This Next Market Crash Will Break Our Fragile Brains

Forget the damage to markets when the passive bid dries up and the Fed is stuck cutting rates into stagflation. The psychological damage will be worse.

I always find it funny when I think about critics of people viewing the economy from an Austrian lens. The old joke is that “newsletter writers” like myself could never cut it managing a portfolio and, to make a living, need to scare people into reading and subscribing—not only to my view on the economy, but to my newsletter.

But at least for now the stocks I’m watching for 2025 are holding up this year (currently about +10.4% vs. the S&P +1.9% as of this weekend, on an equal weighted basis) and, as I’ve explained on countless podcasts, I write an Austrian-centric newsletter because it is derived from the basis of my core beliefs about the economy and the world of finance, as best as I can understand it.

In other words, I’m an Austrian school thinker first, and a “fear monger” second.

Take, for another example, my friend Peter Schiff. I know Peter well and believe him to be a person who is ethically beyond reproach and someone who comes by his steadfast views on free market capitalism honestly. He is constantly criticized as someone who is disingenuous in his economic beliefs because he happens to run a gold company. But I know the truth: he runs a gold company because it is based on his beliefs to begin with, not the other way around.

And let’s be realists for a second. Our “pessimistic” beliefs on markets and the economy—simply referred to by people like me as “reality”—are vastly outnumbered by the majority of perma-bull financial market participants: retail investors, institutional investors, sell-side analysts, corporate executives, financial media personalities, the government, central bankers, and almost every single other person that has some place in the global financial economy. Not unlike us “newsletter writers” that supposedly need to shill our beliefs to make a living, the majority of other people in the financial universe also need to shill their shit and their beliefs to hold up in order to make a living.

While us Austrians haven’t upended modern monetary theory just yet, every time the Fed can’t predict what inflation is going to do, and every time CNBC anchors and Wharton professors shit their pants at the first sight of a market drawdown, and every time a financial institution goes bust from being too optimistic with its capital, credibility erodes slightly from the mainstream financial bedrock and osmoses itself over to our little dark, tinfoil-hat-wearing corner of the financial world.

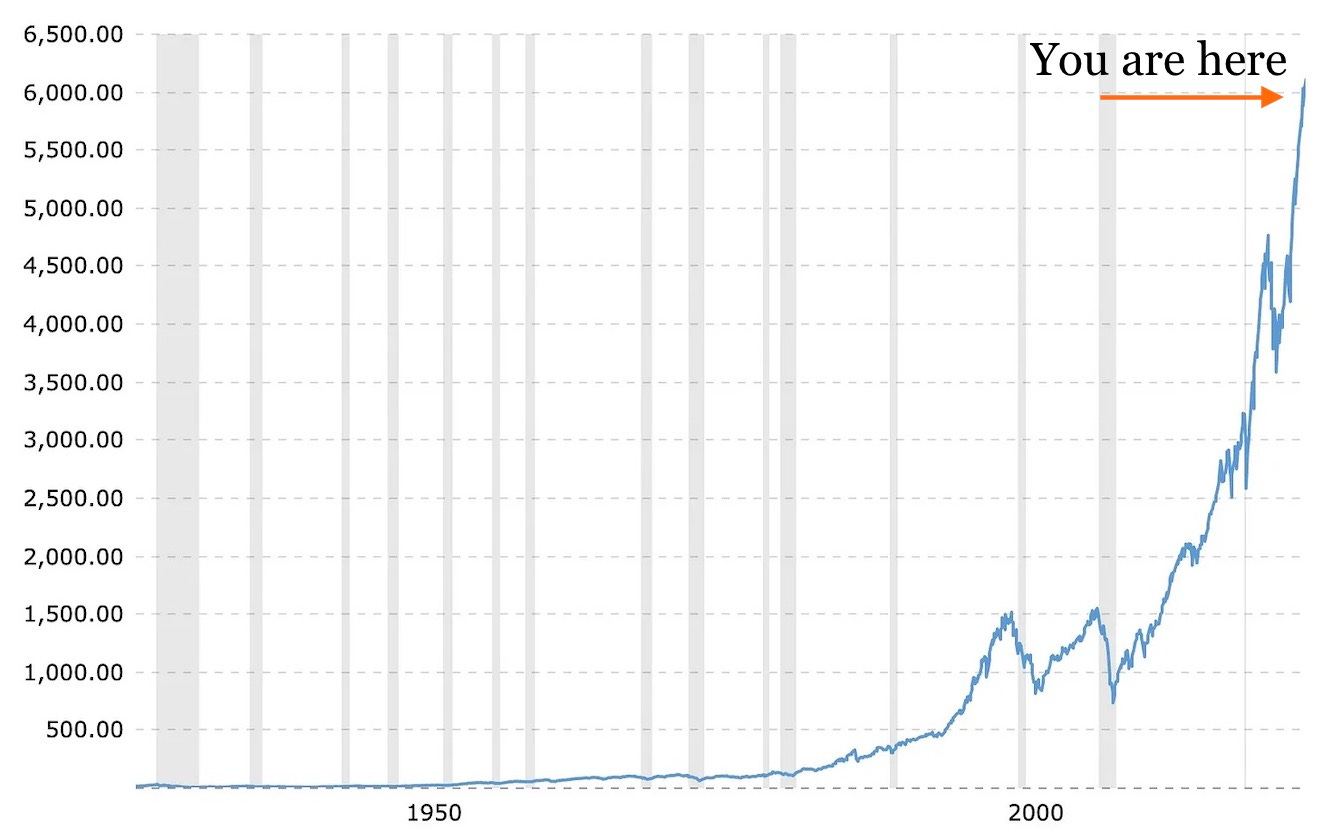

And I’ll be the first to admit: the “establishment” view on the global economy has continued to dominate—not just the nominal stock market scoreboard but also the prevailing state of mind of all participants contained therein over the last few decades. When you're a sports bettor that constantly lays the chalk on the favorite, and the favorite has come in the last 99 times out of your last 99 bets, why wouldn’t you take the favorite one more time on the 100th bet?

So once again, after this past Friday’s market selloff, strategists like a concerned-looking Tom Lee do what they do best: return to financial airwaves in order to proclaim that everything is fine, this time definitely isn’t different, and investors should consistently be buying the top of the market regardless of macroeconomic conditions, valuations, or a guarantee of certain death via asteroid the very next day.

It’s difficult to ignore that Tom Lee has “nailed it” on markets over the last decade, and I need to give credit where it’s due. Holding your nose and buying stocks without giving a single solitary fuck about valuations or the macroeconomy has sadly been the most effective way to generate returns over the last decade or two. But as every piece of financial literature you’ve ever read says somewhere on it: past performance is not indicative of future results.

And people that don’t make daily appearances on CNBC — like, oh, say, Warren Buffett, for instance — are taking another road: getting into cash.

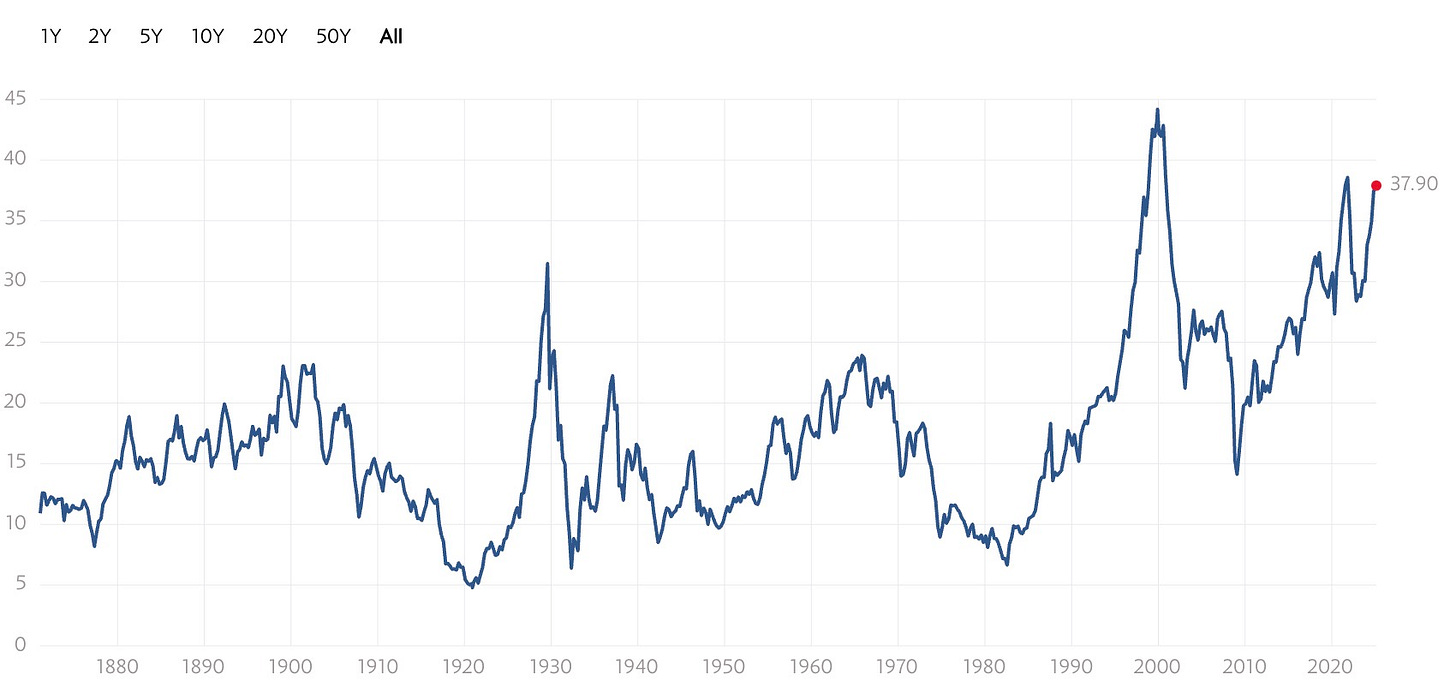

Though the tune of buying the dip has hardly changed, the environment it’s being sung in has. Stocks now trade at a Shiller PE that’s approaching 40x, a level only eclipsed once in history during the 2000s dot-com bubble.

But if the market’s price-to-earnings ratio and the macroeconomy didn’t matter when stocks were trading at 30x earnings, why should they matter with stocks trading at 40x earnings?

