Taxing Unrealized Gains Would Obliterate The U.S. Economy

The reasoning is so simple, a fifth grader could understand it - which is probably why the Biden administration doesn't.

Having used up all of the rest of the batshit, insane, counterintuitive economic dirty tricks left in the "we'll literally do anything but cut spending" bag, the Biden administration is pushing what could be the most destructive idea for our country since prohibition: taxing unrealized gains.

As part of its budget proposal for the 2025 fiscal year, the Biden administration is trying to raise an addition $4.3 trillion over 10 years in the worst way possible: imposing a minimum tax equal to 25 percent of a taxpayer’s taxable income and unrealized capital gains less the sum of their regular tax, for taxpayers with wealth over $100 million.

Putting aside the fact that this high-risk idea only amounts to a pittance, $430 billion per year (25% of which we just sent to foreign nations over the weekend in one fell swoop of a pen and it’s only April), the introduction of taxing unrealized gains could be one of the worst slippery slopes we ever dare to roll our country’s economy down.

I mean, shit, we could save $1 trillion just by not sending $100 billion a year to other nations for starters. But I digress. For an outline of exactly what an unrealized gains tax is, here's the American Institute on Economic Research:

A tax on unrealized capital gains means that individuals are penalized for owning appreciating assets, regardless of whether they have realized any actual income from selling them.

If you purchased a stock for $100 this year, for example, and it increased to $110 next year, you would pay the assigned tax rate on the $10 capital gain. You didn’t sell the asset, so you don’t realize the $10 appreciation, but must pay the tax regardless.

Taxing unrealized capital gains contradicts the basic principles of fairness and property rights essential for a free and prosperous society. Taxation, if we’re going to have it on income, should be based on actual income earned, not on paper gains that may never materialize.

AIER notes that implementing such a tax not only deeply infringes upon personal liberty and private property rights — but I can’t help but think about how it also sets a destructive wrecking ball rolling down a slippery slope for the first time in our nation's history.

And, given the precarious state of our nation's finances, it doesn't seem like the best time to start spitballing about new risky ideas that may or may not catch on only because they sound like they are addressing the problem of a widening wealth gap that Federal Reserve policies created and continue to exacerbate to begin with.

If the administration really wanted to address the problem of wealth inequality, it would be setting its sights on the central bank that sacrificed price stability so it could spray trillions of dollars in "stimulus" toward financial assets, while cutting American families paltry checks of just $600, during COVID. When I did the math during COVID, the total amount spent to bail out the country when we decided to shut down the economy and have the Federal Reserve replace it with a fiat house of cards amounted to something like $17,500 per every citizen in the United States.

Except, again, only $600 of that went to each individual. The rest went to the financial sector, in turn widening the inequality gap further as billionaires like Mark Zuckerberg, Elon Musk, and Jeff Bezos saw tens of billions of dollars added to their net worth in a matter of months.

And so now, rather than take tangible, decisive action to actually address the problem, the Biden administration is putting forth a plan that won’t just be negative for the country, it could very well be the hill that our country’s economy dies on. And to be honest, I’m not being hyperbolic.

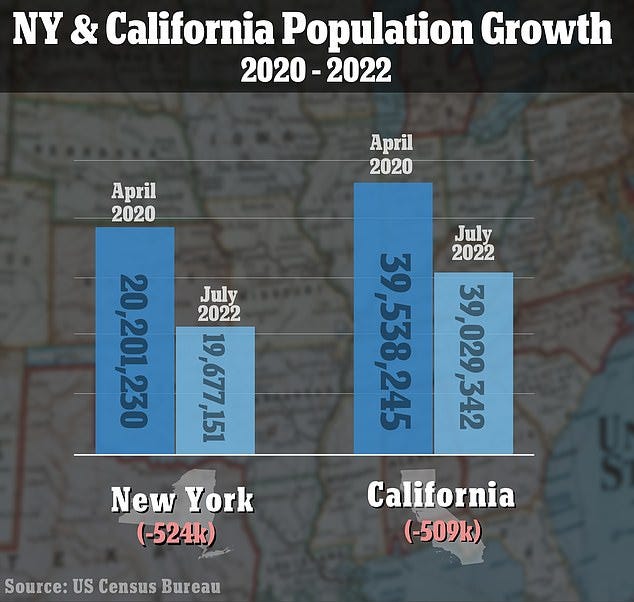

Over the last few years, we have seen an extraordinary exodus from places like New York and California, to places like Florida and Texas, because the former states were essentially taxing far too much relative to the benefits of what they were providing for citizens.

Ergo, places like California have seen people like Joe Rogan and Elon Musk move to Texas, while states like New York have seen businesses like Ken Griffin's Citadel move to Florida. There’s nothing to read between the lines about when it comes to this capital flight out of one state and into another. It is simple cause and effect: at some point, people simply don’t think it is worth living in these states due to the taxes being too high.

It’s a quintessential example of the Laffer Curve. Tax too much, people are disincentivized to generate productivity, or in this case, live in your state.

