The Dominance Of The U.S. Dollar Is Fading Right Before Our Eyes

Saudi Arabia joins Russia as the latest oil-backed nation to eye defecting from the U.S. dollar in favor of China's Yuan.

It was just a couple of weeks ago that I wrote an article arguing that the economic sanctions we have cast upon in Russia, due to its invasion of Ukraine, likely mark the beginning of a period where China and Russia would bifurcate the global monetary system, leading them to eventually challenge the U.S. dollar’s reserve status.

Now, Saudi Arabia is joining the fray, further threatening to tip the balance of the global monetary scales that have kept the U.S. dollar afloat for decades.

The fact that predictions of a “new economy” and “new monetary system” only exist on fringe blogs like mine and haven’t gone mainstream given the current economic situation with Russia (even amidst our abuses of printing the dollar over the last several decades) is baffling to me.

As I noted to Andy Schectman in a recent podcast, our quality of life in the United States and our nation’s entire economy is an elephant balancing, on one leg, on the toothpick of the U.S. dollar’s reserve status.

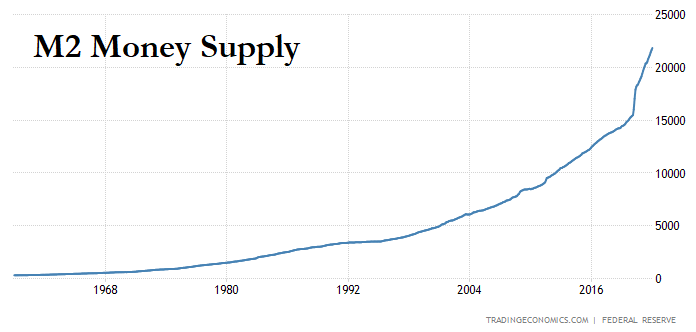

Our quality of life relies solely in our unique ability to import the goods and services that we use and need on a daily basis, while exporting US dollars. We’ve been able to print trillions of U.S. dollars into existence over the last couple of years - monetary policy that is anything but sound, regardless of whether or not your currency has global reserve status – because of the luxuries afforded to us by the dollar’s global reserve status.

But this reserve status, and the $30 trillion in debt we have accrued and convinced ourselves we will never have to pay, quickly go from being long-term liabilities that we can theoretically ignore to current liabilities that we must address if the dollar is ever legitimately challenged.

Today’s blog post is free because I believe the content to be far too important to place behind a paywall. If you have the means and would like to support my work, I’d love to have you as a paid subscriber:

Challenging the dollar’s reserve status would be an obvious and immediate catalyst that would flip everything we think we know about economics in our country on its head. Our monetary policy blind spots, that we have been willfully ignoring for decades, would instantly become leverage for the rest of the world.

The stage appears to remain set for this to happen. Globally, if you are an enemy of the United States, the situation hasn’t looked better to challenge the U.S. dollar, maybe ever, than it does now:

We have run up a mountain of debt and grossly expanded our money supply in an extremely short period of time

We are the most reliant we have ever been on other countries to import goods and services

We have a presidential administration that (1) doesn’t understand basic economics and (2) is limiting our nation’s ability to produce commodities, which act as a foundation for a country’s inherent wealth

We are about to enter into a economic recession

Inflation is setting records and is already bankrupting the middle and lower class of our nation, before even considering a potential challenge to the dollar

And while a week or two ago I was only worried about China and Russia, now that the world has been forced to pick economic sides, other nations are throwing their respective hats in the ring, too.

Saudi Arabia, which is a nation of major consequence economically due to its significant oil and gas reserves, has reportedly embraced the idea of accepting Yuan instead of dollars for Chinese oil sales.

Not unlike Russia and China’s plans to de-dollarize, that date back nearly a decade, the Saudis have been considering this idea for six years already. And not unlike Russia and China’s new economic tie-up, the catalyst for speeding up the process has been U.S. foreign policy:

Saudi Arabia is in active talks with Beijing to price some of its oil sales to China in yuan, people familiar with the matter said, a move that would dent the U.S. dollar’s dominance of the global petroleum market and mark another shift by the world’s top crude exporter toward Asia.

