The Biggest Stock Market Bargain Of All

My buddy Chris DeMuth correctly says that "waves" of bankruptcies and fraud charges are coming in unprofitable tech names. In the interim, here is where he's going bargain hunting in markets.

I’m incredibly stoked to be able to bring you exclusive content from one of my favorite investors, Chris DeMuth Jr. Chris took the time to prepare his up-to-the-minute thoughts on the market exclusively for Fringe Finance subscribers this week.

Chris DeMuth Jr founded event driven hedge fund Rangeley Capital and research service Sifting the World. Rangeley’s strategy is to invest in mispriced securities with limited downsides and corporate events that unlock shareholder value. He also hosts Sifting the World, Seeking Alpha’s SPAC and event driven research product.

Chris also writes the Vale Tudo Substack, which can be found here.

Chris is one of the smartest people I’ve had the chance to meet during my time as an investor. He was one of the first people to ever take a phone call from me in the early 2010’s when I first started looking at the Questcor/Acthar scam. He was also one of the first people to be nice to me when I got my start on Seeking Alpha back about 10 years ago and is also widely respected by many people whose work I admire and follow.

All information contained herein is opinion only & does not constitute investment recommendations. Nothing is a solicitation to buy or sell securities.

Gap Year

Time to spend a year wandering abroad

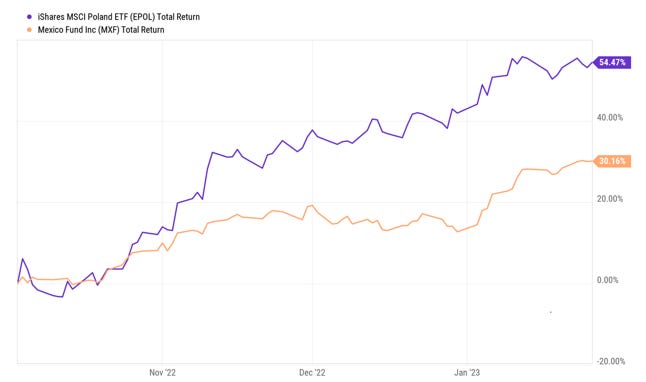

At the beginning of last quarter, QTR was kind enough to post my thoughts on this and that including the fact that the rising dollar offered enticing opportunities abroad. Since then, the dollar has weakened and the near abroad for cheap labor in Europe and the US – Poland and Mexico – have had strong equity performance in local and dollar terms:

I expect both to continue as globalization and reliance on China retreat and regional hegemons reorient around continental labor supplies. Today, US equities are, on average, expensive. While we’ve seen some reversion to making sense in unprofitable tech over the past year, they have yet to face waves of bankruptcy and fraud charges. Those will come. But there has been a record divergence in equity prices by country market. Sure, Poland and Mexico are better bargains. But perhaps the biggest bargain of all is: