Reducing Spending Now: The Key to Growth, Not Austerity

"Spending cuts aren’t a burden—they’re a path to prosperity."

By Romina Boccia and Dominik Lett, CATO Institute

Imagine a future where the average American earns $15,000 more each year because Congress reduced federal spending and national debt. Too often, spending cuts are painted as a necessary evil—painful austerity measures that slow the economy. This narrative couldn’t be further from the truth. Economic research shows that stabilizing government debt by cutting spending can unleash economic growth.

Today, the federal government’s public debt is a staggering $28.8 trillion—equivalent to the nation’s annual economic output—and is projected to skyrocket to 166 percent of GDP by 2054 under optimistic assumptions. This ballooning debt is driven primarily by the growth of interest costs and just a few entitlement programs, including Medicare, Social Security, and Medicaid. High debt levels are already slowing economic growth, driving up inflation, and pushing interest rates higher. This makes it harder for families and businesses to borrow and invest.

Take the crowding-out effect. When the federal government borrows heavily, it competes with the private sector for limited financial resources, driving up interest rates. Between January 2022 and January 2025, for example, the prime bank loan rate doubled from 3.25 percent to 7.5 percent. As loans become more expensive, startups delay expansions, businesses scale back hiring, and innovation suffers. As one business owner noted in 2024, “We are a new business and our loans closed when the rates were at an all-time high … so that has increased our monthly expenses dramatically.”

The result is a less productive economy, lower wages, and reduced competitiveness. Cutting spending reduces this crowding-out effect by freeing up resources for private-sector investment, creating jobs, and boosting incomes.

Economic research reinforces the idea that spending cuts can enhance growth. A 2020 study by researchers at the Hoover Institution found that stabilizing and reducing the debt by restraining the growth in federal spending could boost short-run annual GDP growth by 10 percent and long-run growth by 7 percent. More specifically, Cogan, Hail, and Taylor find that an economic plan that curbs entitlement spending without raising taxes can deliver a powerful one-two punch for growth. A credible commitment to reducing future debt and taxes results in higher long-term disposable income for individuals, motivating more consumer spending today. This surge in consumption more than offsets the initial reduction in entitlement benefits, demonstrating that fiscal discipline can create a win-win for the economy.

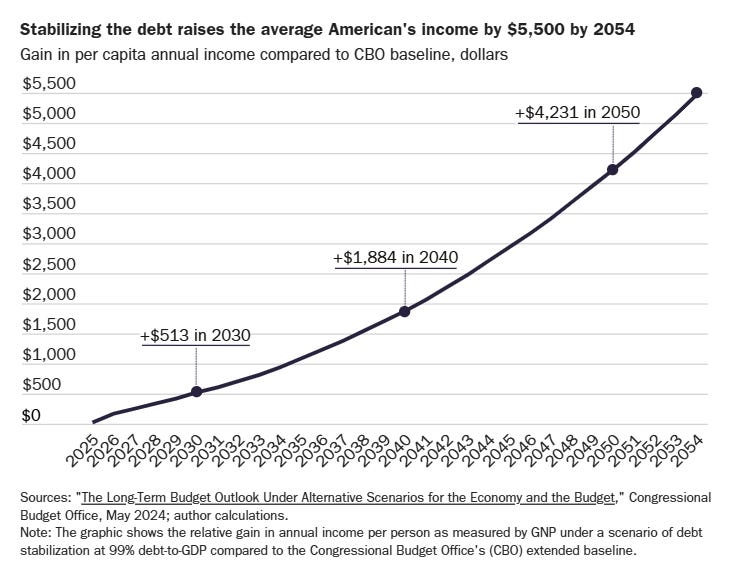

Additionally, the Congressional Budget Office (CBO) projects that stabilizing the debt could raise projected income per person by $513 in 2030 compared to baseline projections. The gain in annual income grows significantly over time, and by 2054, the average American’s income could be $5,500 higher (see the graph below). If debt grows faster than expected under CBO’s baseline—meaning the fiscal outlook worsens—the economic benefits of stabilizing the debt become more pronounced. Under one high debt scenario, the Committee for a Responsible Federal Budget estimates that the income gain from debt stabilization would increase to $14,500 per person by 2054.

