Peak Tesla

That point when the writing is clearly on the wall, but it still hasn't become obvious to everybody.

For a long time, frustrated short sellers and skeptics have wondered how long Elon Musk can continue to “dodge bullets”, as he has been doing with regulators and reality in general, Matrix-style.

Kept buoyant by his company’s stock price trading at a valuation that can only be described as an amalgam of mysterious and downright euphoric, Musk has, over the last several years:

All but gotten away scot-free with faking an $80 billion buyout of Tesla, which he “announced” during mid-day trading hours

Won in court after baselessly defaming a hero by calling him “pedo guy” and allegedly launching a PR effort to drag the man through the mud

Avoided consequence after using $2.6 billion in shareholder funds to bail out the near-insolvent solar company formerly headed by his cousin, that likely could have easily been purchased out of bankruptcy soon thereafter for pennies on the dollar. Musk pitched allegedly fake Solar City roof tiles, ostensibly as the impetus for the transaction. Solar Roof installs, now tucked into Tesla, have reportedly been halted in most markets as of this summer and, despite a good quarter from Tesla energy, had “extremely low” deployment in the most recent quarter.

Brought Tesla “about a month” from bankruptcy without ever disclosing the company’s financial distress to shareholders in SEC filings.

Consistently made forward-looking statements and predictions regarding Autopilot, Full-Self Driving, Robotaxis and other autonomous Tesla features, while collecting revenue based on these statements, that have turned out to, thus far, be falsehoods

Predicted “close to zero” Covid cases by the end of April 2020

But, to me, it appears that the days of praising Musk, who has become the world’s richest man and literally does who and what-ever the f*ck he wants to, could be coming to an end.

Today, I wanted to briefly explain some recent developments that I believe have importantly converged in serendipitous fashion to lead me to believe that in both markets, and in public discourse, we have seen peak Elon Musk. And after we see peak Elon Musk, naturally, peak Tesla is either already here, or is looming around the corner.

For years, Tesla shorts and skeptics have clamored on about competition and Tesla not being able to deliver on many of the claims it has made about its vehicles and their capabilities.

As Tesla’s stock has moved higher over time, such skeptics have been routinely mocked and disparaged by hubris-laden retail “investors” and company CEO Elon Musk.

Video mash-ups have laid out innumerable bold misstatements by Elon Musk and have made their way around social media, giving spectators a first-hand look at exactly how many untruthful statements have been made by Musk over the years, but no one really seems to care. And it sure isn’t showing up in Tesla’s equity valuation.

Here are a couple examples from a YouTube channel, aptly named Bullshit Exposed, that is definitely worth following.

Making untruthful forward-looking statements is one thing — potential talk about having to walk back sales that have already been made due to regulators determining cars that are already on the road are unsafe is a different story.

Putting aside Musk’s forward looking statements, it is widely known that the NHTSA is thoroughly examining and investigating Tesla’s claims related to Autopilot and Full Self Driving.

The findings of this investigation may determine whether or not a recall may be necessary for a feature that has been one of the key selling points of Tesla’s vehicles. Autopilot and FSD have been a linchpin, not only in Tesla differentiating itself from other automakers, but also in getting customers to pony up inflated prices for vehicles.

Tesla has sold customers on everything from cars having “FSD capable” hardware, to promises of being able to drive cross-country on Autopilot without stopping. Almost all of these claims have fallen short, and the financial ramifications from such a recall could be profound.

Additionally, any serious Autopilot or FSD recall could start a snowball effect for other regulators and jurisdictions to act on how Teslas are marketed and sold. In other words, it doesn’t just sever off future potential sales, it winds back the gears on a half decade of sales that Tesla has already made.

At a time when the electric vehicle competitive landscape has never been more robust, this could be devastating for the company. Additional news out last week has me thinking that the NHTSA is going to continue to be active in investigating Tesla going forward. Two motorcyclists were killed in July by two separate Teslas - both of which may have been on Autopilot at the time. According to an AP report, the NHTSA is investigating both of these crashes alongside of their main ongoing investigation.

It certainly feels like the walls are closing in on Autopilot and FSD for Tesla. At a time where Musk has the least amount of political gravitas he’s had over the last decade, it feels like there has never been more of a high time for a regulatory clampdown on the company than there is right now.

I’d also like to draw my readers’ attention to what just happened with Microstrategy last week, where CEO Michael Saylor was remanded to a position on the Board of Directors and surrendered his spot as CEO of the company.

Saylor, who has been CEO of Microstrategy for 33 years, is similar to Musk in the sense that they are both cult-like company figureheads who are perceived by their sycophants to be on some type of holy mission, heading up companies that are on the cusp of revolutionizing the world.

Saylor moved out of the CEO role last week after his company posted a horrific quarter due to the value of its bitcoin plunging. There’s two things to note from Saylor stepping down.

It shows that boards can still hold CEOs, even the crazy unilateral cult-like ones, accountable. If Tesla‘s board can learn one thing from Microstrategy, it’s that Elon Musk is not, and should not be, invincible in the CEO position.

Any of the Tesla concerns I discuss in this article could be used as an impetus to remove Musk from the CEO role.

If the board does remove Musk, who knows what he would do. Saylor will likely quietly sit on his company’s board and “spend more time with his bitcoin”. Can you see the same happening with Musk if he is removed from the CEO position? I can’t. I can see him going ballistic and turning on his own company, but I’m not a psychologist and this is just a guess based on watching his behavior over the last five years.

Meanwhile, a $40 billion question mark looms over the head of Musk regarding his potential buyout of Twitter. I recently discussed these issues at length with my friend Montana Skeptic on a podcast that you can listen to here:

The long and short of it is that if Musk is forced to buy Twitter or remunerate the company by Delaware’s Chancery Court, the ramifications could be in the tens of billions of dollars and would put significant pressure on Musk’s finances and his empire of companies.

Both of these potentially devastating outcomes are looming as legacy automakers have finally caught up to Tesla in the EV space. Tesla is no longer spearheading new ground in the space, they are no longer the leaders in anything involving quality with electric vehicles, and they are no longer the only player in the sector.

My friend Mark Speigel made an analogue to Netflix and BlackBerry, but names like MySpace and Napster also come to mind: first to pioneer an idea, but all companies that eventually fell when competition stepped in with the bigger and better product. The chance that Tesla might be suffering a similar fate as these companies has never been higher, in my opinion.

And let us not forget that we also have China in the picture. At a time when US tensions with China are the highest they’ve been in years, there’s no bigger or better poster boy for the United States in China than Elon Musk.

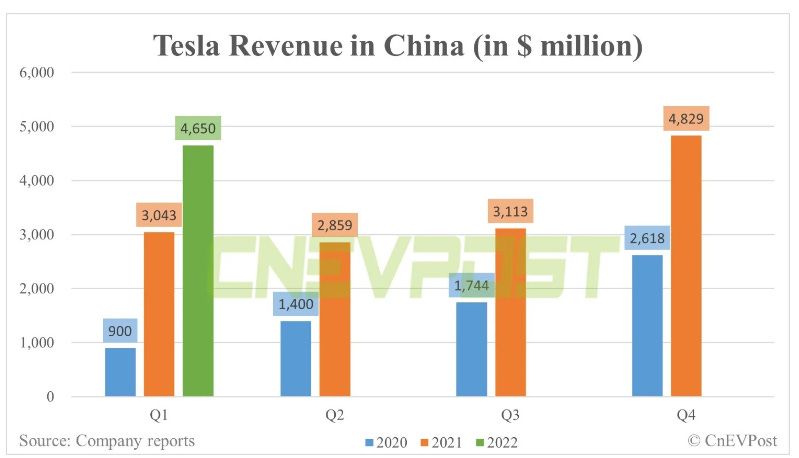

In addition to potentially becoming a pawn in a new Cold War, if Musk hasn’t already been compromised, Tesla relies heavily on its business in Shanghai — not only to produce and sell vehicles to China, but as a means to export vehicles around the world.

Any increase in tensions between Tesla and China could be absolutely devastating for the company and there’s never been a more important time to handicap this risk than right now.

After Nancy Pelosi’s idiotic visit to Taiwan last week, China is ramping up its rhetoric about the United States, even offering up (meaningless) sanctions on Pelosi, as well as sanctions on Taiwan.

If you think Tesla and Musk are not in play as pieces in a geopolitical conflict between the two countries, you just haven’t been paying enough attention. Shanghai remains an integral part of Tesla’s business and, without it, the company’s results would suffer greatly.

Dovetailing off of that point, it’s important to remember that we are fast approaching an inflection point in markets when all equities are going to be carefully scrutinized in a way that they haven’t been for the last 20 years.

It is my contention that the rate hikes we have put forth over the short span of just six months are eventually going to catch up to the market in the back half of this year, helped along by additional coming rate hikes, and will likely cause a lack of liquidity and distress in credit markets.

I believe this is going to put downward pressure on equities before the Fed eventually steps in to allow inflation to run rampant again and, during this time, I wouldn’t be surprised if people started seeing Tesla for what it really is: a car company, and not a technology company.

Sell side analysts can publish as many bullish-sounding notes about nonsense technologies that Tesla doesn’t have yet as they want.

It’s not going to change the fact that when push comes to shove and people are forced to de-lever and re-allocate their capital in a bear market, there’s going to be an inflection point where many investors realize that Tesla is grossly overvalued – and this is without a worst case scenario occurring related to any other concerns that I just mentioned.

A re-rating of Tesla stock would obviously move even quicker if the company was compromised in China, if Musk was forced to offload some of his stock and/or if regulators acted on the company.

Finally, it’s important to note that everyone has gotten really used to thinking that Elon Musk can get away with whatever he wants. And, as I highlighted at the beginning of this article, for the better part of the last decade, he has.

But it isn’t a question of whether the record is going to stop for Musk — it always eventually does for people like him — the question is just when.

Peak Tesla, in my opinion, should be identified as the point when the writing was on the wall, but it still hasn’t become obvious to everybody. That’s the point of astute analysis: having enough information to see what hasn’t become clear to the market yet.

This is an article I never thought I would write because I don’t like calling tops in anything, especially cult-like companies with cult-like followings. And I’ve never said to myself before, over the last five years, that we’ve seen peak Tesla. I’ve always considered in the back of my mind that there’s a chance this company could bizarrely and unexplainably continue to move higher.

But today, when I think about it, I feel content in my assumption. Something is going to give soon, and we may very well have already witnessed peak Tesla.

Disclaimer: I am short Tesla. I own/owned positions as disclosed above and in linked pieces. This is not a recommendation to buy or sell any stocks or securities. I own or may own all crypto/stocks I mentioned or linked to in this piece. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot.

At some point, hopefully sooner rather than later, states are going to pass laws saying that when a car gets in an accident and "auto pilot" (or any kind of fully automated driving) is on, the driver is presumed to be both "at fault" and "negligent" as a matter of law... THEN... insurance companies will look at autonomous cars as too risky to insure... THEN, not being able to get auto insurance, the market for this nonsense will disappear... THEN... Tesla goes to $0.

Can't happen soon enough.

Here how I "vision" the incoming development: regulator FINALLY declares the Autopilot dangerous (never mind those 5 years of investigation) and orders Tesla to stop selling it. Then there will be a follow up liability claim to return those 10k, Tesla was unfairly collecting for this feature. In the meantime, on the Twitter front, Musk is forced to buy the company for $50/share and nobody is going to help him to finance the deal.

Right after that, most of those, owing Tesla for 2 years and longer will ask for full price back, because Tesla has misled them + anyone damaged in an accident involved Tesla, resulting in the bankruptcy of Tesla US and separation of Tesla China.

Tesla shareholders will suit Musk for damages, taking over Twitter and SpaceX and defaulting Musk himself. Musk will escape via Mexico back to the South Africa, seeking for asylum. Later will get rich again while writing books about “fooling stupid Americans for 20 years”…

Anyway, just my 2 cents.