In The Likely Event I'm Wrong About Everything

Listen to Luke Gromen's take.

If you haven’t lately, maybe it’s a good time to refresh your memory by reading the disclaimer I put at the bottom of all my posts. Basically, it says that I’ve been wrong often and will be wrong many times again in the future.

With that being said, a follower of mine on X sent me a great podcast over the weekend featuring one of my favorite market commentators, Luke Gromen and the only CNBC host I like, Guy Adami.

In the podcast, Gromen—who has correctly been long equities the entire time I have been waiting for a crash over the last year—lays out a very succinct case as to why rate cuts don’t have him rethinking his bullish stance on stocks.

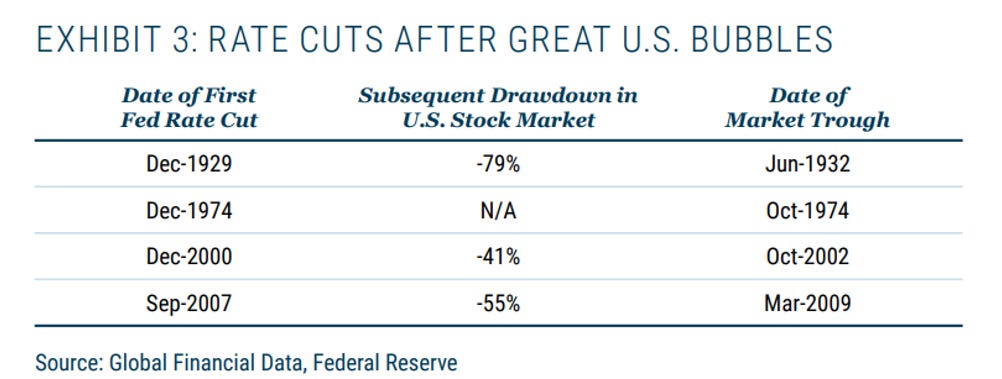

My readers know that I have suggested more than once that the market may be waiting to crash until the Fed cuts rates. As is brought up in this podcast, historically, that is what has happened: major 30% to 40% corrections in the stock market have occurred after rate cuts have begun.

But Luke Gromen does a great job explaining his position as to why this time, it may actually be different. In addition to laying out a case for why equities may not plunge this go-round, Gromen also does a great job painting a picture of the debt driven reality of economics in the U.S. today.

His analysis isn’t all too different from mine, in the sense that, putting equities aside, he believes that gold and Bitcoin will be the beneficiaries of what’s to come for the United States’ monetary policy. Luke does a great job laying out what could be coming volatility in the bond market, and talks about the only scenario he thinks could drive equities significantly lower.

And if Luke is right, this scenario isn’t one that I expect to see anytime soon.

I have no problem sharing perspectives that are at odds with mine, as I believe it to be necessary in coming up with the right answer for prosperity in markets. After listening to Luke’s perspective, I see things in a slightly different light, however, I’m not ready to just outright reject my previous assertions that a coming liquidity crunch could still put downward pressure on markets.

We aren’t far apart on everything, however. I was relieved to hear that, while we differ a bit on equities, we both see precious metals as the coming blow-off valve for the unlimited printing that will be done to try to rescue the everything bubble we are now in.

Oh, and we’re both bald.

The video to the podcast is below, and Luke’s commentary starts about 31 minutes into the show. I’ve queue the video up to the good stuff so you can get right to the action.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

The big drops you list in the past were all for very different reasons, it seems dangerous to try to relate them to the disasters currently in front of us, eg. record government national debt, insane spending on themselves and their millions of welfare-dependent, zero-skills clients, now pouring across our borders, appalling general education of the dumbest population on record, poking nuclear armed Russia, not properly backing Israel against the 7th century lunatics working to get nukes by Christmas, oh, China on the front foot like never before, Democrats cheating another election etc etc

I got my ass handed to me on a platter trying to short this market. Trying to short this one is like stepping into the wrestling ring with a fat, old champion. You know one day he is going to keel over. It’s inevitable. But in the meantime, that mean SOB has a thousand ways to cause you immense pain and make you tap out. And when you do, he celebrates with a JD and Krispy Creme donut. It's just not worth my while. I won't be stepping into that ring again anytime soon, if ever.