"When The Fed Pivots, We Get Paid": Lawrence Lepard

Larry explains that gold and bitcoin "got the memo" in his end of year 2023 letter.

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week. He gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Larry was kind enough to allow me to share his thoughts heading into Q4 2023. The letter has been edited ever-so-slightly for formatting, grammar and visuals.

This is the most recent investor letter from my good friend Lawrence Lepard, which contains a detailed writeup on the following and will be broken up into two parts:

2023 Year in Review

The FED and Treasury Blink in Q4

Inflation

Gold and Bitcoin Got the Memo

US Fiscal Position Not Improving

Catalysts for a Full Fed Pivot

When The Fed Pivots, We Get Paid

Gold’s Outlook Is Improving

Part 1 is called “God Help Us In The Next Crisis” and was published here. This is Part 2 of Larry’s letter.

GOLD AND BITCOIN GOT THE MEMO

As we have chronicled above. the Fed is making its best effort to give us monetary chaos. The interesting thing is that the two sound money alternatives, GOLD AND BITCOIN can see it loud and clear. Basically, the FED began its “we are done raising rates” jawboning at the end of September and since that time frame gold is up 15% and Bitcoin is up 61%. Fairly outsized moves for a 3-month period. Annualize these rates and you see the problem they have.

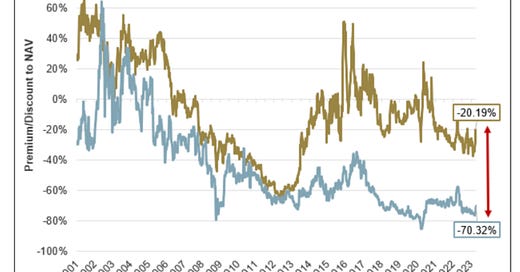

This is not just a US problem of increasing debt and dollar debasement funding that debt. Rather, it’s a global issue. As the chart below shows, global M2 money supply (gold line) is growing again (e.g., Europe/China are stimulating while the US M2 has declined). It is not a coincidence that gold prices correlate with this global M2 money supply and likely is part of what propped up gold making it one of the best performing commodities in 2023.

US FISCAL POSITION NOT IMPROVING

Our investment thesis is that we are in a “sovereign debt crisis” and the largest driver of that crisis is the ever-growing US Federal Debt burden, and that deficit spending is bad and getting worse. Until the Fed’s most recent interest rate hiking campaign, the ZIRP and low interest rate policies masked the underlying problem. But now that interest rates have been increased to fight inflation, the pending insolvency of the US Federal Government is on full display. The charts below show the growth of the debt and the sharp increase in Federal interest carrying costs.