Peter Schiff: “Kamalanomics” Will Make Inflation Even Worse

"With a heavily-planned economy, you try to outsmart an endlessly-complex system made up of a dizzying array of relationships..."

Unveiling her set of “populist” economic actions for her first 100 days in office, Democratic presidential nominee Kamala Harris has promised a slew of government interventions to ease economic pain for Americans. But, like all economic interventions, they’ll make the problem even worse, cutting out the free market’s natural balancing mechanisms in favor of central planning.

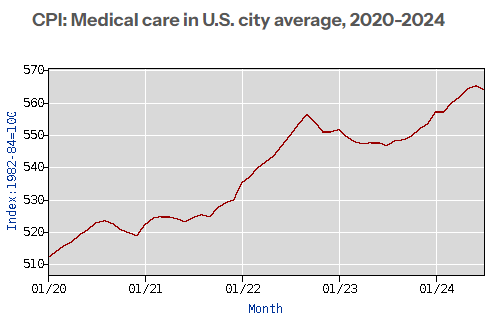

In the political competition for who can promise to give away the most free stuff, we noted a couple of months ago that many on the economic left felt that Biden’s plan for removing medical debt from credit reports didn’t go far enough. Like election season clockwork, Harris is now promising to eliminate outstanding medical debt entirely for millions of Americans and put an artificial cap on prescription costs.

In an industry already racked by low competition and government intervention, striking away medical debt with the stroke of a pen will only incentivize providers to increase prices further as they search for a way to make up the difference.

Harris also promises to end what she calls “corporate price gouging,” joining the chorus of economically illiterate politicians who claim that high grocery prices simply are due to greedy retailers. The plan even includes penalties for noncompliance. But if grocery stores aren’t allowed to charge higher prices for products they themselves are paying higher wholesale prices for because of inflation, they’ll have to make up the cost in other ways: slashing benefits, cutting hours, and lowering wages, salaries, and bonuses.

These cost-cutting measures tend to start with the lowest employees on the totem pole like cashiers, shelf stockers, and custodians. In other words, Kamalanomics will decimate the incomes of the exact people that it promises to help.

Then there’s the promised $25,000 subsidy for new homebuyers aimed at incentivizing home ownership. Combined with an interest rate cut that will come far too soon, these interventions will overheat the market by creating artificial demand for houses. Sellers will increase their prices, knowing that first-time buyers will come armed with their $25,000 in Kamalacash. Meanwhile, already heavily-indebted buyers will take on more loans from banks that are already over-exposed to real estate, since they will be able to offer lower borrowing costs thanks to the Fed.

On one hand, politicians beg for money printing to artificially boost stocks and lower interest rates to juice real estate, making them look good in the short-term. Then when those policies cause hotter inflation later, they blame anyone but the Fed — or themselves — while groveling for even more micromanagement of the economy to fix it.

And whatever money the government makes “disappear,” it must come with an economic cost elsewhere. As Peter Schiff recently noted about recent promises on both sides to eliminate taxes on tips, these taxes should never have existed to begin with — but the government is going to look for that revenue somewhere else:

“The problem is, if you eliminate the tax on tips, well now you’ve got a bigger deficit. What tax are you going to increase because you’re no longer taxing tips?…How are you going to make up the lost revenue?”

As long as interventions boost the economy long enough for politicians to get voted back into office, who cares about the pain it causes when the bust cycle arrives? When these policies inevitably backfire, they can blame the other party, or blame “corporations” as they beg the Fed and Congress for more intervention to make themselves look like wizards who can make debt and inflation disappear.

With a heavily-planned economy, you try to outsmart an endlessly-complex system made up of a dizzying array of relationships, the full nature of which not even mainstream economists can fully agree on. Without real price signals to accurately communicate information to the market, interventions guarantee that economic resources will be misallocated.

This results in predictable and disastrous consequences: shortages of things people need and surpluses of things they don’t, along with general economic instability, lower-quality goods, and higher prices for struggling Americans.

On Friday, Schiff focused on the Harris campaign’s recently announced and economically illiterate policy proposals, including what are effectively price controls and additional subsidies to drive housing costs up. He also discussed what proved to be a great week for gold, with the metal finishing the week above $2500.

Peter begins by reminding us that price controls would actually do nothing to fix price inflation:

“You can’t stop something by treating the symptoms. If someone has skin cancer, and it starts to show up, you got some moles or something on your skin—if you just put a band-aid on the mole so you can’t see it anymore, that doesn’t treat the cancer. The cancer is still there, getting worse. You’re never going to treat a disease by trying to cover up the symptoms. You’ve got to actually get to the root cause of the disease. And the root cause of the inflation disease is deficit spending, which ends up being monetized by the central bank.”

He explains how the Federal Reserve’s actions are only making the situation worse, instead of addressing the core issues:

“We need to suck out the money—all the new money that was put into circulation. We need to withdraw it. We need deflation… But everybody is fighting deflation. Nobody wants deflation. That’s the cure, right? But instead, they want more of the disease. They just want to try to cover up the symptoms so we don’t notice it, but of course, we’re going to feel it because prices are going up one way or another if you create inflation.”

If price controls were actually implemented, it would lead to shortages and black markets:

“Everything that she is proposing is highly inflationary… When criminals start selling oranges, those are going to be some real expensive oranges. Why? Because the criminal is taking a risk… But let’s say there is a black market. How are you going to pay? Well, it’s all going to be cash, right? You want to buy oranges and all you got is a central bank digital currency? You ain’t getting any oranges.”

Expanding housing subsidies is bad enough on its own, but the policy would also add to the debt and could drive more inflation:

“Another thing she said she wants to do is she wants the government to give every first-time homebuyer $25,000 towards the down payment for a house. Now, first of all, where’s the government going to get the $25,000? Because it doesn’t have it, right? We have a $35.2 trillion national debt. So where’s the government going to get the money to give people the down payment? Well, they’re going to borrow it. And who are they going to borrow it from? Well, they’re probably going to borrow it from the Fed. And the Fed’s going to print it. So in order to give people $25,000 to make a down payment, they’re going to have to create a lot of inflation, right?”

He further elaborates on the disastrous impact that these policies could have on the U.S. dollar:

“We’ve been able to convince our creditors to keep loaning us money. We’ve been able to convince the world to keep warehousing U.S. dollars and U.S. treasuries as a reserve asset. But all they have to do is listen to Kamala Harris talk, and they’re going to run from the U.S. dollar.”

The silver (or gold) lining to the week is that gold is looking better than ever. Peter thinks even $2,500 is a bargain:

“The trend is going to accelerate… What is material is if you don’t buy at $2,500 because you’re waiting for $2,400 or $2,300 and you never get it, and the next thing you know, we’re at $5,000. … Just buy it now. … It’s a lot cheaper than buying it a lot higher.”

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

I really like Peter. He has been the patient prophet rejected in his hometown. The only problem is that the more right he is, the more fucked we all are. I would love to see precious metals at astronomical prices but I don’t want to think about how tough day to day life would be if that were the case.

It is so sad that every decision is based on buying votes with a short term damaging hand out, whether it's citizenship or cash.