Knock On Wood

Cathie Wood's performance has been atrocious and she's blaming the NASDAQ, at all time highs, calling it a 'great depression', for her underperformance.

With every year that passes by, I try to talk less unadulterated shit about individuals in the financial industry. I understand that when you point one finger forward, three more point back at you and, to be honest, many of the people I've criticized over the years have all become extravagantly wealthy and successful, whereas I live in a 400-square-foot studio apartment with a dorm-room sized refrigerator.

In addition to not being constructive, calling out obvious idiocy by some individuals gets tiresome and repetitive. I’ve found that legions of other sharp-tongued, social media participants with far higher energy levels than I have now taken up the thankless task of ridiculing the industry’s low hanging cretins.

What’s the point of me sacrificing my own brain cells at this point to take one more jab at a guy like Ross Gerber? To quote the movie "Cabin Boy”:

“So this is what you guys do for fun? Humiliate an imbecile?”

And take somebody like Tom Lee. I give Tom Lee an endless stream of shit for being a permanent bull, but when it comes down to brass tacks, he’s actually the embodiment of the phrase “bears sound smart, bulls make money.”

Nobody gives a damn how dumb he sounds every 6 months when he hikes his S&P target for any and/or no reason at all, and no one cares if the market is rising for rigged reasons or if the perpetual long trade in an overextended market with 5.5% interest rates on the most pornographic debt bubble in world history doesn’t make any sense—the only thing that matters is the scoreboard.

And right now, for better or worse and with the market back at all time highs, Tom Lee is running up the score on his critics, myself included. And for that, I actually give the man quite a bit of credit because in this industry, it’s difficult to argue with results.

Which leads me to the topic of today’s article, Cathie Wood, and her flagship ARKK “Innovation” ETF.

Like Tom Lee, Wood is also an ardent worshiper at the church of “there’s no such thing as overvalued.” She is subjected to the same type of endless praise and adoration from the financial media and is sought after just as often in the world of tech investing for her opinions and insights.

I’ve been critical of Wood since the inception of this blog, pointing out all the way back in November 2021 that her "success", in my opinion, really appeared to be a one-trick pony: anomalous trading in Tesla beginning in December 2019 that has masqueraded as Wood being some type of gifted investor with meaningful insights that the rest of the market couldn’t ascertain, who invested accordingly.

I wrote that in late 2019, call buying in Tesla simply looked odd to me.

I had watched tape and the options market for almost 10 years and had seen unusual options activity before. But these buys — so far out of the money and so far long-dated at the time — just seemed extra weird to me. I first mentioned how weird it was back in January 2020:

