Will Regulation Kill Crypto Or Legitimize It?

What will regulation realistically do to the bid for crypto in the U.S.? Does its legality become a selling point or is regulation a wet blanket thrown over the asset class?

Crypto is once again likely to be the story heading into the new week.

Last week's affirmation of crypto's ban in China has resulted in miners and holders in the Asian country attempting to safeguard their holdings.

Days ago, I wrote about why I thought China’s crackdown on crypto could actually be to sidestep a coming $2 trillion bubble burst in the crypto space.

The larger question was: if a crypto crisis happens, could it be one China engineers on purpose?

As I noted in that piece, crypto bears think China is taking prudent measures, while crypto advocates have openly mocked and laughed in the face of the country, touting crypto‘s decentralized feature as a reason that it could never be “banned”.

Here in the U.S., Securities and Exchange Commission Chair Gary Gensler is in the midst of honestly trying to figure out how to properly regulate the crypto space to keep both advocates and skeptics happy

This led me to the question I have been asking, and haven’t received a good answer on, for years now. Would regulation be good or bad for crypto?

In China, regulation in the form of a blanket ban is obviously a negative for the asset class. China will enforce these rules with draconian measures and Orwellian surveillance.

In the U.S., regulation looks to be on a trajectory where crypto will be made legal, but treated as a security.

This begs several questions I wanted to ask my readers:

Would regulation of crypto as a security in the U.S. stand to legitimize or throw a wet blanket over crypto? What would it realistically do to the bid, given that treating cryptos like a security both acknowledges how big they have gotten while it also works to cut out illegitimate uses?

Do you think the U.S. and other powerful countries could follow in China’s footsteps?

Do you think the U.S. and other powerful countries realize that by stepping out of the crypto atmosphere, China is removing exposure to a potential crash in the space?

You can leave your comments here:

For more on my thoughts, you can read my latest post, “Is China Sidestepping A Crypto Cataclysm No One Else Sees Coming?” by clicking here.

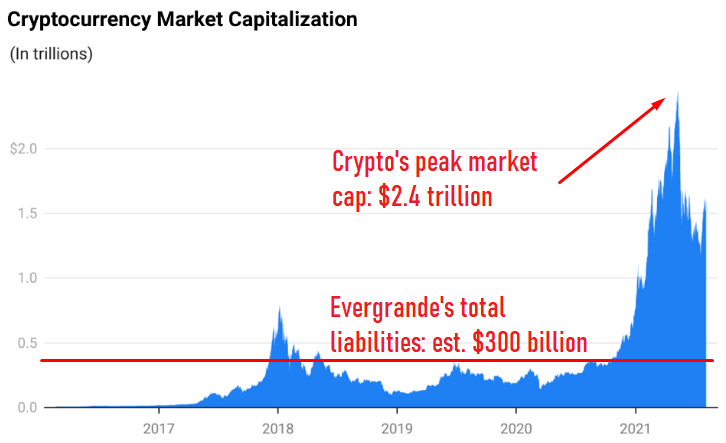

I also have a separate discussion on why I believe crypto is more likely to be the next “Lehman moment” than Evergrande.

Those who participate in the discussion can also get 20% off an annual subscription to my blog here:

It could very well be that the banks of the first world could put up road blocks to spare themselves from the threat if crypto by keeping their customers locked in their respective fiat; and such blocks would likely slow the adoption of crypto. But there are plenty of people in the planet who still desire access to systems of payments that are mutually beneficial and accepted. Bans would more likely result in a balkanization of payment systems over time.

I think the government is about one thing, control. Control of the currency manipulation and control of your money, taxation. They will try to crush what they don't or can't control.