Sky's The Limit For Our Debt And The Money Supply

"No matter who gets elected, expect more debt," Peter Schiff writes this week.

No Matter Who Gets Elected, Expect More Debt

An article in yesterday’s Washington Post assured readers that no matter who wins the 2024 US presidential election, we can count on massive expansion of the national debt to be among the common denominators. The article looked at a recent report from the Committee for a Responsible Federal Budget, or CRFB, analyzing the debt increases of both the Trump and Biden administrations.

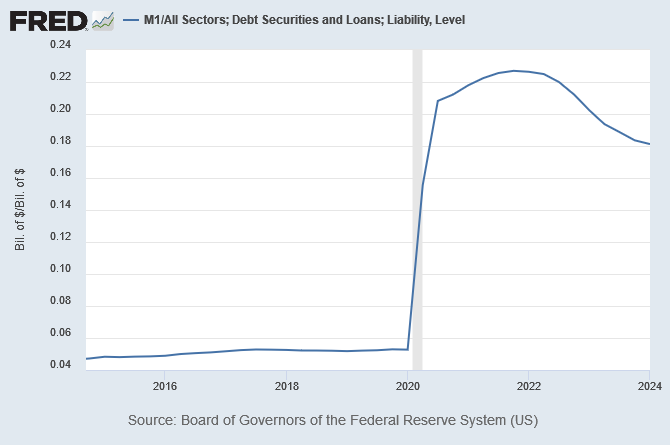

Trump, the “King of Debt,” has never been shy about much of anything — including his love for the money printer. This love affair with “free money” went to new heights during COVID-19, when the Fed printed trillions and federal spending increased by about 50%. The Treasury handed out checks to Americans to help them survive the financial fallout of the lockdowns and chaos that were caused by that very same government’s hysterical, Draconian pandemic response.

M1 Before and After COVID, St. Louis Fed

With Biden in office, the national debt has also expanded, though not as much. The “Fiscal Responsibility Act” he signed in 2023 was praised for reducing the debt by $1.5 trillion — but, as usual, the name of a law can often be relied upon to represent something other than its real-world effect. For example, The FRA put limits on some types of spending, but increased the debt limit — it has no chance of actually putting the US on a fiscally responsible path. The Biden administration’s borrowing still surpassed $4 trillion. With a national debt now over $34 trillion, and another trillion being added roughly every 100 days, these once-unimaginable numbers have now been totally normalized as run-of-the-mill.

Our country is far from having its fiscal house in order, but there’s practically no incentive to do so when the Federal Reserve can monetize as much debt as it wants, finance infinite bureaucratic bloat, and keep up Congress’s endless wars. The Fed can then blame inflation on everything but its own policies.

The Treasury has ways to expand and constrict the money supply on its own as well, but presidential administrations, the Treasury, and the Fed are all bedfellows in the act of selling out the American people for political gain and funding an unsustainable USD empire. If the presidential administration doesn’t like what the “non-political” Fed is up to, it can fire the Fed Chair and appoint a new leader, baking in a natural incentive for the Fed to play ball with the current president.

And so, the allegedly “independent” arms of government and national finance all scratch each other’s backs while the debt continues to expand and inflation runs out of control. Their only way to “fix” it is by making the problem worse by kicking the can down the road. Essentially, the MO is to print free money for bankers and politicians while they dump the burden of their self-interested policies onto the next generation.

As it is now, with slightly elevated rates, interest payments on the debt have surpassed even the bloated national “defense” budget. The game has gone on so long that the economy can’t survive without low interest rates, and now, with inflation unable to be stopped, the Fed can’t decide: Forget about their “soft landing” and crash everything with higher rates for longer, or lower rates again and destroy the dollar.

As the US empire gets stretched too thin, and countries like China and Saudi Arabia begin to ditch the dollar, the infinite debt game will eventually blow up for good. With the US unable to contain its deficits and other countries fighting to regain their sovereignty by ditching the dollar for trade, once the US can no longer export its inflation to the rest of the world through the Petrodollar and US Treasuries, the foundation really begins to crack.

As Peter Schiff said in his debate with Steve Hanke last month: