The Sheer Stupidity Of Student Loan Forgiveness While Inflation Rages Out Of Control

The idea of increasing spending right now, while the country is arguably in the worst financial shape it has ever been in, is simply unconscionable.

I’ve joked on my last couple of podcasts that when it comes to economic problems, the government usually has to exhaust every single one of the wrong solutions before it gets to the right one.

I guess at the times I’ve said this, it was at least a little bit in jest, though I do believe the statement to be accurate as it relates to the economy over the last decade - or at least since I’ve been paying attention.

Most recently, I used the expression when talking about the Biden administration’s fruitless efforts to try and curb the price of oil. The administration is literally doing everything except making it easier for oil companies to increase supply in the market.

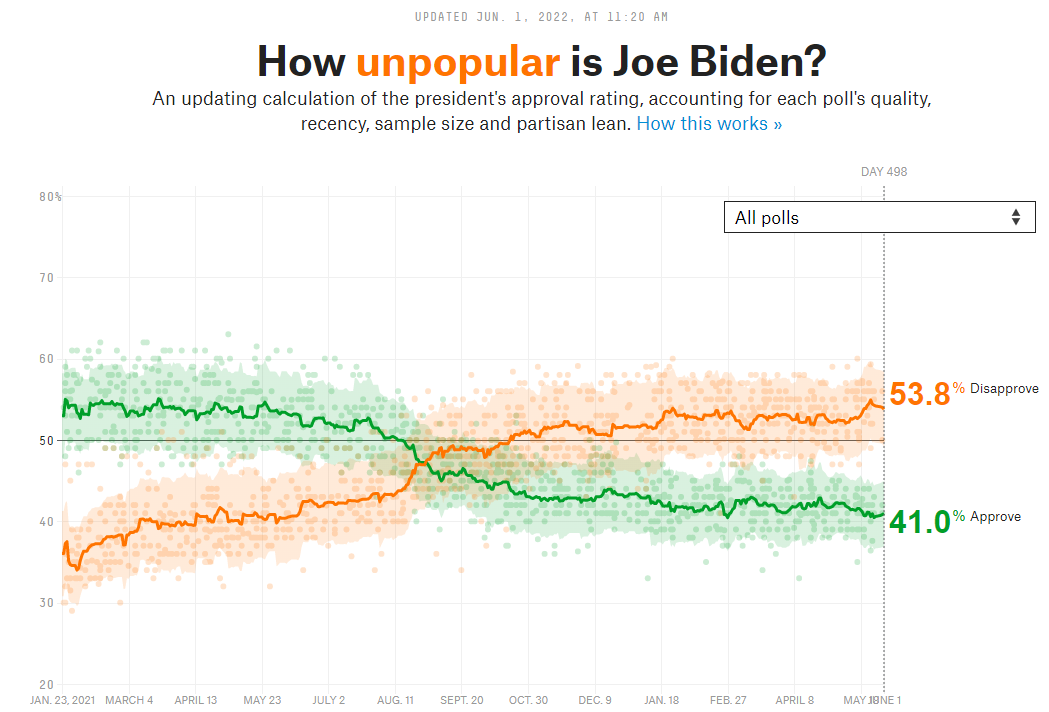

The problem that the Biden administration is trying to address is high prices. This remains easily the biggest issue of consequence heading into midterm elections, and it may even wind up still being the biggest issue when the 2024 presidential election rolls around.

Just as I argued may be the case with leaking the Roe vs. Wade opinion, it appears the floundering Biden administration has adopted the strategy of diverting attention away from the problem in hopes that they can resonate with voters via other channels.

There has been no bigger example of this strategy - or the administration’s profound economic ignorance - than the administration’s recently released plans to relieve $10,000 of student debt per qualified individual.

The idea is a profoundly misguided enterprise for numerous reasons, not the least of which are the inflationary consequences.

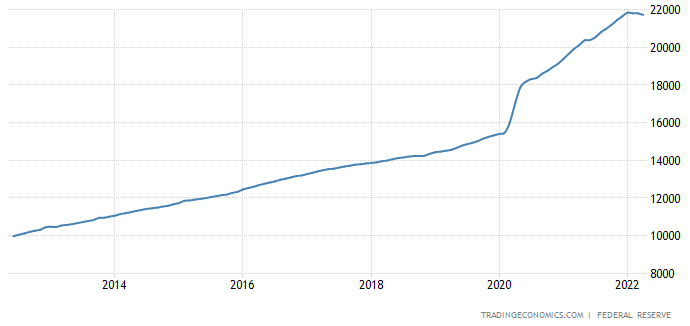

Let’s address that first. As I would explain it to a first grader – or modern monetary theorist Stephanie Kelton – the reason we have been seeing such profound inflation is because the government, along with the Federal Reserve, has flooded the money supply with new issuance.

