Credit Suisse And Equity Markets Teeter On The Brink

The bank run snowball continues to roll down the mountain, gaining in size and speed as the days go by.

I was planning on publishing a different piece on something else this morning, but given the news over the last half hour I figured I would pen a quick note about the impending Credit Suisse mess.

For those that haven’t read, the distressed bank’s biggest shareholder, Saudi National Bank, which is 37% owned by the kingdom's sovereign wealth fund, has publicly ruled out further investment for the bank.

It’s the last message you want to send during a time where markets are already jittery following several bank runs and resultant bank shutdowns.

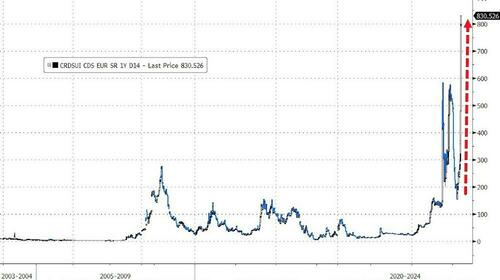

From an excellent Zero Hedge writeup of the situation so far this morning, this has led to “the cost of insuring the bank's bonds against default in the near term to distressed levels.”

"One-year credit default swaps for the embattled Swiss lender were indicated at 835.9 basis points on Tuesday's close of business, based on pricing source CMAQ. Other pricing sources point to a further rise on Wednesday, while a level of 1,000 would indicate serious concern," Bloomberg said.

Credit Suisse’s CEO was out defending the bank and its capital ratios today, but that doesn’t mean much in an investing environment where the smallest spark of bad news can immediately burst into a state-wide, California style wildfire. After the panic, it can almost become and afterthought that does more harm than good, or simply a headstone on the grave of the entity before it is even pronounced dead.

“I would ask everyone to stay calm and to support us just like we supported you during the challenging times,” Silicon Valley Bank’s CEO said just days before the bank was taken over by the FDIC.

“Signature Bank, a New York-based, full-service commercial bank, announced today updated financial figures as of March 8, 2023 and reiterated its strong, well-diversified financial position and limited digital-asset related deposit balances in the wake of industry developments,” Signature Bank wrote in a PR just 3 days before it was also taken over by regulators.

And now, today: "We have strong capital ratios, a strong balance sheet," said Credit Suisse Chairman Axel Lehmann.

Earlier this week, I wrote this piece where I lay out what I continue to buy and how my 2023 thesis continues to play out. While I’m not sure what’s going to play out over the short-term today in markets related to the Credit Suisse situation (the Dow has dropped about 500 points in the last hour alone), it’s a perfect example of what I have been saying the last few days, both on my blog and on my podcast. There’s been one big change over the last week.