"Simple Math" Shows "The Fed Is Losing": Lawrence Lepard

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week, with his updated take on, in his words, how the Fed is “losing”.

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week, with his updated take on, in his words, how the Fed is “losing”.

For those that missed it, I mentioned Larry in my most recent portfolio update, published earlier this week. I believe him to truly be one of the muted voices that the investing community would be better off considering. He gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Larry was kind enough to allow me to share his thoughts heading into Q2 2023. The letter has been edited ever-so-slightly for formatting, grammar and visuals.

This is Part 1 of this letter, Part 2 will be published tomorrow.

THE FED IS LOSING

The big picture theme of this report is: The Fed Is Losing. They are losing control of the markets. They are losing their credibility. They are losing their ability to craft and control the narrative. They may even be losing their institutional freedom as recent moves by Congress reflect the fact that they have done a dreadful job, and tough questions are being asked.

The Fed has a dual mandate from Congress: manage the money supply to provide (i) price stability, and (ii) full-employment. We have also learned by their comments and actions that there is an unspoken third mandate of maintaining functioning financial markets. The GFC in 2008 and the COVID collapse in March 2020 showed that they will bend and break the rules to achieve the third mandate.

The Fed has been all over the map the past few years and has heightened the volatility of the markets. Their policies are now leading to major economic issues. Consider:

2014-2015: Fed Chair Yellen’s reign – Fed was worried that inflation was too low.

2018: Fed Chair Powell - Fed slowly tightened via higher interest rates and reducing their balance sheet. This led to the 2019 REPO blow out and market dysfunction and the original Powell Pivot.

2020 COVID: Markets (including Treasury Bonds) were punished in March 2020. The Fed’s response was to bring a bazooka and their balance sheet grew 73% in 4 months. They grew the M2 money supply by the fastest rate in US history and their QE continued throughout 2021.

2021: Fed’s loose policy moves led to inflation. Fed blew the call saying the inflation was “transitory” and they continued their lax monetary policy.

February 2022: Realizing they were wrong on transitory inflation, Fed slammed on the monetary brakes by hiking the Fed Funds rate 475 bps over the ensuing 12 months - the fastest tightening cycle since the late 1970’s/1980 period. Higher rates address the monetary side, but they are also trying to solve a supply under capacity issue by crushing aggregate demand.

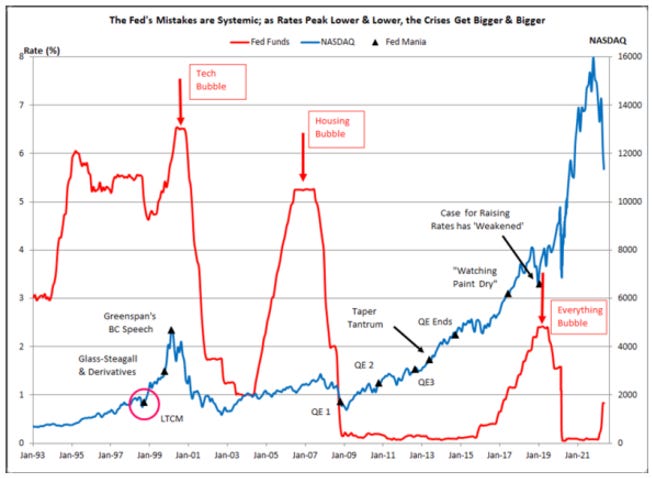

None of this is new. The Fed has been making these mistakes for years:

Source: Peter Schmidt, Twitter: @The92ers

We have always said that this rate hike policy could not be sustained and that it was only a matter of time until something breaks.

Our good friend and monetary analyst Trey Reik makes this point very clearly: