The "Lurking Dangers" In This Stock Market

Friend of Fringe Finance Mark B. Spiegel of Stanphyl Capital released his most recent investor letter on August 30, 2024, with updates on macro and his fund’s positions.

Friend of Fringe Finance Mark B. Spiegel of Stanphyl Capital released his most recent investor letter on August 30, 2024, with updates on macro and his fund’s positions.

Mark is a recurring guest on my podcast and definitely one of Wall Street’s iconoclasts. I read every letter he publishes and thought it would be a great idea to share them with my readers.

Like many of my friends/guests, he’s the type of voice that gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

In his most recent letter he offers new takes on his favorite long, his favorite short and his outlook on the market.

Mark on Macro

This was a volatile month, as it started with a mini-crash during which I covered our large QQQ short near the lows (I couldn’t not cover it when the VIX soared into the 60s!) and then actually got long QQQ for a short, profitable trade for the same reason. (I couldn’t not get long when the VIX soared into the 60s!) I then took off the QQQ position entirely, let it run quite a bit higher, and then put on a smaller short position, which we currently hold. Thus…

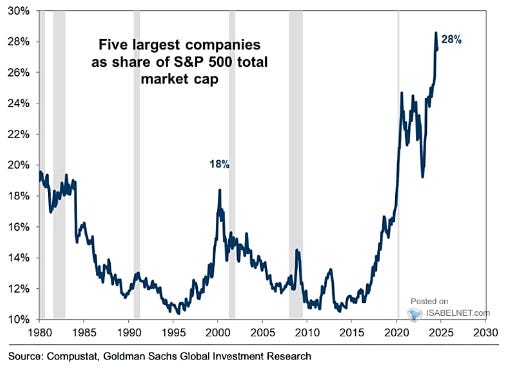

We continue to run net short, as stock prices remain elevated despite an economy that’s beginning to crumble beneath them while the stock market continues its overconcentration in a small handful of Nasdaq 100 (the aforementioned QQQ) companies:

We also remain short Tesla, which continues to be the biggest bubble-fraud in stock market history, as I discuss in detail later in this letter.

