The Elon Musk Elevator Down

ARKK's largest weighting was up 53.9% this year while the ETF plunged -24.6%. What happens to ARKK when Tesla - even if it is part of a longer term move higher - inevitably has a 30% drawdown?

“Stocks take the stairs up, and the elevator down.”

Bear with me today. I know I’ve written extensively over the last two months about the fact that Tesla (TSLA) is the only string that Cathie Wood’s flagship ARK Innovation Fund (ARKK) is hanging on by. And while I definitely don’t want to spend every day harping about the unmatched investing prowess of Ms. Wood, I do think today marks a great time to reiterate and examine this sentiment, and I’ll explain why.

First, I think it’s worth noting: for all of the CNBC appearances, all of the ass-kissing by podcasters and financial media hosts, all of the touting of Cathie Wood as a “visionary”, all the magazine covers and writeups (Forbes called her “Wall Street’s Wizard” on their 50 over 50 cover), all of the conference appearances and the rest of the endless bluster we have had to endure for the last 3 years, ARKK has now officially given up all of its historical outperformance versus its benchmark as a result of the absolutely atrocious year it had in 2021.

This is seven or eight years worth of “work” (or at least making it look like you’re doing some work) down the drain as a result of underperforming the NASDAQ by more than 46% this year, as of 12/29/2021’s close.

All of the comparisons and arguments over the last 2 years about how ARKK is such a better vehicle than the NASDAQ due to Wood’s investing acumen are officially moot and heading into 2022, Cathie Wood is going to have to put up or shut up.

She may get a fresh YTD P/L figure to cling to, but “Wall Street’s Wizard” won’t just be fighting to outperform her benchmark this year, she’ll be fighting for ARKK’s performance versus its benchmark since inception and a lot of the firepower Wood needs is going to have to come from this guy:

If I were an ARKK investor, this would frighten me.

Meanwhile, almost every headline on Wednesday this week was about how the S&P made its 70th new all-time high day and how the year stood out as such a blockbuster one for the stock market. ARKK finished Wednesday down 1%.

In fact, over the last 5 trading days, Tesla has been up 15%, the NASDAQ has been up 2.77% and ARKK is lower by -5.27%.

Are you starting to understand why, exactly, it’s going to be a problem for Cathie Wood if Tesla starts to pull back?

Over the last month, all of the Top 10 holdings in ARKK are lower between -2.8% and -20.9%, including Tesla. The NASDAQ is only down -0.11% over the same period.

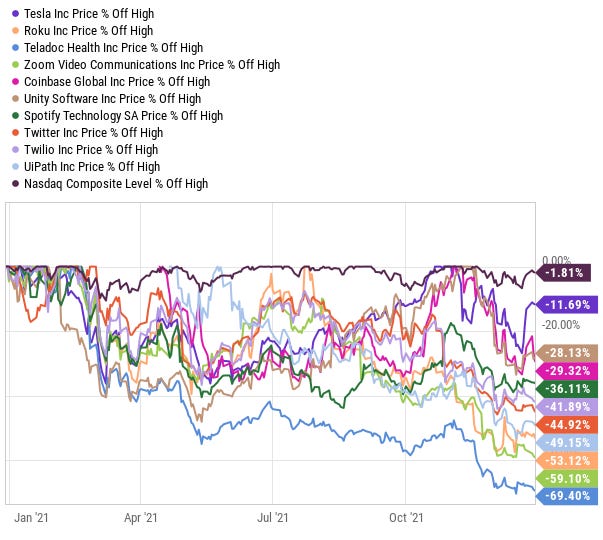

While the NASDAQ is only 1.8% off its 1 year high, ARKK’s well known/top components have fallen between 11.6% and 69.4% from their 1 year highs (Full disclosure: using % off highs is an ugly way to make a chart, no matter what you’re looking at).

