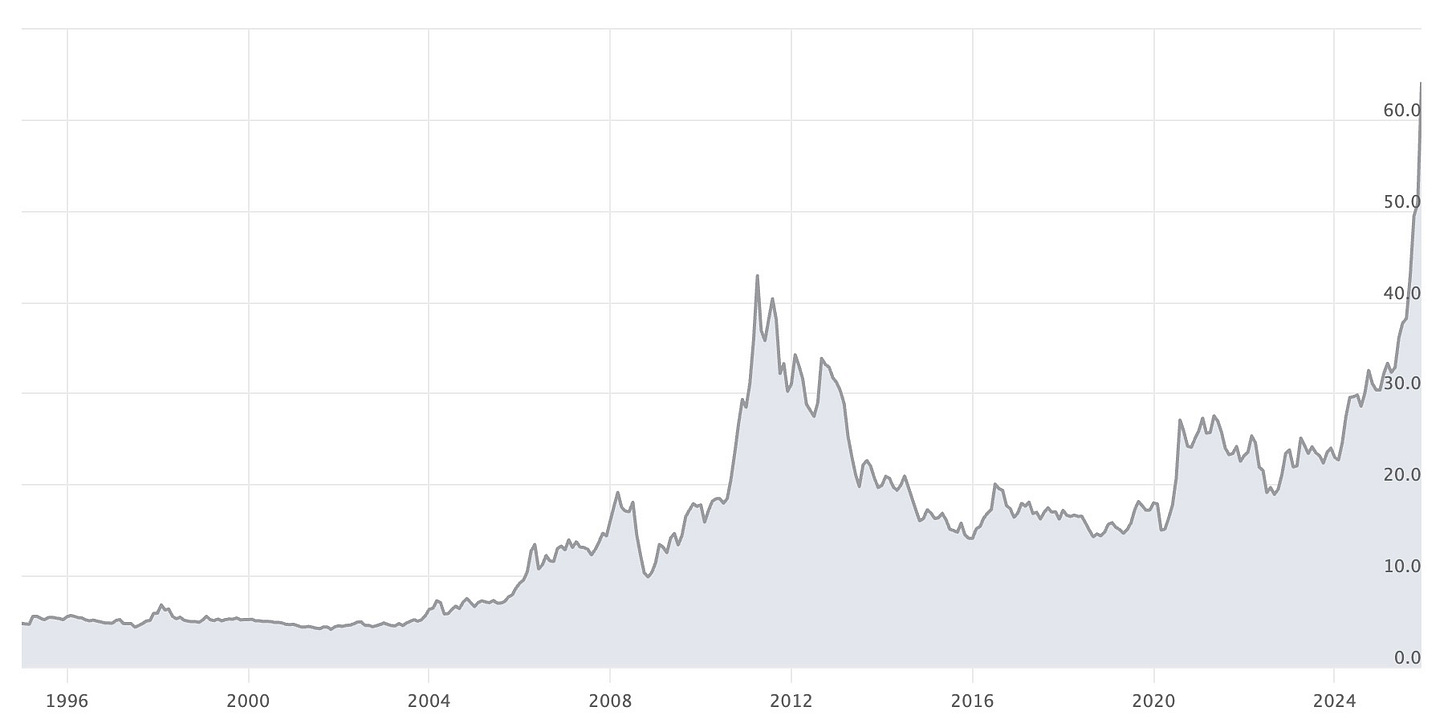

On February 14, 2025, in Don’t Sleep on Silver, I wrote, verbatim: “If you ask for my opinion, it’s not a question of if silver gets to triple digits, it’s just a question of when.”

At the time silver was around $32. I wasn’t describing a gentle appreciation. I was describing a structural repricing driven by distorted ratios, exploding industrial demand, and a monetary environment that had already crossed the point of no return. I wrote that silver’s next run could be “its best in history,” citing the extreme gold-to-silver ratio and the inevitability of retail rediscovering silver once the narrative cracked. That wasn’t a guess. That was an economic conclusion.

“If you look at the cup-and-handle formation forming in silver right now, it looks almost exactly like gold did a year or two ago before its breakout,” I said.

Does it make sense now?

Even earlier, in November 2022, in There Are Massive, Record-Breaking ‘Mystery Buyers’ in Gold All of a Sudden, I pointed out that central banks had purchased a record 399 tonnes of gold, writing that these were not random flows but a signal of de-dollarization underway. I argued that large geopolitical players were quietly repositioning away from dollar dependence because they understood the same thing I did: a debt-based, endlessly expanding monetary system eventually destroys the very trust it depends on.

And threaded through all of this was the same underlying thesis: central banks are trapped, deficits are unfinanceable without currency destruction, and MMT is nothing more than a permission slip for political theft. In pieces like The Federal Reserve Is Clearly Trapped from April 2024, Larry Lepard laid out how gold’s behavior wasn’t just bullish — it was diagnostic. It was the system’s fever breaking through the narrative that everything was under control.

So when silver exploded on Friday, it didn’t just validate a forecast — it validated a worldview.

That candle on the chart is the physical evidence of a broken monetary order. It says: trust in fiat is eroding, confidence in central planning is fading, and markets are beginning to price in the consequences of decades of distortion. A 10%+ move in silver isn’t normal. It’s not healthy. It’s not random. It’s what happens when confidence cracks and price has to adjust violently to catch up with reality.

The most satisfying part of all of this is how little has actually changed in the underlying logic. The Austrian framework — scarcity, sound money, incentives, real price discovery — is doing exactly what it always does. It is exposing the fraud of the prevailing model. Friday’s move didn’t create a new story. It confirmed the one that’s been written for years.

This isn’t a bull market. It’s a regime change. The system is broken. And the metals market is finally forcing everyone to admit it.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

I can tell Chris was in 'the zone' in this writing. When all the good stuff bubbles to the top in his mind dump. The nuggets of wisdom and extreme awareness are sumed up in this sentence.

"That candle on the chart is the physical evidence of a broken monetary order."

Good job our O' Feathered One.

There scared and there lying. They been caught swimming naked & the stackers got them dead to rights.

They will no doubt attempt to hammer the price back down, but SCO & other central banks will be there to buy it back up.

It not so funny when the rabbit has the gun.

Im not selling a oz until i retire in 10 years. An will use it to purchase land to build my retirement house, in the woods.