Timing (These Assholes) Is Everything

It's not a question of "if" the Modern Monetary Theorists and financial media will be proven wrong. It's a question of "when".

About five years ago, I decided I wanted to start a podcast, well before I ever started this blog. I had been offering up my terrible takes on the economy via my Twitter account exclusively until then, but became motivated to start a podcast because the economic iconoclasts and Austrian thinkers that I wanted to hear from never got the play they deserved in the mainstream financial media.

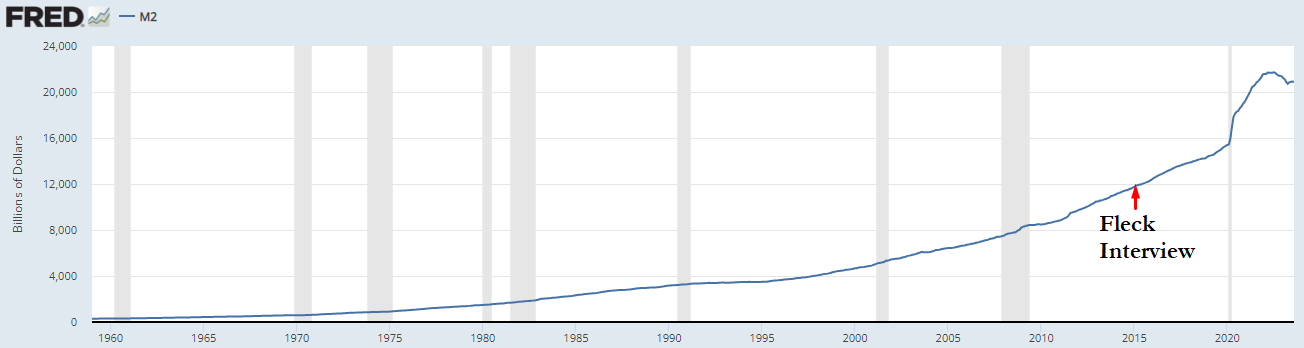

My distain, distrust and general disgust for financial media reached a peak in 2016 when CNBC’s Fast Money invited Bill Fleckenstein on the air to offer up his take on the macroeconomy and why the Fed-fueled market was “un-shortable”. Bill is a well-known advocate for the Austrian school and has been highly critical of the Fed and central banking policies.

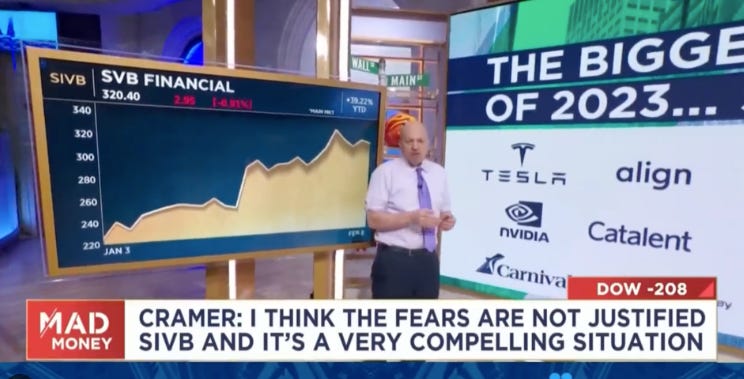

Conversely, CNBC, in my opinion, has a long track record of celebrating anybody who is bullish about anything, for any reason, without asking pointed questions, being skeptical, challenging the status quo or holding anyone accountable for missed calls. Behold, exhibits A through C.

Except for one day in 2016, when Fast Money’s Tim Seymour suddenly decided he wanted to do all of the above after the show invited Mr. Fleckenstein to discuss why the market was unshortable. Rather than welcoming Bill’s contrarian viewpoint, Seymour opted to label him "pathetic" on air and took a swipe at him for consistently being long on gold and silver miners. You can watch the semi-heated exchange in the video below.

Please excuse the poor quality; it's the only version of this exchange that I could find online.

People who have followed me for a while know that I've taken exception to this interview. I've mentioned it multiple times on my podcast and in public speeches.

I find fault with this interview in the same manner that I criticize other instances of mainstream media personalities arrogantly dismissing those who question the central banking model. Much like supporters of Modern Monetary Theory, I believe there's a certain arrogance and hubris that comes with anyone—analyst, investor, or financial media personality—putting all their eggs into the unprecedented MMT experiment basket without knowing the eventual outcome.

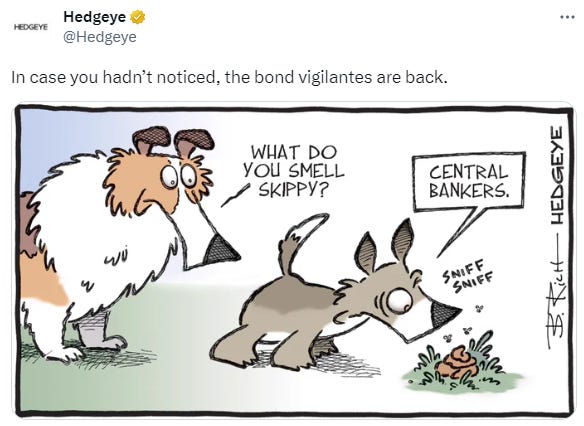

Listening to that Fast Money interview for the umpteenth time this week, I noticed two things I'd never observed before. First, in this interview aired seven years ago, Bill Fleckenstein makes a prediction that seems to be finally materializing. If you listen closely, he predicts that Japan or the U.S.’s bond market will be the first to crack—a broader suggestion that bond vigilantes will eventually return and settle scores with central banks. Make no mistake, this appears to be exactly what's happening now.

“After the rally that comes from QE4, then you’re going to be able to do what you want to do,” Fleckenstein says about potential short setups.

He continues:

“Probably the first bond market to crack up will be in Japan but maybe it won’t. Maybe it’ll be here. I don’t really care if I miss the first break because they’re gonna come with QE4. The trade I want to catch is when people wake up to the fact that these Central Bank strategies are failures. They are the arsonists that create the fire, they’re not the firemen that put it out, even though they claim to be the latter.”

The second thing I noticed is CNBC host Tim Seymour posing the somewhat mocking question of whether gold will reach $2,000 an ounce. He asks this to jab at Fleckenstein for being bullish on precious metals. Yet here we are, seven years later, and gold has not only reached $2,000 an ounce but has surpassed it before pulling back to the $1,900’s.

Yet Seymour couldn’t help but mock Fleckenstein during the interview:

“A lot of this sounds kinda pathetic…”

“Is gold going to $2,000 an ounce? Is it?” Seymour continues to poke at Fleckenstein, sarcastically.

Finally, a calmer head on the desk prevails, stating:

“At some point, [Fleckenstein’s] 100% right. This is going to end and it’s going to end badly…Is it 2 years from now? 6 years from now? I have no idea. And nobody can time it perfectly…unfortunately we never see the next collapse coming.”

We just passed 7 years to the day from that interview.

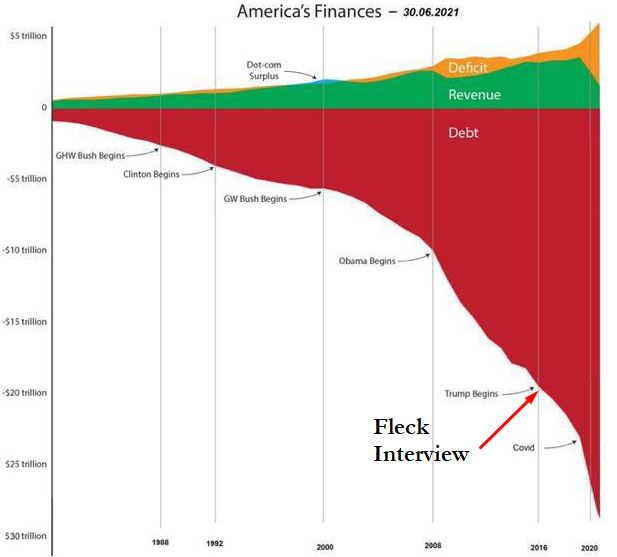

I've long stated that a comeuppance for Modern Monetary Theorists and Keynesian economists is all but a mathematical certainty. The only unknown is the timing. With interest rates at 5%, we stand at the edge of an unprecedented financial cliff. Looking back at this 2016 time capsule, it's fascinating to see how these predictions have played out seven years later.

And though the stock market has yet to implode, it's trading on its shakiest ground in years in my opinion. Valuations remain aggressive (25x earnings), mortgage rates have crossed 8%, and Jamie Dimon actually spoke today of a 7% federal funds rate.

The Federal Reserve shows no signs of reverting to any form of quantitative easing. There's no doubt that we've yet to see the worst economic turmoil to come.

Bill Fleckenstein's 2016 interview serves as another stark reminder that being right or wrong is a matter of timing. Bearish skeptics will eventually be proven correct. While there is always money to be made in the bullish system in the interim, that doesn't change the inevitable, consequential outcome that most of the market neither anticipates nor prepares for.

The question then becomes whether market skeptics, iconoclasts, and Austrian economists offer value by presenting a perspective that most overlook.

Will central bankers rig the system once again? Of course. There will likely be some form of debt jubilee, and the economic landscape that emerges will further erode our civil liberties—a trend consistent over the years. The wealth gap will widen, enriching the affluent while the poor and middle class find themselves increasingly surveilled by government and economically dispossessed for reasons they can’t put into words.

I don't claim to know how to prevent this, but I concur with Bill Fleckenstein: after QE4, opportunities are abound on the short side.

But timing (these assholes), as they say, is everything.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Wow. The “interview” is shocking. Thanks for posting it. The good news is that almost nobody watches CNBC anymore.

Fleck: #Bubblevision