"The Biggest Asset Bubble In U.S. History": Mark Spiegel Eviscerates Fed Policy And Tesla

Mark's March 2022 investor letter doesn't pull any punches.

Friend of Fringe Finance Mark B. Spiegel of Stanphyl Capital released his most recent investor letter yesterday with his updated take on the market’s valuation and Tesla.

Mark is a recurring guest on my podcast (and will be coming back on again soon hopefully) and definitely one of Wall Street’s iconoclasts. I read every letter he publishes and only recently thought it would be a great idea to share them with my readers.

Like many of my friends/guests, he’s the type of voice that gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Mark was kind enough to allow me to share his thoughts from his March 2022 investor letter, which he published on March 31, 2022.

Mark opened by calling the meme stock rally of the last few days “a fierce bear market rally of garbage stocks”. What follows is Mark’s take, from his letter, on the Fed and Tesla - and several chart annotations that I think help make his point.

Mark’s Thoughts On The Market & The Fed

The biggest asset bubble in U.S. history was blown with the Fed printing $120 billion a month and short term rates at zero while the government concurrently ran a record fiscal deficit and inflation was moderate.

Now we have no Fed printing (in fact, its balance sheet may soon be reduced), almost the entire Treasury rate curve well over 2%, rapidly declining fiscal deficits, and the highest inflation rate in over 40 years, exacerbated (and not yet in the latest inflation numbers) by the tragic situation in Ukraine via further supply chain restrictions, while increased military spending for the entire western world (as well as Japan and South Korea) is about to erase the so-called “peace dividend.”

Thus, in addition to our Tesla short, late in the month (and for the first time in many years) I initiated a short position in the S&P 500 (via the SPY ETF) when it bounced back to within 5% of the all-time high it set in early January under far more favorable conditions than those in the present and foreseeable future.

In fact, the last time the 10-year Treasury yield was where it is now (approximately 2.3%) was May 2019 when the S&P 500 was approximately 35% lower than now, yet inflation was vastly lower and growth prospects were far better. And although corporate earnings are higher now than they were in 2019, I believe inflation expectations will soon substantially lower the PE multiples placed on those earnings, as occurred in the inflationary era between 1973 and 1975 when the S&P 500’s PE rapidly dropped from 18x to 8x.

In other words, I think this stock market is going a lot lower, and I want to be positioned for that.

Meanwhile, even with the recent Fed Funds rate of 0.125% and the federal debt financed at an average of a bit over 1%, the interest on the $30 trillion of federal debt costs around $400 billion a year. That average interest cost is now on a path to double, yet even then would still be far below the anticipated rate of inflation.

Does anyone seriously think this Fed has the stomach to face the political firestorm of Congress having to slash Medicare, the defense budget, etc. in order to pay the even higher interest cost that would be created by upping those rates to a level commensurate with even 4% inflation (not to mention today’s over 7%)?

Powell doesn’t have the guts for that, nor does anyone else in Washington; thus, this Fed will likely be behind the inflation curve for at least a decade. And that’s why we remain long gold (via the GLD ETF).

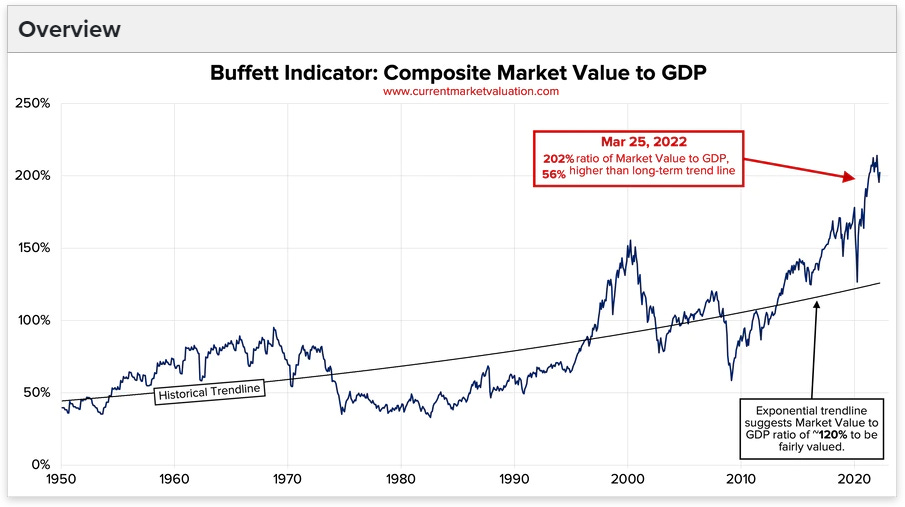

Meanwhile, we can see from CurrentMarketValuation.com that the U.S. stock market’s valuation as a percentage of GDP (the so-called “Buffett Indicator”) is still astoundingly high, and thus valuations have a long way to go before reaching “normalcy”:

[QTR’s editor’s note: This is exactly the indicator I have been using to make a similar case for a market plunge in two recent articles, here and here.]

