Two Buyout Rumor Targets I Just Can't Ignore

Sometimes, buyout "rumors" just seem to make a little too much sense to ignore.

My full thoughts on the market and the rest of my portfolio will be forthcoming in my August portfolio update, which will be out in days to paid subscribers.

But before then, there have been two names over the last month that have had buyout chatter and rumors that are worth paying attention to in my opinion, yet their stocks do not reflect much chance of either getting a deal done.

I wanted to write a quick note about them today because I believe time is of the essence, so I’m splitting these names off from the rest of my update to push them out quicker and let you know why I find them interesting.

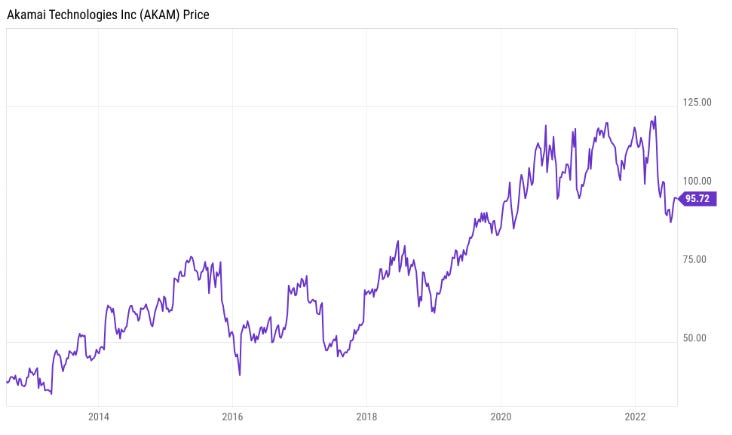

Let’s start with the lesser-known and lesser conviction of the two, Akamai AKAM 0.00%↑ . The company is in two industries I absolutely love for the long-term: cloud services and, as I have talked about many times, cybersecurity.

Akamai Technologies, Inc. provides cloud services for securing, delivering, and optimizing content and business applications over the internet in the United States and internationally. The company offers cloud solutions to keep infrastructure, websites, applications, application programming interfaces, and users safe from various cyberattacks and online threats while enhancing performance

There have been buyout rumors on the name going back to May of this year. The rumor started when Ben Harrington’s Betaville, a blog that publishes rumors and gossip about mergers and acquisitions, published an “uncooked” alert that the company “may be seeing interest from a mystery buyer”.

While Betaville’s track record has been spotty, there was a follow up report from Street Insider, citing an unnamed source, that claimed an “unidentified private equity firm is said to be in talks to try to secure financing for a potential offer for Akamai”.

The same report says that “recent market speculation has suggested activist Elliott Management may be interested”. Elliott has been in the news lately, for snapping up shares in a couple other technology names, like Pinterest PINS 0.00%↑ and Paypal PYPL 0.00%↑ .

Akamai trades about 21% off of its all time high right now, a rarity for the growth company, whose stock is still up more than 2x over the last five years. It wouldn’t be insane for a potential buyer of growth to see a 21% pullback like this as an appetizing point to try and make a bid.

And what would this post about M&A be without wrapping up the Manchester United MANU 0.00%↑ drama from the last two days? For those that missed it, Elon Musk "jokingly" came out and said he was going to buy the company two days ago via Twitter (just committing a little light securities fraud again), putting the beleaguered team into the eyes of many retail investors.

Musk is a fool and will have to deal with the consequences of his stupidity, but let’s put him aside for the moment. What most people need to know from this post is that I have extremely high conviction that a deal is going to get done with MANU, it's just going to be a question of how much of the team gets sold and at what price. I’m long MANU right now and intend to remain long (and this is coming from a Liverpool supporter, so you know I must have conviction in the idea).

There are a couple of reasons I have very high conviction about this idea:

First, as much as I hate to admit it, Manchester United is one of the most storied franchises in sports. Founded in 1878 or 1902, depending on who you ask, they are synonymous with top flight and top class football, regardless of how they are performing. They’re like the Yankees of soccer, for those not familiar with the game.

They have won a record 20 League titles, 12 FA Cups, five League Cups, and a record 21 FA Community Shields and are also one of the most widely supported clubs in the world. They’ve also won the Champions League three times.

