Cathie Wood's $14.3 Billion Implosion

"...the ARK family wiped out an estimated $14.3 billion in shareholder value over the 10-year period"

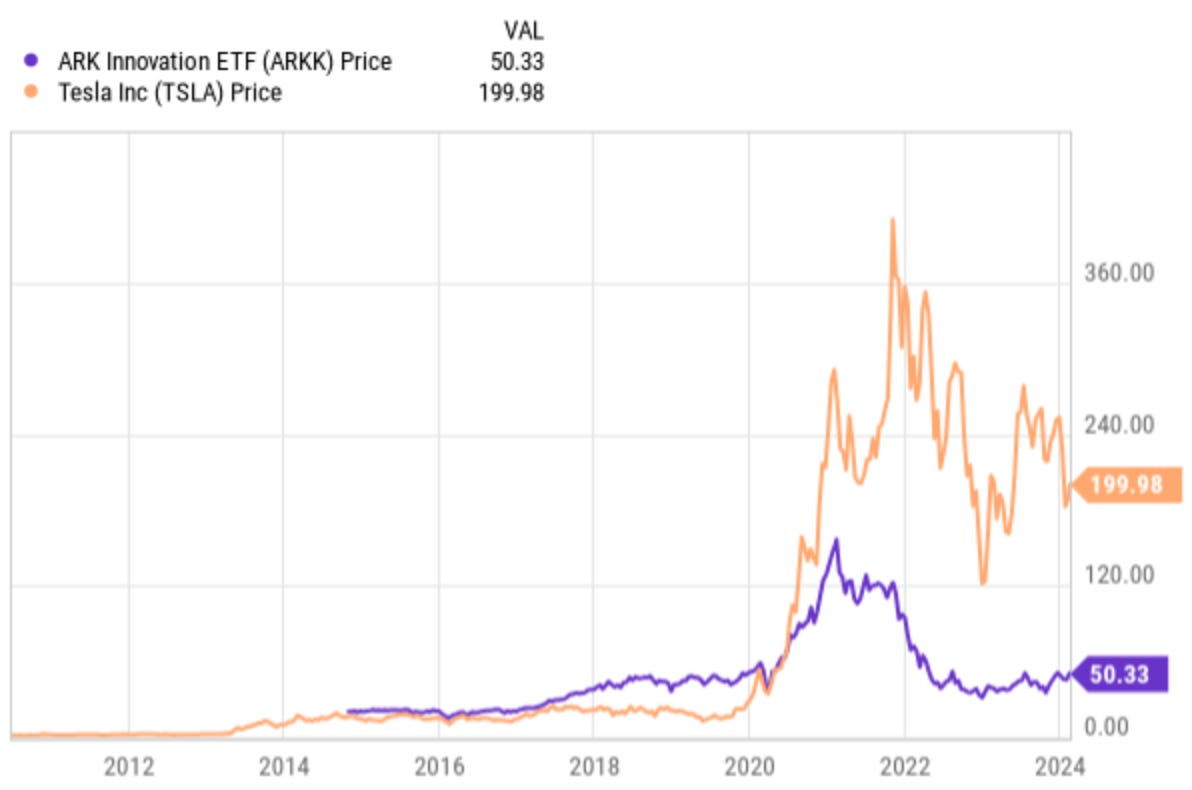

For as long as this blog has been around, I’ve been critical of money manager Cathie Wood, not only suggesting her outsized gains and popularity were simply a fluke based on a one-time gamma squeeze in Tesla (also called the “Ross Gerber effect” or the “Elon Musk pay plan effect”), but also reminding my readers that her stock picking acumen seems, for lack of a better word, to be horrific. So, naturally, she’s a great fit for a daily interview on financial media.

As best as I could tell over the last 5 years, Cathie Wood has stuffed her “innovation” ETF like a Christmas turkey full of cash burning, extremely overvalued companies. Another one of her gems, Invitae, filed for bankruptcy earlier this month.

Wood had been adding to the name since December 2021, and rode it all the way to essentially a 100% loss.

