The Path to Full Stagflation

"With rigidly elevated inflation and shrinking output, it’s not an exceptionally daring proposition to predict that job losses will follow."

By Peter C. Earle, American Institute for Economic Research

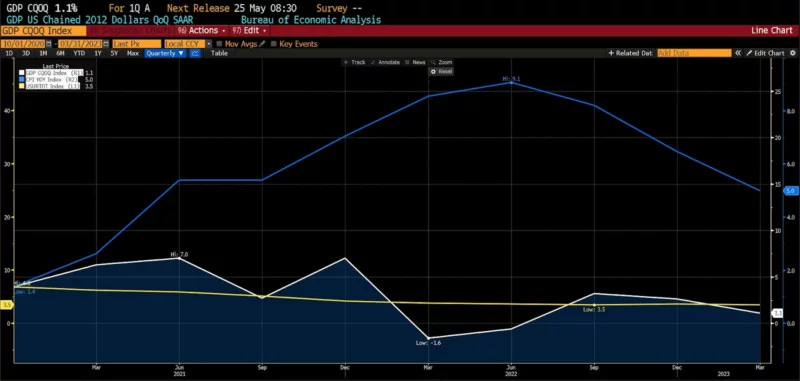

In an article last week, I referred to the combination of rapidly slowing US economic growth and persistently high inflation as “stagflation lite.” Despite receding from the highs of last summer, inflation remains near its highest levels in decades as disinflation (particularly in services) has recently slowed to a crawl. Meanwhile, US economic growth has been on a downward trajectory over the past few years, including a brief recession in the middle two quarters of 2022.

What’s currently missing from the full stagflationary scenario is elevated unemployment. The Bureau of Labor Statistics reported the U-3 US unemployment rate as 3.5 percent in March 2023, which is near historic lows. Indeed, low employment has been a thorn in Fed officials’ side since they began hiking short-term rates in March of 2022. The below chart depicts the current, stagflation lite conditions: high inflation (March 2023 year-over-year headline CPI at roughly 5 percent), declining economic growth (1st quarter 2023 US GDP at 1.1 percent), and U-3 employment at 3.5 percent.

Could a full stagflationary episode evolve from this? It’s possible that one already is, according to two sources of data.

First, a look at unemployment data on a state-by-state basis. Tracking the 4-week, year-over-year percentage changes in initial filings for unemployment, 24 of 51 states (50 states plus Washington DC) are showing an average 10-percent or greater increase in those filings over the period from mid-March 2023 to mid-April 2023.

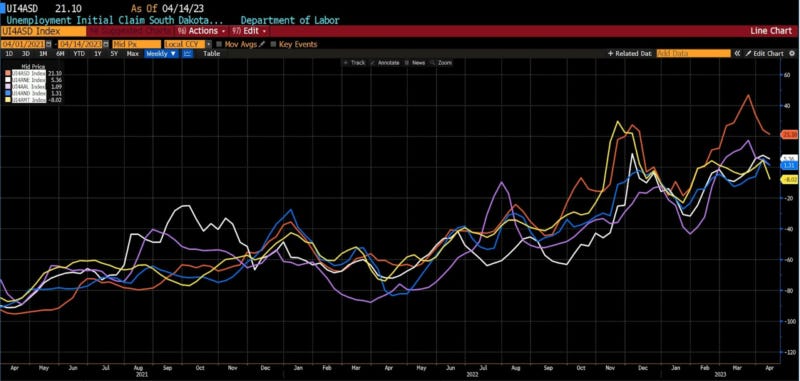

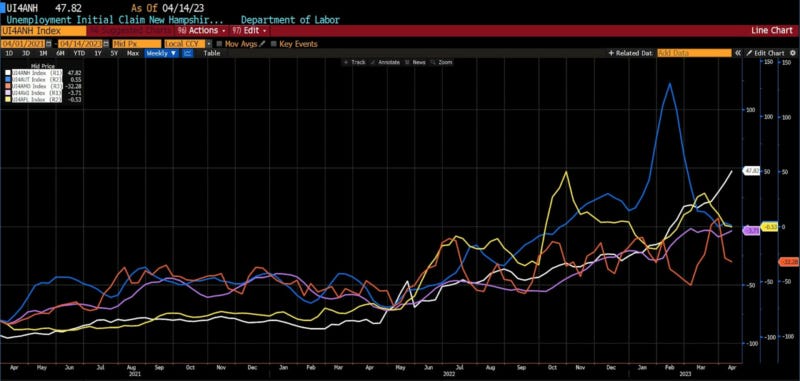

The ten US states with the lowest unemployment rates, as of mid-April 2023, include the following: South Dakota (1.9 percent), Nebraska (2.1 percent), North Dakota (2.1 percent), Alabama (2.3 percent), Montana (2.3 percent), New Hampshire (2.4 percent), Utah (2.4 percent), Missouri (2.5 percent), Wisconsin (2.5 percent), and Florida (2.6) percent. Below are the recent trends in initial unemployment filings in those low-unemployment-rate states.

