Stocks I'm Watching As The Market Sells Off

Trying to find value in an sea of batshit insane valuations.

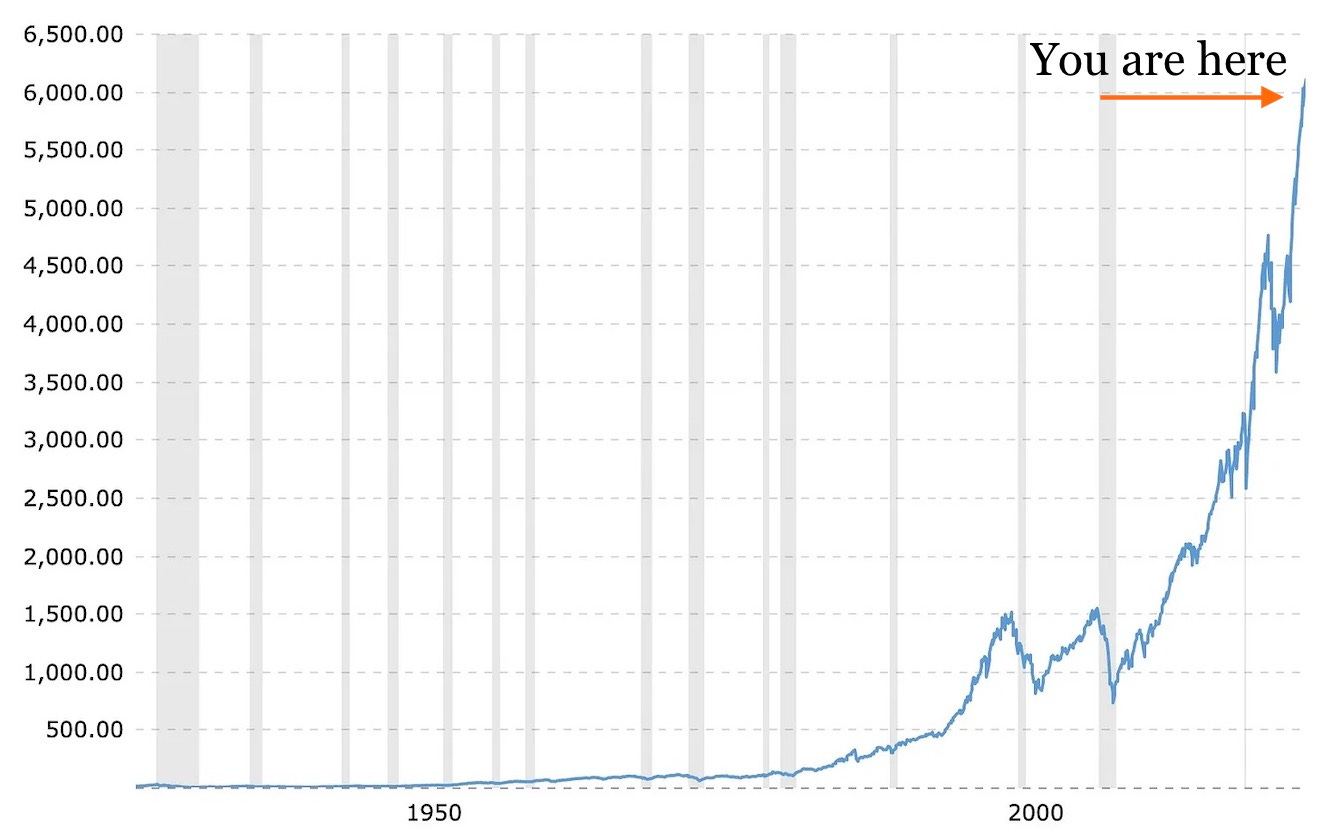

You may have noticed that the stock market has stopped being a complete fairytale for 12 seconds over the last week and actually has moved slightly lower after what feels like thousands of years of doing nothing but going straight up.

