Delusional White House Economists Argue Two Quarters Of Negative GDP Doesn't Mean Recession Anymore

I beg of you - please - don't let them insult your intelligence.

(Update 7/28/2022: Q2 U.S. GDP has fallen -0.9%, marking the second straight quarterly decline in GDP. This is the technical definition of a recession, no matter what the White House blathers on about.)

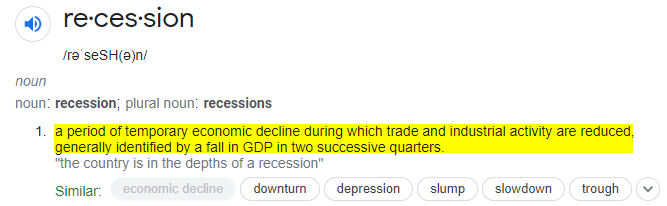

As sure as the sun rises and sets each day, the technical and widely used definition of “recession” in the financial world has been agreed upon by nearly everybody in the industry and both sides of the political aisle for decades.

That definition, of course, is “a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters”.

Usually, when it pops up under the dictionary definition of the word (as the first use, nonetheless) on the Silicon Valley-based and left-leaning censorship factory known as Google’s dictionary, it’s safe to say it is widely accepted.

Webster’s has an even larger funnel for the definition of the word, defining it simply as “a period of reduced economic activity”.

But Joe Biden’s White House - which has been dealt more L’s in less than 2 years than the New York Jets over the last 20 years - wants to move the goalposts, just as they’ve done with the exit from Afghanistan, Hunter Biden’s laptop, the origins of Covid, what vaccines are and are not capable of doing and what is causing enormous price spikes this year (if I hear “Putin’s Price Hike” again while President Biden continues to vilify the oil industry I’m going to stand outside and unload a Costco sized case of Aqua Net brand hairspray directly toward the ozone layer).

Ergo, we are dealt a trusty White House briefing in an attempt to squelch more of that pesky “disinformation” that keeps making the rounds:

The White House Council of Economic Advisers wrote in a blog called “How Do Economists Determine Whether the Economy Is in a Recession?” last week:

“What is a recession? While some maintain that two consecutive quarters of falling real GDP constitute a recession, that is neither the official definition nor the way economists evaluate the state of the business cycle.

Instead, both official determinations of recessions and economists’ assessment of economic activity are based on a holistic look at the data—including the labor market, consumer and business spending, industrial production, and incomes. Based on these data, it is unlikely that the decline in GDP in the first quarter of this year—even if followed by another GDP decline in the second quarter—indicates a recession.”

And after some good ole’ fashioned muck polishing and ad hoc data mining, like a biotech ShitCo whose sole drug just failed Phase III clinical trials, the blog ends with the conclusion that nothing currently is “indicating a downturn”:

Recession probabilities are never zero, but trends in the data through the first half of this year used to determine a recession are not indicating a downturn.

Even Janet Yellen joined the fray stating this week:

"This is not an economy that's in recession, but we're in a period of transition in which growth is slowing. And that's necessary and appropriate, and we need to be growing at a steady and sustainable pace. So, there is a slowdown, and businesses can see that and that's appropriate, given that people now have jobs, and we have a strong labor market."

Period of transition. Where have I heard that before?

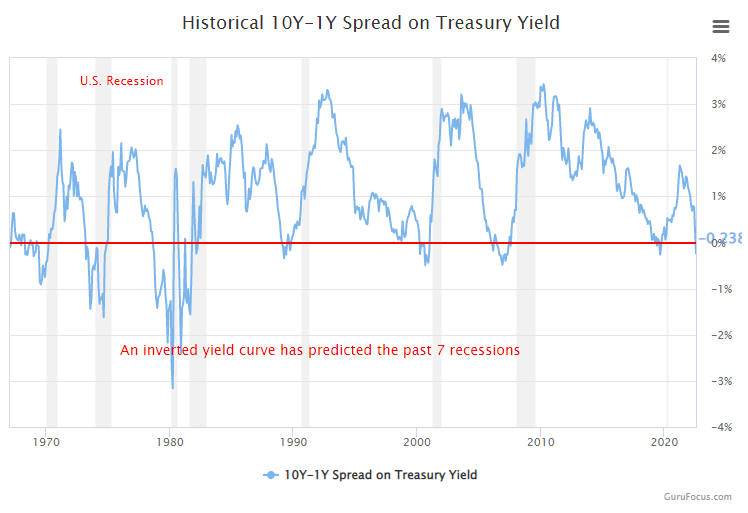

To further demonstrate how idiotic this idea is, the yield curve - currently inverted - has inverted in every recession dating back to 1955, as Fox News noted last week.

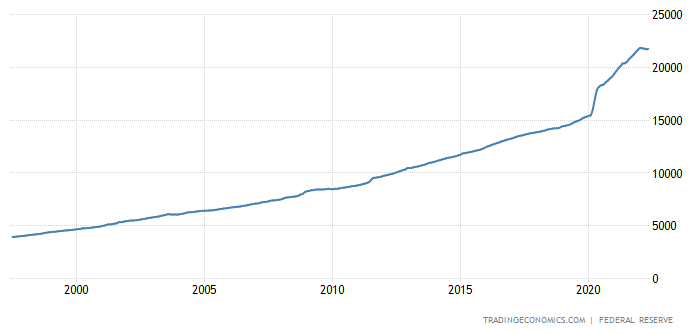

Finally, keep in mind this is the same Modern Monetary Theory/Keynesian/making-shit-up-as-they-go-along lot that got us into this inflationary mess in the first place, with what can only be described as a pornographic amount of money printing over the last three years:

It’s also the same ilk whose leader, Nobel Prize Winner Paul Krugman, issued a big fat mea culpa this week for not seeming to understand dick about where inflation comes from:

"Some warned that the [American Rescue Plan] package would be dangerously inflationary; others were fairly relaxed. I was Team Relaxed. As it turned out, of course, that was a very bad call," Krugman wrote.

Ask anyone in the middle class right now and I’m sure they’ll tell you that’s the understatement of the century. Apparently for Paul, as is likely the case with many delusional MMTers, the number $1.9 trillion just doesn’t seem to even move the needle anymore for them.

Regardless, keep your eyes peeled on the White House. They’ve obviously reached an inflection point where they’ve decided that simply making shit up is fair game - and that’s a slippery slope that I’m certain is going to result in more definition changes, which are next in the Keynesian toolbox after the actual data turns out to be so bad, it simply can no longer be twisted, turned, defiled and deflowered any longer.

Next up, I predict the administration will change the definition of “inflation” again (it used to mean the expansion of the money supply and now is widely accepted to be rising prices).

Will anyone give me odds on that bet?

The federal government has been crafting narratives to fit their agenda for 50 years and will not change direction. We are screwed and people are going to learn (the hard way) to think for themselves. Hard times are coming. Pray, plan, prepare and RESIST.

The government's economists have for decades used the two quarters of declining GDP as the technical definition of a recession.

Given that this country has experienced two YEARS and counting of stagflation, the technical definition has lost almost all practical relevance. For the great swath of the population, the recession has been here for quite a while.

https://newsletter.allfactsmatter.us/p/stagflation-while-inflation-rises

The current's regime's pathetic attempts to deny that reality aren't fooling anyone already grappling with rising economic privation.