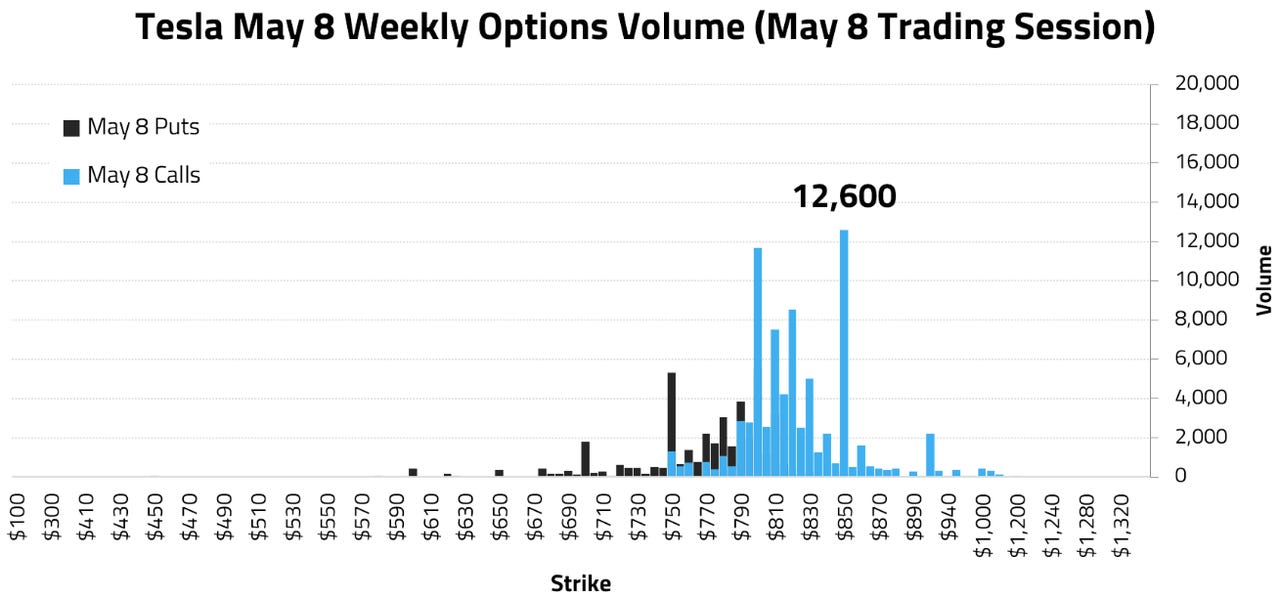

In April 2020, the call buying had hit a fever pitch:

Then, Zerohedge tackled the issue in May 2020, in a piece called “Are Mysterious Call Option Purchases Forcing Tesla Stock Higher?”

The article examined one such buy, where over $2.5 million was deployed in a very short term, very out of the money options buy. The piece explained exactly how certain call buys in the name may have been creating a squeeze upward in the equity price.

From there, it became somewhat of a talking point in the normal FinTwit zeitgeist, but no one (myself included) really tackled the work necessary to try and determine who the buyer could be and what motivation, other than of course simply being bullish, they may or may not have had for such purchases so far out on the bell curve.

By mid-2020, it started to become somewhat of a story.

“Actually... someone is buying a LOT of 8/21 $2,100 call options. This has been going on a LOT (i.e., someone buying way out of the money short-dated call options, which forces the person writing these options to buy stock), which has pushed the stock up consistently,” GLJ Research founder Gordon Johnson told Benzinga in Summer 2020.

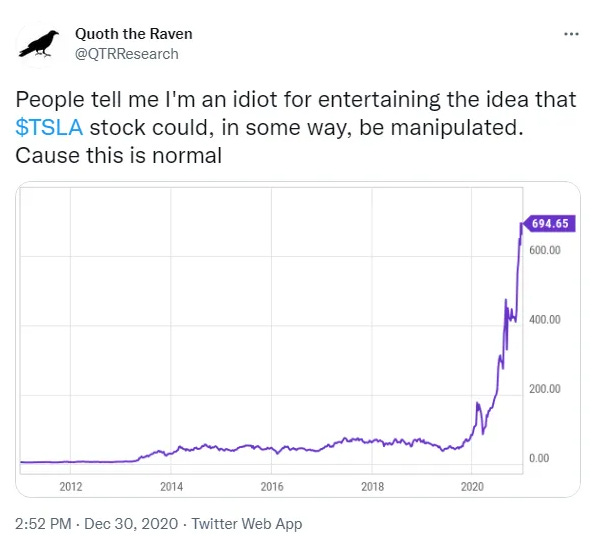

And of course, you didn’t need to be a statistician to understand that the action in Tesla’s stock was anything but normal-looking compared its history. This is how things looked by the end of the year in December 2020:

And despite Tesla having just a $60 billion market cap in 2019, this is what headlines in 2020 and 2021 looked like as a result of the squeeze higher:

It wasn’t only Elon Musk who was benefitting from Tesla’s mysterious rise higher, either. Wood literally became a “disruptor” overnight, taking in billions of dollars under management as a result of her concentrated bet on the electric vehicle company.

And so, without Tesla’s raging (and mysterious) success, there is no Cathie Wood success story. Or, in laymen’s terms, she simply got lucky.

Kind of like how the mystery squeeze in Tesla also allowed Elon Musk to try and cash in on a $55 billion+ compensation package — put in place only the year prior — that was eventually voided by a Delaware court for a breach of fiduciary duty. He got lucky too, I guess.

I wrote back in November 2021:

What should be worrisome to Wood’s investors is not only that her flagship fund has vastly underperformed the major market indexes year-to-date…but also that it has done so while her flagship ETF component, Tesla - weighted at a monstrous 10% of ARKK - has done nothing but go up. Specifically, ARKK is down 1% over the trailing twelve month period while Tesla has posted gains of over 112%.

In other words, Tesla has been saving ARKK from a complete and total meltdown.

Since then, Wood’s ARKK flagship fund has been dead money when compared to its NASDAQ benchmark. One by one, investors have watched other investments that Wood has made alongside Tesla get decimated.

For example, the “visionary” tech investor made a strategic decision to hold off and miss the surge in Nvidia — literally the hottest name in tech the last 2 years — while riding names like Invitae and Ginkgo Bioworks into bankruptcy and the toilet, respectively.

And last month Seeking Alpha published a list of ARKK’s 10 worst performing names. Keeping in mind ARKK only has ~35 names and the NASDAQ is up about 15% YTD, the losses in these names are stunning:

Teladoc Health (TDOC) -32.5% YTD

Tesla (TSLA) -33.4% YTD

Roku (ROKU) -34.5% YTD

Prime Medicine (PRME) -34.6% YTD

10x Genomics (TXG) -35.2% YTD

Ginkgo Bioworks (DNA) -35.8% YTD

Unity Software (U) -37.7% YTD

Verve Therapeutics (VERV) -38.1% YTD

Pacific Biosciences of California (PACB) -65.5% YTD

2U, Inc. (TWOU) -70.9% YTD

With no reputational string left to hold on to except Tesla’s mysterious outperformance between December 2019 and 2023, my prediction years ago was that when Tesla finally started to face reality, so would Cathie Wood's ARKK Innovation Fund. And that’s exactly what has happened:

As I wrote just days ago, it appears to me that Tesla is at the very beginning stages of a years-overdue comeuppance that should see the company's relationship with the truth and reality take precedence over idiotic retail investors and mysterious long-dated out-of-the-money call buying.

That reality check is taking place as you read this in the form of multiple government inquiries into the company, depleted retail investors, and a product line that appears to be humiliating everyone who once believed in it.

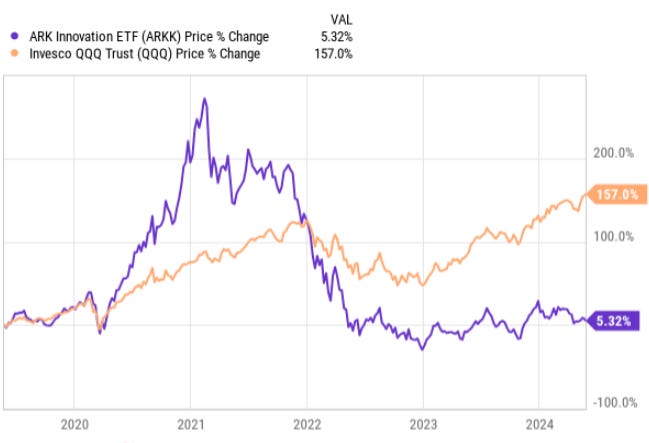

As the Tesla story continues to implode upon itself like a dying star, ARKK’s performance has been unavoidably horrific over any and all timelines one could use to compare it to its benchmark.

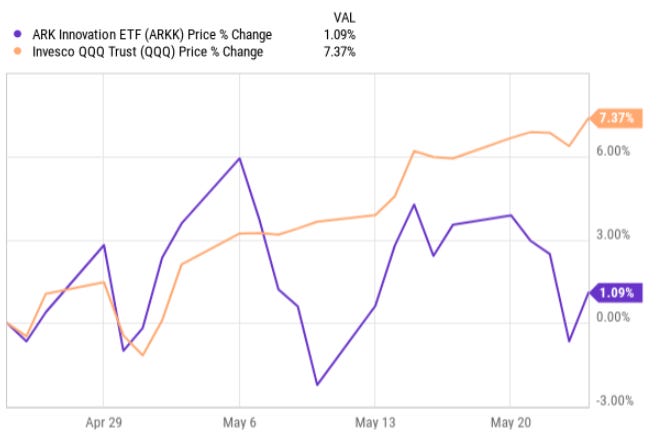

Over the last month, the NASDAQ is up 7.37% and ARKK is up only 1.09%, trailing its benchmark by 6.28%.

Over the last 3 months, the NASDAQ is up 4.85% and ARKK is down -8.32%, trailing its benchmark by 13.17%.

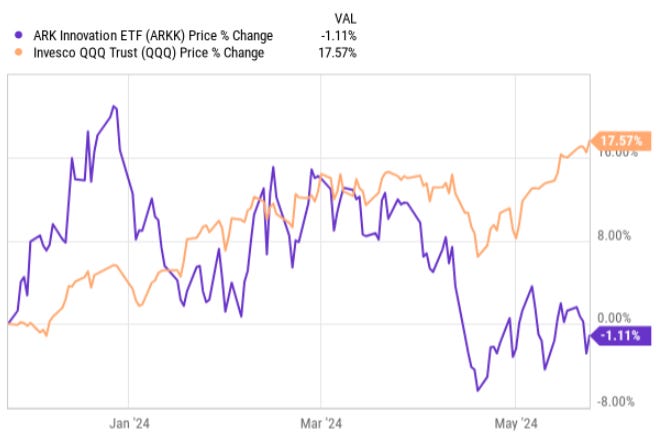

Over the last 6 months, the NASDAQ is up 17.57% and ARKK is down -1.11%, trailing its benchmark by 18.68%.