Thoughts and prayers for those enduring this horror:

As is always the case when we have market corrections, CNBC and other financial networks seem to be littered with a never-ending revolving door of “analysts” and “strategists” who perpetually believe it is a great time to buy the market, regardless of valuation, price, day of the week, whether the asteroid will hit tomorrow, etc.

Of course, as I explained in a half podcast, half sweaty exasperated rant to my friend George Gammon yesterday on his podcast, I find the notion that always having an excuse to buy the market—regardless of price or valuation—and even though it always does continually go up and to the right, according to history, intellectually dishonest.

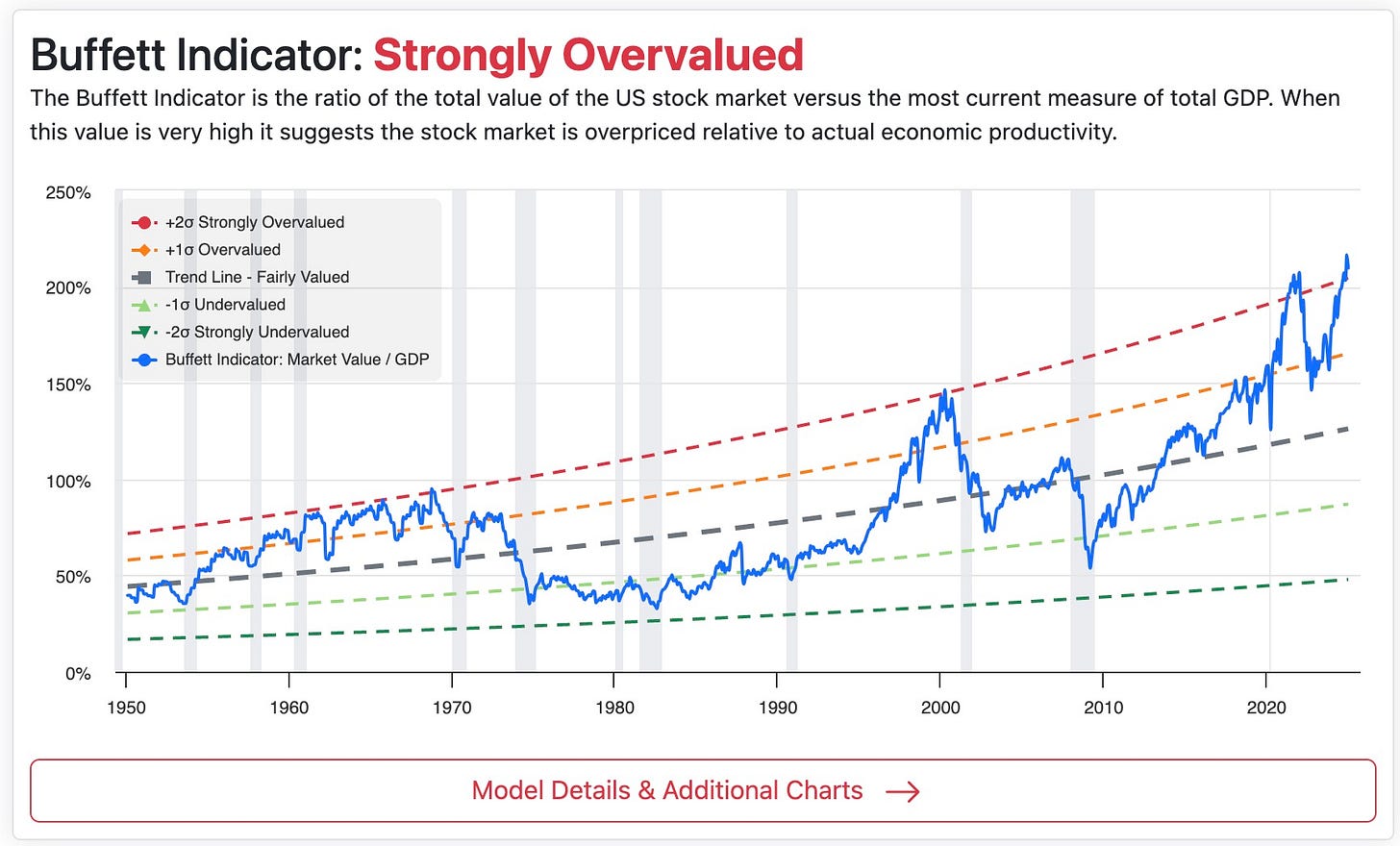

But what do I know. I’m awash in an industry of financial media who is genuinely puzzled by why Berkshire Hathaway is sitting in a record amount of cash right now, despite market cap/GDP — which they even call the Buffett indicator because it’s his favorite way to value the market, for fuck’s sake — is at all time highs at 2 sigma deviations higher than the fairly valued trendline.

The fact is, right now, if you put a couple of first-year Econ students into a room and ask them to come up with a list of reasons to sell the market versus a list of reasons to buy the market at these levels, I believe the list of reasons to sell the market would be extensively longer than the list of reasons to buy it.

But when you are on the sell side, work at a corporation, or are otherwise entrenched in legacy financial media—which exists on the bedrock assumption that everybody, everywhere, is always bullish and should always be—it becomes increasingly difficult to engineer reasons to buy the overall market at any price.

As I’ve pointed out on this blog, right now, we hardly have a market. We have a series of 10 to 20 corporations—like Meta, Apple, Amazon, and others—that are the tail that wags the stock market dog. Most of these names are included in all of the major index ETFs, and the passive bid—which is essentially a perpetual market-buying machine linked up to retirement funds and automatic investing through employers—drives the indices higher using these select names as vessels.

Retail investors now also act as the tail wagging the market dog by mostly using options to invest, instead of stocks.

For example, I took a couple of minutes this weekend, went over to Reddit’s r/wallstreetbets board, and was floored by 1) how almost everybody who invests there and posts their screenshots of their brokerage accounts is trading options and 2) how absolutely horrific some of the stories of losses, driven by speculation and addiction, by retail traders were.

