People who have been reading my blog and listening to my podcast for years know that I hold a special disdain for the idea that markets can, and should, only go up.

On more than one podcast, and in more than one article, I’ve noted that this fallacy is just one of many nefarious concepts that I believe do a major disservice to the average investor.

When these otherwise illogical concepts are dumbed down to be made digestible to the average investor, it casts a signal that the financial industry, and the media that peddles it, are simply too embarrassed or incapable of leveling with the American public about the innerworkings of monetary policy and markets.

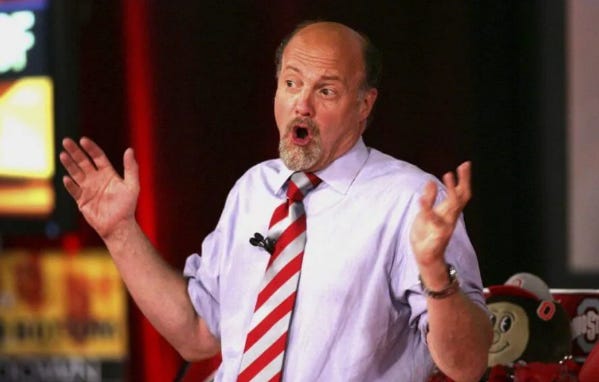

Rather than take concepts like the market only going up - which, when observed casually, sound ridiculous to even the most uninitiated market participants - and deliver them with a straight face, they are instead broadcast with a zany, sensational, insulting ethos that the industry thinks resonates better with the American public.

This is how we wound up with Jim Cramer - and why Cramer’s deadpan admission of market manipulation, caught on video, has gone mostly unnoticed and without consequences - but his show where he routinely rings bells and whistles while screaming, panting loudly and sweating profusely, WWF-style, is celebrated.

In addition to giving us the poor man’s stock market infotainment, financial media has also given us an unlimited number of “easily digestible”, yet equally as inane and useless acronyms, which conveniently help do away with critical thinking about investing when employed.

For example, Jim Cramer coined the term “FANG” year ago, which was an acronym for “Facebook, Amazon, Netflix and Google”.

While Cramer was trying to just be cute for beginner investors, the acronym - eventually adopted by mainstream media - sent another message: stock market investing is so easy, we don’t even need to decouple these names from one another anymore.

After all, Cramer talked about these companies so much that it was just easier to refer to them by one name, saving him time whenever he wanted to recommend or talk about these securities, but not necessarily the entire NASDAQ (despite the fact that these are completely different companies with completely different valuations).

But when referred to by their acronym, which is easy to remember by retail investors, where they went one, they went all.

The market for retail investors has been so similarly dumbed down and gamified with acronyms like ESG, FOMO and BTFD and stock ticker symbols like YOLO, HERO, BOOM and FUN, it has never been easier for retail investors to dump their money into an overpriced flaming bag of dog shit with a clever name than it is now.

But one of the most odious examples of dumbing down already idiotic Wall Street Keynesian thinking to retail investors has been the annual tradition of rooting for a “Santa Claus Rally”. Once used to describe the rally at the end of December heading into the new year, this term is now used by the financial media to describe any stock market rally that happens, for any reason, at the end of the year, on any given year.

Rather than being used to describe a rally that is taking place for legitimate means, the term has now taken on a life of its own over the last decade and has gone from a label to a reason that markets rally. The tail, in other words, is wagging the dog, despite the fact that everybody knows there’s no really good reason to buy stocks just because it’s the end of the year.

Everybody knows that companies are cyclical and everybody knows that holidays result in more sales for many companies. It’s safe to say that this century-old tradition has already been priced into stock markets.

So what, exactly, is a “Santa Claus Rally”?

In reality, it’s nothing - it’s a gimmick, like “FANG” - or to quote Chasing Amy - “a figment of your fucking imagination!”

The “Santa Claus Rally” is nothing more than an easily understood analogic vessel that Keynesians in the financial media use to continue to implant the idea that the market should always go up into the minds of novice investors. It’s the anti-fundamental analysis, and it’s all wrapped up with images of everybody’s favorite holiday - a time of joy, cheer, prosperity, family and friends: Christmas.

That’s right: it’s a gimmick so nefarious, it invokes the time of year when people feel most complete. I mean, what do people look for from an investment? They look for financial security so as to live comfortably. And when do most people feel the most comfortable and secure? Around the holidays.

Get 50% off: If you enjoy this article, would like to support my work and have the means, I would love to have you as a subscriber and can offer you 50% off for life:

But this year I’m calling it the “Santa Pause Rally” - not just because of how toxic the saying is to begin with, but because, as we have been figuring out the hard way for the last 9 months, there really is no reason for random celebration in markets right now.

Markets, and our economy, are in absolutely unprecedented waters right now, with our central bank stuck in a minefield of catch-22s that they can’t get out of without collapsing the economy or letting inflation run rampant. Thus, new paradigms in how investing and markets work are being written daily - and none of them include random stock rallies just because the financial media says so. That shit may have flown when volatility was at all time lows and the world financial and geopolitical order wasn’t in disarray - but that’s hardly the case today.

If 2018 wasn’t a stark enough reminder that the “Santa Claus Rally” is complete and total bullshit (recall, markets collapsed after slow and steady 25 bps rate hikes totaling barely 3%), this year should be.

I’m not saying that the market won’t rally at the end of the year, but what I am saying is that any rally we undergo will more than likely be a bear market rally and be short lived. I am sticking by my analysis that, as we speak, there is a 400 basis point pipe bomb making its way through the economic plumbing of the nation, just waiting to blow up and tank markets on any given day.

At the very least, hopefully this reminder of the idiocy not only of monetary policy, but of Wall Street naming conventions used to feed the hogs, serves to arrest any remaining mindless optimism mainstream media-watchers have heading into the end of the year.

There’s no way to say it without playing into the criticisms that I’m nothing but a fear mongering permabear, but I honestly believe there isn’t really anything to look forward to heading into the end of 2022 with markets or the economy.

All this market wants for Christmas is a soft landing, but instead, it’s almost certainly going to be getting a lump of coal over the next six months.

When that happens - or the next time some lobotomized television anchor uses the “Santa Claus Rally” notion - I beg of you to return to this piece and read the following paragraph, provided in bold font for your visual convenience.

Using cute names and anecdotal slogans does nothing to help educate mom and pop investors about monetary policy, which is the main driving force behind the nation’s current inflationary crisis. This dumbing down of markets and the economy will also be the reason behind any forthcoming panic in markets or economic depression for our country, as shock will be amplified due to investors believing things are better than they actually are. These terms are used as vessels in order to further an extremely misguided policy agenda that has gotten us into this mess to begin with - they put exceptional looking gift wrap on financial lumps of coal.

For more on how I’m positioned heading into 2023, you can read my latest update here.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Kevin Smith and Bad Santa references in the same article about financial market/ media ignorance and corruption. This is why I love QTR. This is the way.

Finger-cuffs!