Spending reductions also shield Americans from higher taxes. In the current fiscal environment, spending significantly outpaces revenues—a gap that will eventually necessitate tax increases. By cutting spending today, lawmakers can prevent harmful future tax hikes and lock in low tax rates, effectively a tax cut compared to the current trajectory. As Cato’s Adam Michel puts it:

Fiscal discipline through spending cuts could act like supply-side tax reform and turbocharge other pro-growth tax cuts and deregulation.

Crucial to this idea is credibly signaling that Congress will commit to spending cuts. The most recent bond market selloff highlights growing investor concerns over America’s fiscal and monetary trajectory. Rising bond yields, in large part, reflect doubts about the government’s ability to manage its long-term debt in the face of widening deficits and repeated budgetary mismanagement. By demonstrating fiscal discipline, Congress can restore market confidence and reduce the premiums bondholders demand for elevated risk, thereby bringing down interest rates and spurring investment.

Voter frustration with inflation underscores the importance of Republicans taking spending cuts seriously. Americans know that excessive government spending over the pandemic was a key driver of inflation, and they voted Democrats out of office. This same voter backlash to spending-driven inflation could occur again come mid-term elections in 2026 should reckless deficit spending continue unabated.

With Republicans crafting a reconciliation bill (or multiple) addressing tax cuts, border security, and the debt ceiling, they have a unique opportunity to rein in inflation, shrink the federal bureaucracy, and reduce government spending, especially on health care and other entitlements. Pairing tax reform with significant spending cuts is not only fiscally responsible but critical to a pro-growth agenda.

Some critics of spending reform may argue that cuts disproportionately harm the less fortunate. Ending billions in corporate welfare (such as farm and energy subsidies) and reducing student loan subsidies, for example, would cut government aid to the rich, hardly a war on the poor. Better targeting programs aimed at the poor also has upsides. Rolling back Medicaid benefits for able-bodied adults, for example, could boost labor force participation, increasing individual earnings while reducing government spending.

These critics also ignore the costs of inaction. Fiscally induced inflation is a hidden, regressive tax that disproportionately hurts low-income households who spend a larger proportion of their income on price-sensitive necessities like food, housing, and energy. The resulting economic effects of excessive government borrowing will end up harming the poor more than the rich.

Others have suggested that even minor cuts to defense pose a risk to national security. There is no shortage of wasteful and unnecessary military spending that can be eliminated without worsening America’s security.

Spending cuts aren’t a burden—they’re a path to prosperity. By prioritizing fiscal discipline, Congress can boost growth, restore market confidence, and secure a brighter economic future for all Americans.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Interesting essay.

If Social security & Medicare are entitlements, then I want every nickel back from their deduction from my paycheck.

First, ain't going to happen until the economy collapses and debts get forgiven or restructured. Going forward after that sure, we can sharpen our pencils. I would like to see Social Security treated more like a pension fund---allow part of it to be invested in the stock market (can you imagine how much it would be worth now if it had not just invested in t-bills?). I'd also like to see a national Medicare for All program that gives the following 'conservative' benefits: lower cost through volume purchases, elimination of redundant paperwork and associated staffing to push such papers from private insurance, elimination of most of the thousands of federal, state, and county programs that subsidize healthcare like Obamacare and Medicaid, perhaps even Workman's Comp and auto insurance medical portions. Being a Medicare model it still allows for private markets to operate as best they can in a business that is ill-suited in many ways to free markets. The government just pays the bills. Rewriting the tax code to a simpler version would also help, requiring less bureaucracy to regulate.