The Fed Hits 3,000% Inflation

0% percent inflation over 130 years before the Fed, compared to 3,000% inflation in less than 110 years after the Fed.

By Thomas L. Hogan, The American Institute for Economic Research

The US economy was pushed to extremes during the pandemic recession and subsequent recovery. The unemployment rate peaked at 14.7 percent, the highest in the post-World War II period. Inflation reached its highest rate in 40 years, prompting the Fed to raise short-term interest rates to their highest levels since 2007.

As of June, the economy hit another dubious milestone: Inflation has now reached 3,000 percent under the Federal Reserve.

Inflation under the Fed

The Federal Reserve Act was passed by Congress in December of 1913, and the regional Federal Reserve banks opened for business in November of 1914. Comparing the price level at the end of 1914 to the level today tells us how much total price inflation the US economy has experienced under the Fed.

The consumer price index (CPI) is the most widely used and longest-running measure of the US price level, but there are disagreements about the accuracy of historical CPI. MeasuringWorth aggregates macroeconomic data such as interest rates, economic production, and the price-level from the most reliable historical sources.

Historical CPI data from MeasuringWorth show that the US price level rose by 2,920.2 percent from 1914 through 2022.

While the MeasuringWorth dataset provides only annual data, we can add monthly data for the current year from the official CPI data from the Bureau of Labor Statistics (BLS). According to BLS data, the CPI rose by 2.74 percent (not seasonally adjusted) in the first half of 2023.

That brings total inflation under the Fed to 3,000.2 percent.

Compared to what?

US inflation was not always as persistently high as it has been under the Fed. Before the Fed, the purchasing power of the dollar was determined by supply of and demand for gold. Consequently, the purchasing power of the dollar was relatively stable.

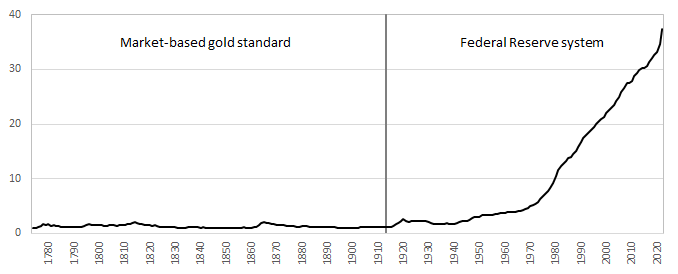

Figure 1. Index of the US price level, 1774-2022

Figure 1 shows the US price level back to 1774. After a brief turmoil during the American Revolutionary War, the price level was about the same in 1784 as it was in 1914.

That’s approximately zero percent inflation over 130 years compared to 3,000 percent inflation in less than 110 years under the Fed.

Official statistics

The MeasuringWorth dataset combines data from the best historical research to correct for shortcomings in the official economic data.

One key difference from the BLS CPI is that, for the early years of the Fed, MeasuringWorth uses a study by Paul Douglas, which fills in a few months of data missing from the BLS and “computes the US index as a population-weighted average of the city indexes, whereas BLS uses an unweighted average.”

How different are the MeasuringWorth data from the official BLS statistics? Using the official CPI data, inflation under the Fed has been only 2,952 percent since 1914. But don’t worry: we’ll hit 3,000 percent on the official measure soon enough.

About the Author

Thomas L. Hogan, Ph.D., is senior research faculty at AIER. He was formerly the chief economist for the U.S. Senate Committee on Banking, Housing and Urban Affairs. He has also worked at Rice University’s Baker Institute for Public Policy, Troy University, West Texas A&M University, the Cato Institute, the World Bank, Merrill Lynch’s commodity trading group and for investment firms in the U.S. and Europe. Dr. Hogan’s research has been published in academic journals such as the Journal of Macroeconomics and the Journal of Money, Credit and Banking. He has appeared on programs such as BBC World News, Stossel TV, and Bloomberg Radio and has been quoted by news outlets including CNN Business, American Banker, and the National Review.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Thank you QTR for posting this article on inflation.

We all need a constant reminder of how the Federal Reserve has screwed us over.

Inflation is the silent tax and amazingly so...folks still do not understand it.

My parent's financial advisor said inflation is rising prices but could not explain how/why that is the case.

This guy manages their money!

We literally are debt slaves and own nothing!

Would be nice to live in a time when you could be assured of access to savings and not risk on casino with uncertain regulations and tax into oblivion.