The Fed Is A Shitfaced Drunk On Its 21st Birthday

At 21, you anticipated the best night of your life, and then made the worst successive decisions possible, ensuring you landed nowhere near your goal.

Ahead of this morning’s Jackson Hole commentary by Fed Chair Jerome Powell, yesterday morning Federal Reserve Bank of Boston President Susan Collins was out with comments basically reiterating that rate hikes could continue for the near future. Federal Reserve Bank of Philadelphia President Patrick Harker followed suit with additional, less-than-dovish comments.

"We may be near, we could even be at a place where we would hold…but certainly additional increments are possible, and we need to look holistically and be really patient right now and not try to get ahead of what the data will tell us as it unfolds," she told Yahoo Finance on Thursday morning. Here’s how her comments looked to hedge fund algorithms worldwide as they hit the tape on the Bloomberg terminal:

COLLINS: MORE FED RATE HIKES ARE POSSIBLE

COLLINS: EXTREMELY LIKELY FED HAS TO HOLD FOR SOME TIME

COLLINS: FED HAS MORE WORK TO DO; MUST BE PATIENT, RESOLUTE

COLLINS: PREMATURE TO SEND CLEAR SIGNAL ABOUT TIMING OF RATE CUTS

"We are in a restrictive stance, do we have to keep going even more and more restrictive? I'm in the camp of let the restrictive stance work for a while, let's just let this play out for a while, and that should bring inflation down," Harker added Thursday morning. Here’s how his comments looked when they hit the tape:

HARKER: CAN'T PREDICT WHEN FED WILL CUT RATES

HARKER: NEED TO SEE INFLATION FALLING BEFORE WOULD BE WILLING TO CUT RATES

HARKER: I SEE US KEEPING RATES WHERE THEY ARE ALL THIS YEAR; IF INFLATION COMES DOWN NEXT YEAR COULD CUT RATES

But it wasn’t just these comments and the overhang of today’s Jackson Hole comments that made Thursday an ugly day. There’s more to the picture and, in my opinion, the shitshow is only getting started.

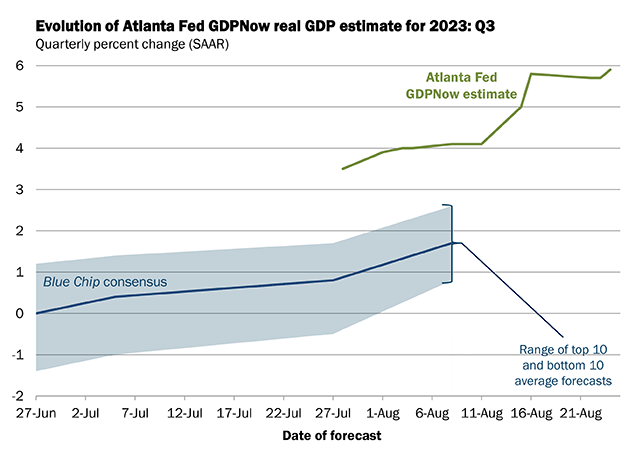

Collins’ and Harker’s statements hit the tape around the same time that the Atlanta Fed raised its GDPNow model estimate (yes, again) to 5.9%, indicating that despite the Fed’s best efforts, the goddamn economy just won’t stop growing.

As I said on my recent interview with Palisades Gold Radio, the Fed likens a robust economy with it not doing its job of curbing inflation, because it believes that it must crash the economy to win the inflation battle. Ergo, great economic news remains terrible news for the stock market.

Imagine if we didn’t need to introduce full on ridiculous Central Banking game theory into the market every time we got data and good news could just be fucking good news. But we could never have no Central Bank, right? Could you imagine a world without them? It reminds me of this Simpsons clip.

“Could you imagine a world without lawyers?”