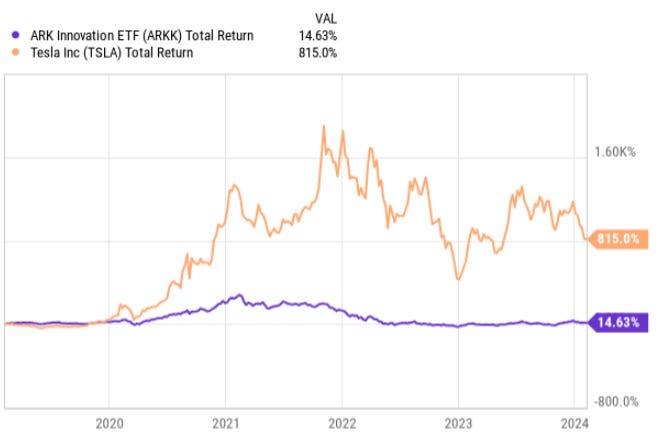

Wood has underperformed her benchmark, the Nasdaq QQQ, by about 95% in the last 3 years. Ex-Tesla, her results would be catastrophically worse over the last 5-10 years.

Meaning if the NASDAQ wasn’t in the midst of some pornographic 10-Sigma move off of March 2020 lows despite the fact that the economy is self-immolating in the background, who knows how much worse her performance would be?

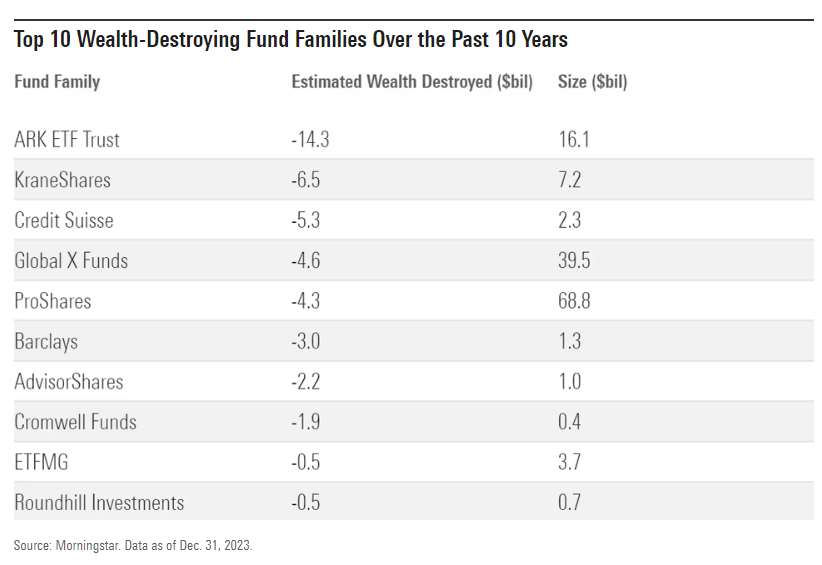

Now think about this: putting aside the fact that she happened to bet on Tesla before it magically went up 10x in months after trading sideways for the 5 years before it, and putting aside she has been riding the top of a move in markets that makes absolutely no sense at all, Morningstar still recently listed her as one of the top 15 funds that have destroyed the most wealth over the past decade.

ARK, home of the flagship ARK Innovation ETF ARKK, tops the list for value destruction. After garnering huge asset flows in 2020 and 2021 (totaling an estimated $29.2 billion), its funds were decimated in the 2022 bear market, with losses ranging from 34.1% to 67.5% for the year. Many of its funds enjoyed a strong rebound in 2023, but that wasn’t enough to offset their previous losses. As a result, the ARK family wiped out an estimated $14.3 billion in shareholder value over the 10-year period—more than twice as much as the second-worst fund family on the list. ARK Innovation alone accounts for about $7.1 billion of value destruction over the trailing 10-year period.

Wood was top of the heap in wealth-destroying:

