Underestimating Washington D.C.'s Debt Trap

"The Triffin crisis is set to become a self-fulfilling prophecy again, potentially on a far greater scale than the failure over fifty years ago."

By Mises Institute (emphasis QTR’s)

In May this year, the Congressional Budget Office estimated outstanding US government debt next October to be $27,388 billion. By the end of the first quarter of the fiscal year, it will exceed $34,000 billion. It is soaring out of control, and perhaps it is not surprising that the CBO has not updated its forecasts with this debt uncertainty. The CBO also assumed that debt interest costs last year would be $663 billion, when it ended up being $980 billion 48% higher than forecast. For the current fiscal year, the CBO assumed that the average interest cost on debt held by the public would be only 2.9%. Short-term T-bill financing upon which the Treasury has become overly dependent is almost double that.

Of the total bond debt, some $7.6 trillion has to be refinanced this fiscal year, to which must be added the financing of the budget deficit. Bearing in mind that 2024 is a presidential election year when government spending always increases in an attempt to buy votes, the deficit excluding bond interest is bound to rise from last year’s nearly $1 trillion.1 And with recessionary forces depressing tax revenue and increasing welfare costs, perhaps we can pencil in an underlying deficit of $1.5 trillion for the current year, to which interest costs must be added.

So far, the US Treasury has not had difficulty in current funding, because at an average rate of over 5.4% since the end of September, T-bills have been draining money market funds out of the Fed’s reverse repo facility. At current discount rates, this probably adds about $150 billion to the government’s interest bill compared with fiscal 2023 so far. The balance of funding requirements for the rest of this year should take the total to about $1.5 trillion, 50% of the total deficit, which in turn at $3 trillion is rising at a 50% annual clip.

With GDP this year estimated by the CBO to be $27,266 billion, it gives a budget deficit to GDP ratio of 11%. That is without factoring in an economic downturn. Together with the estimated $7.6 trillion of maturing debt to be rolled into new debt at higher bond yields this fiscal year, we are looking at a further $3 trillion of deficit to fund, totalling $10.6 trillion. This is miles away from the CBO’s debt estimate of $34,205 billion at the end of the fiscal year. After not three months in, debt is already just $300 billion from that total — it looks like the outturn next September will be closer to $37,500 billion.

Debt funding costs will depend on the marginal collective view of foreigners. Other than offshore funds, such as the Cayman Islands, Ireland, Luxembourg and Switzerland, major holders of the coincidental $7.6 trillion in US government debt such as Japan and China have been net sellers. And of the top twenty holders, seven are arguably categorised as either leaning towards China or threatening to reduce their exposure to US dollar hegemony. On these grounds alone, future foreign participation in US government funding cannot be guaranteed.

In large measure created by debt funding problems, rising interest rates will make this situation even more difficult. For now, there is easy funding available by issuing treasury bills, attracting money market funds out of reverse repos at the Fed. But this sweet spot is rapidly being exhausted. There is the potential for banks to deleverage their risks by dumping private sector exposure in favour of so-called risk free short-term government stock and that is undoubtedly happening. But that intensifies the shortage of credit for cash-flow starved businesses, leading to higher borrowing costs for the private sector if scarce credit is available. And that surely opens up the possibility that down the line the US Government will be forced to step up costly support for failing businesses.

In the process of relying increasingly on short-term funding, the debt maturity profile shortens, so that the costs of rolling over maturing debt rapidly rises. It’s a situation made worse by growing foreign apathy towards investing in dollars, of which they already own too many.

Some commentators are beginning to see this danger, leading them to believe that if only interest rates can fall, it is an outcome which can be avoided. They believe that the Fed controls interest rates and can bring it about. The Fed also appears to believe it, and we can be reasonably sure that as statistical evidence of recession mounts, it expects to cut interest rates, stop quantitative tightening, and even return to QE. Furthermore, it is a presidential election year and employment will become a more important policy objective than inflation. This policy switch being already apparent, the dollar’s exchange rate will begin to decline materially, and then foreigners will surely increase their selling of US Treasuries.

Foreign holders of dollars, some $33 trillion onshore, a further $85 trillion in foreign exchange derivatives, plus a further $10 trillion in eurobonds cannot be expected to stand idly by and just watch their dollars lose value.

Admittedly, similar problems are faced by the other G7 currencies. But if anything, the international community of foreign currency holders are not so exposed to euros, yen, pounds, and loonies. Interest rate arbitrageurs are even short of euros and yen, and their positions would be reversed out if interest rate differentials are expected to decline.

