This Fed Will Be Behind The Inflation Curve For "At Least A Decade": Mark Spiegel

Mark sounds off in his latest letter about the state of the Fed trying to catch up to inflation and his neverending Tesla short.

Friend of Fringe Finance Mark B. Spiegel of Stanphyl Capital released his most recent investor letter last week, with his updated take on the market’s valuation and Tesla.

Mark is a recurring guest on my podcast and definitely one of Wall Street’s iconoclasts. I read every letter he publishes and only recently thought it would be a great idea to share them with my readers.

Like many of my friends/guests, he’s the type of voice that gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Mark On Markets

Occasional rallies notwithstanding, I believe the S&P 500 is only around halfway through (“pricewise”— “timewise” could be a lot longer) a massive bear market in stocks, the inevitable hangover from the biggest asset bubble in U.S. history.

For far too long, the Fed printed $120 billion a month and held short-term rates at zero while the government concurrently ran a record fiscal deficit. Now, thanks to the massive inflationary hangover from those idiotic policies, the Fed must reduce its balance sheet and raise interest rates substantially accompanied by no extra fiscal stimulus.

Thus, the “everything bubble” is in the process of deflating, and we remain positioned for it—albeit, not as short this month as I wish we’d been!

The last time the 10-year Treasury yield was where it is now (approximately 3%) was December 2018 when the S&P 500 was around 2700 (almost 30% lower than it is today), yet inflation was vastly lower (allowing much higher PE multiples) and growth prospects were far better.

And although corporate earnings are higher now than they were then, I believe that due to a looming slowdown in consumer spending and inflationary margin pressure those earnings expectations are too high while inflation will substantially lower the PE multiples placed on them, as happened in the inflationary era between 1973 and 1975 when the S&P 500’s PE rapidly dropped from 18x to 8x. (Perhaps a move from 30x to 14x might be in order this time around, although markets typically overshoot to the downside.)

Thus, I think this stock market is going much lower, and although we covered our large SPY short position in May when I felt it was short-term oversold, I plan to reinstate it if there’s a large enough “bear market bounce.”

Additionally, we continue to have a large short position in Tesla, the biggest bubble-stock in this entire bubble era, which will soon be to electric cars what Blackberry became to smartphones: the pioneer that wound up with arrows in its back.

Meanwhile, even last year when short-term rates were set at just 0.125% and average rates were around 1.5%, the gross interest on the $30 trillion of federal debt cost $573 billion, and that cost is now on a path to nearly double. Does anyone seriously think this Fed has the stomach to face the political firestorm of Congress having to slash Medicare, the defense budget, etc. in order to pay the even higher interest cost that would be created by upping those rates to a level commensurate with even 4% or 5% inflation (not to mention today’s over 8%)?

Powell doesn’t have the guts for that, nor does anyone else in Washington; thus, this Fed will likely be behind the inflation curve for at least a decade. And that’s why we remain long gold (via the GLD ETF).

QTR’s Fringe Finance is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber: Subscribe now

Mark On Tesla

In an interview released in June but conducted in late-May with a local Tesla fan club, Elon Musk called Tesla’s new German and Texas factories “gigantic money furnaces losing billions of dollars.” Yet in the quarterly conference call just five weeks prior to that he implied things were going great at those factories...

So, as Zach said, we remain confident of a 50% growth in vehicle production in 2022 versus ‘21. I think, we actually have a reasonable shot at a 60% increase over last year. So, let’s see. Obviously, we ramped production, as you will know, with Giga Berlin and Giga Texas in the past few months. So, with two fantastic factories with great teams, and they are ramping rapidly. Now, with new factories, the initial ramp always looks small, but it grows exponentially. So, I have very high confidence in the teams of both factories. And we expect to ramp those initially slowly, but like I said, growing exponentially with them achieving high volume by the end of this year.

...and then proceeded to almost immediately dump billions of dollars in TSLA stock.

Back when this country had an SEC that prioritized “corporate fraud” over nonsensical crap such as “climate change disclosures” it might have taken a look at this, but under Trump and now Biden the SEC has become one of the most useless agencies in Washington, which is quite an accomplishment considering its competition!

We also learned in June that Tesla only fulfilled its obligation to report a series of serious Autopilot accidents to the NHTSA after the NHTSA had already learned about them. Elon Musk remains the most vile person ever to head a large-cap U.S. public company, and we remain short Tesla, the biggest bubble-stock in modern market history, because:

It has a flat-to-sliding share of the world’s EV market and a share of the overall auto market that’s only around 1.5%, yet a market cap greater than the next 9 largest automakers (by market cap) combined despite selling fewer than 3% of the cars they do.

It has no “moat” of any kind; i.e., nothing meaningfully proprietary in terms of its electric car technology (which has now been equaled or surpassed by numerous competitors), while existing automakers—unlike Tesla—have a decades-long “experience moat” of knowing how to mass-produce, distribute and service high-quality cars consistently and profitably. Meanwhile, its previously proprietary Superchargers are being opened to everyone.

Excluding working capital benefits and sunsetting emission credit sales Tesla generates only minimal free cash flow.

Growth in sequential unit demand for Tesla’s cars is at a crawl relative to expectations.

Elon Musk is a pathological liar.

Tesla will soon report a terrible Q2 (even before accounting for a roughly $500 million Bitcoin write-down), with deliveries down substantially from Q1, which itself showed no growth over Q4. However, Q2’s decrease was due to a monthlong COVID-related closing of Tesla’s Shanghai factory, and thus it might be a while yet before we can get a “clean” demand picture for the company.