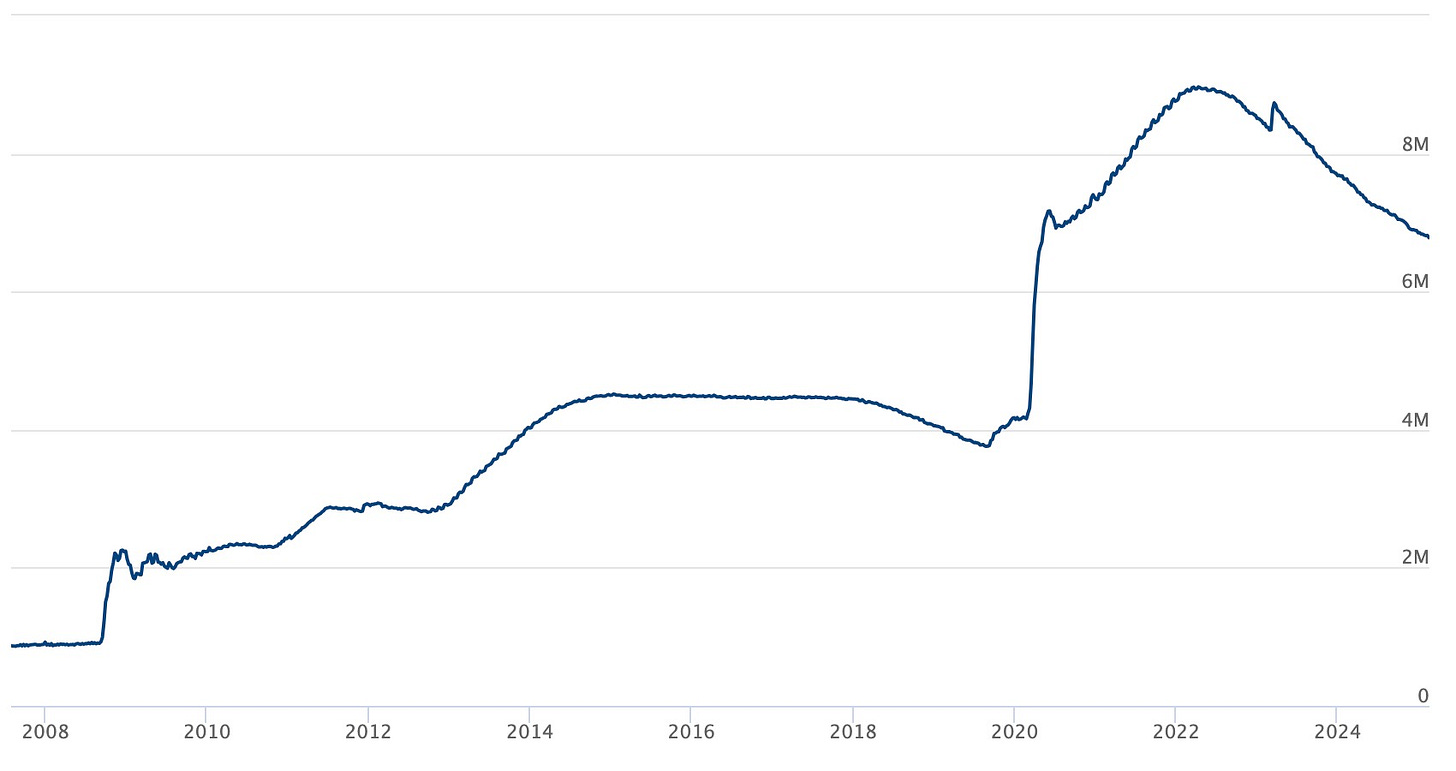

This indifference to valuations—helped along by the “passive bid” of 401(k)s and ETFs consistently buying the market at any given price (well explained by Bill Fleckenstein here on Julia LaRoche’s podcast, and then updated here during his appearance last week), combined with what is widely perceived to be an unlimited Fed put, combined with the unprecedented amount of liquidity doled out as a result of COVID, combined with the stock market becoming accessible to literally any human being on earth that wants to take their shot thanks to the advent of retail trading apps—has distorted expectations and psychology not just about the stock market, but also about the basic fundamentals of economics and finance, in a way that many of us probably would not have even thought fathomable 50 years ago.

Modern monetary theory has acted like a risk-hunger marijuana edible that all traders and investors have been forced to swallow, resulting in an insatiable, decades long case of the market munchies.

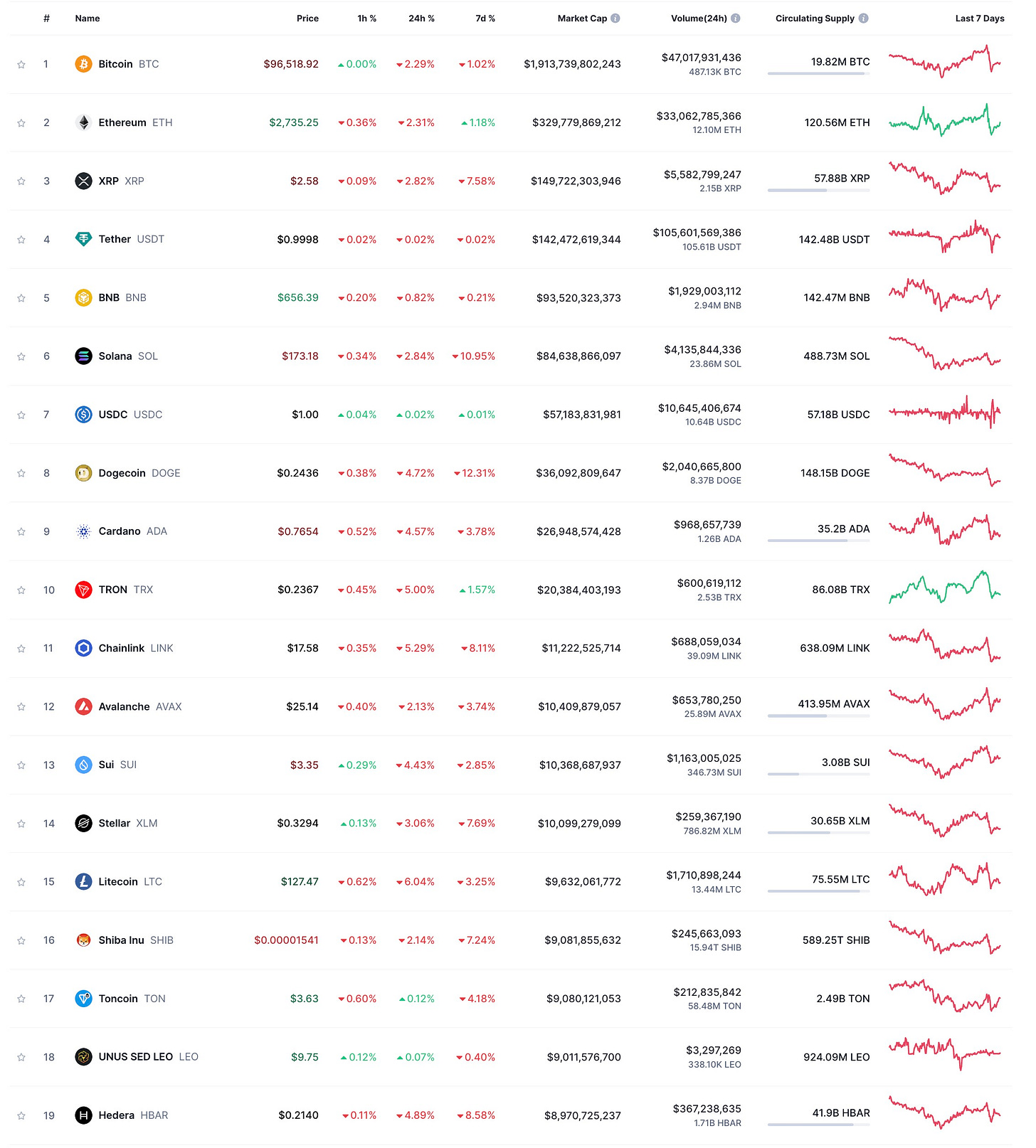

In fact, liquidity has been so ubiquitous and markets have been so rigged that people are speculating upwards of $3 trillion in an asset class — crypto — that, to the best of my understanding, offers very little product or service and exists almost entirely digitally.

If you want to try to make the argument that overvalued equities can sometimes be hard to recognize, especially when they only seem to continue to go up and valuations only seem to continue to expand, that’s one thing. But how, with a straight face, can anyone argue that $3 trillion worth of crypto is in some way “undervalued,” let alone serves a purpose at all?

Here’s a list of the top 19 cryptocurrencies by market cap.

Let’s put Bitcoin aside for a second and assume there’s a value to the protocol in the network. What are the other 18 of these doing? Dogecoin? Sui? Hedera? The rest of the top 50 gets even better. Uniswap? Polkadot? Ondo? Kaspa? VeChain?

I feel like the guys in Major League reading the roster before opening day.

“Ricky Vaughn, Willie Hays? I’ve never heard of most of em. Mitchell Friedman?”

