There's No Easy Way Out of This Debt Spiral

What will the national debt look like by the end of fiscal year 2024? $1.8 trillion is a conservative estimate, especially if the economy continues to worsen.

By Ryan McMaken, Mises Institute

We're about six weeks into fiscal year 2024, but if this year looks anything like last year, we can assume the federal government will continue to pile up debt at astonishing rates.

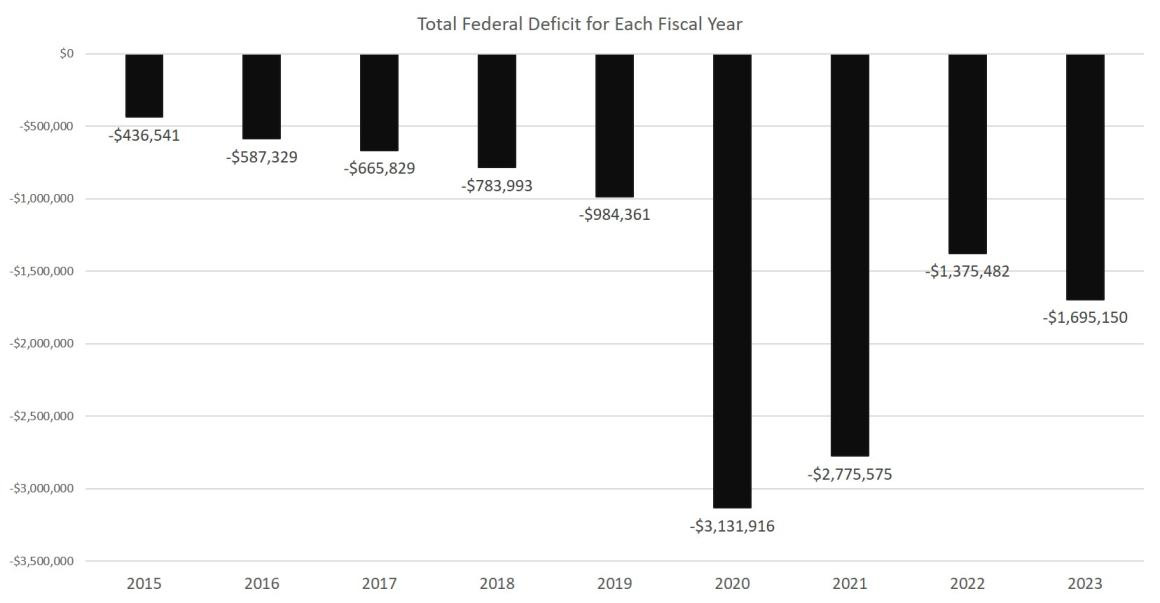

According to the September Monthly Treasury report, the US government accumulated an additional 1.7 trillion dollars in debt for the 2023 fiscal year, which ended October 31. That' up by $319 billion, or 23 percent, from the 2022 fiscal year. As recently as June, budget-watchers had estimated the year-end deficit would be $1.5 trillion, but deficits quickly added on an unexpected $200 billion by years' end:

The pace of increase, however, may have been even higher than 23 percent. As CNN noted, the $1.7 trillion number may reflect some creative accounting. As CNN reports, the Treasury Department reported the cancellation of Biden's student loan forgiveness program as a windfall for federal revenues, and thus reduced 2023's deficit by about $300 billion, bringing it down to $1.7 trillion. In other words, if we ignore the never-implemented student loan forgiveness program, the deficit actually doubled from FY 2022 to 2023. As CNN puts it: "The US Treasury Department listed the fiscal year 2022 deficit as $1.4 trillion because it took into account the cost of the president’s proposal. Without it, the deficit would have been closer to $1 trillion. ... The agency then logged the overturning of the cancellation plan as a savings for fiscal year 2023, which reduced the size of the deficit to $1.7 trillion."

So, the year-over-year increase in the deficit may have actually gone from about $1 trillion to $2 trillion—or an increase of 100 percent instead of 23 percent.

In any case, annual deficits are rapidly growing toward the unprecedented deficits of 2020 and 2021 when the federal government went deeply into debt to avoid an immediate economic catastrophe as a result of government-mandated lockdowns and business closures. In the wake of these enormous deficits, the national debt—the sum of accumulated annual deficits—has now topped $33 trillion. That's an increase of more than $6 trillion just since the beginning of the Covid Panic, and an increase of $18 trillion since the beginning of the 2008 financial crisis.