For those relatively new to options, when you buy or sell an options contract, there is a party on the other side of that trade that must hedge according to the exposure the contract (100 shares per 1 contract) assigns to them. Ergo, if a bunch of people come in and buy Amazon call options, the dealer that sold them has to go into the market to buy shares to hedge against their exposure to the upside. This is a process sometimes called Delta hedging and is why options activity is carefully tracked by many active traders — because often times it can lead to underlying moves in equities.

I’ve written extensively on this blog about how I believe buying options aggressively over the last five years has driven the market higher. Between Delta hedging, the ensuing gamma squeezes higher, and the passive bid, the stock market, to me, is taking shape as more of a leveraged casino where nobody is paying attention to actively picking value. Instead, by virtue of these passive flows, index weightings, and the options market, it has become a casino with a “can’t lose” feel to it, where everybody buying the SPY ETF is forced to eat everyone’s cooking after collectively driving names like Apple to nearly 40x earnings.

As I’ve noted a couple of days ago, I believe crypto will be the tip of the spear that starts to indicate that the markets are going to move lower. So far, over the last week, this seems to have been the case. Last weekend bitcoin took a nosedive, and we’ve had a week of selling in equities as a result. If my contentions continue to be accurate, I believe that the moves lower we could see as a result of immense speculation in crypto—where there is huge leverage getting wiped out—in conjunction with the passive bid slowing and options flows whipsawing to more put buying than call buying (which, in essence, doesn’t just stop the buying but can acts as a gas pedal for selling as things move lower and people are buying puts instead of calls), we could see moves lower at a time where psychologically we’re the least prepared in recent history. More on that here:

With that being said, not everything in the market is overvalued. It’s just that the pockets of finding value are extremely difficult to find and aren’t covered on the mainstream financial media, in my opinion. While analysts are rolled out left and right on financial news to back-engineer excuses as to why market participants should be buying Nvidia at 60 times earnings (my sweaty rant about this yesterday here), I’m actually keeping an eye on areas where there could be deeper value worth adding exposure to.

First off, I still like everything I put on my 25 Stocks I’m Watching for 2025 list (part 1 here and part 2 here). In addition, here’s a couple more names I’m keeping an eye on.