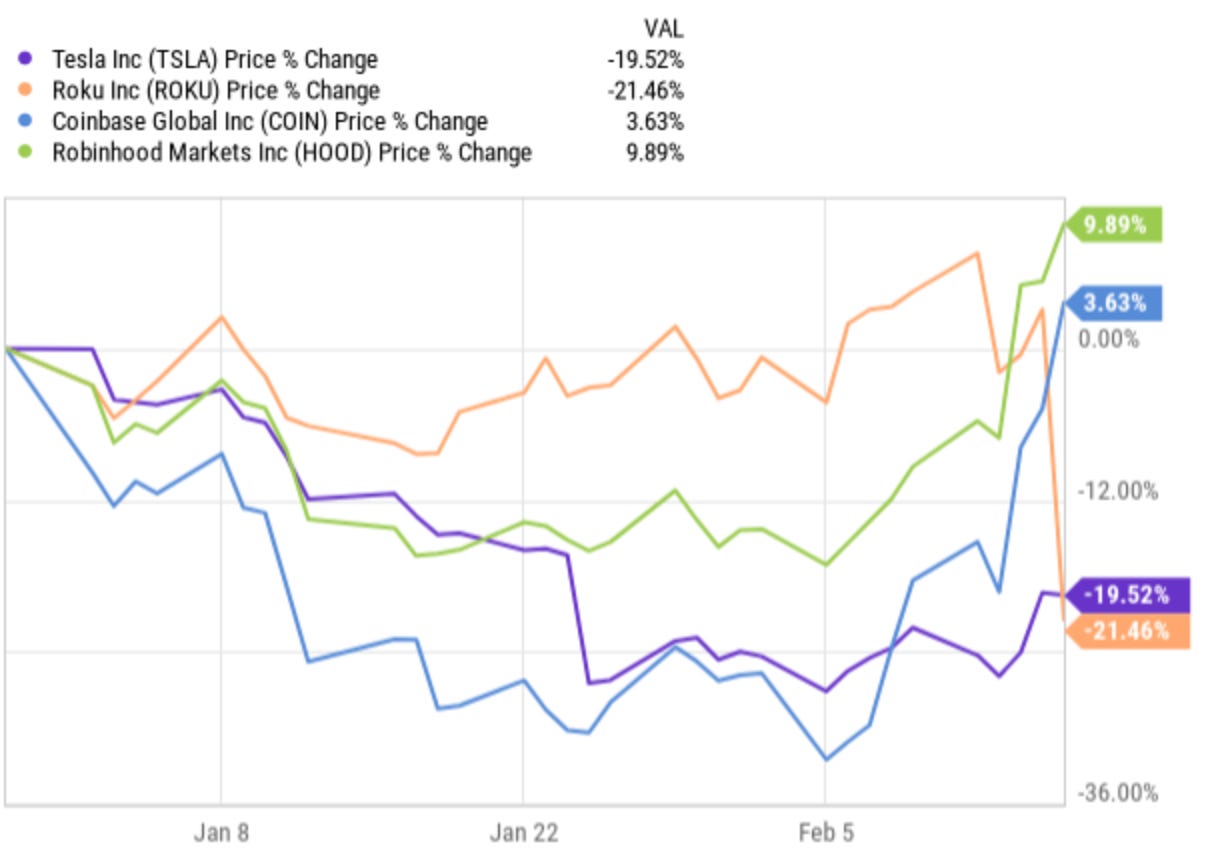

At the moment, Wood’s top 10 picks for ARKK still sees Tesla with an 8.21% weighting. Roku, which was also decimated last week, rounds out the #3 spot with a 7.39% weighting. Saving her ass is Coinbase and Robinhood, both of which have had great years. Robinhood is one of 24 names I even liked coming into the year.

How bad do you have to perform over a 5 year period to have your largest weighting up 815%, while you’re barely up 14%?

You can add that question to the list of questions anyone with an iota of financial journalistic integrity should be asking Wood, but won’t. Despite her horrific performance, Wood has made herself into a celebrity that is still often invited on, and looked to, by traditional financial media.

And has she learned anything? Doesn’t look like it. According to her enablers over at CNBC, she is still wishing for “Robotaxis” — a vision that has proven laughable since Musk first promised it years ago before continuing to fiddle with Tesla’s barely-Level 2 autonomy.

The fact remains once again that Tesla’s mystery stock action starting in December 2019 has forever minted it, Musk, Wood and Gerber into celebrities who have attracted the capital and attention of many who can’t pierce the veil to see the truth. And my guess remains that there will be a swift downfall for each of them. Meanwhile this circus act continues. How can any analyst look at Tesla’s autonomy and Musk’s promises versus reality — let alone the company’s pornographic valuation amidst super-saturated competition and price cuts — and still think the golden goose that got her here is capable of shitting out one more egg?

How bad does a “well known” fund manager need to do in order to never get invited back on CNBC? Is torching $14.3 billion in wealth not enough?

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. I didn’t double check any numbers or figures in this piece and am generally lazy with my research. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. Contributor posts and curated content are posted either with the author’s permission or under a Creative Commons license. This is not a recommendation or solicitation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. Sometimes I just lose money by misplacing it. I’m generally irresponsible. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. Do your research elsewhere. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it numerous times because it’s that important that you understand.

The amount of media coverage she receives is asinine. A true snake oil salesperson.

Cathie Wood, like the apartment syndicators and many others, is a product of this Fed-driven casino age. If/when the bubble ends, to dust she shall return.