Listening to subscriber feedback, I wanted to add a little more market-focused content and, like all of my content, wanted to do it from someone I know, trust and have a track record with.

Which is why I’m really stoked that my friends over at Sang Lucci Trading and The Steamroom, who I have known now for more than 10 years and have considered one of the best in the active trading business, are going to be contributing to Fringe Finance on a weekly basis.

I’ve always liked Lucci, Wall St. Jesus and the crew at The Steamroom because they are honest and upfront about losses when they get their ass kicked (look for a ton of videos like this out there) and don’t try to pitch themselves as more than they are: a group of guys with a little experience trying to find an edge and do their best.

I find their analysis sharp and worth considering, so I’ll be happy to bring it to you on Sundays heading into a new market week each week. As a paid QTR subscriber you get access to these writeups which are normally reserved for their paying members for nothing extra.

As usual, my disclaimer below applies as does Lucci’s full disclaimer, which can be read here, which all boils down to one key point: you’re on your own, this is not trading advice, only the opinions and banter of the authors, and always consult a personal financial advisor before making any financial decisions. Options are extraordinarily risky and carry with them the potential for massive losses.

With that said, let’s get on with this week’s take from some of Lucci’s team.

Wall St. Jesus

Earnings season is well underway which means it's hard for me to look at options flow to provide a clear direction as hedging and stock replacement dominate the action. With the big names yet to report, the market’s momentum will largely hinge on their outcomes. It’s a challenging environment to trade, and until we get past this phase, it’s about staying tactical and avoiding exposure to unnecessary risks.

One European semiconductor leader recently had a negative reaction to its earnings, which put pressure on the stock and, in turn, influenced related names in the sector. You can see this in the chart below.

This is ASML. The blue box shows the pullback after the earnings miss on ASML (top chart) and how it had a ripple effect even on the “always bullish” stock market darling NVDA (bottom chart). It’s a reminder that, during earnings season, the market’s response to specific company results can create ripples across entire industries. It’s why it’s crucial to pay close attention to how these events unfold and react accordingly.

At the same time, we have the U.S. election coming up, which further complicates the picture. Historically, election periods bring heightened volatility, and this year is no different. We’re seeing elevated VIX levels, which indicate market participants are positioning cautiously. This setup often caps equities from making significant gains because systematic funds, like CTAs and vol-control funds, are restricted from adding long exposure with the VIX at elevated levels.

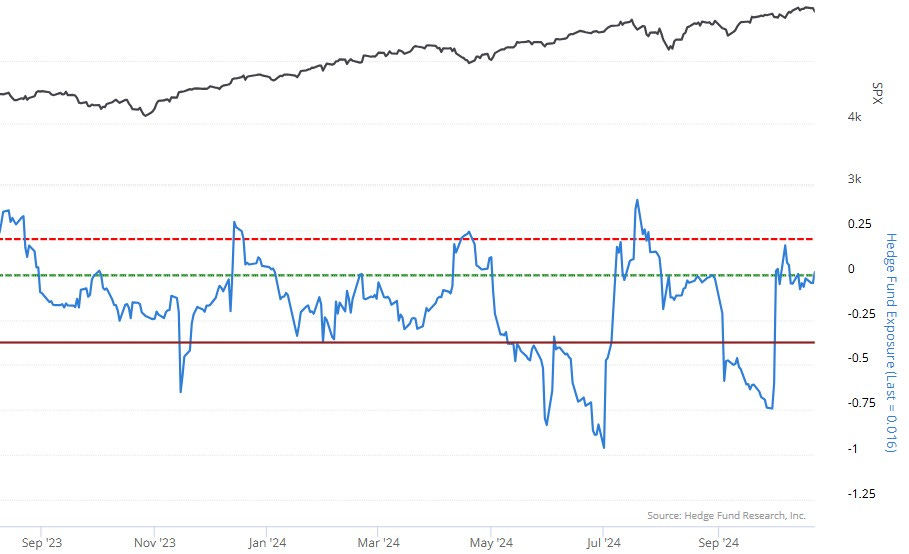

There’s also a peculiar dynamic with positioning. Hedge funds came into this recent rally heavily short and were forced to cover, but they have yet to aggressively switch to the long side. If you look at the chart below, the black line shows the S&P 500 while the blue line shows how much risk hedge funds are taking - when it goes down, they're playing it safe or betting against the market, same vice-versa. Right now they are mostly flat signaling a defensive stance. This alongside the broader cautious sentiment due to the election, creates a delicate balance. If we continue to see volatility and uncertainty around the election, it’s likely the market will remain choppy.

