The New Cold War Has Begun

New developments over the last 3 weeks show the set up for an unprecedented era economically & geopolitically is beginning. Here's what's new...and how I'm investing for it.

Over the course of the last year, I have been sounding the alarm about the growing divide between BRIC nations, like China and Russia, and the United States.

It started last year in August 2021, long before our current inflationary crisis and the war in Ukraine, when I predicted that China would try to concoct a gold backed digital currency that would put the U.S. dollar on its heels.

As Russia’s war in Ukraine has progressed, the country has allied itself with China further and I have written and talked extensively about the threat that I think their relationship poses to the United States and the West.

Reading not so subtle tea leaves - like the BRIC nations’ publicly stated intentions to create a global reserve currency (announced in July 2022, predicted by me in February 2022), and China’s all-but-certain plans to eventually try to take back Taiwan - I have been making the argument that the United States, with its $31 trillion in debt, is in possibly the most precarious economic position it has been in for decades.

As we experienced firsthand, Chinese supply chain interruptions during the Covid pandemic - which now looks to have all-but-certainly started due to a lab leak - have the ability to significantly impact quality of life in the United States.

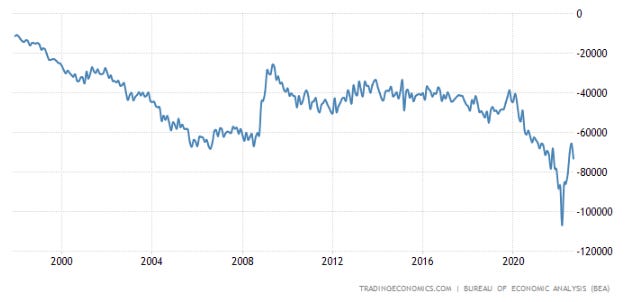

After all, we import a majority of the products that we use on an everyday basis from China. We’ve run huge trade deficits for years and have ignorantly believed that the dollar’s reserve status would allow us to continue this unfair deal, wherein we give China soon-to-be-worthless printed paper and they give us actual goods, for as long as we want.

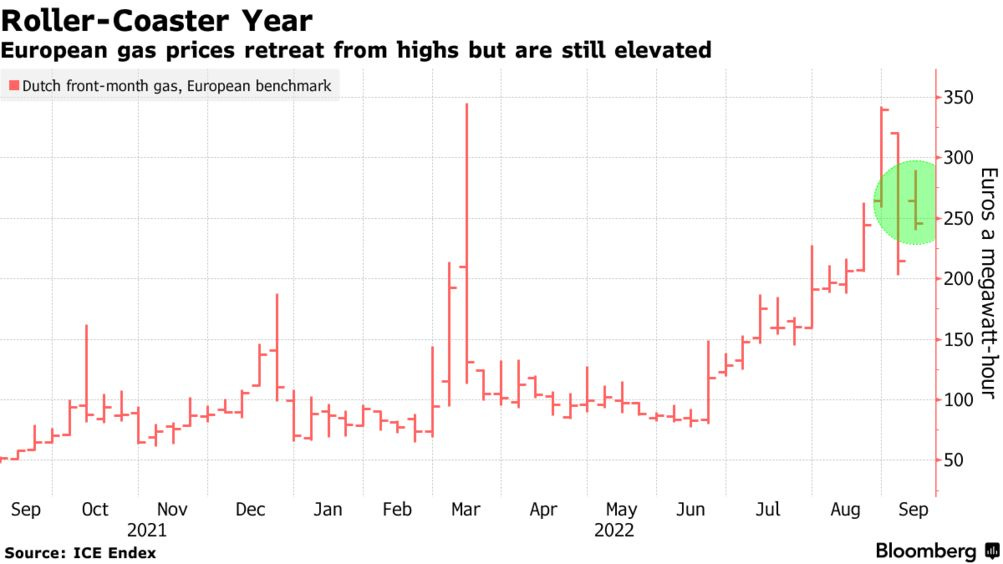

At the same time, lack of Russian energy resources has also had a negative impact on quality of life, not only in the rising price of oil in the United States, but in the soaring cost of energy in Europe.

And additional recent revelations have supported my thesis that the United States could be on the precipice of a sea change in dollar hegemony, geopolitical strength and quality of life.

There’s been several alarming developments over the last several weeks that have furthered my case. Let’s review them and what I believe the situation means for investors.