The Elizabeth Holmes Verdict Is A Risk-On Reality Check

Regardless of the verdict, which is due any second now, I see the trial as a reminder of how quickly frauds can collapse and sentiment can change.

If you hadn’t noticed, a couple of days ago, jury deliberations began in the Elizabeth Holmes trial. For most, updates on the trial have been meaningless as everyone simply awaits the verdict.

Regardless of the verdict, which is due any second now, I see the trial as a reminder of how quickly frauds can collapse and sentiment can change.

These are concepts that I think are more important now than ever.

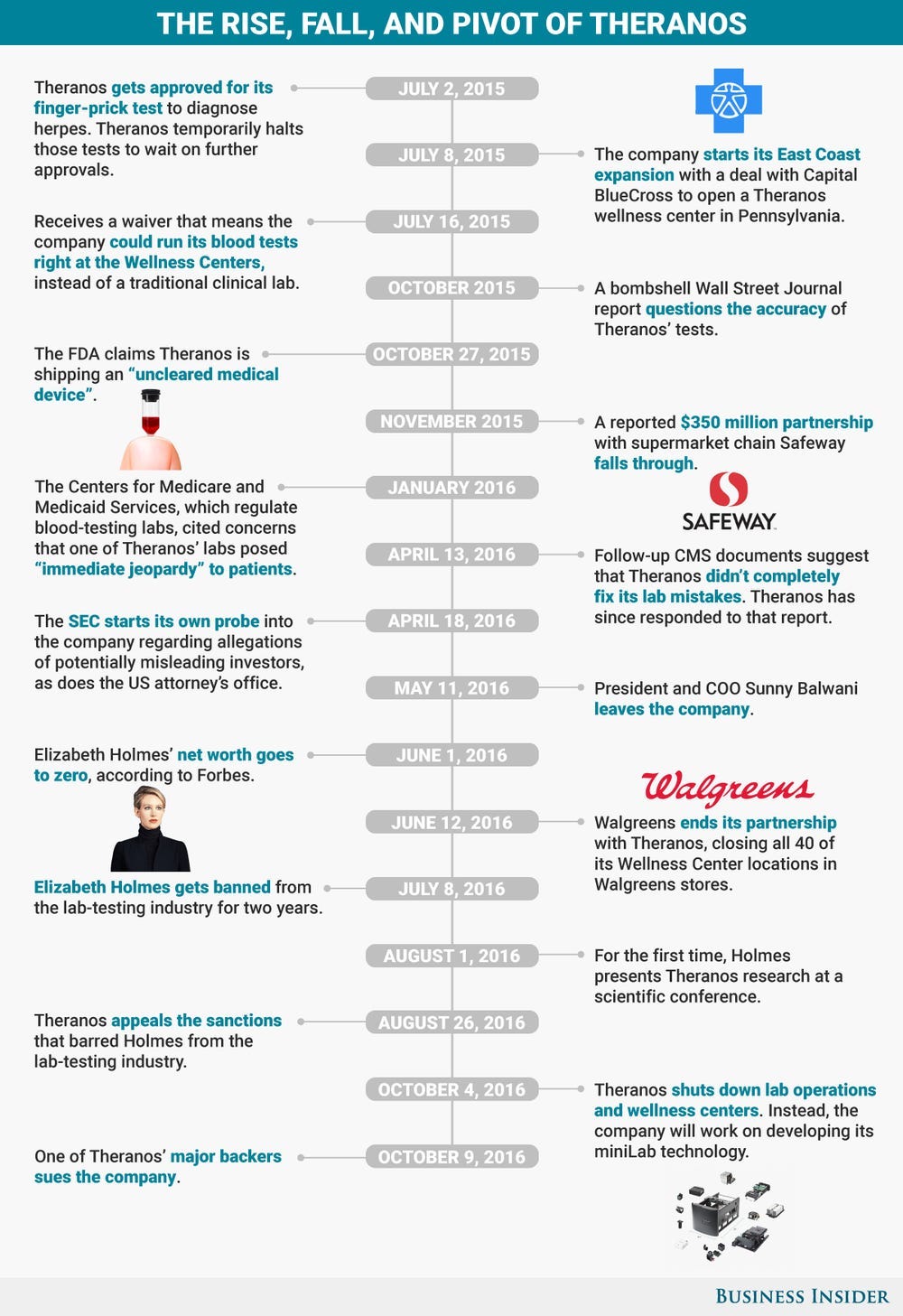

After all, Theranos was a fraud that almost went from the cradle to the grave all within the short time period I have been active in the financial world. I watched it during its infancy, watched it rise to a $9 billion valuation, watched the allegations, watched Holmes’ terrible crisis PR campaign - and I watched it collapse.

Now, its founder is at the end of her criminal trial, just a couple years after the entire ball of string started to unwind thanks to one inquisitive article in The Wall Street Journal.

But the important thing is that Theranos serves as a reminder of how quickly euphoria can turn to despair. This is a lesson that I think is especially worthwhile to examine in the midst of the mania our markets are currently in.

While I’m not suggesting that you specifically own frauds that will blow up over the course of the next couple of years, I do want take a step back and point out how quickly sentiment can change.

And sentiment - psychological buy-in from traders - is a big part of what is carrying and supporting the market right now.

You know, aside from the trillions of dollars in in quantitative easing.

I’ve harped about the pitfalls of FOMO investing or buying every single dip, but when there are no fundamentals to fall back on - as was the case with the money-losing Theranos - the risks are even more pronounced.