Stocks Only "Partway Through A Massive Bear Market": Mark Spiegel

Friend of Fringe Finance Mark B. Spiegel of Stanphyl Capital released his most recent thoughts last week, with his updated take on the market’s valuation and Tesla.

Friend of Fringe Finance Mark B. Spiegel of Stanphyl Capital released his most recent investor letter last week, with his updated take on the market’s valuation and Tesla.

Mark is a recurring guest on my podcast (and will be coming back on again soon hopefully) and definitely one of Wall Street’s iconoclasts. I read every letter he publishes and only recently thought it would be a great idea to share them with my readers.

Like many of my friends/guests, he’s the type of voice that gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Mark was kind enough to allow me to share his thoughts from his July 2022 investor letter, where he noted that his fund was down 10.6% for the month.

Mark’s Thoughts On The Market

Rallies such as this month’s notwithstanding, I believe stocks are only partway through a massive bear market, the inevitable hangover from the biggest asset bubble in U.S. history, and thus today, July 29th, I took advantage of this rally to reinstate our SPY short position.

For far too long, the Fed printed $120 billion a month and held short-term rates at zero while the government concurrently ran a record fiscal deficit. Now, thanks to the massive inflationary hangover from those idiotic policies, the Fed is reducing its balance sheet and raising interest rates, accompanied by no extra fiscal stimulus. (In fact if the new Manchin-Schumer plan is approved, on a net basis it will be somewhat of an anti-stimulus despite its “green energy” boondoggle subsidies.)

Why do I believe that July brought us a bear market rally and not the beginning of a new bull market? Because the Fed is pulling too much money out of the system via quantitative tightening to re-inflate a stock bubble, rates are now high enough that there is “an alternative,” and corporate earnings are too lousy to push stocks up on their own. Bear market rallies such as the current one of 14% (from trough to peak) are not at all unusual; in fact as Keith McCullough points out, there was a 23% bounce in 2008 and a 21% bounce in 2000.

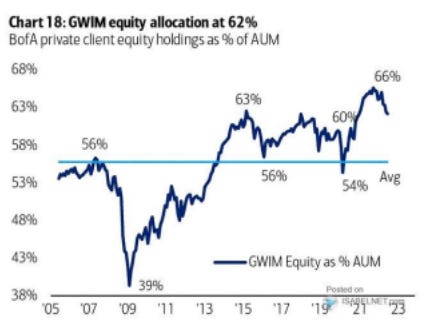

And courtesy of Bank of America we can see that despite bearish short-term investor sentiment polls being cited as “contrary indicators” to support bullishness, investors are still very overallocated to stocks vs. historical norms, and nowhere near as “under-allocated” as they were at the 2009 market bottom:

And regarding sentiment, we can see from Ed Yardeni that in the Investors Intelligence poll the highest the “bear percentage” got (so far) in the current market was only around 45% (it’s currently just 33%), yet there were multiple times during the 1980s, 1990s and 2008 that it climbed much higher:

Also, we can see from this old academic paper that during the grinding bear market of 1973 to 1975, when the S&P 500’s GAAP PE multiple dropped from 18x to 8x (it’s currently over 20x!), the bears in the Investors Intelligence poll climbed to around 75% and went over 80% during the bear markets of the 1960s.