Why Are Gold And The Dollar Trading Together?

"Can be a sign of global market 'stress'," says one metals analyst.

Gold suddenly appears momentarily correlated with the US Dollar Index (DXY). How can gold, a store of value and inflation hedge against dollar inflation, be following the price movements of the same inflationary currency it’s supposed to be protecting you from?

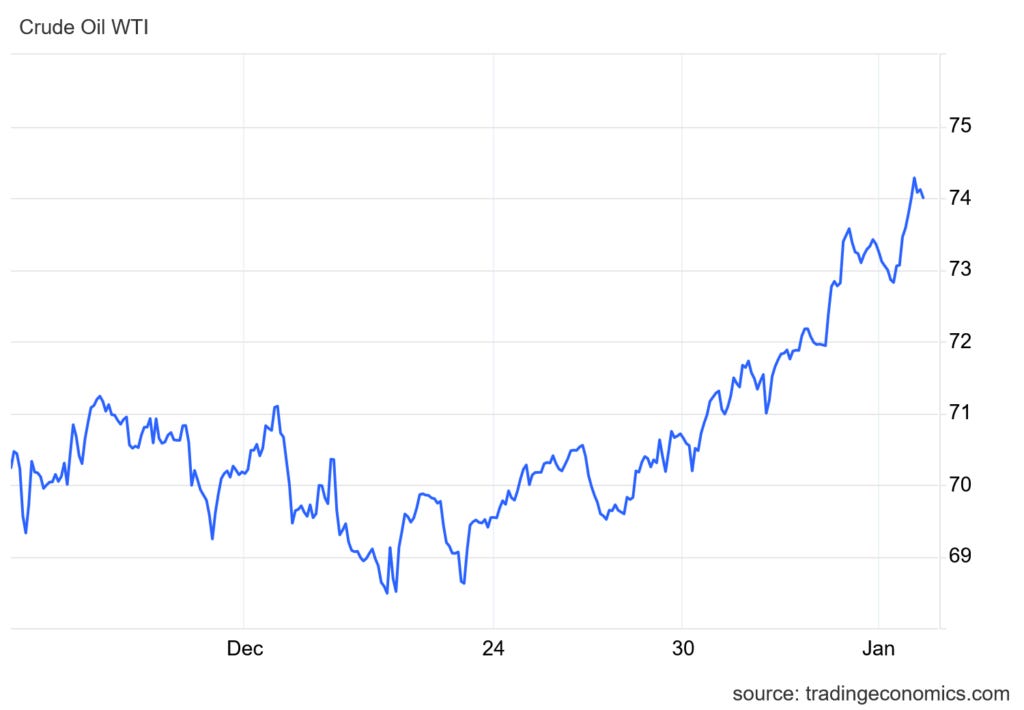

Oil prices are often inversely correlated with the dollar, but if oil producers begin adjusting their pricing strategies or if geopolitical concerns drive commodity prices higher regardless of the dollar’s strength, you could see the emergence of a correlation between COMEX and DXY. Are election-weary markets pricing in the possibility of further escalations in the Middle East? Oil volatility has been relatively low, but prices are on the rise this month as we head toward inauguration day:

Crude Oil, 1-Month

Zoom out. We’re in a wacky, spooky monetary paradigm, and odd things can and do happen in the short-term. But in the longer-term, nature has its way, and economic reality sets in…sometimes violently. Either way, even with a triumphant US dollar, USD is assured to keep losing value relative to the price of commodities like gold—despite some overlap.

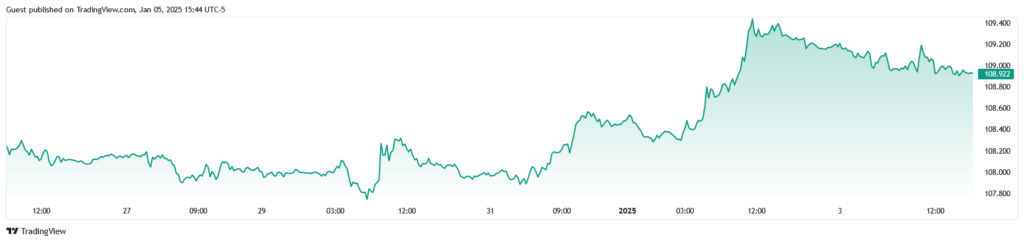

The weirdest chart of the week.

Comex gold and the DXY trading together since Tuesday. Doesn’t happen very often but, when it does, its can be a signal of global market “stress”. pic.twitter.com/UZeEG8g48p— TF Metals Report (@TFMetals) January 3, 2025

Central banks, especially the Federal Reserve, heavily influence both the value of the U.S. dollar and commodities like gold. With tighter monetary policy, the DXY may rise due to higher interest rates, making the dollar more attractive to investors. But if commodities, especially metals like gold, are being bought simultaneously as an inflation hedge, it could create a correlation between the two. If the market sees the tightening as a negative signal for economic growth, commodities could also rise due to fears of stagflation.

DXY 5-Day

Stealth QE through the Treasury could keep adding to the money supply even as the Fed cuts short-term rates, offsetting the effects of more hawkish Fed policy. Even with a slowing pace of cuts, inflation will remain out of control in 2025 no matter what the Fed does. But there’s a push and pull dynamic between Fed tightening and Treasury QE, where it adjusts operations to sell more T-bills over bonds, the Treasury can inject billions or trillions into the market without the Fed. It’s QE through the bond market rather than through monetary policy. Rather than the Fed buying up bonds, the Treasury revisits which bonds it offers on the open market, preferring the sale of short-term debt. If the Treasury sells more short-term bonds, it’s because they expect long-term interest rates to push upward even as inflation rages on.

With post-inauguration chaos, the potential for stealth QE, and the Fed unable to bring down inflation enough to deepen its rate cuts, the price of gold appears ready to take new highs. We are witnessing a changing of the guard as America returns to the most controversial and polarizing presidents in modern American history, fresh off of multiple assassination attempts, in a political comeback with no real precedent, all as embers keep being tossed at multiple powder kegs in the Middle East and Ukraine.

Gold can’t protect you from bombs, assassination attempts, or kamikaze trucks, but it can protect you from economic chaos as more investors flee to monetary safety from inflation, uncertainty, and war—especially wars in faraway lands for which America supplies the weapons, and prints the money to buy them.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

The United States under the Deep (Administrative) State has become one of the most malevolent and destructive empires in history - responsible for almost unbelievable amounts of death and suffering worldwide. To the extent each of us is able we should pray for President Trump’s safety between now and Inauguration Day and thereafter.

As far as precious metals are concerned it is now abundantly clear that the only course left for federal monetary policy is inflation (hidden and obfuscated to the maximum extent possible) and that the greatest amount possible should be allocated to their ongoing purchase.

I have been wondering why Gold prices trade with the S&P direction as well.