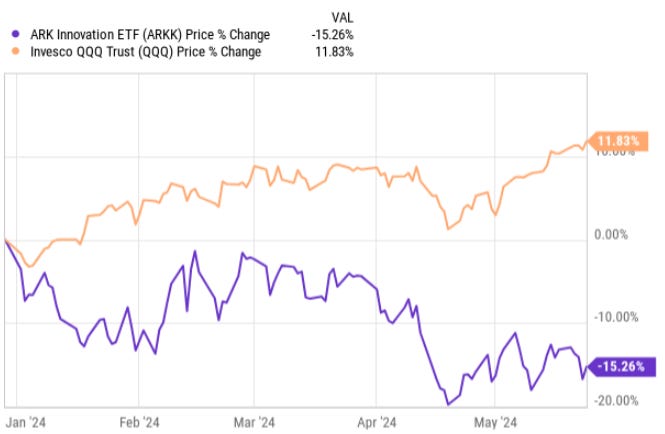

Year to date, the NASDAQ is up 11.83% and ARKK is down -15.26%, trailing its benchmark by 27.09%.

Over the last 12 months, the NASDAQ is up 38.08% and ARKK is up 12.47%, trailing its benchmark by 25.61%.

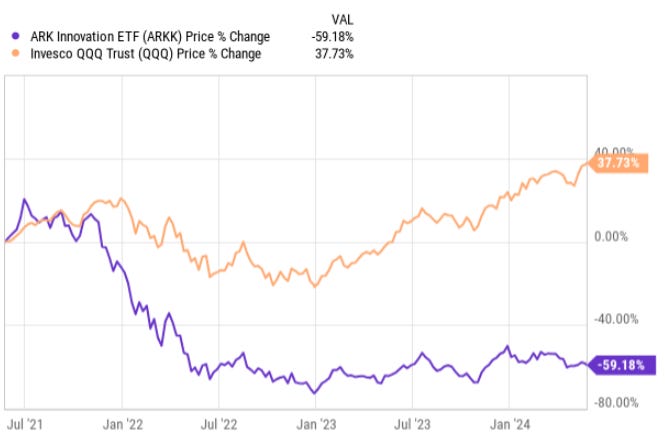

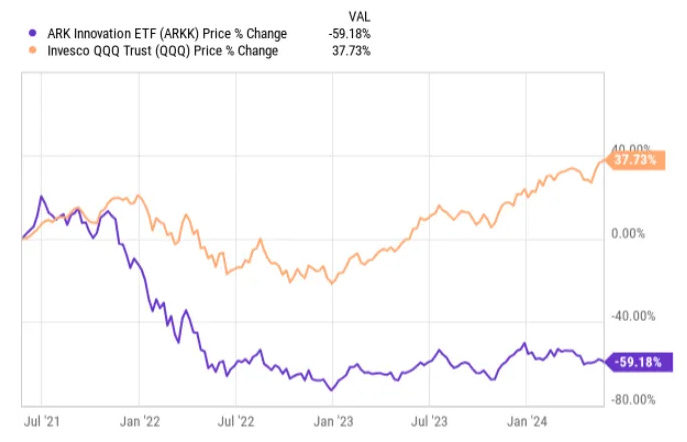

Over the last 3 years, the NASDAQ is up 37.73% and ARKK is down -59.18%, trailing its benchmark by 96.91%.

Over the last 5 years, the NASDAQ is up 157% and ARKK is up a rounding error, 5.32%, trailing its benchmark by more than 150%. See if you can spot the Tesla-driven “anomaly” in ARKK’s “success” in the chart.

And finally, over the last 10 years, the NASDAQ is up 357.9% and ARKK is up 117.8%, trailing its benchmark by 240.1%.

To compound her dreadful numbers, Wood has offered up bizarre, hallucinogenic price targets, unbridled optimism about her own performance going forward that, in my opinion, has been very misleading, and bursts of macro-sounding non-sequiturs as excuses.