When stocks get meaningfully cheaper I’ll be an enthusiastic buyer, but until then we’re likely to remain net short.

This post is 100% free, but if you want to support Fringe Finance and have the means, I would love to have you as a subscriber:

Mark’s Thoughts On Tesla

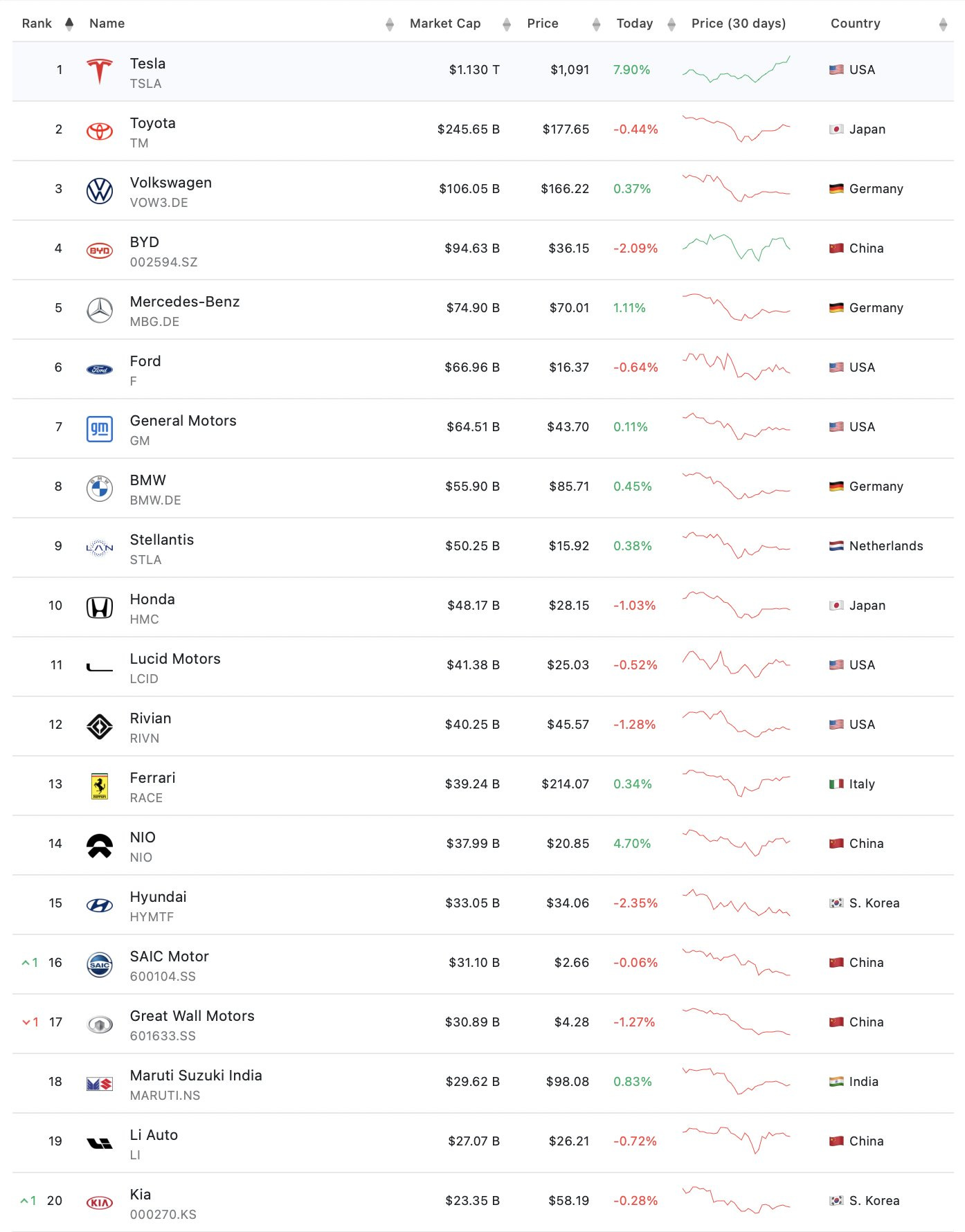

We remain short the biggest bubble in modern stock market history, Tesla Inc. (TSLA) which, despite a steadily sliding share of the world’s EV market and a share of the overall auto market that’s only around 1.5%, Trevor Scott points out has a market cap roughly equal to the next 20 largest automakers combined.