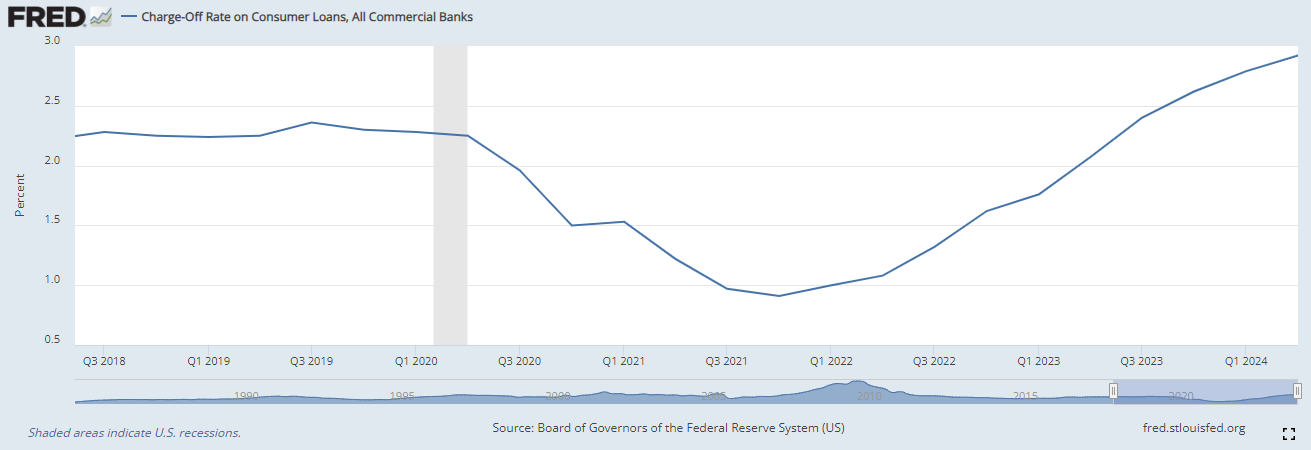

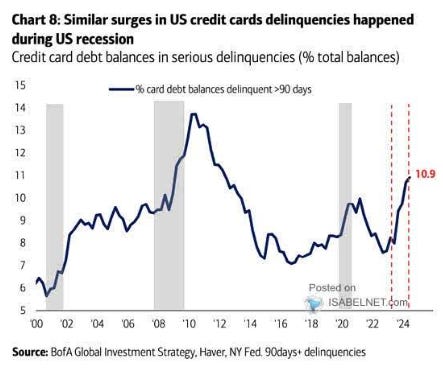

As noted above, this remains a very expensive market (the S&P 500 is at approximately 24x run-rate operating earnings and the Nasdaq 100 is at around 31x trailing earnings) while the U.S. consumer is finally cracking in this consumer-driven economy. Real (inflation-adjusted) retail sales comps are now negative (July sales reported in August were +2.7% year-over-year vs. 2.9% CPI) and scores of retailers have recently warned about a tough business environment. Most recently, Home Depot and Lowes warned in August and McDonald's warned in July about a weakening consumer, and also in August Target, Nordstrom, Dollar General and Foot Locker reported negative real (inflation-adjusted) same-store sales comps and guided to negative real comps going forward, while Macy’s , Kohl’s, Best Buy and Williams-Sonoma comps were negative in both nominal and real terms, and Wal-Mart reported same-store sales that outstripped inflation by a mere 1%, with that small gain likely due to middle-class consumers leaving pricier retailers.

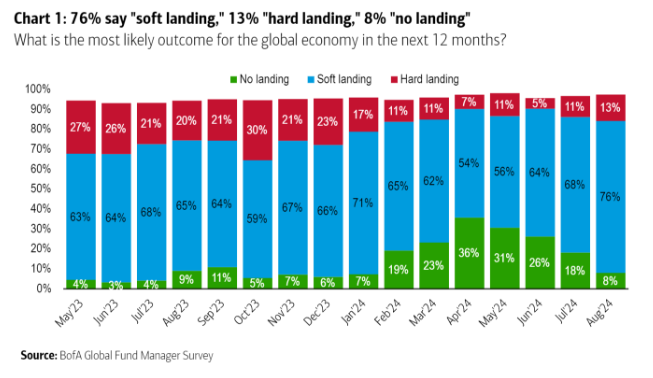

Meanwhile, in August the stock market switched from "bad news is good news" to "bad news is bad news" as it finally began worrying that a recession may be on the way, and yet while the most recent Bank of America survey says 76% of investors anticipate a “soft” landing…

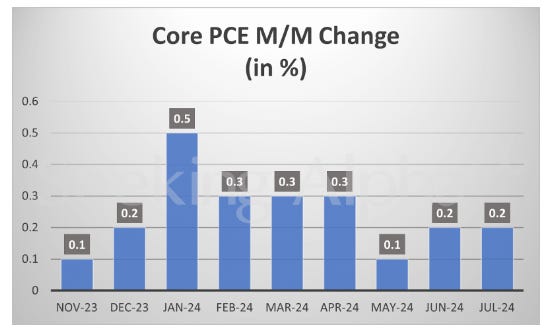

… I expect a “hard” one, with sticky inflation (currently 3.2% core CPI and 2.6% core PCE) driven by massive federal budget deficits preventing the Fed from cutting enough to compensate for it. And inflation is now sticky:

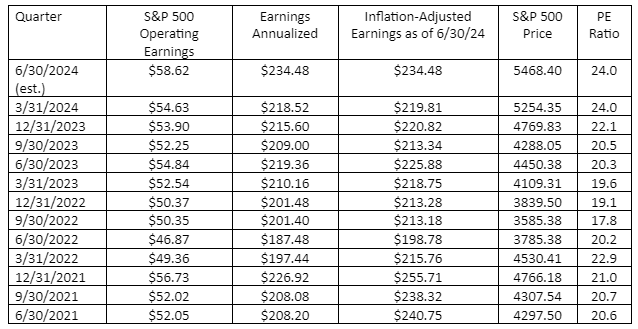

As for precisely how expensive this market is, in the columns below from Standard & Poor’s are the last three years of quarterly operating earnings for the S&P 500 (using the latest estimate for Q2 2024). I then inflation-adjust those earnings to show that in real terms they’re lower now than they were in 2021! I then calculate run-rate PE ratios based on the “nominal” numbers to show that a lot of this bull market’s increase in the S&P 500’s price has been due to unwarranted PE multiple expansion, not real earnings growth. (As of August 31 the S&P 500 is at 5648, making its PE multiple approximately 24.)

Annualizing the Q2 2024 earnings estimate to $234.48 ($58.62 x 4) and using the traditional “rule of 20” (which says that the S&P 500’s PE ratio should be 20 minus the current 2.9% nominal rate of CPI inflation) would put a 17.1x multiple on those Q2 earnings and bring the S&P down to just 4009 vs. the current 5648. And what happens to those earnings when we get a recession?

Why do I believe so strongly that we face a “hard landing”? For the same reasons I’ve been stating since the Fed started raising rates in 2022:

There’s no way an “everything bubble” built on over a decade of 0% interest rates and trillions of dollars of worldwide “quantitative easing” can not implode when confronted with 5% U.S. rates and quantitative tightening plus tighter money from the ECB (even with the tiny June cut), BOJ and other central banks.

And contrary to the belief of equity bulls with short memories, when an asset bubble unwinds, lower inflation and lower interest rates won’t immediately ride to the rescue. When the 2000 bubble burst and the Nasdaq was down 83% through its 2002 low and the S&P 500 was down 50%, the rates of CPI inflation were 3.4% in 2000, 2.8% in 2001 and 1.6% in 2002, and the Fed was cutting rates almost the entire time.

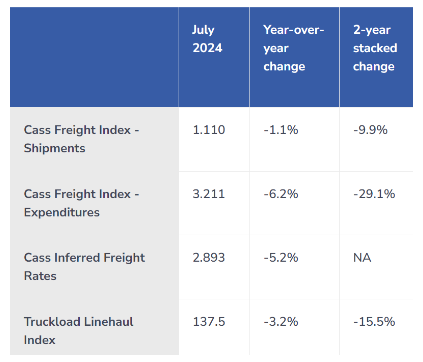

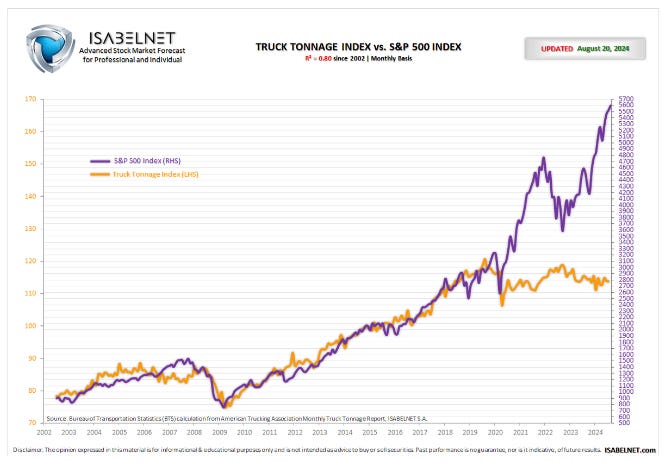

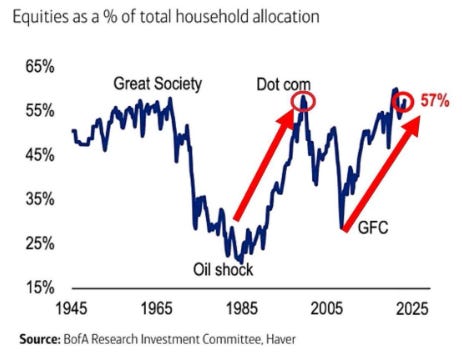

Yet despite myriad lurking dangers—both economic and geopolitical—the stock market (even the non-AI stocks) is still disconnected from a scenario involving any landing. Here are a few exhibits that perfectly capture this decoupling…

Thus, we remain net short.

Mark’s Portfolio Positions

Here is some commentary on some of our other positions; please note that we may modify them at any time…