Trump’s Victory Has "Delayed The Fiscal Meltdown Scenario"...For Now

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week.

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week. Larry is one of my favorite market analysts to follow and he gets little coverage in the mainstream financial media, so I’m happy to bring you his thoughts.

Larry was kind enough to allow me to share his thoughts heading into Q1 2025. The letter has been edited ever-so-slightly for formatting, grammar and visuals.

This is Part 2. Part 1 was published here earlier this week.

MARKETS SMELL FUTURE INFLATION

One of the most interesting market developments during 2024 is that in spite of the stock market doing well, the “sound money” assets (Gold, Silver, Bitcoin) are doing well too. More generally speaking these assets are negatively correlated. In fact, as mentioned earlier it is very unusual for the stock market to be strong and for the prices of gold and silver to outperform it.

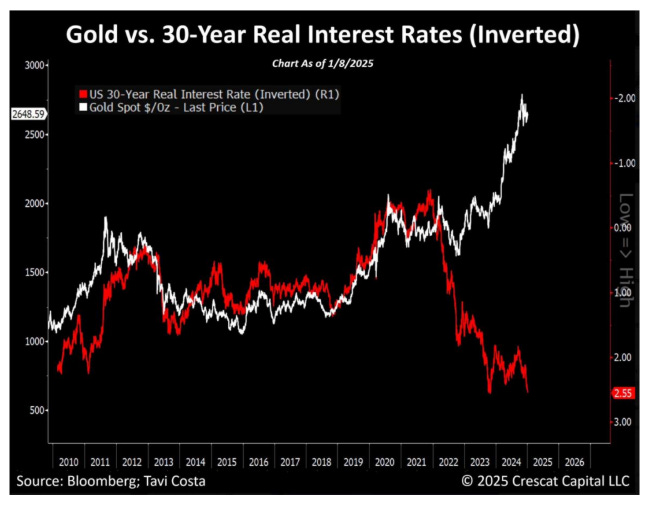

We believe that this is because the markets can see that the Federal Reserve is trapped and they are sniffing out future monetary accommodation. Historically, the price of Gold has correlated with the real interest rates. This makes sense. When bonds offer high real interest rates, or good inflation adjusted returns, then they are more attractive than gold. The opposite is also true.

The next schedule below shows the price of gold versus the real interest rate on bonds (inverted). Note the tight correlation from 2010 to 2022. We have also examined this over much longer historical time frames and the correlation is quite strong. Then note what happened in 2022. When the U.S. seized the $600 billion of Russian foreign exchange reserves the two data series began to diverge. Gold suddenly looked more attractive than Treasury bonds which could be seized. This divergence has persisted because the markets are sniffing out future inflation.

GOLD, SILVER AND BITCOIN SIGNAL INFLATION

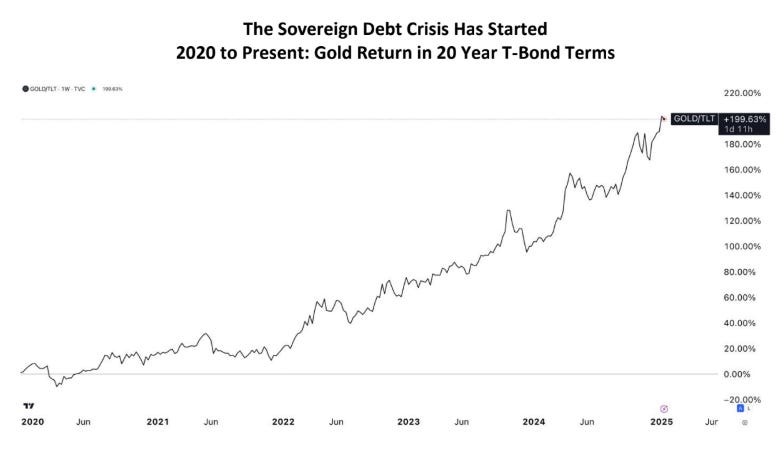

We used to live in a world where the U.S. Treasury bond market was the base layer collateral for all financial markets. Due to the U.S. fiscal malfeasance and the inflation that has resulted from these policies, we see sound money alternatives sending an inflation risk signal that is loud and clear.

The two biggest canaries in the coal mine of money printing and monetary debasement are Gold and Bitcoin, and below we see Gold’s outperformance vs. sovereign bonds (Gold up 200% compared to U.S. T-Bonds since 2020).

What we think is occurring is that we are on the cusp of entering a sovereign debt crisis where the Fed will be forced to add the kind of monetary accommodation that they did in 2008 and 2020. They will be forced to stop quantitative tightening (QT), drop interest rates to zero and resume quantitative easing (QE) by buying all sorts of Treasury bonds, asset backed securities and likely even equities. We have been referring to this as The Big Print. When it happens, the sound money assets that the fund holds will perform extraordinarily well. In the meantime, we mark time waiting for this event.

STOCK MARKET

In past letters, we have explained how this “everything bubble” has led to extreme overvaluation in the stock market. Nothing has changed on this front, and in December most of the major averages made new record highs. If the stock market were to stumble, the fiscal problems discussed above would only become worse forcing the Fed into massive monetary accommodation.

The next chart shows how overvalued the stock market is: