Three Geographic ETFs I Hope Will Sidestep The U.S. Stock Collapse

Here's a couple of the ways I'm trying to position myself away from the U.S. as market turmoil hits.

I’ve been guiding my personal investing over the last few months by whether or not I think the U.S. is entering a longer term market wreck or another 3 month bump in the road like we saw in early 2020.

After all, if we are at a spot where we can shake it off and “buy the dip” were to work again, why wouldn’t you be keen to adopt the strategy of “if you can’t beat the lobotomized automaton active manager buying the dip, join ‘em.”

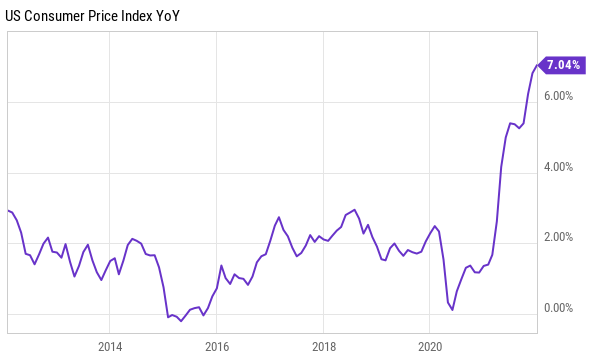

But my readers already know that I don’t feel this way. In fact, I believe the Fed to be in a true catch 22 - stuck between not being able to raise rates, which would very likely crash markets further, and the inability to maintain accommodative monetary policy, which could fan the flames of inflation (or at least appear to fan the flames of inflation from a psychological and political spin perspective).

You see, the inflation is the key here. In years past, the Fed never had to face the consequences of its QE. In fact, it was able to parade around suggesting QE was this perfect mechanism for getting the markets to do whatever the Central Banks wanted specifically because it didn’t cause any inflation.

Well now, the inflation has showed up and the Fed’s gravy train is officially over.

As a result, while U.S. markets continue to be brutally volatile, swinging from getting absolutely spanked to ripping 5% higher for no reason, I have dabbled in a couple U.S. names - namely value stocks and a couple of tech stocks that I think have gotten far too cheap.

But I’m also starting to look outside the U.S. - and why wouldn’t you? Overseas and emerging markets are worlds cheaper than U.S. markets and, if you think the dollar’s dominance is at risk, foreign currencies (and the businesses who transact in foreign currencies) are where you want to be. How am I doing this?