Initial Unemployment Claims in High Employment States: South Dakota, Nebraska, Alabama, North Dakota, and Montana (April 2021 – April 2023)

Initial Unemployment Claims in High Employment States: New Hampshire Utah, Missouri, Wisconsin, and Florida (April 2021 – April 2023)

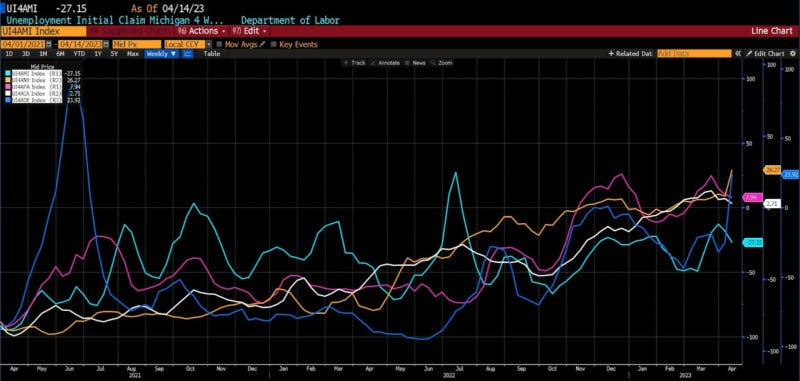

The ten US states with the highest unemployment rates (again, as of mid-April 2023) include: Michigan (4.1 percent), New York (4.1 percent), Pennsylvania (4.2 percent), California (4.4 percent), Delaware (4.4 percent), Illinois (4.4 percent), Washington (4.5 percent), District of Columbia (4.8 percent), and Nevada (5.5 percent). Below are the trends in initial unemployment claims in the highest unemployment states.

Initial Unemployment Claims in Low Employment States: Michigan, New York, Pennsylvania, California, and Delaware (April 2021 – April 2023)

Initial Unemployment Claims in Low Employment States: Oregon, Illinois, Washington, District of Columbia, and Nevada (April 2021 – April 2023)

In most of the ten US states with the lowest and highest unemployment rates, initial claims are trending both higher and at an accelerated rate over the past three to six months. This is at odds with the current publicly available federal unemployment data.

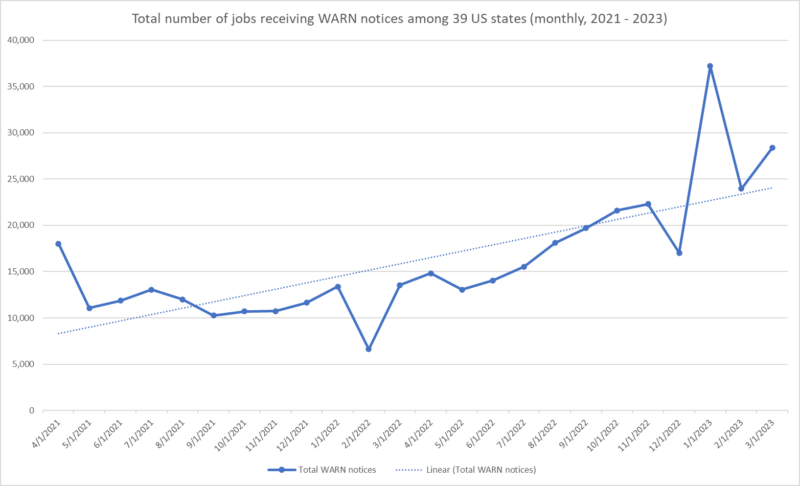

A similar progression is evident in WARN (Worker Adjustment and Retraining Notification Act of 1988) data. Generally speaking, although some states have their own versions of it, the Act requires firms with 100 or more employees to give employees at least 60 days notice of impending layoffs or facility closings. Looking at the aggregate number of jobs accounted for in recent WARN filings across 39 US states, a similar pattern to what’s happening in initial claims is unambiguously clear.

Federal and state unemployment data draw from different sources. As depicted here, state filings provide a more comprehensive “under the hood” view of developing economic trends than that which is available and published by loftier government departments and agencies.

On the basis of both initial claims for unemployment (in both high and low employment states) and WARN filings (in 39 US states), unemployment is rising rapidly. More importantly, those increases are not currently being captured in the reports of the Bureau of Labor Statistics (BLS) or other federal sources.

With rigidly elevated inflation and shrinking output, it’s not an exceptionally daring proposition to predict that job losses will follow. And none of this necessarily anticipates job losses on par with the worst recessions of the last few decades. Should these tendencies continue, though, they would fulfill the third and currently missing criteria of an outbreak of stagflation. Inflation could, over the remainder of this year, return to the levels the Fed seeks. Or the Fed could back away from its stated commitment to the return to a 2-percent long-run price level target, perhaps even choosing instead to lower rates in order to artificially boost employment, induce business expansion, and lift financial asset prices. In any case, the US economy looks to be pointed in a troubling direction. A direction which, let no one forget, finds most of its nascence in reckless and politically motivated public health, fiscal, and monetary policies now three years back.

QTR’s Disclaimer: I am not a guru or an expert. I am an idiot writing a blog and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning and generally trade like a degenerate psychopath. In pieces that I did not write, but that I aggregated from other sources, I did not personally fact check them and am republishing them, with permission, because I found the content useful and believe my readers will too. This is not a recommendation to buy or sell any stocks or securities or any asset class - just my opinions of me and my guests. I often lose money on positions I trade/invest in and I’m sure have lost more than I’ve made in my time in markets. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. Positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it three times because it’s that important.

My view is stagflation light. Current interest rates are a return to normal and high government debt guarantees a slow growth economy. So, I am not sure where the sudden jump in unemployment is going to originate. Personally, I am glad to see wage inflation. The US worker has been screwed by outsourcing since the 70s. I find it funny when companies complain about loyalty. They rarely show their workers what they expect. How come an executive's job paying 40M a year can never be outsourced to India for 200K. Like the country, corporate America is a joke. We do not have serious leaders, and we do not address serious issues.

The party is over. Warren Buffet is even stating it publicly. Look at the cash horde he has and doesn't know what to do with it. Down deep he knows he should be buying gold, but that would require him to admit he was wrong with his pithy, smart-ass statements about gold.

No matter who is elected, no matter what the employment numbers say, no matter what the Fed does, and no matter what the zombie markets do,......the party is over.

This party was built on two dominant criteria: cheap energy, and unlimited government debt. Both of those have come to an end. You can hope and deny all you want, but energy has hit a wall. Do some research. It is not about choices or decisions being made by the global climate freaks. Global Climate Crisis Theory is a ploy being used to convince dumbed-down idiots that the way to save the planet is to use less energy. Saving the planet is not the goal. The use of less energy is. I am not going into a bunch of numbers here, but just realize that the US is 5% of the world's population and uses 20% of the daily world energy production..... every day. (World produces roughly 100 mbpd; we use 20 mbpd.) Of that 5% of the world's population, 21% are boomers and produce very little, and 21% are 18 and under and produce nothing. So of that 5%, 42% are a non-producing portion of society.......yet we use more oil than the 3 billion people in China and India combined. Not only is cheap energy over, but the amount of energy we get is about to be curtailed dramatically. You can't grow an economy on less energy......it is not possible.

Secondly, the world is not buying our debt any longer. The increase in rates was another hail Mary to try and induce purchases of our debt. In the 80s we ran a $1.5 trillion deficit for the decade, in the 90s we were at $1.3 trillion for the decade, in the 2000s our deficit went to $3.4 trillion, in the 2010s it jumped to a whopping $8.2 trillion (more than the entire history of the US combined), and in just 3 1/2 years of the 2020s, we are at $8.4 trillion dollars in deficits. The world is sick of buying our debt, and we have shown the world that if you piss us off, we will come take our reserves back and leave you with nothing.

I will leave you with this chart that clearly demonstrates the lights are about to be turned out. A party of this size ending takes some time for everyone to realize, but when the lights go out, everybody gets the picture. Not saying the lights are literally going out.......though possible.......but a unmistakable signal is coming.

https://cms.zerohedge.com/s3/files/inline-images/2023-05-07_16-32-38.jpg?itok=wB_MvFX9