Republicans Should Aim for Canada-Size Cuts

"In the 1990s, Canada’s economy grew strongly after adopting large spending cuts, privatization, and free trade."

By Chris Edwards, CATO Institute

The federal government is hurtling toward a fiscal crisis. Accumulated debt is reaching historic highs, borrowing rates are rising, and spiking inflation is a major risk. President Trump and Congress must focus on control of spending and deficits.

Given their plans for tax cuts and defense spending increases, Republicans need large budget cuts to prevent the government’s $2 trillion deficits from spiraling higher. Many Republicans want to cut spending, and Trump’s DOGE team talks about annual cuts of $1 trillion or more. But as the Wall Street Journal discusses today, other Republicans are nervous nellies, who need more convincing that cuts are both good economics and good politics.

Republican tensions are currently coming to a head with party leaders assembling a budget resolution that sets overall fiscal parameters for the year. What is a realistic spending cut goal for Republican reformers?

History can be a guide. Let’s look at three charts showing real-world experience in our federal government and Canada’s. Trump is hostile toward Canada these days, but there are fiscal lessons to be learned from our northern neighbor. Canada faced a debt crisis in the 1990s similar to ours today, and its politicians had the backbone to pursue large and sustained spending cuts.

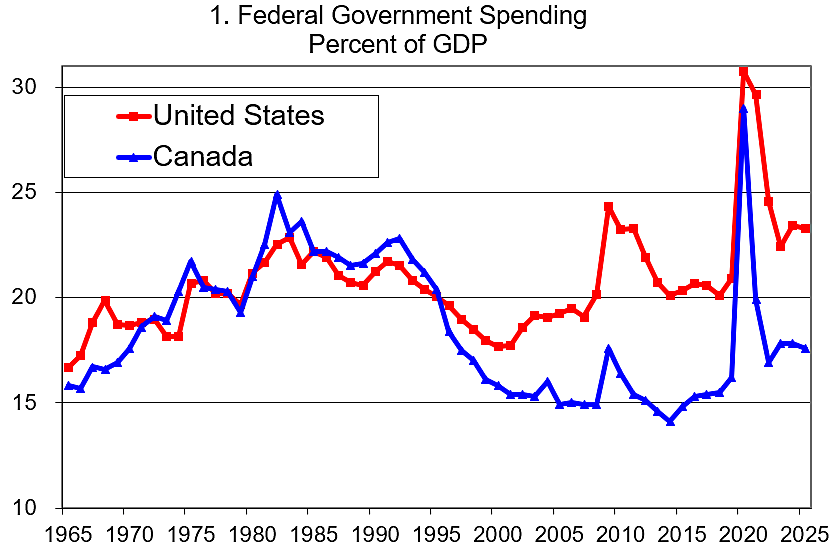

Figure 1 shows federal government spending in the two countries as a percentage of gross domestic product (GDP).

The government grew in both countries from the 1960s to the early 1980s. The US had a string of big-spending presidents, and Canada had Pierre Trudeau, left-wing father of Justin Trudeau.

Both countries began restraining spending in the 1980s and cut in the 1990s. The US cut spending by about 4 percentage points of GDP, while Canada cut about 7 points.

The US abandoned restraint under George W. Bush after 2001, and spending has trended higher since, including spikes during the Great Recession and COVID-19.

Canada slashed spending and then held it down for another 15 years. Canada’s spending spike during the Great Recession was smaller than America’s.

Justin Trudeau’s government (2015–2025) reversed course and has grown spending, including a larger COVID-19 spending spike than under Trump-Biden.

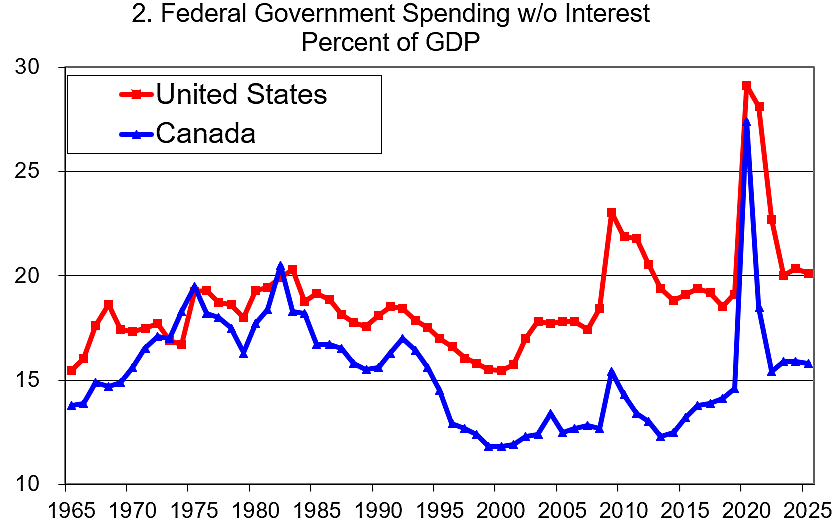

Figure 2 shows spending without interest costs.

This figure shows spending that the politicians directly control—spending just on programs and excluding interest costs.

The US cut noninterest spending by about 3 points of GDP in the 1990s, while Canada cut about 5 points. The Canadian cuts were sustained much longer than the US cuts.

In the 1990s, Canada slashed spending on defense, welfare, business subsidies, aid to lower governments, and many other things. It privatized infrastructure and ended the related subsidies. I discuss Canada’s reforms here.