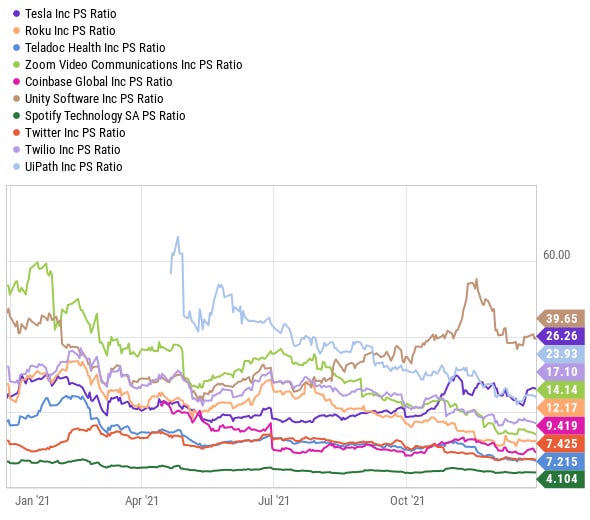

And for those thinking the pain could be over and there’s nowhere to go but up, here’s a gentle reminder that out of ARKK’s well known/top holdings, the lowest price to sales ratio is 4.1x and the highest is still 39.6x sales.

The exercise becomes even funnier when you attempt to use a price to earnings ratio. According to YCharts, six of these 11 companies turn up a null response when asked for a forward PE, while the forward PE’s of the remaining five names, Zoom, Roku, Tesla, Twitter and Twilio, return figures of 37x, 144x, 175x, 189x and (drumroll please) 2,802x.

But hey, maybe ARKK has bottomed, right?

I know I’ve mentioned this before, but the portfolio of companies Wood continues to keep in her “flagship” fund are all still wildly overvalued and, in my opinion, have plenty of room to fall in a situation where high flying stocks re-rate lower.

2022 is going to be such a crucial year to watch ARKK, not only to track its performance against its benchmarks, but to see if Wood’s narrative about her “innovation” stocks (whatever that means) being in “deep value” territory (read: routinely over 100x sales) still holds water with the financial media (it will) and investors (it may not).

My guess is the narrative will not hold up, and that we won’t even need a market crash to prove it - we’ll just need either a slight rotation from growth to value or a 30% drawdown in Tesla at some point.

Ergo, Wood has two options as I see it at this point:

Rebalance her portfolio to remove Tesla as a top weighting, which would contradict all the claims she’s made about the company over the last two years and would subject her portfolio to more exposure to the names that dragged her down in 2021 to begin with.

Cling even tighter to Tesla and simply pray to god that despite volatility in the company’s most crucial market (China), the constant recalls, the amped up valuation, the psychotic CEO who has been charged with securities fraud and routinely taunts regulators in between selling $15 billion whacks of stock and massive emerging competition both domestically and abroad, shit just doesn’t go wrong.

Tesla is what made Cathie Wood - but it could also be what breaks her.

Things get tricky for ARKK’s balancing act heading into 2022. Look, many people have different explanations for Tesla’s historic run over the last two years. Personally, as my readers know, I still believe it was fueled by the options market. Regardless, it’s no longer about how it got here, it’s about where it is going. The stock simply can’t continue to go parabolic forever.

Tesla was up 53.9% this year and ARKK plunged -24.63%.

What kind of outperformance from Tesla will Wood need for ARKK to break even next year?

At some point, either the options market hysteria will end, Tesla will miss operational milestones, or the reality of its valuation will simply set in.

I’ll go further and say that even if Tesla winds up higher in the future, it’s may not get there fast enough to counterbalance the hand-selected portfolio of high flying names that Wood has stuffed ARKK with.

For me, it’s not a question of if ARKK will bear the consequences of what I see to be poor management, it’s a question of when. A friend of mine said it best yesterday about Wood: “A market that takes Tesla down 30% will wreck the rest of her holdings even more.”

And he’s right. After 6 or 7 tough years of taking the stairs up, Cathie Wood could be getting ready to take the Elon Musk elevator down.

Disclaimer: I own ARKK, QQQ, IWM, TSLA puts and am routinely short all of these names and sometimes other names that Cathie Wood has exposure to. Readers should assume I am short Cathie Wood at any given time. I may add any name mentioned in this article and sell any name mentioned in this piece at any time. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

If you can’t beat an index, why bother with an AM? You’re right QTR, Cathie may have reached the end of the ride up.

While the discussion is far outside my investing universe (I like profitable companies with low PEs) I enjoy reading your ARKK articles.