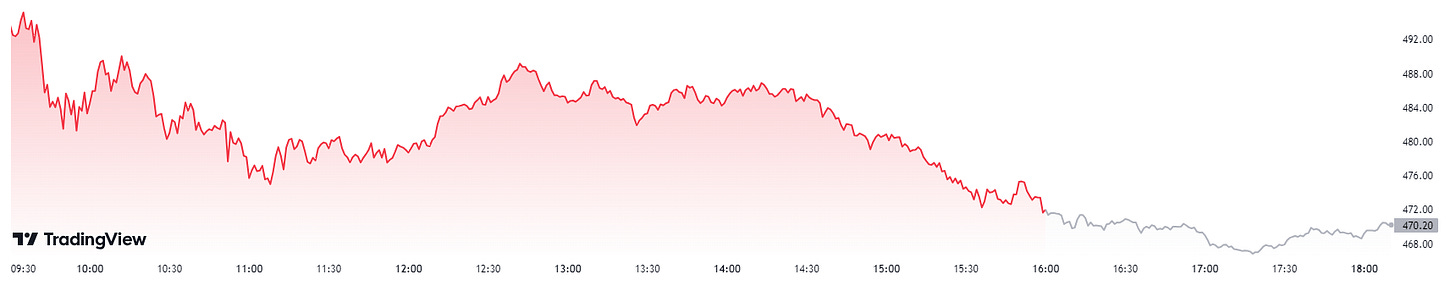

On top of Collins’ and Harker’s comments was a prevailing sentiment on Thursday that saw Nvidia, which has basically become a proxy for the entire market and the entire market’s sentiment, sell off aggressively from its highs, despite reporting earnings and guidance on Wednesday night that blew the doors off of even Wall Street’s loftiest expectations.

While still “rangebound” and all that other technical bullshit, it was a pretty ugly red candle for Thursday, given that the company “issued current quarter revenue guidance of $16 billion, plus or minus 2%, far outpacing Wall Street's already lofty expectations for $12.5 billion in revenue” and “reported revenue of $13.51 billion, a 101% jump from last year, while adjusted earnings came in at $2.70 per share, up 429% from last year,” Yahoo reported.

To me, Nvidia’s selloff yesterday truly feels like the market making a statement. If there were any one event that could have us retest the late July/early August market peaks, you would have thought it would have been Nvidia, the most talked about name in the market by every tiresome and perfunctory “analyst” on financial media (Exhibit A below), posting incredible earnings and guidance.

Behold Tom Lee telling investors to “add risk” with rates at 5%, ahead of Nvidia’s earnings, on Wednesday. The NASDAQ fell 2% the very next session (yesterday).

And so heading into this morning, Nvidia likely isn’t doing the market any psychological favors. As I asked yesterday, what would prevailing sentiment wind up being like heading into today’s Jackson Hole event if the national anthem of technology stocks wound up red for the day after what can only be described as an unthinkable earnings blowout?

Macro Intelligence said yesterday morning that the Fed would be expected to aim for “higher for longer” during today’s Jackson Hole speech:

Fed Chair Powell's Jackson Hole speech is unlikely to bring new elements to the US monetary policy outlook, says Julian Brigden, from Macro Intelligence 2. "They will keep holding out their powder because they don't want to ease financial conditions," Brigden says.

"They will keep holding out this sort of sword of Damocles in the shape of possibly another 25 basis points of rate hikes, while emphasizing they are not going to cut any time soon." Brigden expects inflation to remain above target, leaving no room for dovishness. He says investors are yet to realize that higher-for-longer means "much, much longer than the markets concept of longer."

But regardless of what the Fed says today, its course of actions is already predetermined: it is already a decided outcome that the market is going to have a major meltdown by virtue of the Fed’s policy path, the only question is when. After that happens, it’ll be too late, but the Fed will “ride to the rescue” by doing more unlimited QE and slashing rates at alarming speed.

I know, you’re incredibly surprised, right?

The best way I can think about the Fed and the stock market is to compare them to a college student on their 21st birthday. At least where I went to college, it was mandatory to make the trek out to the bar and at least feign an attempt at putting down 21 drinks. You anticipated the best night of your life, and then made the worst successive decisions possible, ensuring you landed nowhere near your goal.

On your 21st birthday, you usually spend the afternoon or evening getting dressed up and preparing for what you believe will be a great night ahead. You’re bright eyed and looking forward to the future.

This is the Fed sitting around and planning how they believe they are going to bring the economy in the stock market in for a soft landing.

On your 21st birthday, you have a couple of drinks before you even head out to the bar because “what’s a night out without pregaming?” Sure, you’ll still be urged to do 21 shots when you get to the bar, but a couple Miller Lites before you head out couldn’t possibly hurt you, right?