So here’s why we remain short Tesla:

Tesla has no “moat” of any kind; i.e., nothing meaningfully proprietary in terms of its electric car technology (which has now been surpassed by numerous competitors), while existing automakers—unlike Tesla—have a decades-long “experience moat” of knowing how to mass-produce, distribute and service high-quality cars consistently and profitably.

Excluding working capital benefits and sunsetting emission credit sales Tesla generates negative free cash flow.

Growth in sequential unit demand for Tesla’s cars is at a crawl relative to expectations.

Elon Musk is a pathological liar who under the terms of his SEC settlement cannot deny having committed securities fraud.

Tesla’s Q1 2022 delivery number (to be reported in early April) will likely only be slightly better than Q4 2022’s 308,000, perhaps a 20,000 (or fewer) unit gain that would be a rounding error for an auto company trading at even one-tenth of Tesla’s valuation.

If in any quarter GM or VW or Toyota sold 2.02 million vehicles instead of 2 million or 1.98 million, no one would pay the slightest bit of attention to the difference. Seeing as Tesla is still being valued at over seventeen GMs, it’s time to start looking at its relatively tiny numerical sequential sales growth, rather than Wall Street’s sell-side hype of “percentage off a small base.”

In other words, if you want to be valued at a giant multiple of “the big boys,” you should be treated as a big boy. And yes, Tesla is somewhat capacity constrained, but so are all its competitors. Let’s see how quickly “constraint” morphs into “excess capacity” when the German and Texas factories are fully online!

Meanwhile in January, Tesla reported results for Q4 2021 and once again proved that it’s a truly horrible business. Although the company claimed to have generated $2.8 billion in free cash flow for the quarter, that was almost entirely created by massively increased payables & accrued liabilities, and by stock-based compensation.

After adjusting for those factors (and a tiny increase in receivables), Tesla’s free cash flow was just $119 million, and that undoubtedly included several hundred million dollars of previously earned & billed emission credit sales, a revenue stream which will almost entirely disappear next year as other automakers begin selling enough electric cars of their own. Thus, despite all the sell-side and media hype, on a sustainable basis Tesla’s free cash flow is still resoundingly negative.

And for those of you who think that Tesla is “really an energy company,” in Q4 “Tesla Energy” had revenue of $688 million (down 8.5% year-over-year and 8% sequentially) and cost of revenue of $739 million, meaning it had a negative gross margin. So if Tesla is “really an energy company,” it’s even more screwed than if it’s just a car company!

Meanwhile, perhaps the biggest reason Tesla has recently been able to post marginally increasing sequential quarterly deliveries is because competitors’ production is at the lowest level in decades due to the massive chip shortage, thereby eliminating a number of “Tesla alternatives.” Yet Tesla is enjoying record production because Musk (a notorious “corner-cutter”) is apparently willing to either substitute untested, non-auto-grade chips for the more durable chips he can’t get (please see my Twitter post about this) or simply eliminate entire crucial safety systems such as back-up steering and crash-avoidance radar.

Meanwhile, many Tesla bulls sincerely believe that ten years from now the company will be twice the size of Volkswagen or Toyota, thereby selling around 20 million cars a year (up from the current run-rate of around 1.3 million); in fact in March Musk himself even raised this as a possibility.

To illustrate how utterly absurd this is, going from 1.3 million cars a year today to 20 million in ten years means that in addition to one million cars a year of eventual production from the new German and Texas factories, Tesla would have to add 35 more brand new 500,000 car/year factories with sold out production; i.e., a new factory nearly every single quarter for ten years!

And what then? Well, then you’d have a car company approximately twice the size of Toyota (current market cap: $249 billion) or Volkswagen (current market cap: $110 billion). If that would make Tesla worth, say, $500 billion in 10 years, discounting that back at 15%/year and allowing for enough share dilution to pay for all those factories, Tesla—in that absurdly optimistic scenario—would be worth just $100/share today, down almost 93% from its current price.

Another favorite hype story from Tesla bulls has been “the China market.” But based on the Chinese domestic (non-export) sales numbers we have for January and February it appears that Q1 2022 sales there barely grew (or may have even contracted) from Q4 2021’s. And in Q4 Tesla had only around 1.5% of the overall Chinese passenger vehicle market and just 11% of the BEV market.