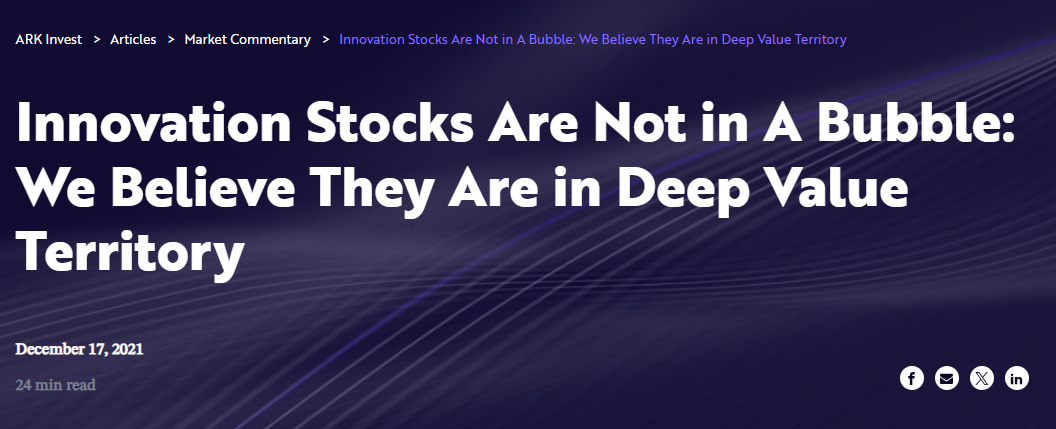

Back in December 2021, she said her ARK Innovation ETF “could deliver a 40% compound annual rate of return during the next five years” and said its stocks were in “deep value territory”.

Her blog post read: “With a five-year investment time horizon, our forecasts for these platforms suggest that our strategies today could deliver a 30-40% compound annual rate of return during the next five years. In other words, if our research is correct – and I believe that our research on innovation is the best in the financial world – then our strategies will triple to quintuple in value over the next five years.”

Wood later edited her December 2021 letter to make the language less aggressive, without making a pronounced note of the change, after being criticized about its content.

Now, read this again: over the last 3 years, the NASDAQ is up 37.73% and ARKK is down -59.18%.

Then, in January 2022, Wood changed ARKK’s website from displaying its YTD return to a 5 year (annualized) return, something I immediately called out as moving the goalposts to try and present a rosier picture of ARKK’s actual performance.

Her site now once again lists YTD NAV return as its key performance metric.

As it stands now, to the best of what I can find online, Wood is touting targets of:

“Innovation” being worth $220 trillion by 2023

Bitcoin at $3.8 million (with a “base case” of $600,000 by 2030)

Tesla at $2,000 per share, representing about 11x from current prices

And of course, like the idea that she was ever bringing something different to the table as an investor to begin with, I think these dubious predictions and distasteful practices are mostly, if not all, nonsense.

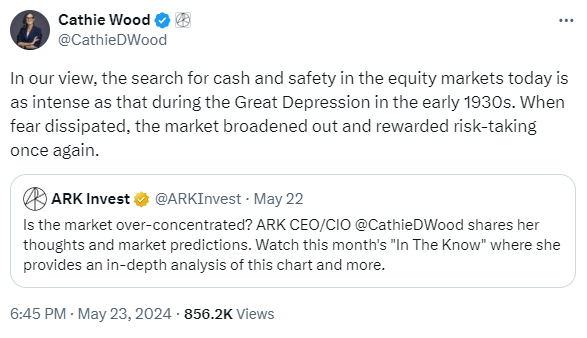

The cherry on top came this past week when Wood, seemingly having run out of euphoric price targets and limpdick excuses, took to Twitter to make what can only be described as a bold proclamation: today's markets—yes, the ones currently sitting at all-time highs—have been experiencing "a search for cash and safety."

In fact, she said the search for safety today has been "as intense as that during the Great Depression in the early 1930s."

You don’t need to be a business school graduate from Wharton to understand that a flight to safety and cash in markets usually leads to stock prices going lower.

If a broader market flight to safety was taking place, that would mean people are selling stocks more than they are buying them. When people sell stocks more than they buy them, their prices go down. It’s simple supply and demand.

In fact, there are no other telltale signs more important in a flight to safety and cash than stock prices moving lower.

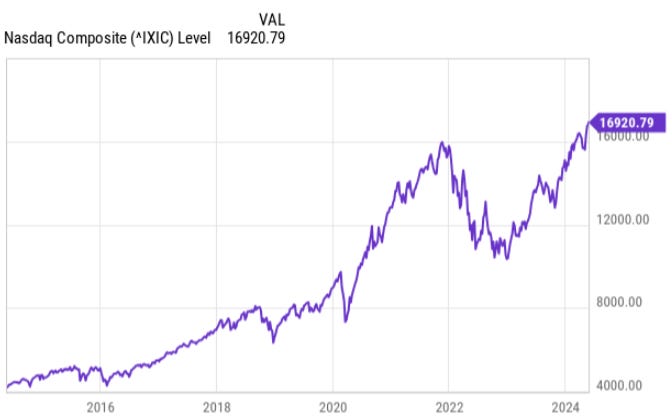

And, as luck would have it, the market isn’t exactly providing an airtight body of evidence for Wood's claims. In fact, the market is doing the exact opposite. Her benchmark, the NASDAQ, is at an all-time high.

Ergo, for Wood to tacitly suggest that there is some broader market selloff causing her underperformance isn’t just ignorant, it should be insulting and humiliating.

As I’ve shown in the comparative charts above, the data suggest that it is only the stocks that Wood has put into the ARKK portfolio that are disproportionately underperforming the rest of the market.

In her tweet, she doesn’t make the case that it is people in her stocks who are running for the hills, she suggests it is an overall market phenomenon. But really, the evidence points to the polar opposite.

If you look at the charts of the NASDAQ and ARK diverging from one another, there’s only one logical conclusion to draw: the market has never been doing better and it is her active management and the stocks that she has specifically gone out of her way to pick and market herself on that have vastly underperformed.

And so, what a person of integrity would be doing in this situation is acknowledging what can only be called the blindingly obvious elephant in the room: that your stock picking is simply horrific compared to your benchmark.

Most managers would look at the data I’ve presented and determine that there really is no other choice but to take a mea culpa. It happens all the time in the hedge fund industry: managers go bust or vastly underperform the market, and they regretfully inform their investors that they have been unable to perform well and are returning their capital. In other words, they cut their losses.

And while this doesn’t bring their investors' money back, it allows them to fall on their sword and continue onto their next venture with some of their integrity intact.

Wood is doing the exact opposite of this: she appears to me to be avoiding all responsibility for her atrocious underperformance, and insulting the intelligence of anybody who follows her on Twitter by making such a grossly ridiculous excuse.

I don’t know how anyone can read something like that ‘Great Depression’ claim and take it seriously.

But of course, all of this brilliance hasn’t stopped Wood from getting endless coverage in the media. Hell, for the price of a CNBC “Pro” subscription, you too can grasp onto 10 minutes of the brain farts of a woman who believes we are in the midst of 1930s bread lines (more genius thoughts here).

The kicker here could still be yet to come. As I wrote last week, I don’t think that the comeuppance is over for Tesla, but even more important is whether or not there will be a comeuppance for the overall broader market on its way.

The idea of the NASDAQ being in depression-era mode right now is beyond laughable, but it doesn’t mean that it won’t happen at some point in the near future.

As I’ve written about before, the Fed is faced with trying to decide whether or not they will allow inflation to run hot or crater the economy by keeping rates at 5.5%. If they choose the latter, there is a chance that the markets could see a depression-era-like selloff. But in that case, Wood’s portfolio of "special" stocks would likely only get hit harder in the overall market selloff.

There was never going to be a time when I was going to be willing to bet on Cathie Wood’s stock picking acumen, but it didn’t mean that I wouldn’t hold out hope for her to salvage her name and what little success, performance-wise, she could hold onto by leveling with investors and taking accountability. That second ship has clearly now sailed, and it has become evident to me that Wood has either lost herself in delusions of praise that she received years back or simply is a person with a character who can’t take accountability for their actions.

Either way, the ARK story is going to be a bizarre case study to watch over the coming quarters, not unlike Tesla itself — and it’ll remain a name that I will continue to want to stay far, far away from.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

She should wait with the bread lines comments until the broader market moves meaningfully lower, her holdings are going to puke even harder.

Cathie Wood also predicted that deflation is what the economy should be fearful of, not inflation. Well, here we are. We could certainly see deflation if a recession is allowed to run its course, but otherwise it feels very much like a structurally inflationary environment for the foreseeable future.

Broader markets should head down in a big way shortly. I just adjusted my exposure in my superannuation portfolio to more stocks, and less cash than I was holding. It would be a miracle if this doesn’t send markets crashing. I got sick of waiting 🤣