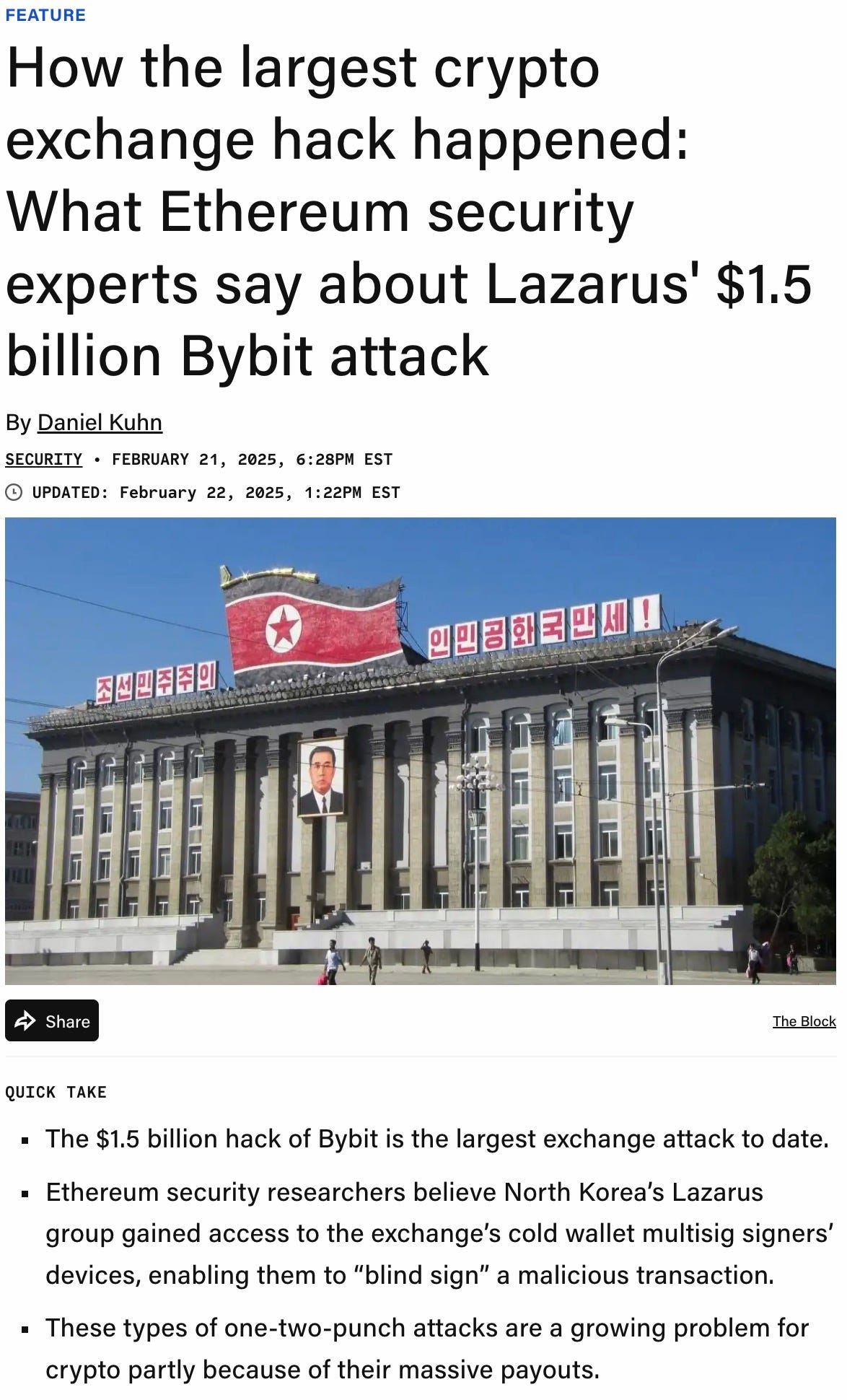

What are all these…things…doing? As best as I can tell, pretty much nothing—other than becoming $1.5 billion liabilities for those who custody them, like Ethereum was this past week.

I’m fairly confident that almost all of the crypto market outside of Bitcoin and Ethereum is nothing more than pure excess.

And, of course, the same type of useless excess exists in equity markets, as well, in the form of thousands of companies burning cash and surviving while paying their executives solely from stock sales. But at least these completely useless, bullshit equities give us the courtesy of inventing some idiotic story about their product or service and what it will do to help humanity. Joke memecoins like Dogecoin and Fartcoin, don’t even do that. They are the literal definition of pure, useless speculation, with their respective labels laughing back directly in the face of the investors who buy them. The first line of this NBC article about Fartcoin is: “Yes, it’s called Fartcoin. Yes, it is totally useless.”

If the saying “hubris comes before the fall” turns out to be even 1% accurate, we are likely in for an unexpected comeuppance for the ages. Other than lighting giant sacks of $100 bills on fire on live television just to make a statement about how little you care about return on investment, it doesn’t get more hubris-laden than buying something like the Hawk Tuah girl’s crypto coin.

And we see the same bullshit with equities too.