Like with any other product, service or commodity, the more dollars in circulation, the less they are worth. When the dollar’s purchasing power declines, it takes more dollars to buy products or services, which is where we get rising prices.

In the case of the United States over the last few years, rising prices have been exacerbated by the fact that we don’t produce anything in the country anymore and supply chains for our imports have been severely disrupted by both the Covid pandemic and Russia’s invasion of Ukraine.

But the key point is that if we want to start fighting inflation, in addition to rate hikes, we need to stop printing more money and address the extremely precarious financial position of the country. The obvious way to do this would be to shrink the size of government, spend less, print less money, bring in more tax revenue and encourage citizens to save instead of spend with the behavioral incentive of higher rates.

President Biden’s plan of paying off student loan debt for people not only issues the wrong behavioral incentive, it takes a huge economic step in the wrong direction towards fighting inflation. The country is broke and we simply don’t have the money to be paying off debts that should be the personal responsibilities of those who took them on.

For a country that doesn’t produce many products or services anymore, you’d think we would be acutely aware of the fact that citizens should have to generate the productivity necessary to earn the funds that will be used to pay back the debt. After all, that is the point of a student loan: to front the money that a candidate will use to obtain skills that ostensibly should help them pay back the loan and then proceed happily to earning a decent living.

In addition to the poor economic strategy behind this plan, there is significant moral hazard involved.

At a time when the country should be battening down the hatches when it comes to spending, the Biden administration is going to hand-pick a select few Americans to receive $10,000 worth of benefits - paid for by other Americans - with the only qualifier being that they haven’t yet taken the steps to already pay down their debt in full.

So not only is there the real life example of people who don’t have student debt wondering why they won’t get credit card or mortgage relief for also being negligent in paying off their debt - but there are plenty of former students who have done the right thing by paying down their debt in full, who are tacitly being punished by this idea. In other words, the country was happy to force them to generate productivity in order to pay off their debt - but this new generation gets a $10,000 free pass. How many days off from working Starbucks barista shifts does that equate to? Wouldn’t those who hustled to pay off their debt like those days back as vacation days?

There are also going to be numerous real world examples of high income earners (doctors, dentists, lawyers, IT professionals) who have pushed off paying their debt who may receive benefits from Biden’s plan. At the same time, people earning a fraction of these high income earners, who have taken more aggressive steps to pay down their debt upfront, receive no benefits. That is “playing favorites” with cash that the country doesn’t have, that the rest of the taxpayers subsidize not only through taxes, but also through the effects of inflation.

As Peter Schiff always notes, the government doesn’t produce anything, so it can’t generate its own purchasing power. All it can do is re-distribute the purchasing power of other people, which is exactly what they are doing with this plan.

Finally, to make matters even worse for the Biden administration, the idea is just plain odious political strategy.

If I had to guess, I would say that the idea of loan forgiveness is being perfunctorily adopted at this point in time as an impotent gesture to help sway last-minute midterm voters in the direction of the Democratic Party.

And as much as I don’t agree with Alexandra Ocasio-Cortez on…well…anything, she raised a good point this weekend when saying that $10,000 simply wasn’t enough to make an impact, but was enough to piss almost everybody off.

In other words, it was a weak idea offered up from a position of weakness, that reeks of weakness.

And of course, $10,000 is too much - any amount is too much, but AOC actually makes an astute point related to the political strategy of the idea.

The issue has been hotly debated and contested among Democrats since Biden took office and many progressives have called for the cancellation of all student debt. Selecting such an arbitrary number - $10,000 - could backfire in the sense that it may come off as a half hearted political attempt to secure votes to some centrist Democrats.

In other words, it’s just enough to anger both sides of the aisle, as President Biden found out last week from AOC.

The idea of increasing spending right now, while the country is arguably in the worst financial shape it has ever been in, is simply unconscionable. The moral hazard and terrible political strategy involved with printing more money to pay off student debt is arguably the worst possible move the Biden administration can make - which is why it’s no surprise to me that it’s the solution they’ve landed on.

Now read:

lets not forget that Universities may see this as another reason to increase tuition. If students know the govt will eventually forgive a portion or all of a student loan- whats to keep them from increasing the prices.

Many new people will apply for loans expecting them to be forgiven in the future. This IS pure vote buying. Typical Democrat move.