Biden's proposal to raise regular capital gains taxes is one thing, albeit still egregious; it is far lesser noxious of the two proposals. Taxing unrealized gains is an exponentially worse type of taxation that introduces not just a higher tax rate and a 3rd type of income tax, but a completely new system for taxation – one that taxes people's assets as they appreciate, not just when they realize the gains of said appreciation.

“But it will only be against people worth more than $100 million,” proponents of the idea will exclaim. Hell, I’m not worth 1% of that, so why should I even care?

First off, it can’t be understated how earth-shattering it is to put this terrible idea into motion, regardless of who it is going to affect. You can’t justify a stunning overreach on people's constitutional rights and civil liberties just because they sit in a certain tax bracket. And it is a line that, once crossed, the government won’t backtrack on. Once taxing unrealized gains makes its way into the zeitgeist, it sticks around for good. And, if it sticks around, it’ll only be another meaningful step moving the U.S. economy closer to an anemic corpse of a state-planned economy.

A tax of this nature creates a vacuum that does nothing but suck the vibrancy out of an economy. In addition to setting a new moral hazard standard, the tax directly targets the people with the most capital at work in our country. By specifically targeting the people that have the means to create new enterprises and invest using this capital, and then driving them out of the country, the tax is a surefire way to suck the lifeblood out of what’s left of the United States economy.

Make no mistake: it will be a clarion call for billionaires to simply move out of the United States and into tax havens. And think about it — these are the people that have the means to up and simply leave the country and relocate anytime they want. For them, if it makes financial sense, they will do it. Implementing this unrealized gains tax will set the ball in motion, you can mark my words. The rich will be as good as gone.

And when billionaires decide to up and leave the United States, all of the tax revenue they were generating otherwise — not just the unrealized gains tax — leaves with them. In other words, an unrealized gains tax will push them past their limit and result in catastrophic consequences for the country's tax revenue as a whole. It’ll literally do far more harm than good. If I can understand why, a fifth grader can. That means the ultra-rich, who are much smarter than I am, definitely understand it. They’re not going to be interested in hanging around and forking over this much more cash “for the good of the cause”. They already likely have a plan in such case this tax is passed, and — as a hint — it isn’t to happily hand over a check to the Biden administration and say “thanks for being such great stewards of my capital, keep up the good work”.

In reality, it likely involves yachts, dual passports, “investments” in places like Bermuda and Mauritius, attending F1 races and tennis matches, expensive champagne and Eastern European escorts (hereinafter referred to as: “The Hunter Biden Experience”).

But seriously, setting aside the billionaires for a moment, the tax is going to dampen everybody’s incentive to try and earn and invest to begin with. Who wants to invest in the market if they’re going to be taxed on their gains the very next day?

Possibly the worst part of this idea is its timing. The country is running a massive deficit now that looks to continue to widen because of our government's refusal to cut spending on both sides of the aisle. As a reminder, you can only push the tax base so far before they turn tail and run. I know I’ve made jokes in the past (read: yesterday) about our government going through all of the solutions mandatory before arriving at any solution that works in the slightest, but this would be the granddaddy of all examples if implemented.

The timing of this proposed solution couldn’t be worse. We are at a point in our country's fiscal history where we need balance more than ever.

We have the largest deficit and the most debt relative to GDP we have had in recent history.

The BRICS nations, including Russia, China, and India, are actively pursuing ways to break off of the Western banking system and challenge the U.S. dollar.

Inflation is running rampant and high interest rates are more than likely to cause our economy to slow down in marked fashion.

We’re running deficits, but we need the tax revenue we are currently bringing in if we have any hope of cutting spending to balance our budget and right the country's ship economically. The loss of tax revenue as a result of capital flight from the United States responding to this proposed unrealized gains tax would be catastrophic and would accelerate the country's financial and monetary demise, not help it.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. They are either submitted to QTR, reprinted under a Creative Commons license or with the permission of the author. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Standard operating procedure for the government. Introduce a new tax that only affects a very small percentage of the population. You know, the portion that just aren’t “paying their fair share”. The populace is fine with the idea, after all it doesn’t affect me. Step two, lower the threshold after a couple of years and don’t tie it to inflation. Step three, wait 20 years. At that point, you’ll have captured a large portion of the population in this totally unmanageable tax (imagine having to value and reach agreement on assets like real estate, classic cars, art every year with the government).

A good example of this is the Alternative Minimum Tax. When first enacted it affected just a few hundred people.

You also made a nice corollary as to why estimated value based property taxes also make no sense.

My working class grandfather tried for decades to sell his home / land that the state valued for over $1 Million. When he died we tried to aggressively sell the property but because of extreme zoning and EPA measures it was impossible to sell or build. We ended up selling the entire property for less than $250k at the hight of the housing boom.

What pisses me off is not the fact that the land was not worth what he thought, but that the government assessed it at a ridiculous value, charged him taxes on that value for decades, and then created a regulatory mess that made the land not developable.