For the US, 85 percent of the cut amount between 1990 and 2000 was defense. Defense procurement fell from $81 billion in 1990 to just $52 billion in 2000 in nominal dollars.

The US balanced its budget 4 years in a row (1998–2001), while Canada balanced its budget 11 years in a row (1997–2007).

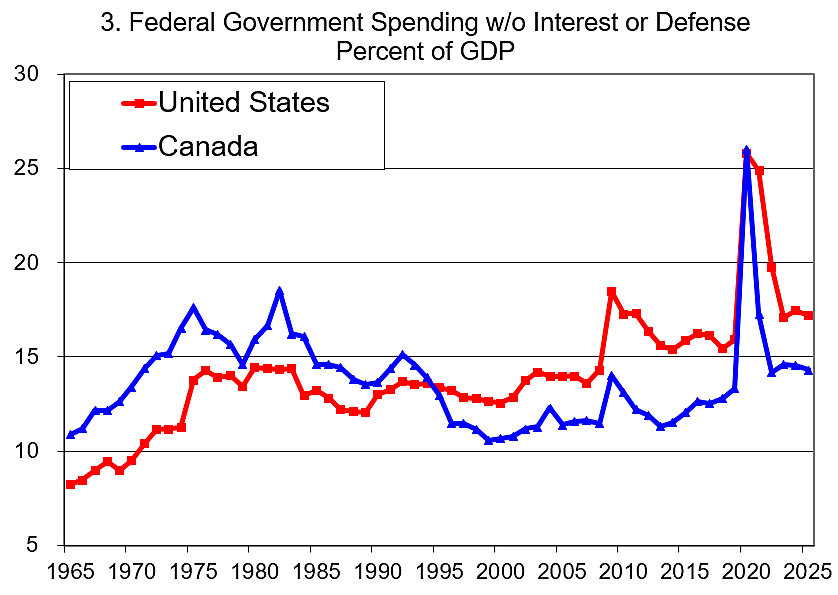

Figure 3 shows spending without interest or defense spending.

The US cut noninterest, nondefense spending in the late 1980s but not much in the 1990s.

Canada cut noninterest, nondefense spending far more than the US, reducing it by about 4 percentage points of GDP from the early 1990s to the end of the decade.

Both countries have shown that substantial spending cuts are possible. In Canada, the parliament cut a range of programs by about 5 percentage points of GDP. In the US, Congress cut almost 3 points of GDP, mainly defense spending, and that was despite the lobbying power of the “military industrial complex.”

Congress can cut any program any time it wants, and 3 percentage points of GDP or more in a decade is entirely doable. It turns out that 3 percentage points is about what we need to stabilize federal debt and hold off a spiraling budget crisis.

The Congressional Budget Office baseline shows budget deficits of about 6 percentage points of GDP over the next decade. Treasury Secretary Scott Bessent says that we should aim for a 3 percentage point deficit, and the Committee for a Responsible Budget calculates that reforms of about that size would stabilize federal debt held by the public at about 100 percent of GDP.

A 3 percent of GDP cut would amount to a 13 percent, or $1.3 trillion, spending cut in 2035. Such a cut can be achieved with reforms Cato has proposed here and here. These cuts are from the CBO baseline, and so with tax cuts and defense spending increases, we will need more cuts. Canada shows that sustained cuts of more than 3 points of GDP are possible.

One final point. Stronger GDP growth will shrink the relative burden of debt, so microeconomic reforms such as deregulation should accompany budget reforms. Alternatively, trade wars would shrink GDP and exacerbate the debt crisis. In the 1990s, Canada’s economy grew strongly after adopting large spending cuts, privatization, and free trade.

# # #

Canada’s fiscal data is here and the story of its reforms are here, here, here, and here.

US fiscal data is here.

A fiscal agenda for Congress is here.

A discussion of how spending cuts boost growth is here.

A discussion of how to avert a fiscal crisis is here.

Note that the charts are for federal spending and do not include state/local or provincial/local spending.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Among the many strange contradictions in the body of pseudo-thinking called "economics" is this:

Let's imagine that 1/3 of what the govermint spends on was instantly privatized. Govermint spending would fall by 1/3, tax collections probably wouldn't change all that much (or maybe go up), the "deficit" would collapse.

Problem solved? It's just cultural accounting. Nothing at the cultural level has really changed. It's like using your nickname rather than your real name. Have you changed? There's no real change in flows of goods and services in the economy.

So what's the difference in before vs. after?

Is there even a difference? Well, one potentially key difference is private actors can fail and go bankrupt. Entrepreneurs can arise and take their place. You don't do that with govt bureaucracies. The Mises Freaks and Libertarians have that right. So yes, there's a discipline imposed that govt lacks.

But wait!!

What about bailouts? Doesn't the govt always bail out failed huge private sector actors? Well, it seems so, after the "revolution" in central banking and political economy dating possibly back to Alan Greenspan. One bailout after the other. Occupy Wall Street got that right.

You can put economic activity into the private sector and it's still "govermint". It walks, talks and quacks like goverment bureacracy. Maybe it is.

So what's all this yada yada about from the Mises Freaks and Libertarians? It seems more complicated than their Boolean Logic. Boolean Logic works in computer circuitry but not in the pseudo-thinking realm of economics. It's all political economy, all the way down.

Superb. Thank you.