Meanwhile, as Tesla continues to sell its fraudulent & dangerous so-called “Full Self Driving” the head of that program just took a four-month sabbatical; the last major Tesla executive who did that (Doug Field) never returned. In a sane regulatory environment Tesla, having sold this garbage software for over five years now…

…would be prosecuted for “consumer fraud,” and indeed the regulatory tide may finally be turning, as two U.S. senators continue to question its safety and in October the NHTSA appointed a harsh critic of this deadly product to advise on its regulation. (For all known Tesla deaths see here.)

Are major write downs and refunds on the way, killing the company’s slight “claimed profitability”? Stay tuned!

Meanwhile, Guidehouse Insights continues to rate Tesla dead last among autonomous competitors:

Another favorite Tesla hype story has been built around so-called “proprietary battery technology.” In fact though, Tesla has nothing proprietary there — it doesn’t make them, it buys them from Panasonic, CATL and LG, and it’s the biggest liar in the industry regarding the real-world range of its cars. And if new-format 4680 cells enter the market some time in 2024 (as is now expected), even if Tesla makes some of its own, other manufacturers will gladly sell them to anyone.

Meanwhile, Tesla build quality remains awful (it ranks second-to-last in the latest Consumer Reports reliability survey) while the latest survey from British consumer organization Which? found it to be one of the least reliable cars in existence. And Tesla’s worst-rated Model Y faces current (or imminent) competition from the much better built electric Audi Q4 e-tron, BMW iX3, Mercedes EQB, Volvo XC40 Recharge, Volkswagen ID.4, Ford Mustang Mach E, Nissan Ariya, Hyundai Ioniq 5 and Kia EV6.

And Tesla’s Model 3 now has terrific direct “sedan competition” from Volvo’s beautiful Polestar 2, the great new BMW i4 and the premium version of Volkswagen’s ID.3 (in Europe), plus multiple local competitors in China.

And in the high-end electric car segment worldwide the Audi e-tron (substantially improved for 2022!) and Porsche Taycan outsell the Models S & X (and the newly updated Tesla models with their dated exteriors and idiotic shifters & steering wheels won’t change this), while the spectacular new Mercedes EQS, Audi e-Tron GT and Lucid Air make the Tesla Model S look like a fast Yugo, while the extremely well reviewed new BMW iX does the same to the Model X.

And oh, the joke of a “pickup truck” Tesla previewed in 2019 (and still hasn’t shown in production-ready form) won’t be much of “growth engine” either, as it will enter a dogfight of a market; in fact, Ford’s terrific 2022 all-electric F-150 Lightning now has over 200,000 retail reservations (plus many more fleet reservations), GM has introduced its fantastic 2023 electric Silverado with over 110,000 reservations and Rivian’s pick-up has gotten excellent early reviews.

Regarding safety, as noted earlier in this letter, Tesla continues to deceptively sell its hugely dangerous so-called “Autopilot” system, which Consumer Reports has completely eviscerated; God only knows how many more people this monstrosity unleashed on public roads will kill despite the NTSB condemning it.

Elsewhere in safety, the Chinese government forced the recall of tens of thousands of Teslas for a dangerous suspension defect the company spent years trying to cover up, and now Tesla has been hit by a class-action lawsuit in the U.S. for the same defect. Tesla also knowingly sold cars that it knew were a fire hazard and did the same with solar systems, and after initially refusing to do so voluntarily, it was forced to recall a dangerously defective touchscreen.

In other words, when it comes to the safety of customers and innocent bystanders, Tesla is truly one of the most vile companies on Earth. Meanwhile the massive number of lawsuits of all types against the company continues to escalate.

About Mark Spiegel

Mark manages Stanphyl Capital, established in 2011, a deep-value equity & macro long-short investing fund based in New York City. Mark can be reached at mark@stanphylcap.com or at @StanphylCap on Twitter.

This post is 100% free, but if you want to support Fringe Finance and have the means, I would love to have you as a subscriber:

Disclaimer: This letter was not reproduced in full. I own Tesla call and put options, as well as ARKK call and put options. QTR is long various gold and silver miners and has both long and short exposure to the market through equities and derivatives. I have no position in Mark’s funds. Mark is a subscriber to Fringe Finance via a comped subscription I gave him and has been on my podcast. The excerpts from Mark’s letter, above, shall not be construed as an offer to sell, or the solicitation of an offer to sell, any securities or services. Any such offering may only be made at the time a qualified investor receives formal materials describing an offering plus related subscription documentation. There is no guarantee the Fund’s investment strategy will be successful. Investing involves risk, and an investment in the Fund could lose money.

I’ve said it for 4-5 years Tesla is the canary in the coal mine.

Mark Spiegel pulls no punches. He might be the only guy more annoyed by the Cult of Elon than I am. Though I do support his snarky tweets directed at Elizabeth Warren.