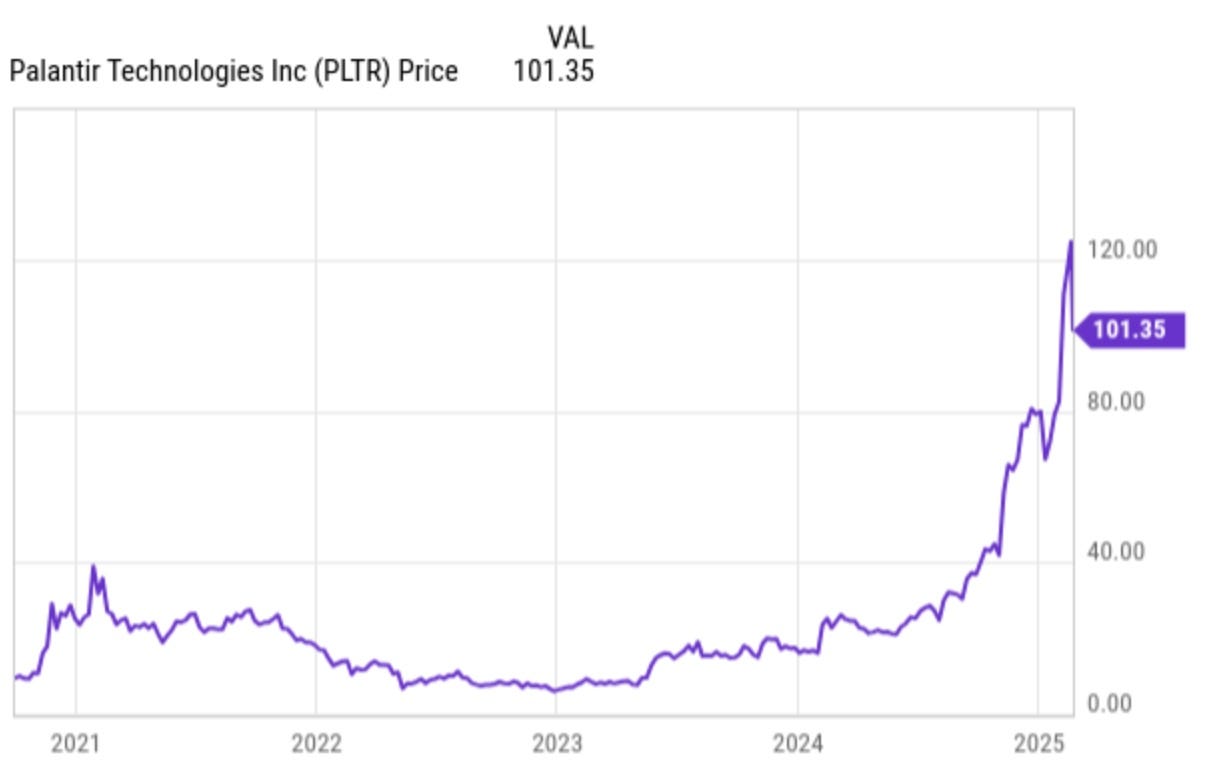

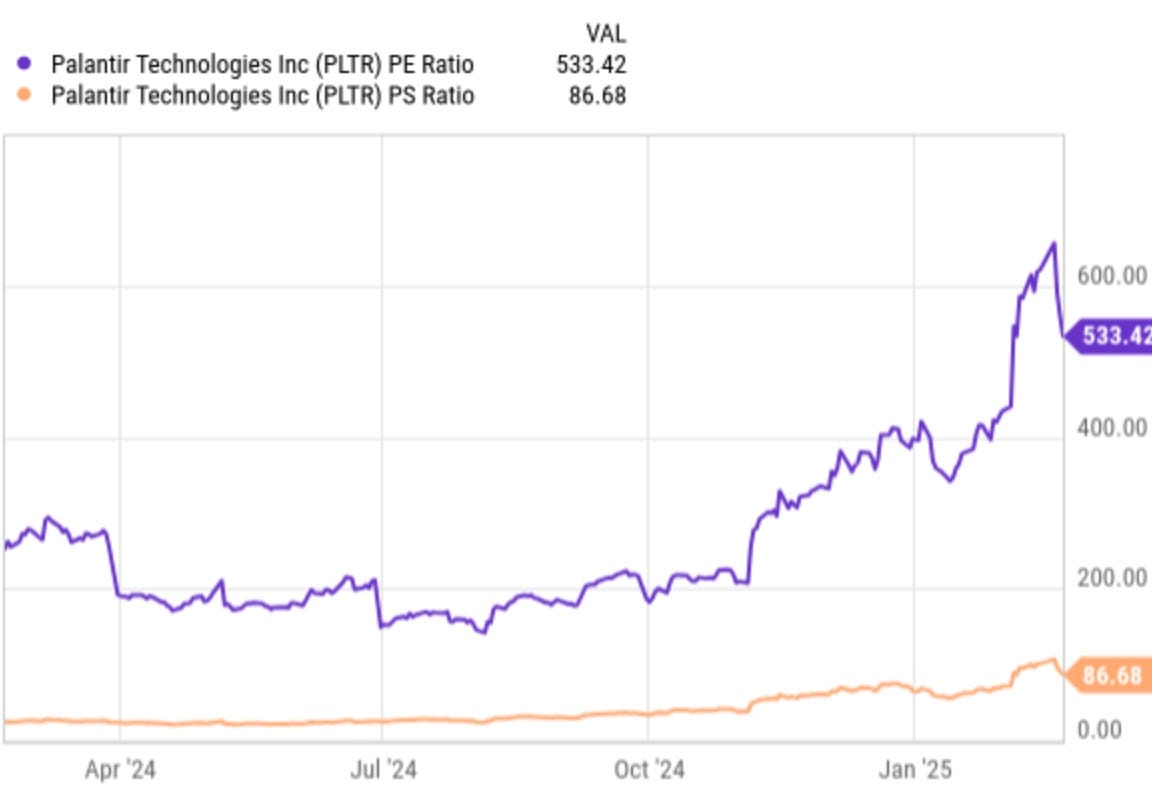

Last week, when there was a momentary headline about the Pentagon possibly cutting spending, Palantir—a stock known loosely to be tied to defense spending—took a momentary breather from its 18 month long parabolic rise, which has seen its stock go up nearly 10x, to correct 5% in one session. Any investor even remotely interested in fundamentals would have told you going into that week that at roughly 550x trailing earnings and 95x sales, the stock was already trading in extraordinarily aggressive territory.

Even after the 5% move lower, the stock still closed the session at about 530x trailing 12-month earnings and 86x trailing 12-month sales. In other words, the stock took in a minuscule hiccup of reality after doing nothing but tearing ass higher for two years.

One may think to themselves: “Any analyst with half a brain or investor with the slightest bit of financial acumen probably could have or should have seen a pullback in the company’s valuation coming.”

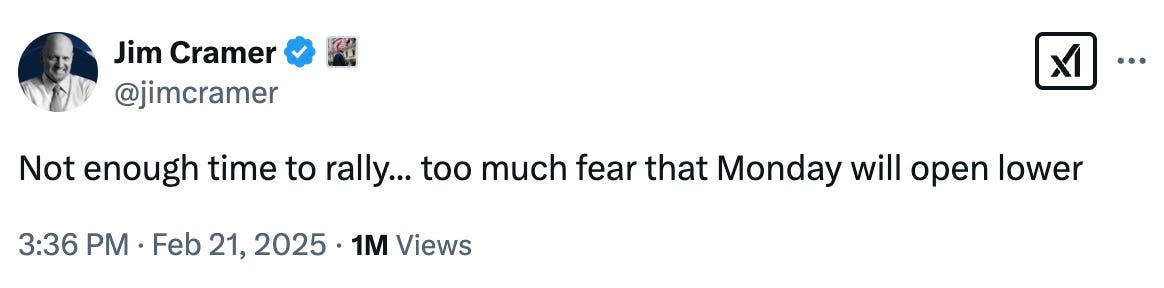

But no. Instead of accepting a subatomic level of reality and warming to the notion that the stock probably shouldn’t be trading anywhere near where it is today to begin with, Jim Cramer took to Twitter to watch every tick and cheer for the company—using a very matter-of-fact tone that came across to me as though he was saying bulls should be able to see the stock double again and again and again, ad infinitum, despite any lack of reason for doing so. Behold, this “analysis”:

And then, commenting on the overall market, Cramer took what appeared to be the same tone, indicating to me he thinks bulls should always be vindicated, bears should always be eating large quantities of shit, and the market should go up every single day, all day, regardless of whether or not it has any reason to.

“Not enough time to rally,” he lamented at the end of the day, succumbing to the horrifying reality that we’re going to have one of those rare ‘red’ days in the market that feel like they come once every academic semester at this point.

“This marks the end. All life as we know it ends at 4PM with the closing bell,” Cramer may have thought to himself before hitting “Tweet”.

Behold the horror of the great crash of February 2025:

I know Jim Cramer has a job to do, and I respect that. I like him just like I like Tom Lee. It isn’t personal. I know his job is to side with retail investors and try to show market neophytes that there is “a bull market somewhere.” I actually agree with the sentiment—there can always be a bull market somewhere—but that doesn’t mean that stocks always have to go up.

When you take these types of disturbing assumptions and you download them onto Cramer’s millions of Twitter followers and television viewers—then you couple that with a Federal Reserve whose unwritten third mandate has proven to be never letting stocks go down, ever, for any reason—is it any wonder that the entire retail investing public has subscribed to the notion of closing their eyes, holding their breath, and buying the dip in any situation, including the end of the world?

This hubris and outright delusion exists as the sharpest tip of an exceptionally long spear of irrational market exuberance, arrogance, crowd-herd mentality, and greed, mixed with financial unsophistication.

The entire economy existing within the confines of a Modern Monetary Theory system that is set up to rig asset prices higher is one thing. To be fair, it would be foolish not to expect the market to have irrational and overly optimistic expectations.

But the fever pitch of where expectations are now, combined with what I believe is a mathematical certainty that markets will eventually have to move lower in dramatic fashion, means that the next crash might just very well break the brains of a good portion of the investing public.

From here, a sharp and decisive move lower in markets probably first comes as the result of an economy grinding slower, and then, in dramatic fashion, the quick cascade of deleveraging and speculation unwinding will torture people financially. But psychologically is where it is really going to torture a whole new generation of investors who have yet to feel any significant prolonged financial pain. Think about it: the COVID crash was over in a couple of weeks.

This means that there is an entire market full of investors who have not felt any type of prolonged recession or drawdown in markets. And they have definitely not felt a depression or the psychological uncertainty of what can happen if the market loses confidence in the currency or the creditworthiness of the United States.