Looking ahead, if we get through this earnings season and the election without any major shocks, we could see a seasonal rally into the end of the year. However, if the uncertainty persists, the market could be set up for a correction early in 2025. For the next few weeks, my approach is to look for intraday opportunities and short-term trades, especially those tied to earnings. I’ve focused on a few select areas like Bitcoin miners and some speculative plays that have shown momentum. I’m also holding onto some gold miners as a defensive hedge, particularly with gold showing signs of strength in the current environment. After we move past the heart of earnings season and the election, we should have a clearer view of the market’s direction, and that’s when the more significant opportunities are likely to emerge.

Ronchero’s Corner

It’s funny that WallStJesus mentioned ASML as that's a company I’ve been closely watching for a potential long-term investment opportunity. ASML is unique in its niche; it's the only company that produces extreme ultraviolet (EUV) lithography machines, which are essential for manufacturing the most advanced and smallest semiconductor nodes. Recently, the stock had a significant run-up, reaching as high as $1110 / share during the AI frenzy back in July. However, its last two earnings reports dropped the stock as low as $679 as ASML hinted at macroeconomic concerns and lowered their guidance.This kind of movement has put it on my radar as a potential opportunity as their fundamentals remain strong, but I’m approaching it with a cautious eye.

First and foremost, the question is whether ASML is trading at a sufficient discount to justify a buy. Despite the pullback, the stock remains below its 50-day and 200-day moving averages, indicating a problematic technical position (see chart below). Typically, I avoid buying stocks that are in a confirmed downtrend unless there’s a compelling reason. With ASML, it’s important to determine whether the current level is a temporary bottom or if there’s more downside risk.

In the semiconductor world, price movements can be abrupt, and they often form V-shaped patterns, which makes ASML interesting despite the technical challenges. However, before jumping in, I want to see how other companies in the sector, such as LAM Research (LRCX), report their earnings. Their results could provide additional insights into how ASML might perform in the near term.

There are a few other key elements I look for before committing to a trade like this. I want to see if the stock offers weekly options. This is crucial because it allows me to write calls against my long-term position when the stock pops, collecting premium to reduce my cost basis. Additionally, I keep an eye on management commentary during earnings releases. Transparency about challenges, headwinds, and forward guidance helps me determine if the stock is fairly valued post-pullback. I also consider insider buying. When insiders start purchasing shares, it indicates confidence in the company’s future. While there are many reasons insiders sell, they only buy when they believe the stock will go up. There are a few more technicals I look at but that's really getting into the weeds.

If I decide to enter a position, I would likely do so using LEAP options rather than buying the stock outright. This approach allows me to control shares with a significantly lower capital outlay while maintaining flexibility. For instance, buying 1,000 shares of ASML would require about $700,000. However, using an 80 delta leap option, I can gain similar exposure for approximately $185,000. This not only reduces my capital risk but also provides flexibility to adjust my strategy as the stock moves. The 80 delta leap is my preferred choice because it offers a good balance—it moves approximately 80 cents for every dollar the underlying stock moves, giving me a solid correlation without the full risk of direct ownership. Over the years, I’ve refined this technique, and it has proven effective in managing risk while maximizing returns.

Overall, while I’m intrigued by ASML and the potential upside, it’s critical to remain cautious. The stock is currently in a downtrend, and I prefer to see signs that the trend is reversing before fully committing. The semiconductor sector can change rapidly, and while this volatility offers opportunities, it also necessitates a strategic approach. If all these conditions align, ASML could present a significant upside opportunity, especially if the AI chip ecosystem continues to expand. For now, it stays on my watchlist, and I’ll be monitoring it closely for signs that the stock is ready to turn around.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors and are bound by their individual disclaimers too, which I’ve tried to also post here. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Very nice piece, Chris. Zero fluff/ bs , all KPI’s & potential 👍.

Shame the summer meetup w/ you two never happened. Maybe this spring in a dive bar with some baseball on the screens

I have been watching ASML as well, then I listened to a Podcast with Doomberg this weekend (10/25/24). While I recommend the whole interview (hour and half) of particular interest would be starting at the 43 minute mark, the specific detail on ASML is more around the 55 minute mark, but the the prior portion gives more context. ASML seems to have some big headwinds in 2025 that certainly require caution

https://youtu.be/VTVTwBLsmw8?si=kFbHC65cRkMb5Ze3

Then I read a recent analysis at Seeking Alpha (10/24/24)

https://seekingalpha.com/article/4728906-reassessing-asml-holdings-why-i-am-lowering-the-stock-to-a-hold-rating

Caveat Emptor