The talks with China over yuan-priced oil contracts have been off and on for six years but have accelerated this year as the Saudis have grown increasingly unhappy with decades-old U.S. security commitments to defend the kingdom, the people said.

The consideration by Saudi Arabia is consequential.

It shows that other nations, when forced to choose sides between the U.S. and its foes, don’t feel obligated to commit to the U.S. dollar, further undermining the world’s perception about the dollar’s strength.

Not unlike Russia, Saudi Arabia is a country that, regardless of how much its currency may “devalue” versus a fiat basket of currencies, is still backed by finite resources.

This gives the country and its currency intrinsic strength. Russia seems to understand this. In fact, just this morning, Russian Foreign Minister Sergei Lavrov, likely alluding to this fact, said that economic sanctions against Russia make the country “stronger”.

Saudi Arabia is now another serious name on the list of contenders who have the currency bite to back up the economic rhetoric bark of challenging the dollar.

As The Wall Street Journal notes, the Saudis have “traded oil exclusively in dollars since 1974, in a deal with the Nixon administration that included security guarantees for the kingdom.”

The U.S. dollar’s ties to oil have been crucial in helping prop up the currency’s demand globally. These ties have also helped drum up the psychological buy-in necessary for the world to collectively accept that “the next guy” is going to want their U.S. dollars.

But given the alliance between Russia and China – and the newfound alliance between Saudi Arabia and China - it looks as though that confidence game might be coming to an end right before our very eyes.

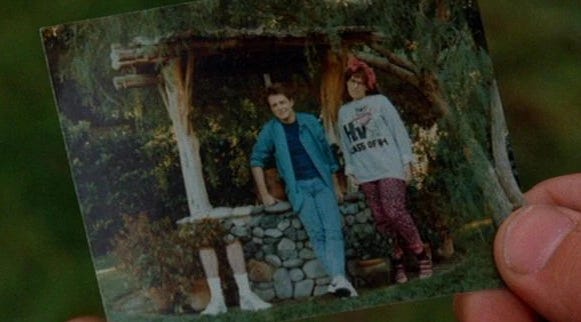

In other words, the dollar could be fading from the global picture like Marty McFly’s brother from that family photo in Back to the Future.

We may not notice it right away…

…but eventually it’ll be clear.

Far be it for me to be a harbinger of too many uncomfortable predictions at once, but, as I wrote last year, I also strongly believe that China will eventually back its forthcoming digital currency with gold to further strengthen its economic and monetary posture globally.

The contrast between a forthcoming divided global economy would be stark: nations like China and Russia seem genuinely interested in the idea of sound money backed by commodities, while the United States seems preoccupied with jargon filled academic circle jerks trying to convince ourselves that debt is money that “we owe to ourselves”, to quote Paul Krugman, and that money literally grows on trees.

If given the choice between the two ideologies, where do you think the world is going to wind up?

I’m not sure we’re ready to embrace the answer here in the United States, but we better get ready to.

The very best thing that could happen to the USA as of this moment would be for the rest of the world to stop allowing our politicians, our bankers and all of the various connected con-men to continue feeding at the trough of wealth they have not earned. This largesse has warped our culture, spawning generations of entitled morons, has destroyed the competitiveness of our businesses and industries and allowed the most worthless group of idiots to stay in positions of power than at any time in world history. We need a cleansing by Mr. Market. Only after the Great Bankruptcy will we begin to understand how sick we have truly become and take the steps to become healthy again.

I would suggest all the wars we keep fighting are tied directly to the defense of our dollar. Khadafi said no more dollars for oil, he’s gone…Saddam said no more dollars for oil, he’s gone … now with Russia and China threatening the same thing, it is no coincidence we are beating the drums of war again. As for Saudi, they take our dollars - so we fight their wars for them in places we have no business like Yemen. It’s all about the dollars…