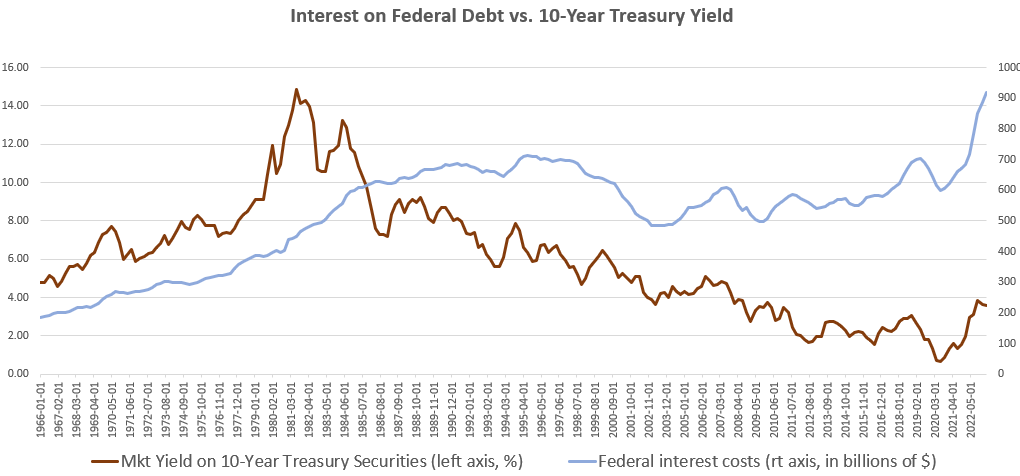

When Interest Rates Rise, Debt Becomes a Problem

Some jaded readers may now be telling themselves, "so what? ... the national debt has been huge for decades, and nothing catastrophic has happened." Things are different now because interest rates generally fell from the mid1980s to 2022. But that trend ended last year as the central bank was forced to allow interest rates to rise in an effort to combat price inflation. The new problem we now face arises from the fact that huge deficits are only manageable so long as interest rates remain very, very low. Once interest rates head upward, debt service on an enormous debt begins to swallow up large portions of federal revenues.

When this happens, we can see that even if federal debt flattens, interest obligations can continue to quickly mount when interest rates are increasing. As of the end of the second quarter, for example, federal interest on the debt had already surged to over $900 billion. By comparison, that's more than the likely Pentagon budget for 2024. These numbers are in 2023 dollars:

This is both a political problem and an economic problem. It's a political problem because as interest payments mount, Congress must reduce its spending on popular programs like Social Security and defense—or go even more deeply into debt to pay off the old debts.

It's an economic problem because attempts to avoid budget cuts to federal programs will mean more deficits and a need to use the central bank to suppress interest rates via monetary easing. That will lead to more price inflation (whether on assets or consumer goods) which creates its own economic and political problems.

The only real problem, then is austerity in which the federal government actually cuts federal spending to bring federal interest payments under control. Should the federal government choose any path other than budget austerity to address this problem, the federal government will enter into a debt spiral in which mounting debts are "solved" with even more debts, and more monetary inflation.

Keep in mind that all of this is taking place during a period when we're told the economy is—as the The Wall Street Journal puts it "great." Or, as Paul Krugman has put it, the economy is "surreally good." Yet, deficits are supposed to stabilize or go down during periods of economic expansion. Surging deficits are supposed to be a characteristic of recessionary periods and times of economic crisis. We saw this in at work in response to the financial crisis of 2008.

Of course, if it were true that the economy is in wonderful shape right now, we would not see such huge deficits because tax revenues would not be falling as they have in ten of the last twelve months. Were the state of the economy so strong, federal tax money would be pouring in as economic activity expanded, and deficits would at least be stable, if not falling. Yet, it's tax revenues that are falling as incomes, corporate profits, and consumer activity underwhelms. Falling revenues, of course, when combined with continued runaway spending, means ever-larger deficits.

What will happen when the economy turns to an undeniable recession and a weak job market? Federal tax revenues will plummet and deficits will soar.

Can the Fed Force Down Interest Rates Yet Again?

The conventional view of the media and policymakers is that the Fed will then intervene to force down interest rates to "stimulate" the economy while simultaneously making government debt more affordable. Yet, the Fed cannot just implement lower interest rates whenever it feels like it. In practice, the Fed forces down interest rates via open market operations. It can influence market interest rates, but cannot dictate them.

In other words, the Fed cannot ignore the challenges that ensue when the Treasury dumps large amounts of new debt into the marketplace. All else being equal, if the amount of government debt surges—as it will do in the next period of recession and crisis—the Fed must buy up a substantial amount of that debt if the Fed seeks to prevent increases in interest on the new debt. If the Fed does not intervene in this way, interest rates will increase because that's the only way the Treasury will be able to attract enough buyers to the new mountains of debt the Treasury must issue to avoid budget cuts.

Yet, if the Fed begins buying up large amounts of this debt, where will the Fed get the money to do so? The Fed will create new money to do this, which also means price inflation, a falling dollar, and declining real wages for workers.

What will the national debt look like by the end of fiscal year 2024? The Committee for a Responsible Federal Budget estimated $1.8 trillion back in March. Looking at trends since last Spring, $1.8 trillion is a conservative estimate, especially if the economy continues to worsen.

Author:

Ryan McMaken (@ryanmcmaken) is executive editor at the Mises Institute. Send him your article submissions for the Mises Wire and Power and Market, but read article guidelines first. Ryan has a bachelor's degree in economics and a master's degree in public policy and international relations from the University of Colorado. He was a housing economist for the State of Colorado. He is the author of Breaking Away: The Case of Secession, Radical Decentralization, and Smaller Polities and Commie Cowboys: The Bourgeoisie and the Nation-State in the Western Genre.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors and are either published with the author’s permission or under a Creative Commons license. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

There is NO WAY out........except total collapse.

Those who talk about solutions to the problem, do not understand the system or the problem.

Money is borrowed into existence......at interest. The interest is not borrowed into existence, so there is always more debt AND interest than there is money in existence.

People talk about the Fed raising rates to "fight inflation." Hell, the Fed is raising rate to generate more inflation. They need the inflation. They love the inflation. Has inflation gone down, since they started raising rates on the biggest mountain of debt the world has ever seen? Hell no! Look at the increase in debt since they started raising rates. The world is awash in debt. Raise the cost of debt, and you raise the price on everything.

You are not going to get these people running this shit show to act responsibly. We passed any hope of that a couple of decades ago.

Like that internet meme pic in Mandarin and English: Carefully Fall Into The Cliff. This may be less orderly than that.