The US Is Now on Track for a $3.5 Trillion Deficit in 2025

"It remains to be seen how long it will take for the public to see how it’s being ripped off by this endless cycle of debt and price inflation."

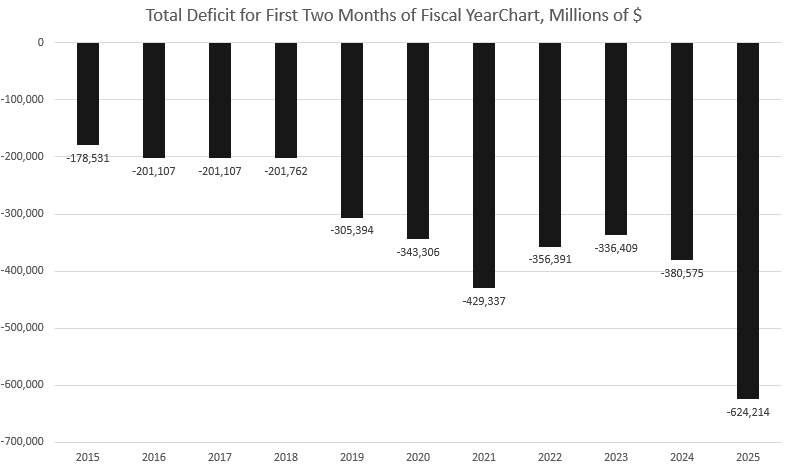

According to the latest monthly statement from the Treasury Department, the US government spent $668 billion in November, the second month of the 2025 fiscal year. That’s in addition to October’s spending total of $584 billion, for a total of $1.25 trillion in spending so far this year. All that spending is a drain on the real economy. But it gets worse: the federal government has only collected $628 billion in revenue for the same period, meaning the two-month total deficit is now as $624 billion.

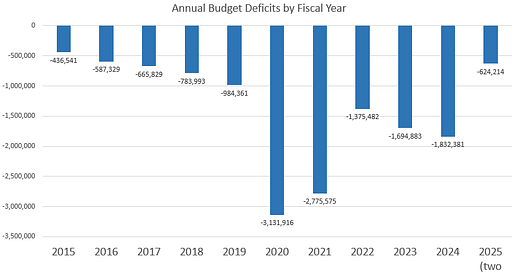

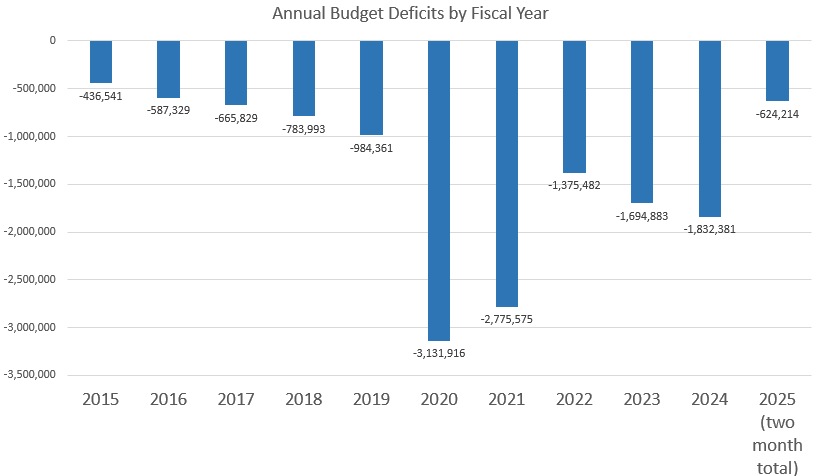

That’s the largest total ever for the first two months of the fiscal year, higher even than the $429 billion spent during the first two months of the 2021 fiscal year—October and November 2020. It should not surprise us, then, that the federal government is now on track to have the largest peacetime deficit of all time during the 2025 fiscal year. With the two-month total at over $620 billion, the year-end total is likely to be over $3.5 trillion by the end of the year. That would make the next annual deficit even larger than 2020’s budget busting deficit of 2020 when the Covid panic fueled months of runaway spending.

Unfortunately, there is no reason to expect any change to the current trend. In spite of much talk about the so-called “Department of Government Efficiency” (DOGE) leading to big budget cuts, there is virtually no chance of any sizable cuts to spending in the current political climate. The budget process is dominated by the Congress—as is constitutionally required—and recommendations from the executive branch are generally DOA when they reach Congress. Moreover, the first Trump administration was notable for very large increases in spending, not for “efficiency.” The first Trump administration, for example, rung up a 2019 deficit of nearly one trillion, making it the largest deficit ever seen during a period that was neither recessionary nor wartime. Trump than signed off on the mega-deficit of 3.1 trillion during the 2020 fiscal year.

Clearly, fiscal austerity and Donald Trump have not been spotted together very often. Indeed, if the new Trump administration is going to make any sizable cuts, it will have to push Congress hard to send him a budget with big cuts. Where will Congress make these cuts?

The overwhelming majority of federal spending is in three areas. The first is non-discretionary social benefits like Social Security and Medicaid. The second is defense spending. The third is interest on the national debt. It’s clear that Congress won’t be formally repudiating the debt, so those interest payments aren’t going anywhere. So, is there any public support for cutting federal pensions or military spending? Certainly not. Even as federal deficits have rapidly risen to new heights in recent years, poll after poll has shown the public wants more federal spending, not less. In a 2023 poll by the AP, a majority of those polled said they wanted less spending in a generic question about spending overall. But when it came down to specifics, majorities called for more government spending in education, healthcare, Social Security, Medicare, and border security. Only 29 percent of those polled said they wanted cuts to military spending.

So, where would a sitting member of Congress think it is safe to vote to cut hundreds of billions—if not trillions—of dollars from the federal budget? It’s hard to imagine.

If we’re going to be realistic, we just have to admit that big budget cuts will remain politically unfeasible until the public starts to see the light on the reality of runaway federal debt and federal deficits. That will only come when austerity is forced on us by an ever-growing debt burden in the form of interest on the debt. That will both force up interest rates and eat up ever larger portions of the federal budget forcing cuts to popular programs. Meanwhile, the central bank will try to force interest rates back down, but that will require “printing” money and that will mean more price inflation. In short, our current debt trajectory will require the federal government to funnel more and more taxpayer wealth to paying interest or managing interest rates as the Treasury tries to sell ever larger piles of government bonds. Only after the public begins to understand how this process of impoverishment works will the public begin to actually tolerate sizable budget cuts. Not before.

So, until then, we can expect a lot of talk, but no action, when it comes to budget cuts.

In the meantime, we’ll hear a lot from politicians about how they’re trying really hard to be fiscally responsible. They don’t actually care, but pretending to care about deficits has long been a performative ritual that politicians participate in. This was on display this week when Treasury secretary Janet Yellen said she’s “sorry” that “more progress” wasn’t made in bringing deficits under control during the Biden administration.

“Well, I am concerned about fiscal sustainability, and I am sorry that we haven’t made more progress. I believe that the deficit needs to be brought down, especially now that we’re in an environment of higher interest rates,” Yellen said.

Yellen, of course, was directly responsible for helping facilitate enormous deficits and the rising national debt during her time as chairman of the Federal Reserve. As deficits rose, Yellen enthusiastically cooperated with the Treasury to keep interest rates low to make it seem that borrowing a half-trillion dollars (or more) each year was virtually free. Yellen, unlike Jerome Powell, was lucky enough to be the Fed chairman during a period when that actually worked.

It appears, however, that the era of ultra-low interest rates has come to an end, and we are now in, as Yellen notes, “an environment of higher interest rates.” This is, in part, itself a result of rising debt and deficits because the Treasury can only dump so much new debt on the market without investors demanding rising interest rates. Normally, the Fed would intervene to force interest rates back down to rock-bottom levels by buying up more federal bonds. But, stubborn price inflation is now tying the Fed’s hands.

Thus, we’ve seen longer-term yields rise even as the Fed has been reducing its target interest rate. Thursday, in fact, the 10-year yield was ripping most of the day, and rose to a three-week high following news that price inflation still isn’t going away.

We have good reason to expect this trend to continue, and the consumers and taxpayers will feel it. Huge deficits will mean higher interest rates, and that will drive more bankruptcies as consumer and business debt becomes less and less manageable. Meanwhile, the Fed won’t be able to really rein in price inflation because that would require allowing interest rates to rise to a level that would be unsustainable in terms of federal debt service.

It remains to be seen how long it will take for the public to see how it’s being ripped off by this endless cycle of debt and price inflation. Until then, don’t expect any public chorus in favor of fiscal sanity.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

I suffered in the middle 1970's to the middle of 1980's with inflation causing my educational costs to soar and then interest rates to cripple my small business. It took 20 years for my net worth to build. As a youngster, houses in my parents' neighborhood cost $15-25k, in the expensive part of town the larger houses with larger lots sold for under $50k. Earning $4.50 was a great wage at Caterpillar which allowed a husband to buy a small house, have a family, and afford a used car.

Here in Frankfurt am Main, house/condo prices for quality and good location have tripled since I bought my condo and my wife bought a house and two apartments for rentals. We saved to pay for the properties.

If the inflation is gradually done, people will adjust and politically there won't be much discussion. I personally expect prices to be 3-4x to bring the debt/GDP ratio down to manageable levels. Anybody on a fixed income without Cost-of-Living increases will be squeezed.

Taxes for Government "Services" have increased and one has to be wary as to whether a university "education" is worth the price.

In summary, the financial situation for many Americans in 20 years will be far more difficult than when I was a kid. As a consolation, the US is in a better position than most European countries.

This is an excellent article and written simply enough for Billy Joe Beercan to understand. A copy should come with everyone's pay stub this week. I am just waiting for them to have a bond auction and no one comes to the party.