The Inverted Yield Curve and Next US Recession

"History reveals that it doesn’t matter how or why the yield curve inverts; as long as it does so, it signals trouble ahead."

By Richard M. Salsman, American Institute for Economic Research

No better, more reliable forecaster of the US business cycle has existed in recent decades than the initial shape of the US Treasury yield curve, and since last October it’s been signaling another US recession that’s likely to begin in 2024. This is important, because recessions have been associated with bear markets in stocks and bull markets in bonds. Moreover, if a recession arrives early in 2024 it may affect the US elections in November.

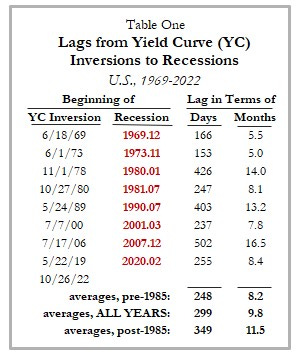

Typically, the yield curve is upward sloping (longer-term rates are higher than shorter-term rates) and precedes economic expansions; but an inverted curve, which occurs more rarely (only eight times over the last six decades), signals a recession with a lag of roughly 10-13 months. Counting from October 2022, a contraction will probably start in early 2024.

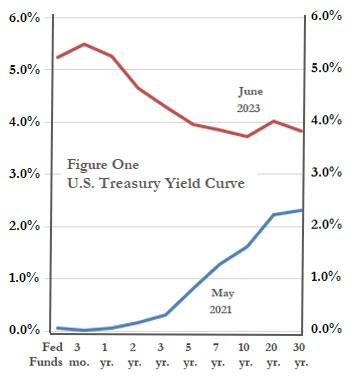

Figure One depicts the yield curve as it stands today (inverted), and as it stood in May 2021 (upward-sloping) before the Fed embarked on a series of rate hikes that brought its overnight Fed Funds rate to above 5 percent. Longer and medium-term interest rates have also increased over the past two years, but not by as much as short-term rates. History reveals that it doesn’t matter how or why the yield curve inverts; as long as it does so, it signals trouble ahead.

Since the late 1960s US yield-curve inversions have predicted all eight US recessions, beginning roughly a year in advance (Table One). The yield curve’s forecasting record since 1968 has been perfect: Not only has each inversion been followed by a recession, but no recession has occurred in the absence of a prior yield curve inversion. There’s even a strong correlation between the initial duration and depth of the curve inversion and the subsequent length and depth of the recession. The current inversion will likely be long and deep. The Fed isn’t likely to materially cut its policy rate over the balance of 2023, which means not only that the next US recession will be relatively more severe, but it may also extend into 2025.

The yield curve spread that most accurately forecasts recessions is that between the 10-year Treasury bond yield and the 3-month Treasury bill rate. Figure Two depicts the US bond yield, bill yield, and yield-curve spread since 1968. Negative spreads preceded all recessions, regardless of whether yields generally were high or low, and regardless of whether inversion resulted from short-term (bill) yields rising above long-term (bond) yields (due mainly to Fed rate hiking) or instead (and less frequently) from bond yields declining below bill yields.

The US yield curve also provides reliable forecasts of economic-financial results abroad, especially when coupled with signals from local yield curves. Most major yield curves today are also inverted because major central banks tend to mirror each other on rate policy.

Relevant empirics and reliable quantitative models are crucial, but it’s also important to understand the theory and logic behind this relationship. In 2019, while forecasting the most recent US recession (five months before it began in February 2020), I explained in some detail “Why the US Yield Curve Reliably Predicts US Recessions.” Here’s what I wrote:

First, a sharp decline in bond yields means a sharp rise in bond prices, which suggests a big demand for a safe security, reflecting a desire by investors to immunize against trouble ahead. Second, the longer the maturity at which one lends, the greater (normally) is the yield one receives (due to credit risk and/or inflation risk), so if bond yields are below bill yields it signals materially lower short-term yields in the future (i.e., Fed rate-cutting), which occurs during recessions. Third, the essence of financial intermediation is institutions “borrowing short (term) and lending long (term).” If longer-term yields are above shorter-term yields, as is the normal case, there’s a positive interest-rate margin, which means lending-investing is fundamentally profitable. If instead longer-term yields are below shorter-term yields, there’s a negative interest-rate margin and lending-investing becomes fundamentally unprofitable or is conducted (if at all) at a loss. When market analysts observe credit markets “seizing up” before (and during) recessions, it reflects this crucial aspect of financial intermediation.

Some wonder whether Fed officials know about this relationship, and if so, why they don’t act to avoid or prevent curve inversions and subsequent recessions. Matter of fact, they do know about the relationship; in recent years various Fed researchers and board members have documented it and discussed it, and for many decades the New York Fed has maintained a sophisticated website about the relationship (“The Yield Curve as a Leading Indicator”). But Fed economists and policymakers are also predominantly Keynesian, so they believe in the Phillips Curve – in some imagined “tradeoff” between inflation and economic growth. They attribute higher inflation to real factors, whether to a growth rate that’s “too high” (“overheating”) or a jobless rate that’s “too low” (“wage-push” inflation). They deny the principle that inflation is always and everywhere a monetary phenomenon; they certainly don’t wish to be held accountable for the inflation they alone cause (by overissuing money).

In retrospect I think it’ll be important to acknowledge that the next US recession (2024-25) will result from Fed rate-hiking (2022-23), which was undertaken to “fight” fast-rising inflation (2021-22), which the Fed alone caused by massive money issuance and debt monetization (2020-21) in response to inadvisable COVID lockdowns (2020-21). When a crisis fosters phobias and policymakers become panicky, a cascade of tragic failure can result. When will the start of the next recession be recognized? On average since 1980 the NBER has waited eight months before assigning a starting date (and fifteen months to assign ending dates), so if the next recession were to begin in early 2024 it might be publicized by August.

That the yield curve’s predictive prowess is chronically misunderstood and misapplied, even by forecasting pros and the supposedly sophisticated financial media that cover them, is illustrated best in two recent essays by James Mackintosh at the Wall Street Journal – “Economists Think They Can See Recession Coming – For a Change” (December 4, 2022) and “Where’s the Recession We Were Promised?” (June 23, 2023). In the first essay Mackintosh recounts how “a survey of economists and investors by the Federal Reserve Bank of Philadelphia shows expectations that GDP will fall in three or four quarters are by far the highest since the survey started in 1968,” but adds that since that survey began, “not a single recession was spotted a year in advance.” Huh? Not a single recession – of the eight that have occurred since 1968? Why then bother mentioning that survey or trusting its signals? In the same essay Mackintosh declares that “the yield curve isn’t magic.” What’s that got to do with anything? What about cold, hard empirics? In his more recent essay Mackintosh devotes more space to the meaning of the inverted yield curve – even admitting that “each of the eight recessions (since 1966) was preceded by an inversion, with no more false signals” – yet insists it has “failed” just this time because recession didn’t occur within six months of his first essay.

Many economists and investment strategists, if they use market-price signals at all or rigorously to forecast recession, tend to use less reliable yield spreads, or miscalculate the lags, or focus on particulars that make them insist “it’ll be different this time.” That’s been the refrain for many decades. But eight for eight since ‘68 is better than just good – it’s great.

About the Author

AIER Senior Fellow Richard M. Salsman is president of InterMarket Forecasting, Inc. and a visiting assistant professor of political economy at Duke University. Previously he was an economist at Wainwright Economics, Inc. and a banker at the Bank of New York and Citibank. Dr. Salsman has authored the books Gold and Liberty (1995), The Collapse of Deposit Insurance and the Case for Abolition (1993) and Breaking the Banks: Central Banking Problems and Free Banking Solutions (1990), all published by AIER, and The Political Economy of Public Debt: Three Centuries of Theory and Evidence (2017). His fifth book – Where Have all the Capitalists Gone? Essays in Moral Political Economy – was published by AIER in 2021.

Dr. Salsman earned a B.A. in economics from Bowdoin College (1981), an M.A. in economics from New York University (1988), and a Ph.D. in political economy from Duke University (2012). His personal website is https://richardsalsman.com/

For more on the yield curve inversion and other fundamentals that QTR believes are signaling a coming plunge in stocks, read this piece.

For a list of what I own and how I’m personally positioning myself, check out my portfolio review, released just a couple of days ago.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

This one may be a lot of worse than previous recessions too. 2008 was housing - but people had an asset behind their debt.

2023 and 2024 - we have had a decade + of inflation in 2 years. Credit card debt is the highest in history - average rate of 23%. The credit card debt does not have an asset behind it - mostly because it was spent on food or a trip.

When this recession hits - the bubble that bursts will be people’s personal credit as they just try to maintain their lifestyle of the past decade. Wages did not keep up with cost of living and interest rates of 20%+

The government or fed will not be able to “rescue” the general public like they did for banks in 2008 - mostly because our government is broke too.

The housing market is going to come to a complete stop - people will do whatever they can stay in their homes with 3% mortgages and the cost of new construction with 8% mortgages - houses will sit empty.

The stock market appears to be leveraged to moon with valuations it is trading at. Feel that we have a 1987 moment coming when we have a down 25% week.

Well lots of random thoughts from me. Just do not see any positive angles for the economy at the moment

There is too much much emphasis on curve inversions. Yes, I use them within a multifaceted analysis. They are useful, but you shouldn't make it your "tried and true" recession indicator.

1. Obviously, there are other economic factors and dynamics going on as the curve inverts or steepens. The curve is a reflection of that.

2. Typically, a recession occurs after the 10y/3m curve inverts between 12 and 18.

3. The mean time between inversion and recession is 15 months. The shortest time between the two is 9 months, with the longest being up to 24 months.

4 What you do between that time is fucking crucial, and you'll like will have to adapt to changing dynamics.

Feel free to check out my Substack @ themacrobrief.substack.com - currently 50% OFF annual, earn free months when you refer friend. More you refer, more you save!