The Case For Sanity

Mark Spiegel explains why he's still shorting the S&P heading into 2026.

The main thesis for being bullish heading into 2026, as I see it, is simply: the rules don’t apply anymore and everything is broken, so the market will never again trade on historical fundamentals or with any semblance of sanity ever again.

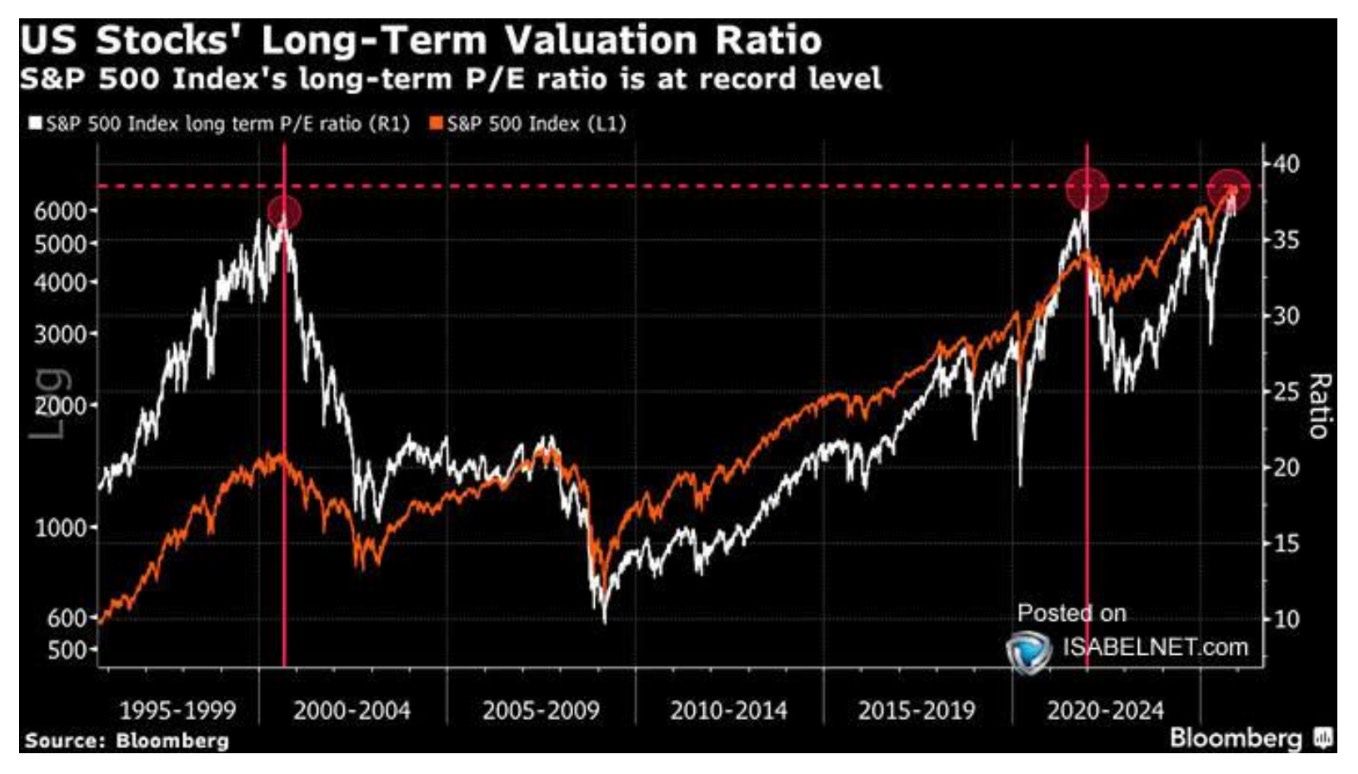

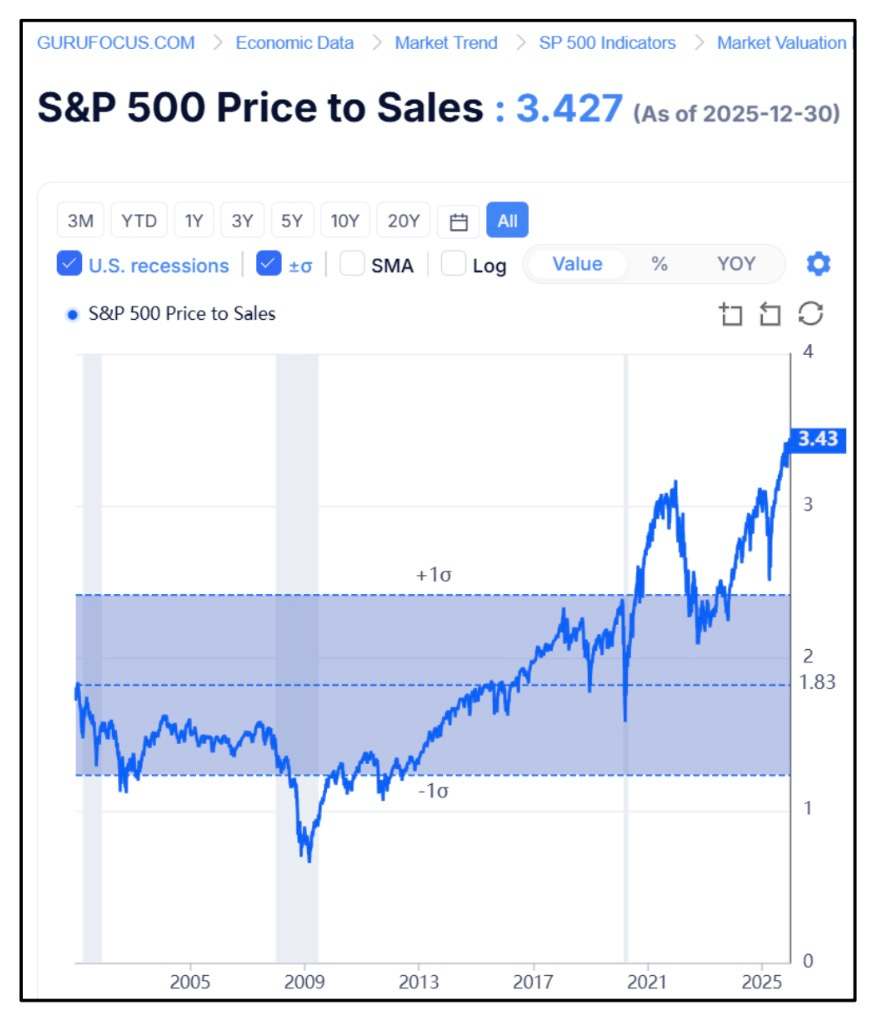

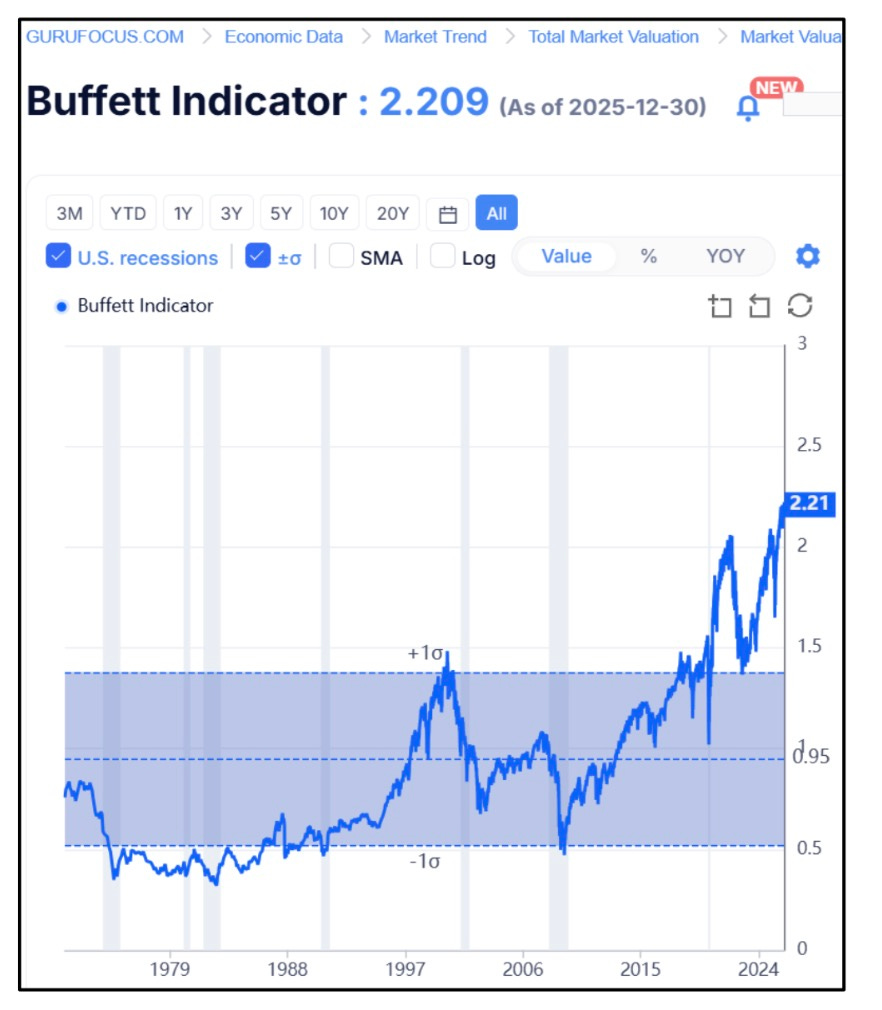

So far, this is the case that has been winning out in markets over the last few years, thanks to caustic monetary policy and an unsophisticated retail investor base, layered on top of a passive bid that doesn’t care about P/E ratios or the like.

And yet, if you happen to be of that increasingly endangered species — like myself — that still clings, perhaps masochistically, to the notion that fundamentals are supposed to matter, then the case for a meaningful pullback in equities doesn’t just exist… it almost demands to be made at this point.

My friend Mark Spiegel is one of those stubborn, “tethered-to-reality” types. To him, the idea that markets are trading at current levels is not merely questionable, it’s borderline absurd. And honestly? A large part of me is right there with him. In any rational vacuum, he’s not just right… he’s obviously right.

The problem, of course, is that we’re no longer operating in a vacuum. We’re operating in a financial ecosystem distorted by unprecedented monetary intervention, speculative reflexivity, algorithmic momentum, and a collective willingness to suspend disbelief as long as prices keep going up. Which raises the only question that truly matters now: are we even playing on a sane, level field anymore — one in which common sense is still allowed to cast a vote?

Mark, for his part, hasn’t abandoned that belief despite an ugly year for his fund in 2025. He continues to lay out the case for an overvalued market with the kind of clarity and intellectual discipline that feels almost old-fashioned in today’s price-chasing environment. His latest investor letter, released this week, is one of the cleanest articulations of that case I’ve seen in some time and I thought it was worth sharing with you.

This is the biggest bubble in modern history and we remain positioned for it to pop, via rotating, on and-off short positions in various S&P 500 & Nasdaq ETFs and individual companies. (I temporarily reduced our short exposure late this month but expect to soon increase it again substantially.)

Consumers in this consumer-driven economy are fading fast, with the latest (government shutdown delayed) data (for October, released in December) showing negative “real” retail sales comps when adjusting for inflation (which the government data doesn’t do):