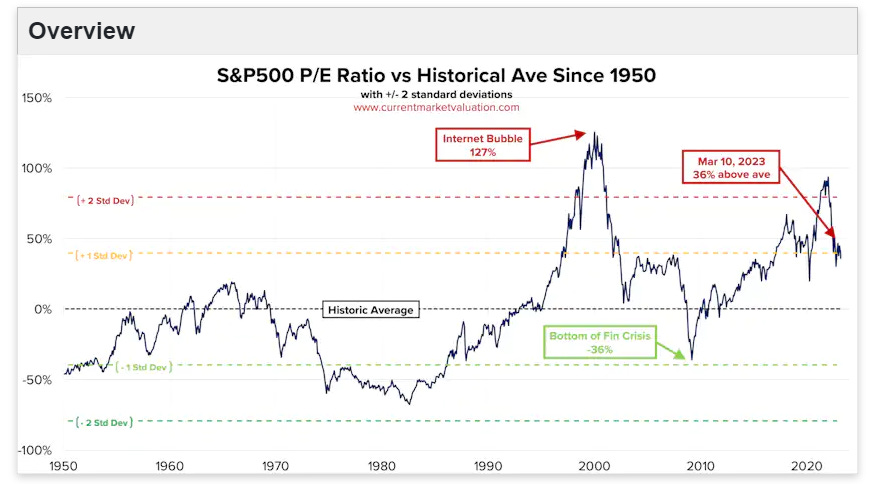

Friday was a day that truly showed how decrepit and sick the idea of “markets” have become. With rates at over 4% and the S&P multiple still at a frothy 18x-ish multiple on earnings that will likely remain in decline, the market begged for intervention like it was underwater drowning and the Fed had the oxygen tank.

Stocks, bonds and the like spent the day rallying on the news that a $200 billion bank had failed and that more bank runs were on their way. And they laugh when you contend that the system is rigged.

Over the weekend, more physical bank runs took place, with customers lining up outside of First Republic Branches on the West Coast.

On Sunday, the Fed, FDIC and Treasury responded swiftly by overdoing it (as they do - remember QE infinity in March 2020?) and guaranteeing funds at Silicon Valley Bank and shutting down Signature Bank pre-emptively.

They also set up a “new Bank Term Funding Program aimed at safeguarding institutions” (read: giant pool of printed money to bailout additional irresponsible bankers).

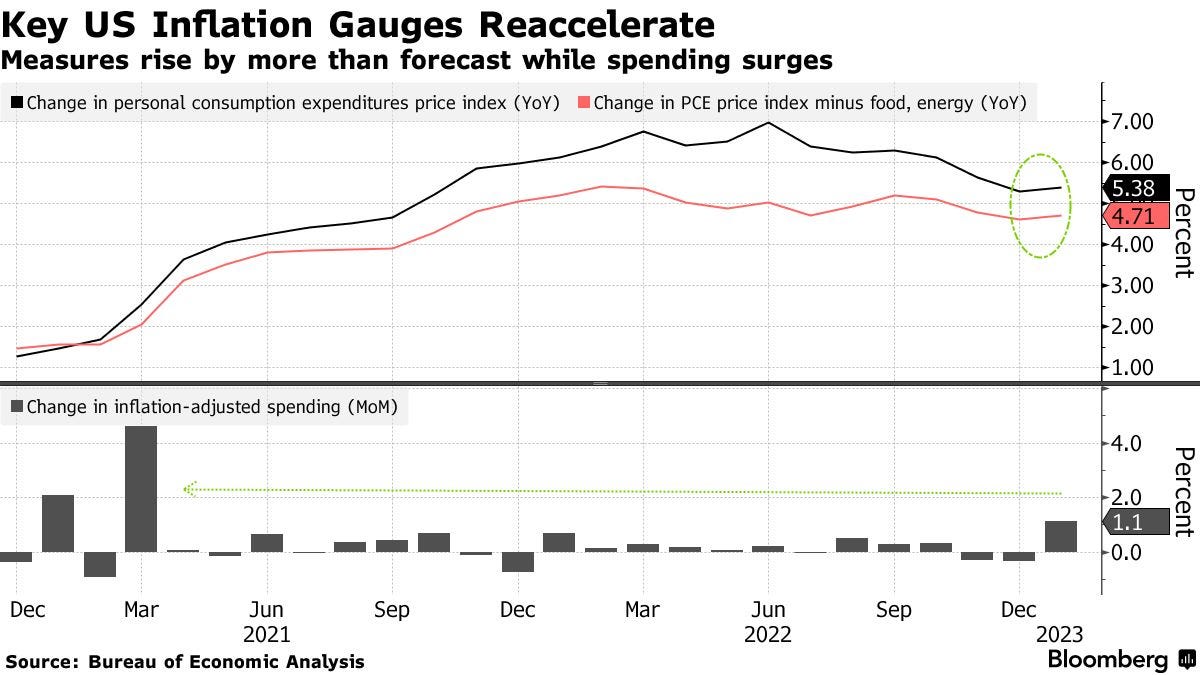

In other words, free printed money for everyone despite the continuing inflationary crisis the country is in the midst of.

It was frightening how quickly the Treasury and Fed worked together over the weekend unilaterally to make the decision conveniently before the Asian market open on Sunday night.

There apparently no longer needs to be any debate about bailouts in the hundreds of billions of dollars because, after all, when you’re printing and shelling out as much as our Fed and Treasury have - and you’ve already thrown your hat into the “death of the dollar” ring - what’s another $200 billion?

Here’s my quick updated take on the market now that it’s clear - at least to one major investment bank - that the hiking cycle is over.