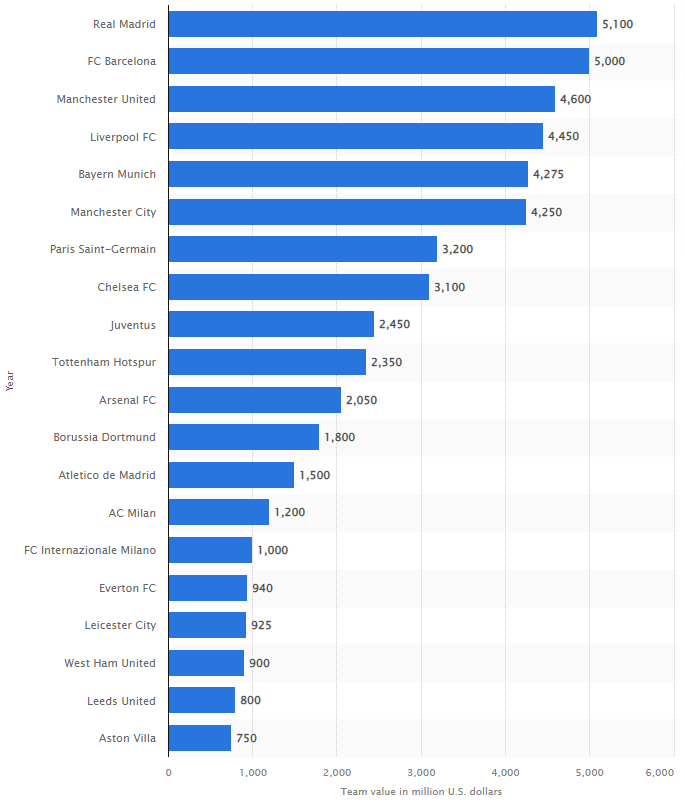

Their value has plunged from almost $5 billion in early 2022 to where it stands now, at barely over $2 billion. The club’s current value, due to an ownership spat and poor team performance, vales them in line with clubs with Tottenham and Arsenal, two lesser known (yet still heavily supported) English teams that don’t nearly have the supporter base or track record as United.

The above chart from early 2022 shows where the company truly belongs in terms of valuation - sitting amongst Real Madrid, Barcelona and Liverpool as top in all of Europe.

This divergence in the club’s prestige and its listed value won’t last long, in my opinion. One of the reasons I thought the idea of Musk buying the club wasn’t crazy was that it seems like nowadays anyone could just muster up $3 billion and make a cash offer to take the company at a nearly 50% premium.

In my opinion, in 10 years, the club could be a $10 billion+ asset. Their name will continue to win them talent and they will return to winning once again, if they don’t do so this season (only about 5% of the Premier League season has been played so far, MANU has lost both of its matches).

Second, the team’s current ownership is absolutely detested by the fan base. The Glazer family has not won favors from the fan base by paying out dividends to themselves and running the team into the ground in terms of its football quality.

The Glazers have even sold off shares along the way, hitting the bid at about $18 per share last year. Since then, the fan base’s loathing of the ownership has risen in intensity.

The Glazer family has publicly said they think the club is worth closer to 4 billion or 5 billion pounds, which would put the club’s valuation well north of USD $25/share, based on their opinion. That would put the club near its all time high valuation. It’s currently about 47% off of its all time high as a public company.

At some point, the drumbeat of the townspeople with torches is going to get to the Glazer family, especially if the team continues to underperform. Any additional sell off in the equity here due to underperformance by the team, I see as opportunity. Even if you want to take this entire season and scrap it (they will bounce back, trust me), I still think a deal could get done at $20+/share. Given the chance, I think the Glazers will hit the exits. It’s tough not to want to when you’re not liked.

Finally there has been real interest in the name. Despite Elon Musk acting like a fool, other actual serious billionaires have shown an interest in the team. For example, just yesterday Sir Jim Ratcliffe said he was “serious” about buying the club. He missed out on buying Chelsea for 4.5 billion pounds, but is an “even bigger” Manchester United supporter. He could easily draw up a similar bid, which would fall into the Glazers’ comfort zone and would represent almost 2x upside for the equity at current prices.

Ratcliffe's spokesperson told The Times: "If the club is for sale, Jim is definitely a potential buyer.

"If something like this was possible, we would be interested in talking with a view to long-term ownership.

"This is not about the money that has been spent or not spent. Jim is looking at what can be done now and, knowing how important the club is to the city, it feels like the time is right for a reset."

And there has been other interest in the team, too. The Glazer family has turned down offers from Saudi price and multi-billionaire Mohammed bin Salman for the team. He had offered about 3.5 billion pounds several years ago. This deal is now dead in the water, but it shows there is genuine global interest in the name.

To me, a deal for MANU 0.00%↑ just makes too much sense to ignore. There's too much upside in making a bid for the company: their play has nowhere to go but up, it’ll appease the worldwide fanbase and will give the team a much needed fresh start. Most importantly, for an incoming owner, they won't just have a chance to make sporting history, there's also a financial incentive in being able to potentially 2x or 3x a 3 billion-4 billion pound investment in 10 years, in my opinion.

Disclaimer: I am an idiot and often get things wrong and lose money. I am long MANU and currently have no position in AKAM, but may open one. I own/owned positions as disclosed above and in linked pieces. This is not a recommendation to buy or sell any stocks or securities. I own or may own all crypto/stocks I mentioned or linked to in this piece. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Great to know that the world's richest man is a fool and stupid. I now feel much better about myself.

Looking good this afternoon with MANU. Thanks Chris.

It feels like watching my son lining up to take a penalty kick for his travel team

https://twitter.com/tjisonline/status/1595173642916270101?s=46&t=8OBljJHg0_nC09QseSeSRw