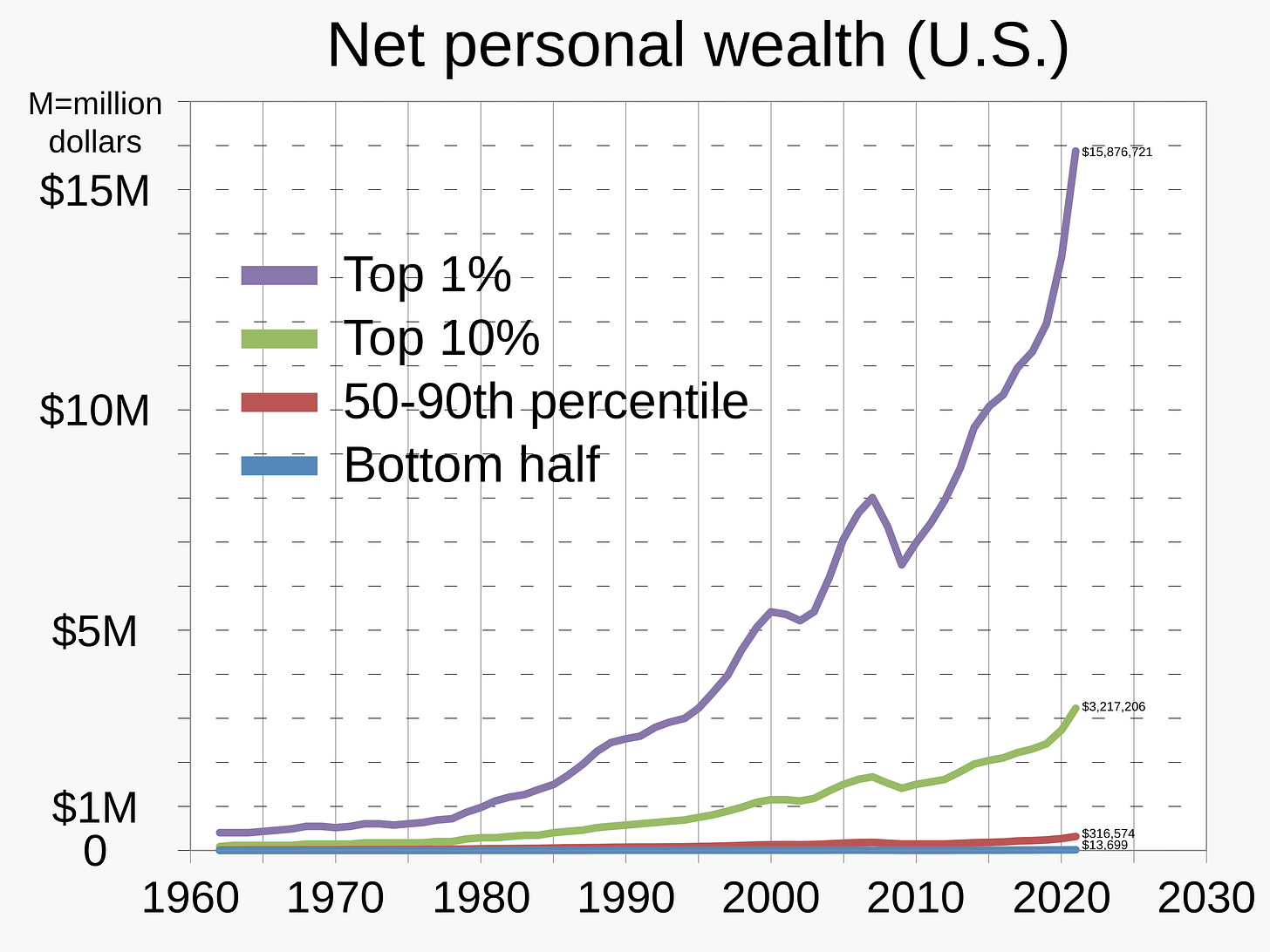

The Fed put is always going to be there, and nominal prices are probably always going go up. But at some point, just like a lot of the populace has learned about money printing over the last 10 years thanks to Bitcoin, people are also going to learn about the differences between nominal prices and real prices. They will compare the price of assets to inflation. They won’t be fooled by prices rising faster than the value of their assets. In fact, they will know exactly what it means: that the system, as the Fed wants it to exist today, doesn’t work, widens the inequality gap, and disproportionately negatively affects the middle and lower classes.

We bailed out a tech bubble in the early 2000s, and the result of our bailout came back as a housing crisis. We bailed out housing in 2008, and the result of that, if you ask me, is going to either be a currency or sovereign debt crisis.

There will come a point one day where, psychologically, the Fed intervenes and stock prices may go up again, but the average investor is living out depressionary hardships. And I mean this for people who are lucky enough to even own financial assets. Many lower- and middle-class families don’t even have significant amounts of financial assets but, rather, have negative net worth. The wreckage to these classes will be unlike anything we’ve ever seen before.

Make no mistake about it—we appear to be stuck between a rock and a hard place where the only exit door seems to be stagflation. This is something we haven’t combated since the 1970s, and the monetary policy and fiscal layout of the country right now is so distorted that people from the 1970s wouldn’t even recognize it.

The Fed has no option to raise rates into a stagflationary environment because of the ungodly amount of debt we have outstanding. Even with rates where they are now, I believe the Fed is out over its skis and has already sealed the fate of guaranteed defeat for the economy and markets.

So what happens then? We’re stuck between welcoming a deflationary depression by raising rates to try to combat inflation, or we’re going to have to let inflation run wild. We’ve never been in this situation before in modern history. And even more frightening than that is the fact that market participants and the average American citizen are the most coddled and the least equipped to handle bad news related to the economy than they’ve ever been.

I write this article today not to stir up fear but to do what I did leading up to the country panicking about COVID: to try and get some mental exercise in so that if the shit truly hits the fan, psychologically, it won’t be a total blindside surprise to everyone, including myself.

See you Monday morning.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Well written and cogent thoughts, I hope your readers listen. I’ve been in finance for 45 years and this cannot be sustained. Buffett—whose preferred holding period is “forever”-hasn’t gone to cash for no reason.

It’s the peoples’ money being channeled through Wall Street courtesy of ERISA. The vast majority of people have no clue or input. It is being channeled to people who get paid tons of money to look the other way .

Keep getting the word out, if for nothing else for your integrity and sanity. That said, there is little the few can do but protect themselves as best they can.

You’re a good man, and we are fortunate to have your thoughts.