This is the Fed preparing the market for coming hikes in order to try and combat inflation, as well as the first several quarter point hikes to get things started.

On your 21st birthday, when you get to the bar, it’s all business. Your friends have informed you that your mission for the evening is 21 drinks while consuming any and all beverages any asshole stranger may also buy you in the process. From there, you will hold your shit together and waltz home without a problem or care in the world, only to wake up the next morning and talk about what a resounding success your birthday party was and what a fine all around citizen and human being you are. Your friends cheer you on from the sidelines.

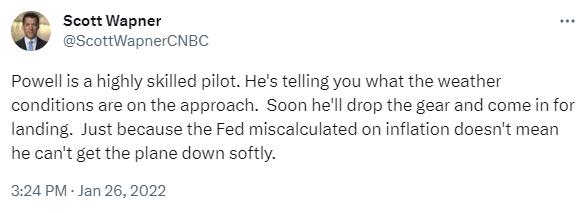

This is the Fed getting into the thick of a long series of rate hikes over 18 months. Scott Wapner cheers Jerome Powell on from CNBC.

On your 21st birthday, you know you will do short term damage to your equilibrium and long-term damage to your body, but as long as those signs don’t show up in a debilitating way, you keep pushing forward.

This is the Fed, doing damage to the economy with its rate hikes, but forging forward in the absence of a market crash.

On your 21st birthday, later in the evening, you’ll make it to your 21st drink. Despite being slightly intoxicated and wobbly, your legs dance on as the music continues to play. For all intents and purposes, despite being hammered drunk, you can still see a path where the night ends in a resounding success. You carry forward.

This is the Fed getting rates all the way above 5% without the economy or the stock market having an obvious catastrophic incident. Somehow, someway, the band has continued to play, and Jerome Powell continues to dance like Nick Beam with his feet on fire in Nothing to Lose.

On your 21st birthday, things eventually go horrifically wrong. You take that one molecule of confidence that you have a 3AM and decide that you are completely indestructible. Despite downing 30 drinks over the course of six hours, you have made a conscious decision that you are a God amongst gods, for whom the rules of basic human biology do not apply. At 3AM, you leave the bar and continue to rip shots despite the majority of your senses telling you not to. “Who cares,” you think to yourself. “I am indestructible.”

This is the Fed right now. Collins and Harker suggesting more rate hikes could be coming. Powell set to do the same today (likely). Hikes will continue and the economy hasn’t even had a chance to catch up with the ones that took place months ago. It’s impossible to say that it will make the consequences worse than they already are because consequences haven’t yet caught up to us. But they will, and now with every inch that we decide we want to push this pipe bomb deeper into the economy, we will suffer a mileslong worth of consequences.

On your 21st birthday, you wind up vomiting in a friend’s washing machine before stripping completely naked and running through a 24 hour Burger King. You are eventually found unconscious and naked on the front steps of the English Department building, holding an essay that was due 4 months ago that you hoped to turn in at 4:30AM. Police arrest you and bring you to a holding cell where you continue vomiting into a stainless steel toilet last used by your indigent cellmate who appears to have terrible aim with his bodily functions. The next day when you are released, the burden of consequences starts to become clear: thousands of dollars in fines and property damage, court appearances and humiliation that will take years to overcome.

The Fed hasn’t had this moment yet, but rest assured it’s coming.

QTR’s Disclaimer: I am not a guru or an expert. I am an idiot writing a blog and often get things wrong and lose money. I do not fact check contributor material that I aggregate from other sources. I may own or transact in any names mentioned in this piece at any time without warning and generally trade like a degenerate psychopath. This is not a recommendation to buy or sell any stocks or securities or any asset class - just my opinions of me and my guests. I often lose money on positions I trade/invest in and I’m sure have lost more than I’ve made in my time in markets. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. Positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it three times because it’s that important.

A great analogy of the foolish Fed policy, LOL

The Fed and Congress were shitfaced drunk when they expanded the money supply during COVID, and we are now in deep hangover. The Fed's little rate rises have barely dented that money supply, which is still far higher than it was when 2020 began. And IOER being paid on the Fed's massive balance sheet keeps expanding the money supply. I think rates will have to go much higher, and they may be forced to reduce interest on excess reserves as that counteracts the effect of the rate rises.