The Dollar Dethroned: We Have Reached The End Of Monetary Policy As We All Once Knew It

And the world hasn't even noticed yet.

People who speak out openly with concern about the potential death of the U.S. dollar have been written off as conspiracy theorists for the better part of the last few decades.

But looking back, unfortunately, I’m sure history is going to be kind to these people and their prognostications. They will have been the ones who sounded the alarm in a relatively short amount of time before ultimately being proven right.

I don’t say this to brag or boast in advance in any way, I say it because I truly believe we are at the “beginning of the end” of the Keynesian economic experiment.

Less than two weeks ago, I wrote an article proclaiming that Russia would back the ruble with gold as a way to fight back against Western economic sanctions. I also made similar predictions about the new digital Chinese currency last summer when I first started Fringe Finance.

To me, since I began piecing together my understanding of macroeconomics and the global economy about a decade ago, it had become painfully obvious that the fiat system the U.S. plays by, which hinges on the dollar being the global reserve currency, had its days numbered.

The catalyst that is helping hurl us toward our monetary rude awakening faster than ever has been the war in Ukraine. Actually, it hasn’t been the war so much as it has been the West’s reaction to the war. As only blindly arrogant believers in the Keynesian dog-and-pony show could do, we rushed to cut Russia off the SWIFT system, limited investing in Russia companies and sanctioned the country’s oligarchs.

To which Russia basically replied, “OK. We still have the oil.”

And that has been the attitude the Kremlin has adopted, for the most part. They are falling back on their country’s productive capacity when it comes to oil, continuing to do business with the Chinese, and are adding to their gold reserves. After small shocks lower in Russian markets and in the ruble, things have stabilized relatively quickly - except now, Russia has used the opportunity to make clear that they do not want to be participants in the global fiat system any longer.

And it looks like China (and likely India) feel similarly situated.

Just this weekend, the Kremlin said that sanctions against Russia would “accelerate the erosion of confidence in the dollar and Euro”. Russian propaganda or not, I think they’re right.

Russia, China and the rest of the world - having seen billions in FX reserves essentially seized without due process globally - now understand they must get off the same monetary system as the rest of the world. Russia and China, in my opinion, will be leading the charge, once again, to a new era of sound money that I believe is going to bring the U.S.’s Keynesian experiment to its knees.

Today’s post is not behind a paywall because I feel its contents are too important. If you enjoy my work, and have the means to support, I’d love to have you as a subscriber:

Economists and strategists globally are starting to understand what I have been pointing out for months.

Precious metals analyst Ronan Manly of Bullionstar.com, said in an interview with RT.com this past weekend that it could eventually blow up the paper metals markets:

“By playing both sides of the equation, i.e. linking the ruble to gold and then linking energy payments to the ruble, the Bank of Russia and the Kremlin are fundamentally altering the entire working assumptions of the global trade system while accelerating change in the global monetary system. This wall of buyers in search of physical gold to pay for real commodities could certainly torpedo and blow up the paper gold markets of the LBMA and COMEX.”

And continued by pointing out the obvious: that if Russia leads the way by backing their currency with gold, other countries “may feel the need” to follow suit:

“Other non-Western governments and central banks will therefore be taking a keen interest in Russia linking the ruble to gold and linking commodity export payments to the ruble. In other words, if Russia begins to accept payment for oil in gold, then other countries may feel the need to follow suit.”

I contend that other countries will have to follow suit.

This led him down a road that I - and many other Austrian economists - have been predicting would happen since we first understood how the system works today: that the consequences could be crushing for the dollar:

“Since 1971, the global reserve status of the US dollar has been underpinned by oil, and the petrodollar era has only been possible due to both the world’s continued use of US dollars to trade oil and the USA’s ability to prevent any competitor to the US dollar.

But what we are seeing right now looks like the beginning of the end of that 50-year system and the birth of a new gold and commodity backed multi-lateral monetary system. The freezing of Russia’s foreign exchange reserves has been the trigger. The giant commodity strong countries of the world such as China and the oil exporting nations may now feel that now is the time to move to a new more equitable monetary system. It’s not a surprise, they have been discussing it for years.

While it’s still too early to say how the US dollar will be affected, it will come out of this period weaker and less influential than before.”