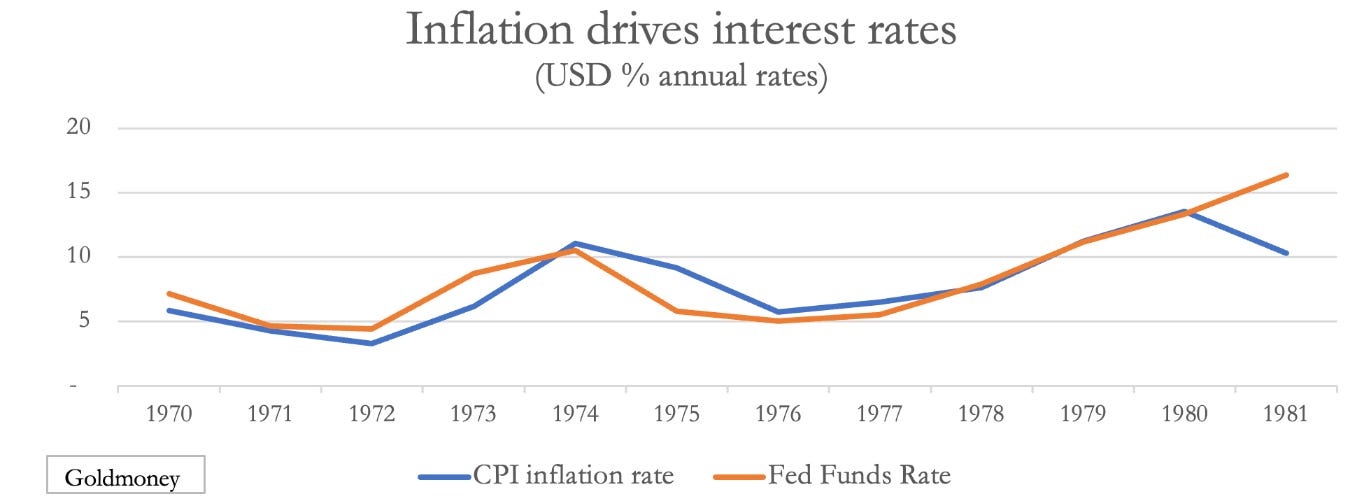

With credit in the form of national currencies and bank lending no longer being attached to gold, monetary theories which evolved during the era of fixed exchange rates are no longer valid. They should be revised for the reality of a fiat currency system. Failure to do so caused major policy failures in the 1970s. As was the situation in the 1970s, it is the rate of consumer price inflation which now correlates with the Fed’s interest rates. If, as seems increasingly likely, foreigners begin liquidating their overweight dollar holdings thereby driving the exchange rate lower in terms of purchasing power, both interest rates and inflation must rise. The tightness of the relationship during the 1970s is shown in the chart below.

Fifty years ago, before the introduction of index linking of benefits and bond yields the CPI’s compilation was reasonably objective with government statisticians independent from outside pressures. That is no longer the case. According to estimates compiled by John Williams at Shadowstats, if the basis of calculation in 1980 had not been subsequently revised, it would reflect an inflation rate closer to 12% than the official 4%.

It should be admitted that there is no correct way of calculating an entirely theoretical concept such as the general level of prices. But there should be no doubt that the average of consumer prices is still rising at a far faster rate than generally admitted. It is perhaps fortunate for the US Treasury that the public doesn’t question official figures. If anything, they are in thrall to them. But this obvious foolery conceals a developing catastrophe.

It was economist Robert Triffin who pointed out that you cannot fool markets all the time. Back in the early 1960s, he pointed out that for the dollar to act as a reserve currency trade policy must ensure that there is an adequate international supply. This meant running a deficit on the balance of trade while retaining a balance of payments, the difference amounting to supply accumulating in foreign hands. He further pointed out that this meant policies must be pursued which were economically destructive in the long run, inevitably leading to a monetary crisis.

In his eponymous dilemma, Triffin proved to be correct when the US and European nations with gold reserves were corralled into establishing the London gold pool to assist in stabilising the dollar-gold exchange rate, a move which failed. The problem persisted, which led to President Nixon suspending the post-war Bretton Woods Agreement in August 1971. Driving that rolling crisis was a surplus of dollars in foreign hands, the realisation that it was debased, and therefore overvalued in terms of real money, which is and always has been gold. It was the crisis predicted by Robert Triffin.

There can be no doubt that the world is on the edge of a similar event today.

The figures quoted above, amounting to over $125 trillion dollars and derivative commitments in foreign hands is nearly four and a half times US GDP. The Triffin crisis is set to become a self-fulfilling prophecy again, potentially on a far greater scale than the failure over fifty years ago. All it needs is a loss of faith by foreign holders of dollars in the US government’s finances and its self-serving statistical manipulation.

Article is excerpted from Underestimating Debt Traps, originally published at GoldMoney.com

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. Contributor posts and curated content are posted either with the author’s permission or under a Creative Commons license. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Just waiting and adding to my gold holdings, keeping a big chunk on hand to jump on the SQQQ

This country is in the hands of voters,who are ill informed,voting their self interests,so we are going down.