Regardless, Tesla has objectively lost its “product edge,” with many competing cars now offering comparable or better real-world range, better interiors, similar or faster charging speeds and much better quality. (Tesla ranks second-to-last in Consumer Reports’ reliability survey while British consumer organization Which? found it to be one of the least reliable cars in existence.)

Thus, due to competitors’ temporary production constraints, waiting times are now longer for many of Tesla’s direct EV competitors than they are for a Tesla. (Here’s one example, and here’s another.)

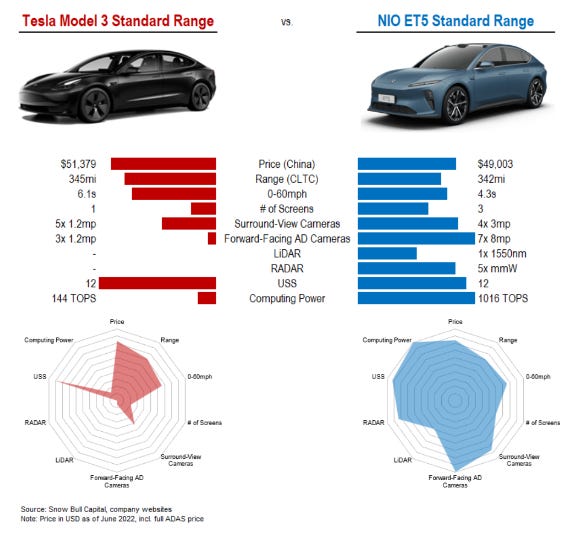

In fact, Tesla is now the second, third or fourth choice for many EV buyers, and only maintains its volume lead though a short-lived edge in production capacity that will disappear over the next 12 to 36 months as competitors rapidly increase the ability to produce their superior EVs. In fact, Tesla’s poorly-built Model Y faces current (or imminent) competition from the much better made (and often just better) electric Hyundai Ioniq 5, Kia EV6, Ford Mustang Mach E, Cadillac Lyriq, Nissan Ariya, Audi Q4 e-tron, BMW iX3, Mercedes EQB, Volvo XC40 Recharge and Polestar 3. And Tesla’s Model 3 now has terrific direct “sedan competition” from Volvo’s beautiful Polestar 2, the great new BMW i4, the upcoming Hyundai Ioniq 6 and Volkswagen Aero, and multiple local competitors in China—here, from Snowbull Capital’s @TaylorOgan, is just one example of that Chinese competition:

And in the high-end electric car segment worldwide the Porsche Taycan (the base model of which is now considerably less expensive than Tesla’s Model S) outsells the Model S, while the spectacular new Mercedes EQS, Audi e-Tron GT and Lucid Air make it look like a fast Yugo, and the extremely well reviewed new BMW iX and Mercedes EQS SUV do the same to the Model X.

The worst thing that can possibly happen to “the Tesla story” will be when its German and Texas plants are fully operational and the subsequent excess capacity stares the world right in the face, thereby ending its myth of “unlimited demand” (especially at current, drastically-raised prices, where the cheapest Model 3 now starts at $47,000 and the cheapest Model Y begins at $66,000); in fact, look for margin-destroying price cuts by late this year or early 2023.

About Mark Spiegel

Mark manages Stanphyl Capital, established in 2011, a deep-value equity & macro long-short investing fund based in New York City. Mark can be reached at mark@stanphylcap.com or at @StanphylCap on Twitter.

This post is 100% free, but if you want to support Fringe Finance and have the means, I would love to have you as a subscriber:

Disclaimer: This letter was not reproduced in full. I own Tesla call and put options, as well as ARKK call and put options. QTR is long various gold and silver miners and has both long and short exposure to the market through equities and derivatives. You should assume I have positions in any names I publish about. I have no position in Mark’s funds. Mark is a subscriber to Fringe Finance via a comped subscription I gave him and has been on my podcast. The excerpts from Mark’s letter, above, shall not be construed as an offer to sell, or the solicitation of an offer to sell, any securities or services. Any such offering may only be made at the time a qualified investor receives formal materials describing an offering plus related subscription documentation. There is no guarantee the Fund’s investment strategy will be successful. Investing involves risk, and an investment in the Fund could lose money.

Chris, long time reader here who agrees with your position on many things. I do not agree with you and Spiegel on Tesla.

I know the Twitter deal is currently on hold, (I still think Elon ends up buying at a renegotiated price) but you could at least mention that as the reason for him dumping billions of dollars in tesla stock after Q1. That is where the majority of his wealth is held, so of course he had to dump some of it. He still holds ~170 million shares, around 17% of the float.

How can Spiegel claim the Mach-E mustangs are better made when ford just recalled every single one they've ever delivered due to a problem of "losing power while moving?" Also could mention that there have only been ~50,000 made total. Not even gonna mention the geniuses at Ford completely trashing one of the most iconic car bodies in the world for whatever that abomination of a vehicle is supposed to be.

There are many other claims he makes I could refute, but I'd be typing all day. I agree Tesla is overvalued, but a lot of statements made by Spiegel here are just outright false. Tesla is still selling way more cars than it can make, till that changes I think you guys may be a little early on that blackberry take.

Should also mention the lockdown in Shanghai, the location of second most productive Gigafactory, and the effect on Q2 delivery numbers, but that would require Mark looking at Tesla objectively. Who knows, come back to this comment in a year and I may sound like a complete idiot, but it's always good to hear both sides of the narrative!

"Meanwhile, even last year when short-term rates were set at just 0.125% and average rates were around 1.5%, the gross interest on the $30 trillion of federal debt cost $573 billion, and that cost is now on a path to nearly double. "

Isn't it only the new debt that has to pay a higher rate? In that case, why couldn't the Fed keep rates higher for longer?