In fact, all I’ve talked about recently is how I believe the U.S. dollar is going to be challenged and how what’s going on in Russia, India and China is actually a challenge to the way that all Western countries run their respective economies - it’s a challenge to Keynesian and Modern Monetary Theories.

I’ve often noted that Keynesianism works great for the people that it truly works for: mostly elites, elected officials and politicians. It has worked that way for the “Davos crowd”, or anyone that benefits from a fiat system, not just in the United States, but globally.

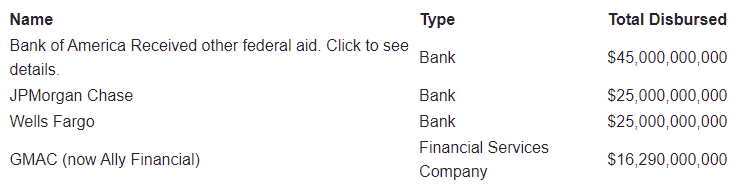

The beneficiaries don’t just include politicians and central bankers, they also include all of those who have been “bailed out” along the way; namely, a lot of bankers who saw their respective corporations survive using other taxpayers’ purchasing power in the form of TARP and quantitative easing.

Lawrence Lepard made a couple of great points on a podcast he did last week with Palisades Gold Radio. One of which was that he thought Russia’s Vladimir Putin had been treated like a second class citizen by the Davos crowd over the last couple of decades. And to be honest, while I’m no fan of Putin’s, I see Lepard’s point. I would go one further and say the same for a Xi Jinping, despite the fact that both have ugly track records of human rights abuses. I’m not condoning them, I’m stating that I can agree with Lepard’s argument and see how they could be feeling like they are being left out and/or taken advantage of while they produce the tangible goods we rely on, and we are off somewhere else playing with Monopoly money.

If you’re China, and you produce everything that the U.S. uses, and you’re Russia, and you produce a meaningful portion of the world’s oil, the question then becomes how long you’re willing to just sit back and “take it” from the Western fiat bully?

This is a point that Austrian economists and skeptics have been bringing up for decades now. For example, Peter Schiff has written entire books about the United States’ reliance on its ability to export dollars and import goods and services. He always predicted these chickens would eventually come back home to roost in the form of China deciding they don’t want dollars anymore. Russia appears to have decided exactly that.

With the economic sanctions that the West has tried to implement against Russia, these nations finally have an impetus to stand their ground and fight back monetarily. And that seems to be the attitude of both Russia and China right now: let’s allow the currency to crash and fall back on our resources and productive capacity, because we’re so confident that when the dust settles, in the long term, we’ll be in a better monetary state than the West.

It marks a shift not only in how the world does, and will, perceive the US dollar, but also possibly how the world will view Keynesian economics going forward. In other words, my prediction that Modern Monetary Theory Would Destroy the United States looks like it could be well on its way out of the starting gate.

I want to say that my certainty level that I’m right about this marking a new era for the dollar – despite the magnitude of this prediction - continues to rise every day. Every day we get new headlines out of Russia and China that confirm that they want to continue to peel away from the West even further.

And I would caution people that the next time you go to make fun of a Austrian economist or a skeptic of monetary policy, that you look back on exactly how accurate predictions that were being laughed at just weeks ago are turning out to be.

I always predicted that it wasn’t a question of us all being wrong, like many people thought we were, it was just a question of when our thesis would play out.

And that time looks like now.

Today’s post is not behind a paywall because I feel its contents are too important. If you enjoy my work, and have the means to support, I’d love to have you as a subscriber:

Disclaimer: I am long gold and miners and oil in many ways that will benefit from this situation. This is not a recommendation to buy or sell any stocks or securities. I own or will own all names I mentioned or linked to in this piece. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

Thanks for making this a free post.

Absolutely on target with this. The key thing to using a weapon is to know both a) when to use it, b) when not to use it, c) at some point it will have diminishing effects and your enemy will copy it. Once we tied the USD to policy and showed it to be a completely political weapon with zero neutrality, other governments were incentivized to find both counters and other options. I'm a full on statist patriot, but I'm also a practical man and completely understand why Russia and China have sought other options. If positions were reversed, I would want the US to do the same. Put another way, we turned the petro-dollar into an ied, handed the detonator to our competitors, then gave them a reason and the right time to press the button. How are we surprised when they press it?